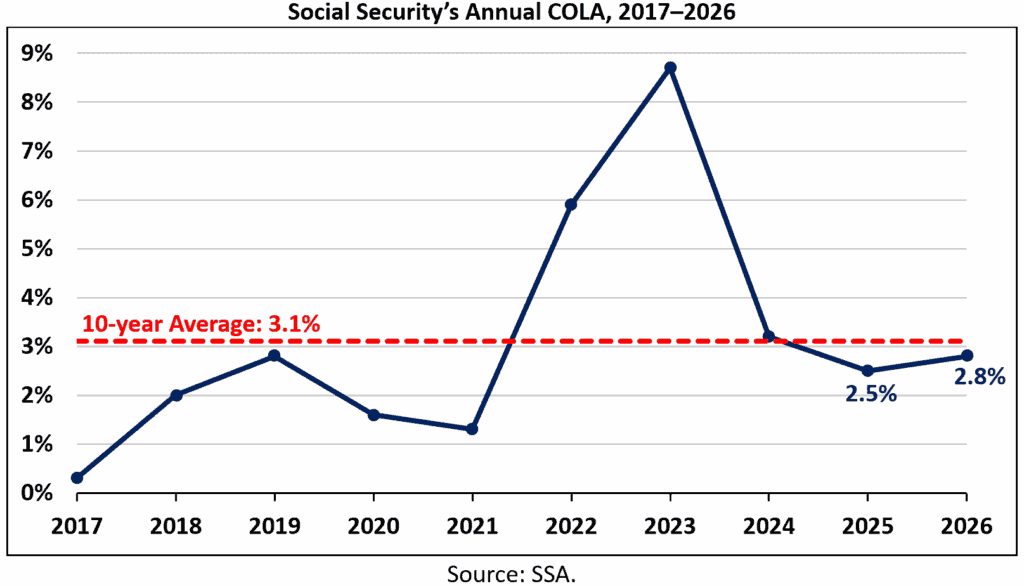

December Social Security Check: If you’re expecting your Social Security check this December 2025, there’s a lot to unpack. December is not just another payout month — it’s the final full payment under the current benefit amount before the 2.8% cost-of-living adjustment (COLA) officially kicks in for January 2026. That means your December payment will still reflect 2025’s rates, but come next month, you’ll see a modest increase in your benefits to help offset inflation. While the bump is small, it’s a welcome change for millions of retirees, disabled workers, and survivors relying on Social Security as a financial lifeline. This article breaks everything down — payment schedules, the impact of Medicare premiums, practical planning tips, and what this COLA increase really means for your wallet in 2026.

Table of Contents

December Social Security Check

December 2025 isn’t just another Social Security payday — it marks the final month before your benefits rise under the new 2.8% COLA. For most Americans, that translates to roughly $56 more per month, though higher Medicare premiums will trim the net increase closer to $40. While the raise won’t fix everything, it’s a small step in the right direction. If you rely heavily on Social Security, use this transition period to review your finances, update your budget, and explore supplemental income or savings strategies. As inflation cools and Washington debates Social Security reform, staying informed and proactive is your best bet.

| What | Details |

|---|---|

| 2026 COLA Increase | 2.8% increase for most Social Security and Supplemental Security Income (SSI) beneficiaries |

| Average Monthly Raise | About $56 for the average retired worker |

| First COLA-Adjusted Payment | January 2026 for most; SSI recipients get it early on Dec 31, 2025 |

| Medicare Part B Premium (2026) | $202.90 per month, up from $185 in 2025 |

| Real-World Net Gain | Around $39–$40 per month after factoring in Medicare premiums |

| SSI Payment Schedule | December 1 and December 31 (advance for January 2026 payment) |

| Primary Source for Updates | Social Security Administration Official Site |

December Social Security Check Schedule: When You’ll Get Paid

The Social Security Administration (SSA) pays out checks according to beneficiaries’ birthdays. Here’s how it shakes out:

- Birthdays 1–10: Payment arrives on Wednesday, December 10, 2025

- Birthdays 11–20: Payment arrives on Wednesday, December 17, 2025

- Birthdays 21–31: Payment arrives on Wednesday, December 24, 2025

If you started receiving benefits before May 1997, or you receive both Social Security and SSI, you’ll likely get your check earlier — on Wednesday, December 3, 2025.

For Supplemental Security Income (SSI) recipients, two payments are scheduled:

- December 1, 2025 — Regular December payment

- December 31, 2025 — Advance January 2026 payment due to the federal holiday on January 1

So yes — many SSI recipients will see two deposits in December, though technically, the December 31 deposit counts as January’s payment.

What Changes in 2026 — The 2.8% COLA Explained

Every year, the SSA reviews inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to decide how much benefits need to rise. This automatic adjustment — called the Cost-of-Living Adjustment (COLA) — ensures beneficiaries don’t lose purchasing power due to inflation.

In 2026, that increase is set at 2.8%.

To put that into perspective:

- A retired worker getting $2,015 per month in 2025 will see that rise to roughly $2,071 per month.

- A disabled worker earning $1,584 monthly will receive about $1,628.

- The average widow(er) receiving survivor benefits will see an increase from $1,575 to $1,619.

These may sound like small changes, but they add up over the year — and for retirees on fixed incomes, even an extra $50 per month can help cover essentials like food, gas, or utilities.

What Could Offset That Raise — Medicare and Inflation

While the COLA bump is good news, it doesn’t tell the whole story. Healthcare costs are expected to rise significantly in 2026, especially Medicare Part B premiums, which most retirees pay directly out of their Social Security checks.

Here’s how the math breaks down:

- Medicare Part B premium: $202.90/month in 2026 (up from $185)

- Annual deductible: $283 (up from $240)

That $17.90 increase in monthly premiums eats up nearly one-third of the typical COLA raise. So instead of keeping all $56 in extra benefits, many retirees will only see about $38–$40 more per month after the Medicare deduction.

For retirees with higher incomes (those paying income-related Medicare premiums), the deduction will be even larger — meaning their net gain could be smaller still.

The takeaway? Don’t assume your check will grow by the full COLA amount. Always account for healthcare costs when budgeting for the new year.

Why the COLA Matters — And Its Limitations

The COLA system is meant to protect retirees from losing ground to inflation. But here’s the reality: it’s far from perfect.

The CPI-W, which the SSA uses to calculate COLA, tracks inflation for working households — not retirees. Seniors tend to spend more on healthcare and housing, categories that often rise faster than the overall inflation rate.

Many policy experts and advocacy groups, including the National Committee to Preserve Social Security and Medicare, have called for switching to the Consumer Price Index for the Elderly (CPI-E). This measure better reflects seniors’ real-world expenses.

Until that happens, COLA will continue to help, but not fully bridge the gap between benefit growth and actual living costs.

Practical Planning Tips to Make the Most of Your December Social Security Check

- Verify your direct-deposit details through your “My Social Security” account. Mistakes in banking info can delay your payments by weeks.

- Budget proactively. Use that December 31 SSI payment wisely. It’s technically January’s money — don’t double-spend during the holidays.

- Keep track of Medicare changes. Review the Medicare handbook or visit Medicare.gov to confirm your 2026 premium and coverage options.

- Reassess your withholding or taxes. A higher benefit might push you into a slightly different tax bracket or alter your combined income for tax purposes.

- Consider delaying Social Security (if not already retired). Each year you delay claiming after full retirement age increases your benefit by about 8%, up until age 70.

- Supplement your income. Even a small side hustle, rental income, or part-time gig can add breathing room to your retirement budget.

- Review your long-term care plans. Healthcare costs rise faster than COLA increases — consider how you’ll handle those expenses later.

What the Experts Are Saying?

Financial experts largely agree: the 2.8% COLA is better than expected but not enough to match real inflation. According to The Senior Citizens League, cumulative inflation over the last five years has eroded more than 36% of retirees’ purchasing power.

Economist Mary Johnson of The Senior Citizens League noted that, “While any increase is welcome, this COLA doesn’t fully reflect the true cost-of-living increases most older Americans face — especially in healthcare, rent, and everyday necessities.”

Some analysts, like those at Moody’s Analytics, predict that inflation will remain moderate through 2026, meaning smaller COLAs in coming years unless there’s a significant economic shift.

Meanwhile, Congressional Budget Office (CBO) forecasts suggest that the Social Security trust fund will face a shortfall by 2033, meaning long-term adjustments to taxes or benefits may be required.

For now, the 2.8% boost provides short-term relief — but retirees should not assume future increases will keep pace indefinitely.

Looking Ahead: Social Security’s Future

The Social Security Board of Trustees projects that, without legislative changes, the trust fund reserves could be depleted by 2033. At that point, incoming payroll taxes would only cover about 77% of scheduled benefits.

However, this doesn’t mean benefits would stop — they’d simply be reduced unless Congress acts. Proposals on the table include:

- Increasing or removing the payroll tax cap (currently $168,600 in 2025)

- Gradually raising the full retirement age

- Adjusting how COLAs are calculated

- Introducing higher payroll taxes for high earners

While none of these changes are immediate, they underscore the need for personal financial planning beyond Social Security alone.

New Bill Could Force Social Security to Issue New Numbers—Are You Affected?

Historic Social Security Boost Coming to These 5 States in 2026; Are You on the List?

$2,000 Stimulus Checks Are Coming; But Here’s What You MUST Verify First with the IRS

What to Expect in 2026?

Here’s what next year might bring:

- Steady inflation: The Federal Reserve projects inflation near 2.5–3% for 2026, which could influence next year’s COLA.

- Medicare cost pressure: Expect medical premiums to keep climbing as healthcare costs continue rising.

- Tax brackets shifting: Inflation adjustments will slightly move income tax brackets higher, offering small tax relief for some retirees.

- Potential legislative discussions: Congress may revisit Social Security reforms to shore up long-term funding.

In other words, the 2026 COLA provides short-term help, but retirees should plan beyond just one year’s increase.