December Social Security Check: If you opened your bank account this December and noticed your Social Security check looks the same as last month’s, you’re not alone. Millions of Americans are wondering why their 2.8% COLA (Cost-of-Living Adjustment) didn’t show up yet. Here’s the deal: your December check still reflects 2025 rates. The new COLA increase doesn’t officially take effect until January 2026, meaning the first bump lands in your January 2026 payment. This isn’t a mistake or a delay — it’s just how the system works. Before we dive into the “what” and “when,” let’s look at the key details you need to know.

Table of Contents

December Social Security Check

So, if your December Social Security check doesn’t include that 2.8% boost, don’t panic — everything’s right on schedule. The COLA increase takes effect in January 2026, offering a modest but meaningful bump to help offset inflation. Whether it’s an extra $40 or $100 a month, it’s a reminder that Social Security still works as designed — protecting Americans’ hard-earned benefits and adjusting with the times. Stay informed, track changes, and plan your budget early to make the most of this year’s raise.

| Topic | Details |

|---|---|

| 2026 COLA Rate | 2.8% increase announced by the Social Security Administration |

| Average Monthly Boost | About $56 for the average retiree |

| December 2025 Checks | No COLA applied — reflects 2025 rates |

| First Check With 2.8% COLA | January 2026 (mid-month depending on your birthday) |

| SSI Payment for January | Paid early on December 31, 2025 |

| Medicare Part B Premium | Expected to rise slightly, possibly offsetting part of the increase |

| Official Source | SSA.gov |

What Exactly Is the COLA and Why Does It Matter?

The Cost-of-Living Adjustment (COLA) is how the government ensures that Social Security payments keep up with inflation — meaning your benefits don’t lose value over time as prices rise.

Every October, the Social Security Administration (SSA) calculates this adjustment based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), published by the U.S. Bureau of Labor Statistics.

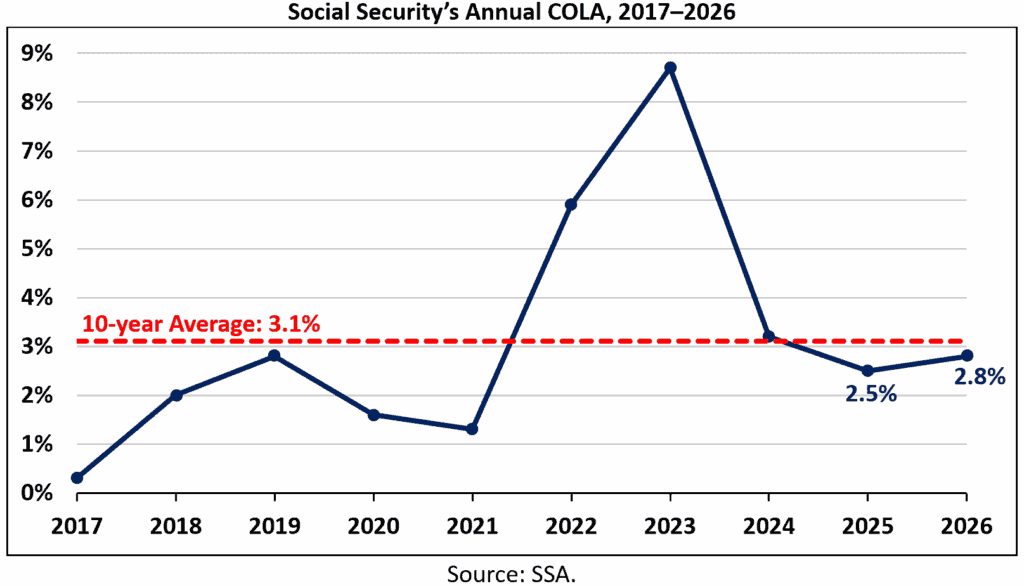

For 2026, the SSA confirmed a 2.8% COLA, marking a moderate rise after years of fluctuating inflation. Compare this with recent years:

- 2023: 8.7% (one of the largest in four decades)

- 2024: 3.2%

- 2025: 3.2%

- 2026: 2.8%

So, while this year’s bump isn’t record-breaking, it’s still an important adjustment for millions of retirees relying on Social Security to make ends meet.

Why Your December Social Security Check Doesn’t Include the COLA?

This is one of those quirks of Social Security that trips people up every year. Even though the new COLA is announced in October, it doesn’t actually kick in until January of the following year.

Here’s the timing breakdown:

- Your December 2025 payment is based on your 2025 benefit rate.

- Your January 2026 payment (arriving mid-January) is the first to reflect the new 2.8% increase.

That’s because Social Security payments are paid after the month they’re due. So your December payment is technically your November benefit, and your January payment reflects December’s new rates.

If you receive Supplemental Security Income (SSI), it’s a little different. The January SSI payment is always sent early — on December 31, since January 1 is a federal holiday. That means some people will see the COLA increase at the end of this month, while others won’t see it until mid-January.

How Much More Money You’ll Get in 2026?

The SSA estimates the average retired worker will see an increase of around $56 per month once the 2.8% COLA kicks in. But everyone’s situation is unique because the exact dollar amount depends on your current benefit.

Here’s what that looks like in real numbers:

| Current Benefit (2025) | New Monthly Amount (2026) | Annual Increase |

|---|---|---|

| $1,500 | $1,542 | +$504/year |

| $1,800 | $1,850 | +$600/year |

| $2,200 | $2,261 | +$732/year |

| $3,000 | $3,084 | +$1,008/year |

It might not sound like much, but when you consider that many Americans rely on Social Security for 90% of their income, even small increases can make a difference — covering a week’s groceries, prescription copays, or utility bills.

When You’ll Receive the First Check With the New COLA?

Your Social Security payment date depends on your birthday:

| Birthday Range | January 2026 Payment Date |

|---|---|

| 1st–10th | January 14, 2026 |

| 11th–20th | January 21, 2026 |

| 21st–31st | January 28, 2026 |

For SSI recipients, the January payment arrives December 31, 2025.

People who receive both Social Security and SSI will see two separate deposits — one on Dec 31, 2025 (SSI for January) and one later in January 2026 (Social Security with COLA).

Checking Your New Benefit Amount

The easiest way to confirm your new amount is through your mySocialSecurity account.

- Log in and go to “Messages.”

- Click your COLA notice — it shows your exact 2026 benefit amount.

- You can also request a Benefit Verification Letter online or by phone.

If you prefer mail, the SSA mails paper COLA notices each December.

How Medicare Premiums Could Affect Your COLA?

Here’s the part most folks overlook: your Medicare Part B premium may increase at the same time as your COLA — and that could eat into your raise.

For 2026, the Centers for Medicare & Medicaid Services (CMS) projects a small premium increase, though final rates aren’t published until fall 2025.

For example, if your premium rises by $10 a month, and your COLA adds $56, your net increase is only $46. Still, that’s money you didn’t have before — but it’s worth planning for so you’re not caught off-guard.

Why COLAs Don’t Always Keep Up With Inflation?

Here’s some real talk: even though COLAs help, they don’t always fully cover inflation.

According to the Senior Citizens League, Social Security benefits have lost about 36% of their buying power since 2000, mostly due to rising healthcare and housing costs.

That’s why personal savings, retirement accounts, or part-time work are still important tools for financial stability. Social Security was never designed to replace your entire income — it’s a safety net, not a complete paycheck.

If you’re still working or planning for retirement, the SSA recommends checking your retirement estimator in your mySocialSecurity account to project future benefits.

Financial Tips: Making the Most of Your COLA Increase

Whether you’re living on a fixed income or balancing multiple sources of retirement income, here’s how to use your COLA raise wisely:

- Create a mini emergency fund. Even $50/month adds up over time — and can cover surprise medical or car expenses.

- Adjust your budget. Recalculate your spending to reflect your new income.

- Check for Medicare Advantage or Part D changes. Open enrollment (Oct 15–Dec 7) is your time to compare plans.

- Watch for scams. The SSA will never call, email, or text to “verify” your COLA — scammers love this time of year.

- Plan for taxes. Depending on your total income, part of your benefits could be taxable.

A Broader Look: Why the COLA Still Matters

More than 67 million Americans receive Social Security benefits each month. That includes retirees, disabled workers, and survivors.

Even modest COLA increases prevent seniors from falling further behind as prices rise. According to the AARP, Social Security payments lift roughly 15 million older Americans out of poverty each year.

The COLA ensures that promise continues — adjusting benefits automatically so that Americans who worked and contributed for decades can live with dignity.

Looking Ahead: What Could Happen in 2027?

Financial analysts expect inflation to stabilize through 2026, meaning future COLAs may remain in the 2% to 3% range. That’s good news for retirees — steady, predictable adjustments without the volatility of past years.

Meanwhile, policymakers continue debating Social Security’s long-term solvency. According to the SSA’s 2025 Trustees Report, the program’s trust funds could face shortfalls by 2034 if no changes are made.

However, most experts — including those at AARP and Brookings Institution — agree that benefits are safe for current retirees and near-retirees. Congress has time to adjust payroll taxes, benefit formulas, or retirement ages to protect the system’s future.

New York Social Security Schedule: Exact December 2025 Payment Dates

Up to $4,018 in Social Security Arrives December 10 — Who Qualifies for This Payment

Your December Social Security Check Arrives Soon — Last Month Before the 2.8% COLA Kicks In