Working While Receiving Social Security: Working while receiving Social Security used to be a confusing topic, filled with fine print, myths, and more red tape than a courthouse clerk’s desk. But now, with the 2026 Social Security rule changes, it’s time to get crystal clear. Whether you’re hustling part-time, running a small business, or considering going back to work after retirement, these new rules could raise or reduce your monthly payments — and you need to know how.

The good news? These changes give older Americans more flexibility, more money, and more choices. The catch? There are limits — and going over them could temporarily cut your Social Security checks. This guide breaks everything down in simple terms: what’s new in 2026, how it affects you, how to keep more of your money, and what tools to use to stay ahead.

Table of Contents

Working While Receiving Social Security

Working while receiving Social Security in 2026 offers more flexibility and better earnings thresholds — but not without some complications. From COLA increases to income limits, tax surprises, and withheld payments, it’s easy to overlook the fine print. The trick is to know your full retirement age, calculate your earnings, and use SSA tools to plan the smartest path forward. Whether you’re picking up shifts, consulting, running a small business, or just easing into retirement, you have options — and now, you have the knowledge.

| Topic | 2026 Value / Rule | Why It Matters |

|---|---|---|

| Cost-of-Living Adjustment (COLA) | +2.8% increase | Raises monthly checks to match inflation |

| Earnings Limit (Under FRA) | $24,480/year | Go over, and benefits may be withheld |

| Earnings Limit (Year of FRA) | $65,160/year | Higher limit before reduction kicks in |

| After Full Retirement Age (FRA) | No earnings limit | Work as much as you want |

| Social Security Wage Cap | $184,500 | Only earnings under this are taxed |

| Work Credits | $1,890 per credit (4 max/year) | Needed to qualify for benefits |

| Spousal/Survivor Benefit Rules | Still apply if working or remarrying | May reduce or affect eligibility |

| Benefits Taxation Threshold | $25K (single), $32K (joint) | Exceeding triggers federal tax |

| Tools | SSA.gov/myaccount | Estimate benefits, income limits |

What’s Changing in 2026 and Why It Matters?

Each year, the Social Security Administration (SSA) adjusts benefit rules to reflect wage growth, inflation, and longevity. In 2026, changes are more than cosmetic — they directly affect your monthly checks, how much you can earn, and how much you might owe in taxes.

Whether you’re already retired, about to retire, or just testing the waters of part-time work, these changes are crucial.

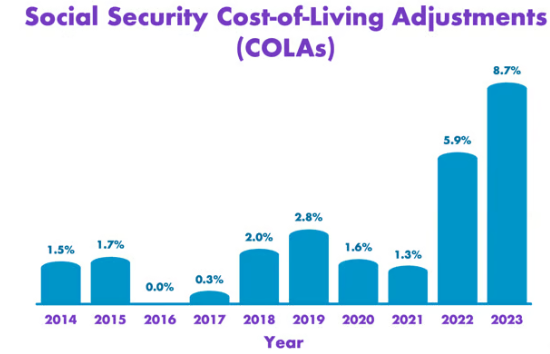

1. Cost-of-Living Adjustment (COLA): The Annual Raise You Didn’t Ask For

The 2026 COLA is set at 2.8%, following moderate inflation and economic stabilization.

Let’s say you currently receive $2,200 per month in Social Security. With the COLA, you’ll now receive about $2,261 per month. That’s nearly $730 more per year.

But before you celebrate, remember:

- Medicare premiums may rise, potentially eating into the increase.

- COLA applies to retirees, spouses, widows/widowers, and SSDI recipients.

- It’s calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

So while it’s not a fortune, it does help with groceries, rent, and other rising costs.

2. Earnings Limits and Withholding Rules

This is where things get tricky. If you work while collecting Social Security before reaching Full Retirement Age (FRA), there’s a limit to how much you can earn before the government starts withholding some of your benefits.

Here’s how it works:

a. If You’re Under FRA (Most People 62–66)

- Limit in 2026: $24,480

- For every $2 you earn over that, SSA will withhold $1 from your benefits.

Example:

You earn $30,000. That’s $5,520 over the limit. SSA withholds $2,760 from your benefits.

b. If You Reach FRA in 2026

- Limit: $65,160

- For every $3 over that, SSA withholds $1

- Applies only until your FRA month

Example:

You earn $70,000 in the year you turn 67. Over the limit by $4,840 = $1,613 in withheld benefits.

c. After You Reach FRA

- There are no earnings limits.

- You can earn $50K, $100K, $200K, and keep every penny of your Social Security benefits.

This rule often surprises people — especially those delaying retirement because they thought working would hurt their checks. It won’t — not after FRA.

3. Maximum Taxable Earnings Cap Increases

In 2026, the Social Security wage base cap rises to $184,500.

If you earn under that threshold:

- You’ll pay 6.2% in payroll tax.

- Your employer pays another 6.2% (or 12.4% total if self-employed).

This wage cap also affects how much you’ll receive in benefits. The more you earn under the cap, the higher your average indexed monthly earnings (AIME), which forms the base for your benefit calculation.

It’s a double-edged sword — you pay more tax now, but potentially receive more later.

4. Taxation of Benefits Based on Income

Let’s talk taxes. Yes, Social Security benefits can be taxed — especially if you’re working while receiving them.

Income Thresholds for Benefit Taxation:

- Single filer: Benefits taxed if income > $25,000

- Married filing jointly: Threshold is $32,000

Once you cross these lines:

- Up to 50%–85% of your benefits could be taxed.

And income isn’t just from work. It includes:

- Wages

- Pensions

- Rental income

- Investment returns

- Half of your Social Security benefits (yes, that counts too)

So, your part-time job or side hustle might not reduce your check, but it might increase your tax bill.

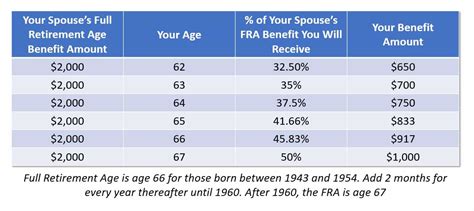

5. Spousal and Survivor Benefits While Working

Working doesn’t just affect your check. It can also affect benefits based on someone else’s record.

Spousal Benefits

If you’re receiving benefits as a spouse:

- The earnings limit still applies if you’re under FRA.

- Working above the limit can reduce your monthly amount.

Survivor Benefits

If you’re a widow/widower collecting survivor benefits:

- The same earnings limits apply if under FRA.

- Remarrying before age 60 disqualifies you from survivor benefits.

These rules often trip up folks who switch to survivor benefits after a spouse dies, thinking they’re “safe” from income tests. Always double-check the Earnings Test.

6. Real-Life Scenarios You’ll Actually Relate To

Case 1: Linda, 64, Semi-Retired Teacher

Linda works 20 hours a week and earns $26,000/year. She’s $1,520 over the limit and will have $760 withheld from her $1,400 monthly benefit. But when she turns 67, she’ll get a benefit boost due to those withheld months.

Case 2: Joe, 68, Consultant

Joe earns $120,000 as a freelance accountant and collects $2,500/month in Social Security. Since he’s over FRA, he keeps all his benefits with zero withholding — but part of it will be taxed.

Case 3: Maria, 62, Claims Early

Maria takes Social Security early while working at a retail job. She makes $30,000/year. Her benefits are reduced due to earnings over the limit, and she later decides to suspend her benefits until 66 to maximize future checks.

7. Tools to Help You Plan Ahead

Don’t fly blind. The SSA offers free tools to help you figure out exactly what to expect.

- My Social Security:

View benefit estimates, earnings records, and full retirement age. - Retirement Estimator:

Simulate different claiming ages and income scenarios. - COLA Tracker:

See historical and current cost-of-living adjustments.

Use these tools before making decisions. A little planning can save you thousands.

Four Ways to Boost Income in Retirement Without Reducing Social Security Payments

Social Security Payments Abroad – SSA Confirms Benefits Can Be Received Outside the US

Final Social Security Payments of 2025: Check Updated December Dates and Benefit Amounts