Working While Collecting Social Security 2026: The Earnings Limit That Keeps Your Benefits Safe is more than a mouthful — it’s a topic that matters to millions of Americans navigating retirement with side gigs, part-time jobs, or full-on careers. Whether you’re a 62-year-old teacher-turned-barista, a retired construction worker still swinging a hammer, or a financial planner guiding clients through retirement income strategies — the rules around working and collecting Social Security can either help or hurt. The good news? In 2026, the Social Security Administration (SSA) has raised the earnings limits again, meaning you can earn more before seeing a reduction in your benefits. But the bad news? If you don’t know the thresholds, you might accidentally set yourself up to lose out on money — or worse, trigger tax headaches.

Table of Contents

Working While Collecting Social Security

Working while collecting Social Security in 2026 is not only allowed — it’s increasingly common. The key is understanding the earnings limits, planning ahead, and coordinating income sources wisely. The $24,480 and $65,160 limits in 2026 give you more wiggle room than previous years. And once you reach Full Retirement Age, the SSA puts no limit on your earnings. Stay smart, plan ahead, and make your retirement income work for you.

| Topic | 2026 Number / Rule | Why It Matters |

|---|---|---|

| Earnings limit (Under Full Retirement Age) | $24,480/year | Work income above this could reduce benefits temporarily. |

| Earnings limit (Year you reach Full Retirement Age) | $65,160/year | Higher limit applies before the month you reach FRA. |

| Withholding rule (Under FRA) | $1 withheld per $2 over limit | SSA reduces your benefit temporarily. |

| Withholding rule (Year of FRA) | $1 withheld per $3 over limit | Applies until the month you hit FRA. |

| No earnings limit after FRA | Unlimited earnings allowed | You keep 100% of your benefits after full retirement age. |

| Cost‑of‑Living Adjustment (COLA) | 2.8% increase | Boosts monthly benefits for inflation. |

| Taxable wage base | $184,500 | More income is subject to payroll tax in 2026. |

| Official SSA resource | https://www.ssa.gov/benefits/retirement/whileworking.html | Source for latest rules, calculators, and benefits guide. |

What “Working While Collecting Social Security” Really Means?

Once upon a time, retirement meant gold watches and golf courses. Not anymore. Many Americans are either choosing or needing to work beyond age 62 — and doing so while collecting Social Security.

But here’s the deal: Social Security isn’t designed to punish you for working, but it does include rules to ensure people don’t double-dip in a way that threatens the system’s solvency.

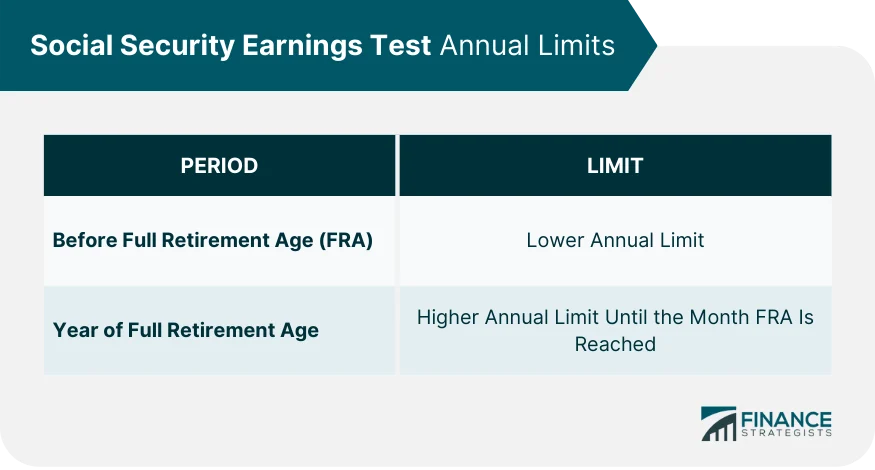

So when you draw benefits before your Full Retirement Age (FRA) — which is 67 for anyone born in 1960 or later — and continue working, there are earnings thresholds that can reduce your benefit temporarily.

The core idea: SSA withholds part of your benefit if you earn too much — but it pays it back later.

2026 Social Security Earnings Limits — Step-by-Step Guide

1. Under Full Retirement Age All Year

If you’re collecting Social Security early, and you’ll remain under 67 the entire year, here’s what applies:

- Earnings Limit: $24,480/year (about $2,040/month).

- Reduction Rule: SSA will withhold $1 from your benefits for every $2 you earn above that limit.

Example:

You make $30,000 at a part-time job. That’s $5,520 over the $24,480 limit. SSA will hold back $2,760 from your benefit checks for the year.

This doesn’t mean your checks disappear forever — just temporarily reduced.

2. Reaching Full Retirement Age During 2026

If you reach FRA (67 for most) during the year:

- Earnings Limit: $65,160/year — but this applies only to the months before your birthday month.

- Reduction Rule: SSA will withhold $1 for every $3 earned above this limit.

Example:

You turn 67 in October 2026. You make $70,000 between January and September. That’s $4,840 over the limit, so SSA withholds about $1,613.

Starting in October (the month you hit FRA), you keep every penny of your benefit regardless of income.

3. At or Over Full Retirement Age

Once you’re at FRA (67 or older), Social Security gives you the green light to earn as much as you want. Whether that’s $20,000 from a weekend business or $200,000 from a late-career consulting gig, your benefits won’t be reduced at all.

This is why many people delay benefits: No penalties, and higher monthly payouts.

What Happens to Withheld Benefits?

Here’s where it gets interesting — and often misunderstood:

Withheld benefits aren’t lost.

When the SSA withholds money because you went over the earnings limit, they track those months and recalculate your benefit when you reach full retirement age. You’ll get a bump in your monthly check to reflect the months of “delay” caused by withholding.

In plain English: It’s like hitting pause on some checks, not losing them.

Additional 2026 Social Security Changes You Should Know

To better plan your income and taxes, here are a few more changes in 2026:

1. COLA Adjustment: 2.8% Increase

Social Security checks in 2026 get a 2.8% boost to account for rising prices. This COLA helps ensure that the purchasing power of your check keeps up with inflation.

2. Maximum Taxable Earnings: $184,500

If you’re still working and paying into Social Security, only the first $184,500 of your income is subject to payroll tax — up from $176,200 in 2025.

This mainly impacts high earners but also means potentially higher benefits down the line.

3. Work Credit Requirement

To qualify for Social Security, you need 40 work credits. In 2026, one work credit equals $1,890 in earnings, and you can earn a maximum of 4 credits per year.

What Counts as “Earnings” for the Limit?

It’s not all income that counts. Only earned income — like wages, salary, or net self-employment earnings — affects your Social Security benefits.

Income from these does NOT count toward the earnings limit:

- Pensions

- IRA/401(k) withdrawals

- Dividends and interest

- Rental income

This distinction matters a lot when building a retirement income plan.

Real-Life Examples of Working While Collecting Social Security

Case #1: Michelle, 64, Substitute Teacher

- Earns $28,000

- Limit is $24,480 → Over by $3,520

- SSA withholds $1,760 from her annual benefits

Case #2: George, 66, Turns 67 in November

- Earns $66,000 by October

- Limit is $65,160 → Over by $840

- SSA withholds $280 from benefits

Case #3: Carla, 68, Business Consultant

- Earns $120,000

- At or past FRA → No impact on benefits

Professional Tips: Maximize Benefits While Working

1. Delay Benefits If You Can

Delaying Social Security until age 70 increases your benefit by about 8% per year beyond FRA. Combine that with work income, and you may not need benefits right away.

2. Use Strategic Withdrawals

If you’re working and near the earnings limit, consider pulling funds from IRAs or Roths to avoid tripping the SSA threshold — since that money doesn’t count toward the earnings test.

3. Watch for Tax Consequences

Up to 85% of your benefits may be taxable depending on your total income. If you’re married filing jointly and make over $44,000 (including Social Security), expect to pay taxes on benefits.

4. Use the SSA’s Earnings Test Calculator

This handy tool lets you estimate how much benefit reduction you might face.

SNAP Benefits January 2026 Schedule – Check State-by-State Payment Dates You Should Know

When is the January 2026 Florida TCA Payment made? Check Eligibility

2026 Social Security Update: Check Important Changes to COLA, Medicare Costs, and Benefit Rules