Wells Fargo Settlement Payouts: Wells Fargo Settlement Payouts are a big deal right now, and not just for lawyers or Wall Street folks. Regular people — parents, elders, small business owners, workers, homeowners, and even retirees — may be owed money because of how Wells Fargo handled certain accounts, loans, calls, and fees over the past decade. If you’ve ever had a checking account, auto loan, mortgage, or even a phone call with Wells Fargo, this is something you should pay attention to.

This article explains what these settlements are, why they happened, who qualifies, how much money could be coming your way, and what steps you should take right now. We’ll keep the language simple, straight‑shooting, and grounded in real experience — no confusing legal talk unless it actually helps you. Think of this as guidance from someone who’s been around the financial block and wants you to walk away informed, not overwhelmed.

Table of Contents

Wells Fargo Settlement Payouts

Wells Fargo Settlement Payouts cover a wide range of consumer harms — from privacy violations and mortgage mismanagement to auto loan errors and unfair banking fees. Billions of dollars have been set aside to correct these issues, and millions of Americans are eligible for refunds or compensation. Some payments happen automatically. Others require action. The only way to know is to check your records, stay alert, and use official resources. This isn’t about chasing free money — it’s about reclaiming what was taken unfairly.

| Settlement Category | Total Settlement Amount | Who May Qualify | Potential Payout |

|---|---|---|---|

| Unauthorized Call Recording | $19.5 million | California residents & businesses | ~$86 per call, up to ~$5,000 |

| COVID Mortgage Forbearance | $185 million | Homeowners placed into forbearance without consent | Varies, automatic & claimed payments |

| CFPB Consumer Redress | Over $2 billion | Auto, mortgage, and deposit customers | Refunds to thousands per consumer |

| Auto Loan & Repossession Issues | Included in CFPB action | Auto loan borrowers | Refunds, loan corrections |

| Overdraft & Banking Fees | Included in CFPB action | Checking & savings customers | Fee refunds |

Understanding the Bigger Picture Behind Wells Fargo Settlement Payouts

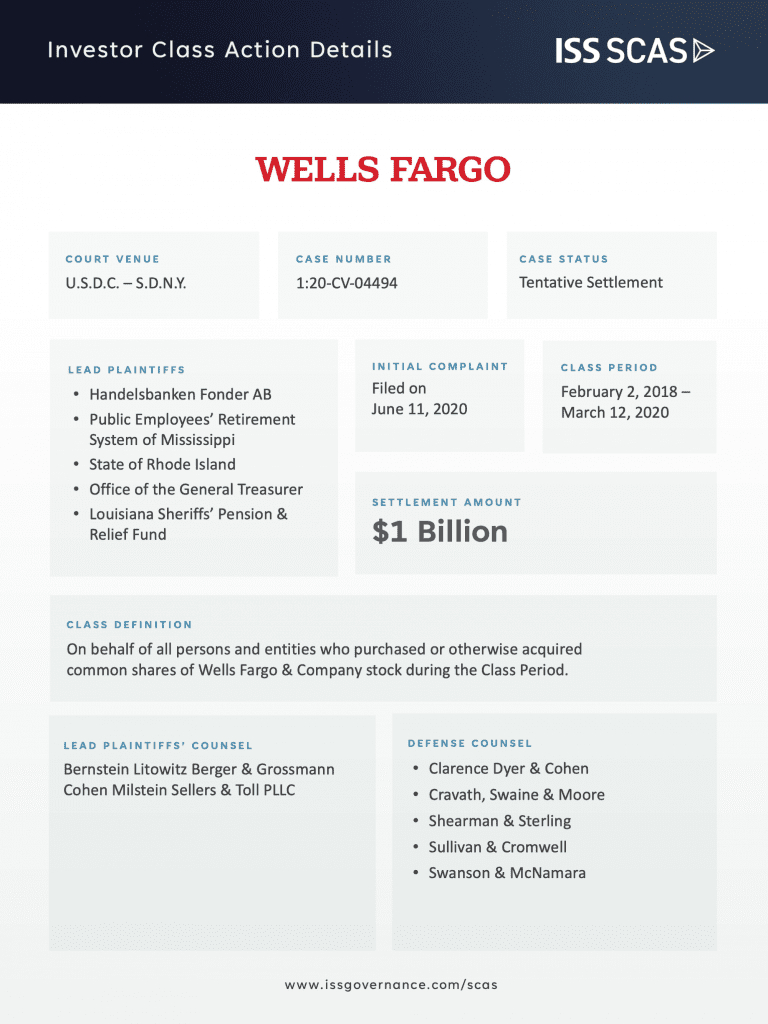

To really understand Wells Fargo Settlement Payouts, you need to understand how we got here. Over the last 10–15 years, Wells Fargo faced repeated investigations by federal regulators, state attorneys general, and consumer watchdogs. These weren’t small paperwork mistakes. They involved systemic problems — meaning issues that affected large numbers of customers over long periods of time.

The purpose of these settlements isn’t just punishment. It’s about accountability and correction. When a bank’s actions cause financial harm — even unintentionally — the law requires that affected consumers be compensated. That compensation is what you’re seeing now in the form of settlement payouts, refunds, credits, and checks.

The Call Recording Settlement: Why It Matters

One of the most talked‑about settlements is the unauthorized call recording case.

What Happened

In California, the law requires two‑party consent for call recording. That means both sides of a phone conversation must agree before the call is recorded. Wells Fargo, or companies working on its behalf, allegedly recorded calls without proper disclosure between 2014 and 2023.

This violated the California Invasion of Privacy Act and resulted in a $19.5 million class‑action settlement.

Who Qualifies

You may qualify if:

- You lived or ran a business in California during the covered period

- You received one or more calls from Wells Fargo or its contractors

- Those calls were recorded without your consent

How Much Could You Get

Payments are calculated per call, not per person.

- Average payout: around $86 per call

- Maximum payout: up to approximately $5,000, depending on how many valid claims are submitted

This means someone with multiple qualifying calls could receive significantly more than someone with just one.

Why This Settlement Is Important

This case reinforces a simple truth: privacy still matters. Even in a world of customer service recordings and automated systems, companies must follow the law. This settlement sends a message that consumer consent isn’t optional.

COVID Mortgage Forbearance Settlement: When Help Hurt

During the COVID‑19 pandemic, many homeowners were struggling. Mortgage forbearance programs were created to help — but in some cases, Wells Fargo placed borrowers into forbearance without clear permission.

Why That Was a Problem

Forbearance can affect:

- Credit reports

- Ability to refinance

- Home sales

- Long‑term loan costs

Some homeowners didn’t want forbearance at all but found themselves flagged as “paused,” which caused financial complications down the road.

The Settlement

A $185 million settlement was approved to compensate affected borrowers.

How Payments Work

- Some homeowners received automatic payments

- Others had the option to file claims for additional compensation

- Distribution began in early 2025

What You Should Check

If you had a Wells Fargo mortgage during the pandemic:

- Review your loan history

- Look for unexplained forbearance periods

- Check your credit reports from 2020–2022

Even if you’ve already moved or refinanced, you may still qualify.

CFPB Consumer Redress: The Largest Source of Wells Fargo Settlement Payouts

The biggest pool of money tied to Wells Fargo comes from enforcement by the Consumer Financial Protection Bureau.

In 2022, the CFPB ordered Wells Fargo to return over $2 billion to consumers, in addition to paying a massive civil penalty.

What the CFPB Found

The agency identified widespread issues, including:

- Incorrect auto loan charges

- Wrongful vehicle repossessions

- Surprise overdraft fees

- Misapplied mortgage payments

- Improper account handling

More than 16 million consumer accounts were affected nationwide.

How CFPB Redress Is Paid

Unlike class actions, CFPB redress often happens automatically:

- Wells Fargo identifies affected customers

- Refunds or credits are issued directly

- Checks may arrive without much explanation

This is why many people throw these checks away by mistake. Always open mail from banks or payment processors.

Auto Loan and Repossession Issues Explained Simply

Auto loan problems were one of the most serious findings in the CFPB action.

Common Issues Included

- Payments applied incorrectly

- Late fees added in error

- Insurance charges mishandled

- Vehicles repossessed when they shouldn’t have been

What Consumers Received

- Refunds for excess fees

- Loan balance corrections

- Compensation for wrongful repossessions

For families relying on a car to get to work, school, or medical care, these errors had real‑world consequences — and the redress was designed to reflect that.

Overdraft Fees and Banking Account Refunds

Another major area of concern was deposit accounts.

What Went Wrong

Some customers were charged overdraft fees even when:

- Transactions were authorized with sufficient funds

- Deposits were pending but not credited properly

- Fees were stacked unfairly

What the Settlement Did

Affected customers received:

- Fee refunds

- Account credits

- Adjustments to negative balances

If you ever wondered why your account dipped even when you were careful, this may be why.

Step‑by‑Step Guide: How to Protect Yourself and Claim What’s Yours

Step 1: Review Your History

Look at:

- Old bank statements

- Loan documents

- Credit reports

- Call logs or phone records

Patterns matter more than single mistakes.

Step 2: Watch Your Mail and Email

Settlement payments often arrive:

- As plain checks

- From third‑party administrators

- Without clear explanations

Never assume it’s junk mail.

Step 3: Use Official Resources Only

If you believe you were harmed and received nothing:

- File a complaint through the CFPB’s official website

- Avoid third‑party “claims helpers” who ask for payment

Real settlements never require upfront fees.

Common Mistakes People Make (And How to Avoid Them)

Many people lose settlement money because they:

- Miss deadlines

- Throw away checks

- Assume they don’t qualify

- Fall for scams

The biggest mistake? Not checking.

Even professionals miss payouts because they assume someone else handled it.

Infosys McCamish Wins Final Approval for $17.5 Million Class Action Settlement – Check Details

Wells Fargo $33 Million Settlement: How Eligible Customers Can Claim Their Payout

AT&T Settlement Deadline Extended; Here’s How to File Your Claim Before Time Runs Out

Why These Settlements Matter Beyond the Money?

These payouts aren’t just about checks. They represent:

- Stronger consumer protections

- Better banking practices

- Accountability at the highest levels

They also show that regular people matter, even when dealing with massive financial institutions.