New 2026 Minimum Wage: Washington State is making headlines again for leading the nation in progressive wage policies. On January 1, 2026, the state will officially raise its minimum wage to $17.13 per hour for workers aged 16 and over. This adjustment is part of Washington’s automatic wage increases tied to inflation and continues its trend of pushing for fairer labor standards. Whether you’re a worker looking forward to a larger paycheck, a teenager starting your first job, or an employer trying to budget for the upcoming year, this wage bump affects you. We’ve created this easy-to-follow, SEO-optimized guide to explain the change, who it applies to, and what it means for Washington’s economy and its people.

Table of Contents

New 2026 Minimum Wage

Washington’s 2026 minimum wage hike to $17.13 per hour continues a legacy of fair pay, worker protection, and smart economic planning. It’s a wage backed by data, law, and community needs. Workers get a better shot at financial stability. Employers gain clarity and consistency. The bottom line? Whether you’re hiring, job hunting, or budgeting, now’s the time to get prepared.

| Item | Details |

|---|---|

| Effective Date | January 1, 2026 |

| New Minimum Wage (Age 16+) | $17.13 per hour |

| Youth Minimum Wage (Ages 14–15) | $14.56 per hour (85% of adult wage) |

| 2025 State Minimum Wage | $16.66 per hour |

| Top Local Wages | Seattle ($19.97+), SeaTac, Tukwila |

| Inflation Indexed? | Yes – Adjusted annually via CPI-W |

| Applies To | Most jobs in Washington State (age 14+), excluding exempt categories |

| Official Source | Washington L&I |

What’s Behind the New 2026 Minimum Wage?

Washington’s minimum wage law is structured to reflect the real cost of living. This isn’t about political grandstanding—it’s about economic fairness. Thanks to Initiative 688, passed by voters in 1998, the state is required to adjust the minimum wage annually based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

So when inflation goes up—when gas prices spike, groceries cost more, or rents increase—the minimum wage goes up too. It’s a smart, sustainable approach to ensure workers don’t fall behind.

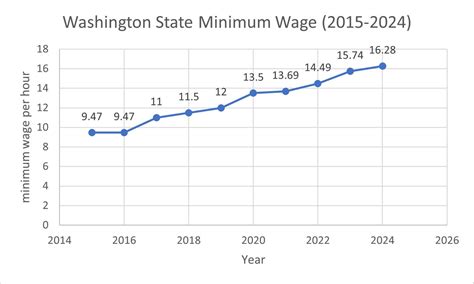

Historical Wage Trends in Washington (2000–2026)

Washington has consistently led the nation in minimum wage laws. Here’s a snapshot of how things have changed over the past 25 years:

| Year | Minimum Wage |

|---|---|

| 2000 | $6.50 |

| 2005 | $7.35 |

| 2010 | $8.55 |

| 2015 | $9.47 |

| 2020 | $13.50 |

| 2023 | $15.74 |

| 2025 | $16.66 |

| 2026 | $17.13 |

That’s a 163% increase since 2000—well above the federal minimum wage, which has been stuck at $7.25 since 2009.

Who Is Affected By New 2026 Minimum Wage?

Workers

If you’re 16 or older and working hourly in Washington, you’re entitled to at least $17.13/hour. If you’re 14–15 years old, you can legally be paid 85% of that rate, or $14.56/hour.

This applies to most industries: restaurants, retail, warehouses, customer service, delivery, and more. And remember—tip credit is illegal in Washington. So if you’re a server making tips, your employer still owes you the full minimum wage.

Employers

Every business, big or small, needs to comply. There are no “small business” exemptions in Washington unless you’re governed by a local minimum wage law that’s higher (like in Seattle or Tukwila).

Local Minimum Wages May Be Higher

Several Washington cities have passed local minimum wage ordinances that exceed the state rate:

Seattle

Seattle has its own tiered system based on employer size and healthcare contributions. In 2025, the wage is $19.97/hour. For 2026, it will rise again based on inflation.

SeaTac

SeaTac’s 2025 wage for transportation and hospitality workers is $19.71/hour. This will also increase in 2026.

Tukwila

Tukwila passed a phased-in increase, aligning with SeaTac’s wage by 2027. By 2026, larger employers will likely need to pay over $20/hour.

A Closer Look: Real Impact of $17.13/Hour

Let’s break down what this wage means in the real world.

Example: Full-Time Worker (40 hours/week)

- Weekly earnings: $685.20

- Monthly earnings: $2,970.60

- Yearly earnings (before taxes): $35,647.20

Comparison:

- 2025 wage ($16.66/hr) earns $34,652/year

- That’s a $995/year difference—enough to cover a month of groceries, a car repair, or a small vacation

Best Practices for Employers (Compliance 101)

1. Update Payroll Systems

By December 2025, your payroll should reflect the new rate. Systems like QuickBooks, Gusto, or Paychex usually allow you to schedule wage adjustments in advance.

2. Train HR & Managers

Make sure your team understands the new wage, especially if managing minors or tipped workers.

3. Update Job Ads & Offer Letters

All postings must reflect the updated wage by the January 1, 2026 deadline.

4. Post Wage Notices

State law requires you to display current wage posters. Download the updated version from Washington L&I.

5. Budget for Increased Costs

Don’t get caught off guard. Consider how this wage affects not just base pay but also:

- Overtime calculations

- Bonuses

- Shift differentials

- Paid leave accruals

Employee Rights: How to Protect Yourself

If you believe you’re being underpaid, you can:

- Check your paycheck stub: Make sure hours match up

- Talk to your employer: Sometimes it’s an honest mistake

- File a wage complaint: Use L&I’s wage complaint portal

And remember: it’s illegal for an employer to retaliate against you for asserting your rights.

Long-Term Outlook: What to Expect Beyond 2026

With inflation still an ongoing issue and housing costs rising, don’t expect the wage to freeze at $17.13.

Experts predict that by 2030, Washington’s minimum wage could exceed $19–20/hour, especially if inflation continues at moderate rates.

That’s why both workers and businesses should treat wage planning as an annual exercise, not a one-off event.

New Montana Law Means Bigger Paychecks: Minimum Wage Hike Kicks In January 1, 2026

It’s Official: New York Announces 2026 Minimum Wage Hike; Here’s Who Benefits Most

$967 SSI Payment December 2025: Will you get it? Check Eligibility