Warrior Dividend Military Christmas Bonus: The Warrior Dividend military Christmas bonus is making headlines across military bases, hometowns, and veterans’ communities this December — and for good reason. It’s not every day the U.S. government offers a special $1,776 tax-free bonus to over a million active-duty troops and reservists. Announced as part of a high-profile White House and Department of Defense initiative, the Warrior Dividend is designed to honor America’s military service members in a way that blends both symbolism and substance. This payment recognizes the contributions of military personnel and celebrates the United States’ 250th anniversary in 2026 — tracing its roots back to the founding year 1776.

In this comprehensive guide, we’ll break down who qualifies, how much you’ll get, how to receive it, and what it means — all in clear, human language. Whether you’re an enlisted service member, a military spouse, a reservist, or just curious about the policy — this article has you covered.

Table of Contents

Warrior Dividend Military Christmas Bonus

The Warrior Dividend is more than just a bonus — it’s a symbol of national gratitude, a financial boost during the holidays, and a nod to the military’s vital role as the United States approaches its 250th year. If you’re an enlisted soldier, a mid-career officer, or a Guard/Reserve member called to serve — this is your bonus. It reflects both your service and your connection to the legacy of the founding of the nation. Be sure to check your bank deposit, LES, and eligibility status, and don’t hesitate to contact finance if something seems off. This is your well-earned reward for service and sacrifice.

| Topic | Details |

|---|---|

| Bonus Name | Warrior Dividend |

| Amount | $1,776 (one-time, tax-free) |

| Purpose | Symbolic recognition for military service ahead of U.S. 250th anniversary |

| Announced by | White House & Department of Defense |

| Eligibility Cutoff | Must be in qualifying status as of Nov. 30, 2025 |

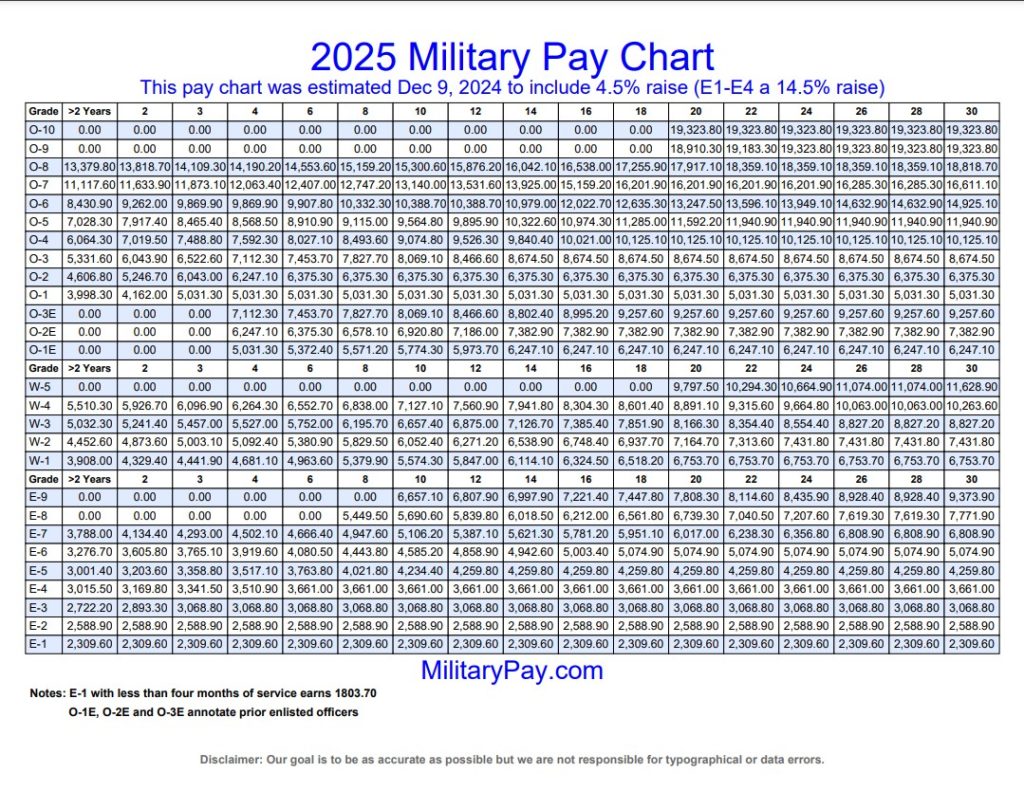

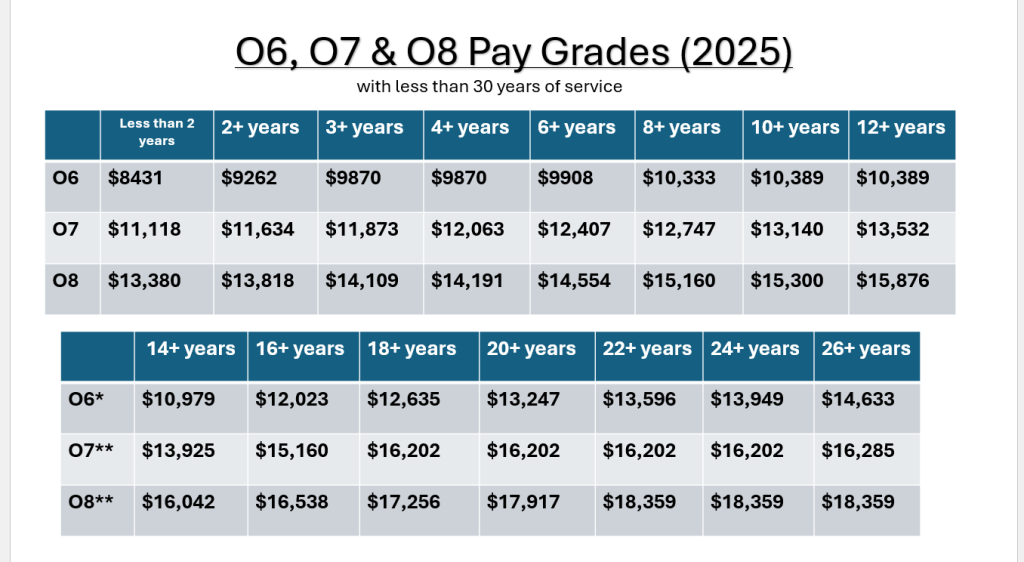

| Pay Grade Limit | E-1 to O-6 (Enlisted through Colonel/Navy Captain) |

| Reservist Eligibility | Guard/Reserve on 31+ days of active duty as of cutoff |

| Expected Payout | Before Christmas 2025 |

| Official Source | war.gov |

What Is the Warrior Dividend?

The Warrior Dividend is a one-time cash payment of $1,776 to qualifying U.S. military service members. It is being issued before Christmas 2025 as a holiday bonus, with the amount referencing 1776, the year America declared its independence.

But this is more than just a Christmas gift — it’s part of a broader recognition of military service as the nation prepares for America250, a nationwide celebration of the Semiquincentennial — the 250th birthday of the United States.

This isn’t a recurring allowance or pay raise. It’s a standalone supplemental bonus, designed for morale and appreciation. It does not affect regular base pay, retirement calculations, or annual cost-of-living adjustments.

How Much Will You Receive?

$1,776 — exactly. No more, no less. Every qualified service member will receive this fixed amount.

- It doesn’t vary based on years of service, job title, or duty station.

- There is no application process. Payment will be automatic via DFAS or your service’s pay system.

- Officials have stated that the bonus will be non-taxable, treated as a housing supplement or cost-of-living bonus under current federal guidelines.

Although final confirmation on tax implications will appear on your Leave and Earnings Statement (LES) or W-2, early indications suggest you’ll receive the full $1,776 without tax withholding.

Who Is Eligible for the Warrior Dividend Military Christmas Bonus?

Eligibility is based on pay grade, duty status, and active service as of November 30, 2025.

Eligible Groups

You will receive the Warrior Dividend if you meet all of the following:

- You are a member of the U.S. Armed Forces: Army, Navy, Air Force, Marine Corps, Space Force, or Coast Guard.

- You were actively serving on November 30, 2025.

- Your pay grade was E-1 through O-6, including enlisted personnel, NCOs, and officers up to the rank of colonel or Navy captain.

- If in the Reserves or National Guard, you were on orders for at least 31 consecutive days by the cutoff date.

This group includes approximately 1.28 million active-duty members and over 170,000 Reserve Component troops, according to Pentagon data.

Who Is NOT Eligible?

Several categories of personnel are excluded from the Warrior Dividend:

- Retired military veterans (unless recalled to active duty).

- Inactive Guard or Reserve members not on qualifying orders.

- General officers and flag officers (O-7 and above).

- Civilian employees of the Department of Defense, even if formerly enlisted.

The rationale? This bonus is targeted toward frontline, actively serving troops — not administrators, senior leadership, or retirees.

When Will You Get It?

The Department of Defense has confirmed that payments will be disbursed in December 2025, with a goal of completion before Christmas.

How you’ll receive it:

- Via direct deposit, same as your normal paycheck.

- It will appear on your December LES, likely under a special line labeled “Warrior Dividend” or “Special Housing Adjustment.”

- If you don’t see the payment by January 5, 2026, contact your unit finance office or DFAS to resolve it.

Political and Historical Context

This bonus didn’t just appear out of thin air — it’s tied closely to national pride, election-year messaging, and the Semiquincentennial celebration of America’s founding.

Officials and lawmakers referenced the “spirit of 1776” as a key theme. The number itself — $1,776 — is deliberate, patriotic, and meant to evoke emotional resonance with service members and their families.

There’s also a strategic timing element. The bonus was announced in late 2025, just ahead of the 2026 federal elections and amid efforts to improve military retention and morale after recruitment shortfalls from 2022–2024.

How Warrior Dividend Military Christmas Bonus Compares to Other Military Benefits?

Let’s put the Warrior Dividend in context.

| Benefit | Amount | Frequency | Taxable? |

|---|---|---|---|

| Warrior Dividend | $1,776 | One-time | Reported as non-taxable |

| Enlistment Bonus | Up to $50,000+ | Contract-based | Taxable |

| Base Pay Raise (2025) | 4.6% avg. | Annual | Yes |

| BAH (Housing Allowance) | $1,000–$3,000/month | Monthly | Non-taxable |

While the Warrior Dividend isn’t the highest payout you’ll ever see, it’s one of the largest one-time, universal bonuses ever provided to such a broad swath of the military — and without taxes, strings, or obligations.

Practical Steps: What Should You Do Now?

Here’s what service members and military families should do:

1. Confirm Eligibility

- Check your current pay grade and duty status.

- If you were on leave, TDY, or mobilized orders as of Nov. 30, 2025 — you’re covered.

2. Log into MyPay or Your Pay System

- Update your banking info to avoid misdirected payments.

- Check for pending LES updates after Dec. 15.

3. Track Your LES and W-2

- If the bonus does not appear on your December LES, contact your unit finance officer.

- Confirm its presence on your 2025 W-2 (if listed at all, since it may be tax-exempt).

4. Use It Wisely

Consider putting the bonus toward:

- Holiday expenses (gifts, travel, food).

- Emergency savings or credit card payments.

- Investing in military spouse careers or certifications.

- Home repairs, PCS prep, or childcare.

$1312 Stimulus Checks December 2025: Verify Eligibility & Payment Schedule

Planning Retirement? Here’s the Average Social Security Payment in Every State for 2025