US SNAP Benefits in 2026: is the topic we’re breaking down here — and we’re gonna walk through this with respect, clarity, and real‑talk grounded in reliable facts and lived experience. This program affects millions of American households, and understanding the 2026 updates — what’s actually changing, why it matters, and how to take action — is essential whether you’re a family making ends meet, a community worker, a tribal advocate, or a policy professional. In this article you’ll find contextual background, policy explanations, clear examples, practical advice, accurate data, official sources, and a straightforward guide on how SNAP works in 2026 and what’s shifting for recipients.

Table of Contents

US SNAP Benefits in 2026

The landscape of US SNAP Benefits in 2026 represents a significant policy shift that affects millions of Americans. With expanded work requirements, updated income limits, changes to what you can buy, and shifting administrative responsibilities, being proactive and informed has never been more important. This article has laid out a clear, detailed roadmap — from eligibility and benefit amounts to food restrictions and practical steps to keep benefits — so you can approach SNAP with confidence and strategy. Whether you’re directly affected or helping others navigate these changes, the goal is the same: build food security, preserve dignity, and ensure access to nutrition for all.

| Topic | Details & Data |

|---|---|

| Program | Supplemental Nutrition Assistance Program — Official USDA SNAP info: https://www.fns.usda.gov/snap/ |

| People Affected | ~42 million Americans rely on SNAP monthly (USDA data). |

| New Work Rules | Ages 18–64 without dependents under 14 must complete 80 hours/month of work, training, or approved activities to remain eligible beyond 3 months in a 3‑year period. |

| 3‑Month Limit | Without meeting work requirements, benefits limited to 3 months in a 36‑month period. |

| Maximum Benefit (48 States) | 1 person: $298; 4 people: $994 (2026 update). |

| Food Purchase Restrictions | Multiple states have approved restrictions on sugary drinks, candy, and some snack foods. |

| Admin Costs | States will cover more SNAP administrative costs starting late 2026. |

| Income Thresholds | Gross and net income limits updated for 2025–2026 benefit year. |

| Deductions | Rent, utilities, medical costs, and childcare can reduce countable income. |

What Is SNAP — A Full Working Definition

The Supplemental Nutrition Assistance Program (SNAP) is the largest federal food assistance program in the United States. SNAP provides monthly benefits via an EBT debit‑style card that can be used to buy eligible foods at supermarkets, grocery stores, and farmers’ markets.

SNAP is designed to help low‑income individuals and families stretch their dollars for groceries — meaning bread, milk, produce, meat, and many staples — but not alcohol, tobacco, vitamins, or hot prepared foods. SNAP benefits help reduce food insecurity, support healthier eating, and stabilize local economies — studies show that nearly every dollar spent through SNAP returns in local economic activity.

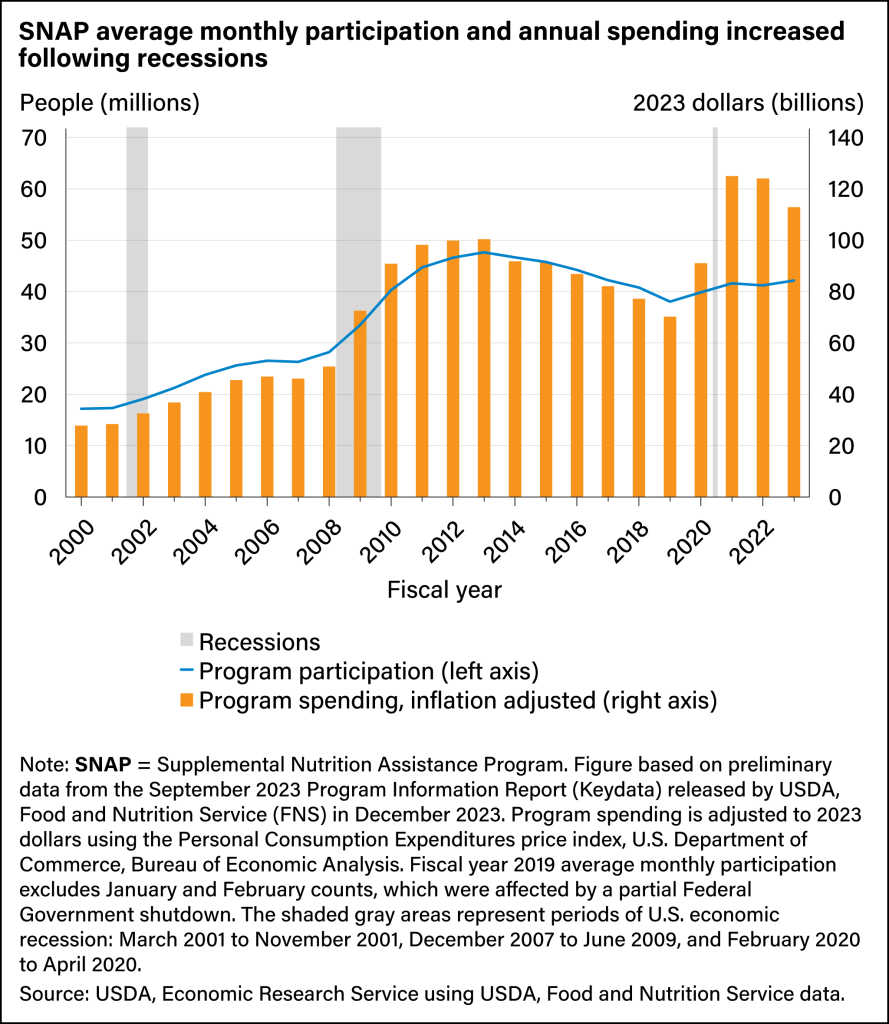

Historically, SNAP began as the Food Stamp Program in the 1930s and has evolved into a cornerstone of the social safety net, responding to changing needs in times of recession, inflation, or economic disruption.

Why 2026 Is a Big Year for SNAP Changes?

The changes in 2026 stem from a combination of federal legislation, administrative policy shifts, and evolving state decisions:

- Federal law adjustments have broadened work requirements and redefined eligibility categories.

- State governments are taking up new authority to impose food purchase restrictions and manage administrative workloads.

- Cost‑of‑living adjustments continue to change the real value of benefits as inflation impacts food prices.

- Eligibility rules are being updated to reflect economic conditions and budget considerations.

These updates are not just technical edits — they represent real shifts in how millions of Americans access food support and how families plan around work, school, health care, utility costs, and childcare.

Work Requirements — In‑Depth Explanation

New Expanded Rule

Starting in 2026, SNAP’s work requirements expanded significantly:

- People aged 18–64 who do not live with a dependent under age 14 must complete 80 hours per month of qualifying work or approved activities to remain eligible beyond three months in any 36‑month period.

- Qualifying activities include paid employment, SNAP Employment & Training programs, community service, or approved education/training.

This change brings more people into the work requirement than previous years. It’s a return to a stricter interpretation of “able‑bodied adults without dependents” that has varied through legislative and administrative shifts over the last decade.

Example: How This Works in Practice

Let’s say Maria is 38 years old and lives alone. She receives SNAP benefits to help buy groceries. In 2026, to keep SNAP beyond three months in a 36‑month period, she must complete 80 hours each month in one or a mix of:

- Part‑time paid work (e.g., 20 hours/week),

- A community service program approved by her state,

- A job training program that qualifies under SNAP regulations.

If Maria only completes 30 hours one month, she still qualifies for up to three months of benefits during the 36‑month period — but after that, SNAP benefits could stop until she meets the 80‑hour rule or qualifies for an exemption.

Exemptions to Work Rules

Some people are exempt from work requirements. These commonly include:

- People with disabilities documented by medical providers.

- Individuals aged 65+.

- Adults caring for a dependent with a disability or someone incapacitated.

- Participants in certain approved education programs.

- Pregnant individuals (depending on state and guidelines).

- People meeting other specific criteria under state policies.

The official SNAP work requirement document provides full details on qualifying exemptions.US SNAP Benefits in 2026

US SNAP Benefits in 2026 Amounts and How They’re Calculated

SNAP benefit amounts are not “one size fits all.” They are based on your countable income and the maximum benefit level for your household size.

Maximum Monthly Benefit Levels — 2026 (48 States)

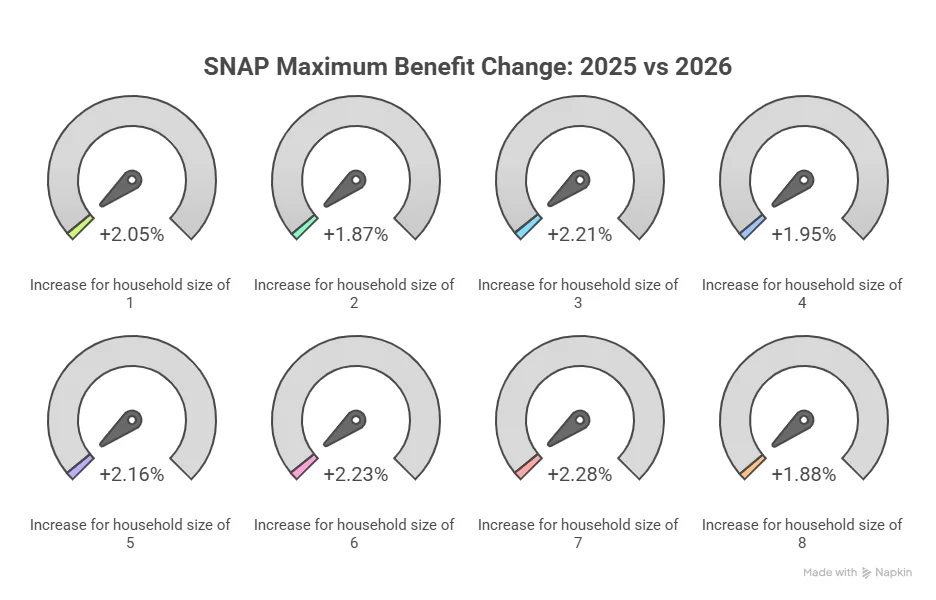

For the 2025–2026 benefit year, the USDA adjusted maximum benefit amounts based on inflation and food cost data:

| Household Size | Maximum Monthly SNAP Benefit |

|---|---|

| 1 person | $298 |

| 2 people | $546 |

| 3 people | $785 |

| 4 people | $994 |

| 5 people | $1,183 |

| 6 people | $1,421 |

| 7 people | $1,571 |

| 8 people | $1,789 |

| Additional person | +$218 |

These numbers represent the maximum benefit — if your household has any income above zero, the actual benefit is typically lower based on a formula that assumes households will spend a fixed percentage of income on food.

Example Calculation

Suppose a family of four has a net monthly income of $1,500 after deductions (rent, utilities, medical costs). SNAP estimates expected food spending, subtracts that from the maximum, and arrives at a benefit amount. It’s not a flat check — it’s a calculated support aimed to fill the gap between income and a nutrition standard.

Deductions That Lower Your Countable Income

Some expenses are deducted from your gross income when calculating SNAP benefits:

- Standard deduction (varies by household size)

- Shelter costs (rent or mortgage, utilities)

- Medical expenses (for elderly or disabled)

- Childcare costs required for work/training

- Other allowable deductions under SNAP rules

These deductions can increase your SNAP benefit by lowering your countable income.

Income Eligibility — Gross and Net Limits

SNAP eligibility considers both gross and net income:

- Gross income: Total income before deductions.

- Net income: Income after deductions.

To qualify for SNAP in most states, your income must be:

- Gross income ≤ 130% of the federal poverty level

- Net income ≤ 100% of the federal poverty level

For example, in 2026, the rough gross/net income limits for a single person were approximately:

- Gross: ~$1,696/month

- Net: ~$1,305/month

Food Purchase Restrictions — What’s New in 2026

In addition to eligibility changes, state governments now have authority to impose food purchase restrictions on SNAP benefits under USDA‑approved waivers.

This means some states have restrictions that block certain items like:

- Sugary drinks

- Candy

- Certain processed snack foods

These restrictions are implemented to promote healthier eating habits and align SNAP spending with nutrition goals. However, they also create complexity at the checkout for SNAP recipients.

States that have implemented or are considering food restrictions in 2026 include Arkansas, Colorado, Florida, Louisiana, Oklahoma, and Texas — with more reviewing waiver approval.

Recipients should check their state’s approved SNAP eligible item list — many grocery stores use systems that automatically block restricted items at point of sale

Clear guidance from your state SNAP office helps avoid confusion at checkout and ensures you’re planning your grocery lists effectively.

Administrative Costs and State Implementation

Beginning late 2026 and beyond, states will take on a larger share of SNAP’s administrative costs. These costs cover staffing, technology systems, case processing, call centers, and outreach programs.

Shifting more administrative burden to states may lead to:

- Longer processing times for applications and renewals.

- Increased demand for caseworker hires.

- Changes in how work requirements are documented and reported.

This administrative shift means advocacy and community support organizations become even more critical — helping households navigate the process, avoid gaps in benefits, and meet documentation deadlines.

SNAP + Healthcare and Other Programs

SNAP often interacts with other social programs like:

- Medicaid

- Temporary Assistance for Needy Families (TANF)

- WIC (Women, Infants, and Children nutrition program)

- Childcare assistance

Many states coordinate applications so households eligible for Medicaid may be “categorically eligible” for SNAP if they meet certain criteria. Understanding how these programs align helps families maximize support.

For example, people enrolled in Medicaid often undergo a simplified SNAP application process because income and asset checks have already been verified for Medicaid.

Historical & Legal Context

SNAP’s work requirement changes in 2026 reflect broader policy debates over the years about how food assistance should be structured:

- Work requirements have ebbed and flowed based on economic conditions, federal leadership, and legislative priorities.

- During the Great Recession and COVID‑19 pandemic, many work mandates were relaxed to improve access.

- The current shift reflects a return to more traditional work engagement expectations.

Understanding this legal history helps advocates and recipients recognize why the rules are evolving and how to prepare for future policy changes.

Practical Steps for US SNAP Benefits in 2026

1. Know Your Work Requirements

Document hours weekly — paid work, job training, community service count. Ask your caseworker about SNAP E&T (Employment & Training) programs.

2. Track Income and Deductions

Make sure rent, utilities, medical, and childcare deductions are properly recorded to maximize benefits.

3. Shop With Awareness

Check your state’s eligible items list — especially if food restrictions apply.

4. Claim Exemptions Early

Medical or caregiving exemptions should be documented as soon as possible to avoid losing benefits.

5. Work With Community Partners

Food banks, legal aid clinics, tribal advocacy organizations, and health clinics often provide SNAP guidance and help with applications.

6. Prepare for Renewals

SNAP renewals happen periodically — missing documentation on time is a common reason benefits lapse.

SNAP Benefits 2026 Update – New Rules and Orders That Could Change Eligibility

SNAP Changes in 2026 – New Payment Amounts & Rules Explained

SNAP Benefits February 2026 – Full Payment Schedule and Key Changes You Should Know