Up to $4,018 in Social Security: If you’ve been scrolling through headlines saying “Up to $4,018 in Social Security arrives December 10”, you might be wondering who’s actually getting that money and whether your check will be one of them. Here’s the deal: this isn’t a random bonus or surprise gift from Uncle Sam. It’s part of the Social Security Administration’s (SSA) regular payment cycle — and December 10, 2025, happens to be payday for millions of Americans whose birthdays fall early in the month. But that big $4,018 number that everyone’s talking about? That’s the maximum possible benefit a retiree can get in 2025 — not the average. Most Americans receive around $2,008 per month, and how much you get depends on your earnings history, when you retire, and how long you’ve been paying into the system.

Table of Contents

Up to $4,018 in Social Security

The upcoming December 10, 2025, Social Security payment is part of the regular schedule, not a surprise bonus. But for millions of Americans, it’s a crucial part of their monthly income. Whether your check is $1,500 or the max $4,018, understanding how it’s calculated, when it arrives, and how to make it grow is the best way to secure your financial future. If you haven’t already, log into your My Social Security account, check your records, and start planning. You’ve worked for this — now make sure you get every penny you’ve earned.

| What It Means | Details / Stats |

|---|---|

| Maximum Monthly Benefit (2025) | $4,018 per month for retirees at full retirement age (FRA). |

| Average Monthly Benefit (2025) | $2,008.31 for a typical retired worker. |

| Maximum at Age 70 | $5,108/month for those who delay benefits until age 70. |

| COLA for 2025 | 3.2% Cost-of-Living Adjustment (COLA) applied to all benefits. (SSA.gov) |

| Payment Date (Born 1–10) | Wednesday, December 10, 2025. |

| SSI Payment Timing | December 1 (Dec payment) and December 31 (January payment sent early). |

Why Up to $4,018 in Social Security Matters?

Social Security isn’t just a line on a government form — it’s a financial lifeline for over 71 million Americans. Retirees, disabled workers, and survivors rely on these monthly payments to cover everyday essentials like rent, medicine, food, and utilities. In 2025, Social Security benefits received a 3.2% COLA increase, designed to help offset inflation and higher living costs. While that’s good news, inflation is still a big deal — especially for fixed-income seniors. So knowing exactly when your money is coming, how much you’ll receive, and how to maximize it matters more than ever.

Who Qualifies for Up to $4,018 in Social Security?

Not everyone will see their deposit on December 10. The SSA uses a birthdate-based payment schedule, which helps spread out deposits over the month.

You’ll get paid on December 10, 2025, if:

- You receive retirement, disability (SSDI), or survivor benefits.

- Your birthday falls between the 1st and 10th of any month.

- You first started receiving benefits after May 1997 (new payment system).

- Your payments are through direct deposit or a Direct Express card.

If your birthday falls between the 11th and 20th, your payment arrives on December 17. For birthdays 21st–31st, it’ll hit on December 24.

Those who began receiving benefits before May 1997 follow the old system, where checks go out on the 3rd of each month — regardless of your birthday.

What “Up to $4,018 in Social Security” Really Means?

The $4,018 maximum benefit isn’t a myth, but it’s rare. You only reach that number if:

- You worked at least 35 years.

- You consistently earned at or above the Social Security taxable wage base, which is $168,600 in 2025.

- You waited until your full retirement age (FRA), around 66 or 67 depending on your birth year.

If you wait until age 70, your benefit jumps even higher — up to $5,108 per month in 2025. That’s because SSA gives you an 8% annual bonus for delaying past your FRA.

For comparison, if you claim early at age 62, your maximum benefit drops to about $2,831/month. That’s a big cut for claiming early, even though many do it out of necessity.

Real-Life Examples

- Jack, 68, worked as an engineer earning six figures for 40 years. He waited until FRA to retire. His benefit: around $3,950/month.

- Linda, 62, retired early due to health reasons. Her monthly benefit is $2,300, permanently reduced because she claimed early.

- Maria, 70, waited until the max age. Her benefit tops $5,000/month thanks to delay credits and a strong earnings record.

The takeaway? The longer and more you earn — and the later you claim — the bigger your check.

How Social Security Payments Are Calculated?

The SSA uses a formula based on your average indexed monthly earnings (AIME) over your 35 highest-earning years. If you have fewer than 35 years of work history, zero-income years are added in — which lowers your average.

Your AIME is then plugged into a progressive formula that replaces a higher percentage of income for lower earners. In short, high earners get larger checks in dollar terms, but a smaller replacement rate of their income.

And remember, benefits are adjusted annually through the Cost-of-Living Adjustment (COLA), tied to inflation based on the CPI-W index (Consumer Price Index for Urban Wage Earners and Clerical Workers).

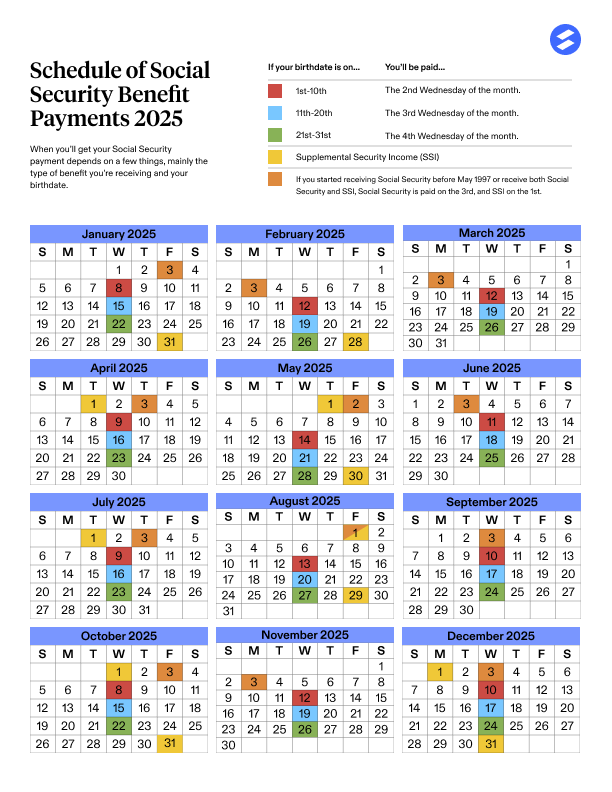

Social Security 2025 Payment Schedule

| Group | Payment Date |

|---|---|

| SSI Recipients | December 1 and December 31, 2025 |

| Beneficiaries before May 1997 | December 3 |

| Birthdays 1–10 | December 10 |

| Birthdays 11–20 | December 17 |

| Birthdays 21–31 | December 24 |

If your deposit doesn’t arrive by the expected date, SSA recommends waiting at least three business days before contacting them or your bank.

Practical Advice to Make the Most of Your Benefits

Review Your Earnings Record

Set up your My Social Security account at SSA.gov/myaccount and review your earnings record annually. Mistakes happen, and missing income years can shrink your monthly check.

Delay if You Can

Each year you delay claiming between your FRA and age 70 adds roughly 8% to your benefit. Waiting even one or two years can make a noticeable difference.

Coordinate With a Spouse

Married? Strategically timing your claims can maximize spousal or survivor benefits. One spouse can delay benefits to increase household income later in life.

Watch Out for Taxes

If your combined income (including pensions or investments) exceeds certain limits, up to 85% of your Social Security benefit could be taxable. Check the IRS thresholds before filing.

Plan for Healthcare Costs

Medicare premiums are often deducted directly from your benefit. Factor that in when budgeting.

Keep Inflation in Mind

COLA adjustments help, but they rarely match real inflation in housing and healthcare. Consider other savings vehicles like IRAs or Roth accounts to bridge gaps.

Common Mistakes People Make

- Claiming too early — Many Americans file at 62 out of fear SSA will “run out of money,” but that leads to smaller checks for life.

- Not checking their record — Errors in earnings history are more common than you’d think.

- Relying solely on Social Security — It’s meant to replace about 40% of pre-retirement income, not 100%.

- Ignoring spousal benefits — You may be eligible for up to 50% of your spouse’s FRA benefit, even if you never worked.

- Missing COLA updates — Staying informed helps you plan better.

How to Stay Informed and Protect Your Benefits?

Fraud and misinformation are rampant online, especially with scammers pretending to be SSA employees.

The SSA will never ask for your Social Security number, bank info, or payment over the phone. You can also sign up for official email alerts through your MySSA account to track benefit changes and updates safely.

New Bill Could Force Social Security to Issue New Numbers—Are You Affected?

Historic Social Security Boost Coming to These 5 States in 2026; Are You on the List?

Trump Wants to Bring Australia’s Retirement System to the U.S.—Could It Replace Social Security?

The Bigger Picture — Why Planning Ahead Matters

Think of Social Security as a foundation — not your entire retirement plan. The earlier you start learning the rules, the better you can use them to your advantage. For younger workers, that means maximizing your 401(k), IRA, or other investments so you’re not solely dependent on government benefits later.

For those already retired, understanding your payment schedule, COLA increases, and tax responsibilities helps you make smarter monthly financial decisions.

Retirement is a lifelong journey — not a finish line.