Two Energy Tax Credits: Two powerful Energy Tax Credits are set to expire on December 31, 2025, and if you’re planning to save money while making energy-efficient upgrades to your home, this is your last window of opportunity. These credits can help American homeowners offset the cost of improvements like solar panels, insulation, energy audits, battery storage, and heat pumps — offering savings that can total thousands of dollars on your tax bill. But here’s the catch: the upgrades must be installed and operational before the clock strikes midnight on the last day of 2025. Whether you’re a homeowner, contractor, real estate investor, or simply exploring ways to reduce your utility bills and improve property value, this guide walks you through exactly what’s available, how to qualify, and how to claim these energy tax credits before they disappear.

Table of Contents

Two Energy Tax Credits

If you’ve been thinking about making energy upgrades — whether to cut utility costs, go green, or boost home value — now is the time to act. These federal energy tax credits offer significant savings, but they’re set to expire December 31, 2025. With high demand, limited contractor availability, and complex installation timelines, waiting could mean missing out entirely. Plan now, take action, and make sure you file correctly to get every dollar you’re entitled to.

| Credit Name | Section | Max Credit Value | Covers | Deadline |

|---|---|---|---|---|

| Energy Efficient Home Improvement Credit | 25C | Up to $3,200 per year | Heat pumps, insulation, windows, doors, electrical upgrades, energy audits | December 31, 2025 |

| Residential Clean Energy Credit | 25D | 30% of project costs (no cap) | Solar, wind, geothermal, battery storage, fuel cells | December 31, 2025 |

What Are These Two Energy Tax Credits?

These tax credits are part of federal initiatives encouraging homeowners to make energy-saving upgrades to their properties. Think of them as incentives that help Americans save on their taxes while improving the energy efficiency and sustainability of their homes.

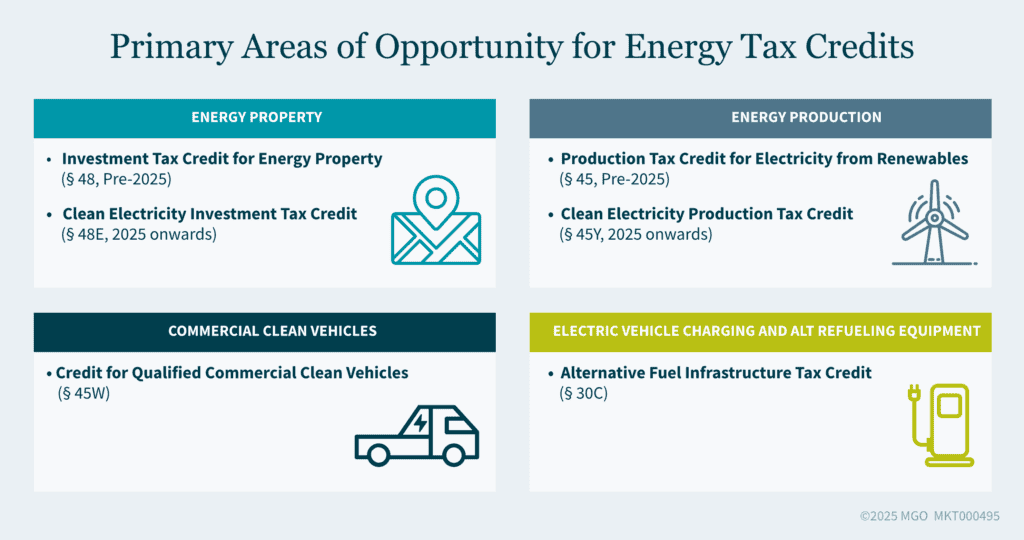

The Energy Efficient Home Improvement Credit (25C) and the Residential Clean Energy Credit (25D) were both expanded under the Inflation Reduction Act and are now offering generous tax benefits — but only until the end of 2025. Once the deadline hits, these incentives may shrink or disappear altogether unless new legislation extends them.

Understanding the Energy Efficient Home Improvement Credit (25C)

This credit is aimed at encouraging homeowners to make upgrades that reduce their home’s energy usage. Under current rules, taxpayers can claim 30% of the cost of eligible improvements, up to a maximum of $3,200 per year.

What You Can Claim Under 25C:

- Up to $2,000 for heat pumps and heat pump water heaters

- Up to $1,200 for improvements like:

- Insulation

- Exterior windows and doors

- Central air conditioners

- Furnaces and hot water boilers

- Up to $600 for electrical panel upgrades

- Up to $150 for a professional home energy audit

Annual Limits Apply

The credit resets annually, so if you can’t get all your upgrades done in one year, you may plan to split projects across 2024 and 2025 to maximize the benefit.

Eligibility Criteria for 25C:

- The property must be your primary residence.

- The home must be located in the United States.

- The improvement must be installed (not just purchased) before December 31, 2025.

- Equipment must meet the specified energy efficiency standards (e.g., ENERGY STAR certification).

- The credit is nonrefundable, meaning it can reduce your tax bill to zero, but you won’t get a refund if the credit exceeds what you owe.

Additional Tips:

- Labor costs are covered for certain installations like HVAC systems and heat pumps.

- Keep all receipts, product labels, and certifications to support your claim in case of an audit.

Residential Clean Energy Credit (25D): A Game-Changer for Green Projects

Unlike 25C, this credit focuses on clean energy systems that generate renewable power for your home. It’s especially beneficial for those installing solar panels, battery storage, or geothermal heating systems.

What Qualifies for the 25D Credit:

- Solar electric (photovoltaic) systems

- Solar water heaters

- Wind turbines

- Geothermal heat pumps

- Battery storage systems (installed after Jan 1, 2023)

- Fuel cells

How Much Can You Claim?

You can deduct 30% of the total cost of the system, including:

- Equipment

- Labor and installation

- Permitting

- Wiring

- Associated electrical upgrades

Unlike the 25C credit, the 25D credit has no upper dollar limit. So if you install a $25,000 solar system, you can expect a $7,500 federal tax credit.

Eligibility Criteria for 25D:

- The system must be installed and placed in service by December 31, 2025.

- The credit can be claimed on primary and secondary residences (but not rental properties).

- You must own the system — leased systems don’t qualify.

- The credit is nonrefundable, but you can carry forward unused portions to future tax years.

Combining Both Credits for Maximum Savings

Yes — you can claim both credits in the same tax year if you qualify. For example, if you install solar panels and a heat pump in the same year, you can claim the 30% credit on the solar system (25D) and the up to $2,000 credit on the heat pump (25C).

How to Claim These Two Energy Tax Credits?

Here’s your step-by-step playbook for taking full advantage of these credits:

1. Research Eligible Products

Before buying or hiring anyone, make sure the products you’re purchasing meet IRS and ENERGY STAR requirements.

2. Hire Certified Contractors

Work with licensed, experienced contractors who can verify that your system meets the criteria for the tax credits.

3. Keep Detailed Records

Hold on to:

- Manufacturer’s certification statements

- Invoices

- Contracts

- Installation dates

- Proof of payment

4. File IRS Form 5695

When you file your federal tax return for the year the project was installed, include IRS Form 5695 to claim the credits.

State and Utility Rebates: Stack the Savings

In addition to federal tax credits, many states and local utilities offer rebates or incentives that can be stacked on top of these federal programs.

For example:

- California offers incentives through the Self-Generation Incentive Program (SGIP).

- New York’s NYSERDA program provides rebates for geothermal and solar.

- Many utilities offer cash-back rebates for efficient appliances and weatherization.

Case Studies and Real-World Examples

Let’s say you’re a homeowner in Arizona who installs a $20,000 solar PV system in July 2025. You’ll qualify for:

- 30% federal tax credit = $6,000 (25D)

- State solar tax credit = $1,000

- Utility rebate = $500

That’s a total savings of $7,500, and your utility bills will likely drop by hundreds of dollars per year.

In another case, a homeowner in Michigan replaces their 20-year-old furnace with a new high-efficiency heat pump and adds attic insulation:

- Heat pump cost: $10,000 → eligible for $2,000 credit (25C)

- Insulation cost: $3,000 → eligible for $900 credit (30%)

- Home energy audit: $300 → eligible for $150 credit

Total credits: $3,050

It’s Official: Federal Employees Are Getting a Pay Raise in 2026 — Here’s How Much

If the IRS Sends You This Letter, Don’t Panic; But Don’t Ignore It Either

Google’s $700M Settlement, Explained: Eligibility, Deadlines, and Payouts