Trump’s $2,000 Tariff Dividend Check: Trump’s $2,000 Tariff Dividend Check has become one of the most talked‑about economic ideas in the United States as 2025 winds down. From barbershops to boardrooms, Americans are asking the same question: Is this money really coming, or is it just political noise? The short answer is that the proposal is real, but the checks are not — at least not yet. This article explains exactly what the tariff dividend proposal is, where it stands legally and politically, how it compares to past stimulus programs, and what Americans should realistically expect heading into 2026. Whether you are a working parent, a small business owner, a retiree, or a financial professional, this guide breaks it down clearly and responsibly.

Table of Contents

Trump’s $2,000 Tariff Dividend Check

Trump’s $2,000 Tariff Dividend Check is a bold and attention‑grabbing proposal that taps into real economic frustration felt by many Americans. While the idea of sharing tariff revenue has surface appeal, the financial, legal, and political hurdles remain significant. As 2025 ends, no checks have been approved, no funding mechanism has been finalized, and no timeline has been guaranteed. The proposal’s future depends entirely on congressional action and broader economic priorities in 2026. For now, Americans should remain cautious, informed, and skeptical of any claims suggesting payments are imminent or guaranteed.

| Topic | Details |

|---|---|

| Proposal Name | Trump’s $2,000 Tariff Dividend Check |

| Proposed Payment | $2,000 per eligible individual |

| Funding Source | U.S. tariff revenue |

| Current Status | Proposal only, not approved |

| Congressional Approval Required | Yes |

| Estimated Tariff Revenue | $158–$216 billion annually |

| Estimated Program Cost | $280–$600+ billion |

| Earliest Possible Timeline | Mid to late 2026 |

What Is Trump’s $2,000 Tariff Dividend Check?

At its core, Trump’s $2,000 Tariff Dividend Check is a proposed one‑time payment that would send up to $2,000 directly to eligible Americans. The money would come from tariff revenue, which is income the federal government collects from taxes placed on imported goods.

Former President Donald Trump has publicly stated that because tariffs are generating billions of dollars, Americans should share in that revenue. His argument is straightforward: if tariffs raise prices for consumers, then consumers deserve a rebate.

However, as of late 2025, this idea remains a policy proposal, not a law. No checks have been authorized, no eligibility rules have been finalized, and no payment dates have been scheduled.

Understanding Tariffs in Simple Terms

To fully understand the tariff dividend idea, it helps to understand tariffs themselves.

Tariffs are taxes placed on goods imported into the United States. When a foreign product enters the country, the importer pays a tax to the federal government. In many cases, that cost is passed on to consumers through higher prices.

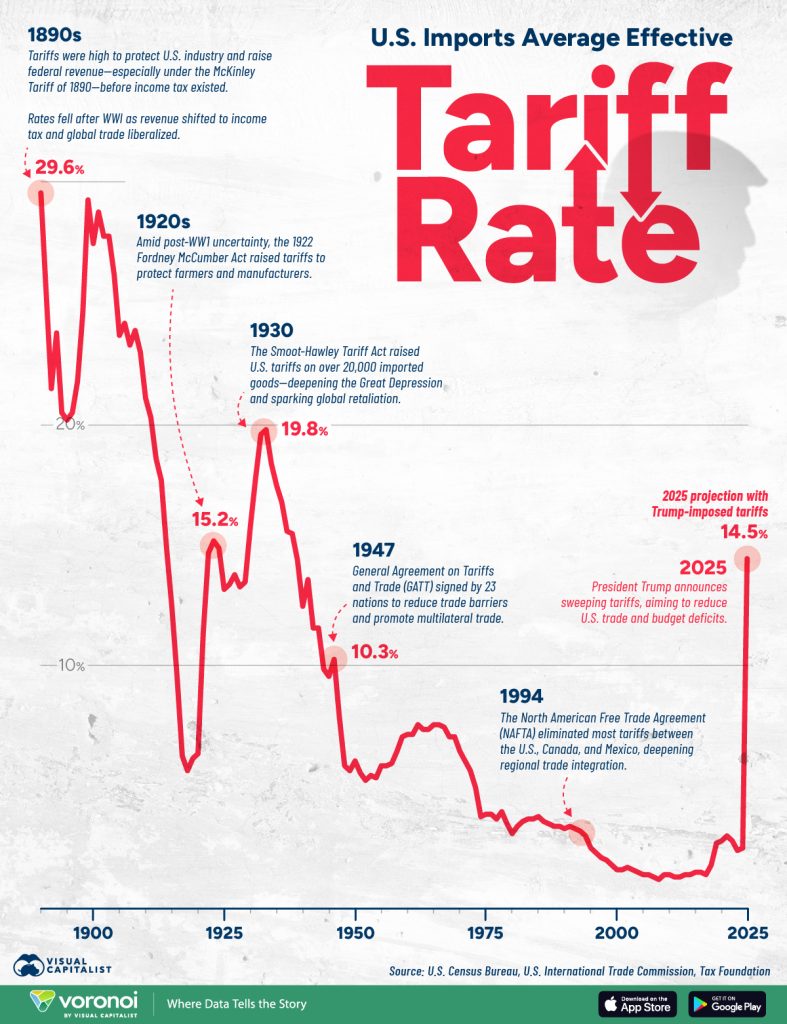

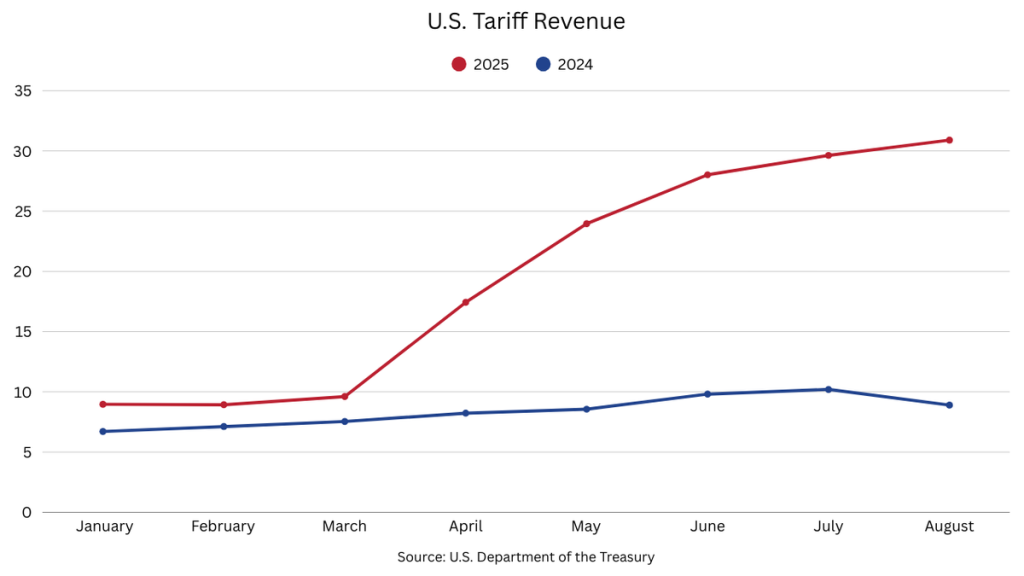

In recent years, tariffs have been used as both an economic and political tool, aimed at protecting American industries and encouraging domestic manufacturing. In 2025, tariff levels rose significantly, increasing government revenue but also raising concerns about inflation and consumer costs.

Trump’s tariff dividend proposal is built on the idea that if Americans are paying higher prices due to tariffs, they should receive a financial offset in return.

How Trump’s $2,000 Tariff Dividend Check Compares to Past Stimulus Checks?

Many Americans naturally compare the tariff dividend to COVID‑19 stimulus checks, but there are important differences.

During the pandemic, Congress approved multiple stimulus payments because the economy was in crisis. Those payments were funded through deficit spending, not tariffs, and were passed with bipartisan urgency.

The tariff dividend proposal differs in three key ways:

First, it is not tied to an economic emergency. Second, it relies on an existing revenue stream rather than borrowing. Third, it does not yet have bipartisan congressional support.

Because of these differences, the tariff dividend faces a higher legislative hurdle than pandemic relief checks did.

Can Tariff Revenue Actually Pay for $2,000 Checks?

This is where economics enters the picture, and it is the most important question surrounding the proposal.

Current estimates suggest that tariffs generate between $158 billion and $216 billion per year. However, sending $2,000 checks to tens or hundreds of millions of Americans would cost significantly more.

For example, if 150 million Americans qualified, the total cost would be $300 billion. If eligibility expanded further, costs could exceed $500 billion.

This means tariff revenue alone would likely fall short. Lawmakers would either need to limit eligibility, supplement funding from other sources, or increase deficit spending. Each option brings political and economic consequences.

Who Might Qualify If the Program Is Approved?

Because no legislation has passed, eligibility rules are still speculative. However, based on previous programs and public statements, eligibility could be determined by factors such as income level, tax filing status, and residency.

Some proposals suggest limiting payments to individuals earning under $100,000 per year, while others suggest a lower threshold or household‑based eligibility.

It is important to understand that until Congress acts, no one officially qualifies, and no action is required from individuals.

Why Congressional Approval Is Non‑Negotiable?

Under U.S. law, the president cannot authorize direct payments without congressional approval. Even if the White House supports the tariff dividend idea, legislation must pass both chambers of Congress and be signed into law.

As of late 2025, no finalized bill has cleared Congress. Some lawmakers support the idea in principle, while others oppose it due to deficit concerns, inflation risks, and skepticism about tariff funding.

This legislative reality is the biggest reason checks have not been issued.

Political Strategy and the 2026 Landscape

Many analysts view the tariff dividend proposal as both an economic idea and a political strategy. With 2026 approaching, economic messaging is expected to play a major role in campaigns.

The promise of direct payments resonates strongly with working‑class voters, particularly those impacted by rising prices. Whether the proposal becomes law or remains a talking point may depend on election outcomes and congressional composition.

Potential Economic Effects of a Tariff Dividend

Supporters argue that a $2,000 payment could provide meaningful relief to families struggling with high costs. Critics warn that injecting large sums of money into the economy could increase inflation or reduce the effectiveness of tariffs as a trade policy tool.

There is also concern that tariff dividends could normalize the idea of using trade taxes for direct payouts, potentially complicating future trade negotiations.

Economists remain divided, and much depends on how the program would be structured.

State‑Level Implications

States with large ports, manufacturing hubs, or import‑heavy economies could experience different impacts from tariffs and any associated dividend program. Some state governments may welcome federal payments that stimulate local spending, while others worry about price increases tied to tariffs.

However, states would not administer the payments directly. Distribution would likely be handled by the IRS or Treasury Department.

Scams and Misinformation: A Serious Warning

As interest in the tariff dividend has grown, so have scams. Fraudsters are circulating fake messages claiming recipients need to “register” or “confirm eligibility” for a $2,000 check.

There is no registration process. Any message asking for personal information, Social Security numbers, or payment details related to a tariff dividend is fraudulent.

Official information will only come from federal agencies such as the IRS or U.S. Treasury.

What Americans Should Do Right Now

The most important thing to do right now is nothing. There is no application, no enrollment, and no verification process.

Americans should focus on staying informed through reputable news sources and official government announcements. Financial planning should not rely on an unapproved proposal.

If the program moves forward, clear instructions will be widely published.

VA Disability Benefits January 2026 – Updated Payment Levels, Deposit Dates, and Eligibility

Medicare Update 2026: Some Prescription Drug Costs Expected to Drop by Half

SSDI Payments 2026 Increase – New 2.8% Boost Explained, Check Updated Monthly Amounts