Third Social Security Check: Some recipients could receive up to $1,491 — and for many low-income Americans, that’s headline news. But before you start dreaming of a surprise bonus, let’s get one thing straight: this ain’t extra money. It’s the same benefit just showing up early, all thanks to a calendar quirk and the way the Social Security Administration (SSA) schedules payments. Millions of folks across the U.S. — including Native elders, disabled individuals, and low-income families — depend on Supplemental Security Income (SSI) to make ends meet. So when checks arrive early or pile up in a short span, it can stir confusion, hope, and sometimes panic. This guide breaks it all down clearly — what’s happening, who gets the payment, what the $1,491 means, and how to plan smart when multiple checks roll in close together.

Table of Contents

Third Social Security Check

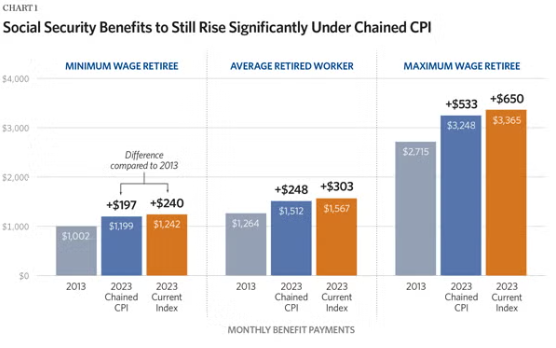

The “third Social Security check” making headlines is really just a case of early delivery, not extra benefits. Thanks to a COLA increase of 2.8%, maximum 2026 SSI payments now reach $994 for individuals and $1,491 for couples. But the key takeaway? Don’t confuse early checks for a bonus. If you’re living on a fixed income, understanding when and why checks arrive can help you stay on track, avoid overspending, and maintain your financial stability throughout the year.

| Topic | Details |

|---|---|

| Program Affected | Supplemental Security Income (SSI) |

| Why Three Payments? | Calendar quirk (weekend/holiday rule) |

| Payment Dates | Dec. 1, 2025 / Dec. 31, 2025 / Jan. 30, 2026 |

| Max SSI Benefit (2026) | $994 (individual) / $1,491 (couple) |

| 2026 COLA Increase | 2.8% raise across all benefit categories |

| Is It a Bonus? | No — just regular checks sent early |

| Administered By | Social Security Administration (SSA) |

| Official Website | ssa.gov |

What’s This “Third Social Security Check” All About?

If you’ve seen talk of a “third Social Security check”, you might think Washington’s handing out surprise cash. The truth is simpler — and way less flashy.

This so-called third check happens when SSI payments, normally sent on the 1st of each month, get shifted earlier due to weekends or federal holidays. If Feb. 1 lands on a Sunday, the February check might arrive Jan. 30 instead.

That’s what’s happening between December 2025 and January 2026. Some recipients will see three payments hit in a two-month stretch: Dec. 1, Dec. 31, and Jan. 30.

Important: It’s not a bonus. It’s not extra money. And it doesn’t mean you’ll get another check on Feb. 1 — that payment already came early.

Third Social Security Check Payment Timeline: How It Works

Let’s break it down in simple steps:

December 1, 2025 — Regular December Payment

This is your usual check for December. No change here.

December 31, 2025 — January 2026 Payment Comes Early

Since Jan. 1, 2026 is a federal holiday, the SSA sends the January check out one day early, on Dec. 31.

This check also includes the new 2.8% Cost-of-Living Adjustment (COLA), raising monthly amounts.

January 30, 2026 — February Check Paid Early

Why? Because Feb. 1 falls on a Sunday, so SSA mails the February payment two days early, on Friday, Jan. 30.

That’s three checks within 60 days, but again — it’s all about timing, not extra income.

What Does $1,491 Really Mean?

That number — $1,491 — isn’t some new check you’ll be getting. It’s the maximum federal SSI payment a couple can receive per month in 2026, after the 2.8% COLA increase.

Here’s the 2026 breakdown:

- Individuals: $994/month

- Couples: $1,491/month

These are maximums. Most people receive less based on:

- Additional income (even part-time work)

- State supplements

- Living situation (e.g., in-kind support or shared housing)

Understanding SSI vs. SSDI

It’s worth clearing up a common confusion: SSI and SSDI are not the same.

| Feature | SSI | SSDI |

|---|---|---|

| Based On | Need (low income) | Work history |

| Funded By | General taxes | Social Security payroll tax |

| Monthly Max | $994 / $1,491 | Varies based on earnings |

| Eligibility | Age 65+, blind, or disabled + low income | Disabled + sufficient work credits |

| Health Benefits | Medicaid (most states) | Medicare |

The Economic Impact of Early Payments

For folks living paycheck-to-paycheck, early SSI deposits can feel like a lifeline — or a trap.

Pros:

- You get the money sooner, which can help cover bills or rent that’s due before the 1st.

- Helps avoid late fees when rent or utilities are due end-of-month.

Cons:

- Without proper planning, the gap between the Jan. 30 and March 1 checks (30 days) could be tough.

- It may distort your monthly budget, especially if you assume it’s a bonus.

That’s why understanding the timing vs. total is crucial. Knowing it’s your usual benefit, not a windfall, helps keep your budget in check.

Budgeting Advice: Don’t Get Caught Short

When checks come early, it’s easy to spend them early. Here’s how to avoid running dry mid-month:

- Use Envelopes or Categories

Divide your check into categories: food, rent, meds, savings. Set it aside so you don’t blow through it in one week. - Delay Optional Spending

Don’t treat early checks like free money. Wait until the calendar month starts before making non-essential purchases. - Use Free Budget Apps

Tools like EveryDollar, GoodBudget, or paper planners can help you stretch what you’ve got. - Ask for Help

Many tribes and nonprofits have emergency assistance or food pantries if things get tight in late February. Don’t wait until it’s too late.

Historical Context: Why SSA Moves Dates

The SSA has used this weekend/holiday rule for decades — it’s not new.

If a payment date falls on:

- Saturday/Sunday → Payment is made the Friday before.

- Federal Holiday → Payment is made the business day before.

That’s why we sometimes see two SSI checks in one month — it’s happened before and will happen again. But rest assured, no benefits are being skipped.

Common Misconceptions

Let’s set the record straight:

- Myth: I’m getting extra money this month

Truth: You’re receiving the same benefit, just early. - Myth: SSA is giving bonuses due to inflation

Truth: The COLA raise is standard and annual — not a one-time bonus. - Myth: I’ll get another check on Feb. 1

Truth: No. That check already came on Jan. 30. - Myth: This only happens in election years

Truth: This happens any time the 1st lands on a weekend or holiday, regardless of politics.

Social Security Increases by State 2026 – The Five States Seeing the Largest Benefit Gains

Social Security Rules 2026 Explained – COLA Changes, Payment Updates, and New Maximums

Social Security Check at $1,850 – How Much Your Monthly Payment Could Increase in 2026