These States Are Sending Tax Refunds: that’s a headline you’ve likely seen floating around news sites and social media. But what’s it really about? No, it’s not another federal stimulus check or surprise IRS deposit. Instead, several U.S. states are issuing tax refunds, rebates, and economic relief payments before the year closes — and they’re doing it on their own terms, independent of Washington, D.C. Whether you’re a parent trying to stretch the holiday budget, a retiree eyeing that property tax relief, or a tax pro tracking year-end benefits, this article breaks it all down — clearly, simply, and with real facts you can use. We’ll cover which states are sending money, how much you could receive, who qualifies, and what you need to do (or not do) to claim yours.

Table of Contents

These States Are Sending Tax Refunds

As 2025 comes to a close, dozens of states are offering meaningful financial relief — ranging from a few hundred to over a thousand dollars — through surplus tax refunds, property credits, and inflation relief programs. These aren’t federal stimulus payments, but state-based efforts to give back to residents. Whether you’re in Alaska, California, Colorado, New Jersey, or any of the other participating states, now is the time to check if you’re eligible and take the steps needed to claim your refund.

| State | Program or Payment Type | Estimated Amount | Who Benefits |

|---|---|---|---|

| Alaska | Permanent Fund Dividend (PFD) | ~$1,000–$1,300 | Full-year residents |

| Colorado | TABOR Refund | ~$800–$1,500 | Taxpayers who filed |

| California | Middle Class Tax Refund | Up to $1,050 | Based on income/tax status |

| New Jersey | ANCHOR Property Tax Relief | Up to $1,750 | Homeowners and renters |

| Oregon | Kicker Refund | Average ~$980 | All filers with tax liability |

| Virginia | One-time Tax Rebate | $200–$400 | 2024 tax filers |

| Illinois | Family Relief Rebates | $100–$400 | Based on dependents & AGI |

| Florida | Disaster Property Tax Refund | Varies, up to ~$1,200 | Property owners affected by storms |

| Minnesota | One-Time Inflation Credit | $260–$520 | Low to moderate earners |

What Are These Refunds and Why Now?

Here’s the scoop: these refunds aren’t federal. They’re state programs funded by surpluses, inflation relief budgets, disaster funds, or constitutional mandates. Some states — like Colorado and Oregon — are legally required to return excess tax revenue when certain benchmarks are met. Others, like California or Illinois, have created temporary relief packages to help residents cope with rising living costs, housing burdens, or natural disasters.

These payments can show up as:

- Paper checks mailed to your address

- Direct deposits to your bank (if you filed electronically)

- Preloaded debit cards

- Applied credits on upcoming tax returns

The amounts vary wildly — from as little as $50 to over $1,500, depending on your location, income, and filing status.

How Do States Decide Who Gets a Refund?

Each state makes its own rules, but common factors include:

- Adjusted Gross Income (AGI): Refunds may be tiered by income to focus aid on low-to-middle-income families.

- Tax Filing History: If you didn’t file a state return in the last year or two, you may be ineligible.

- Residency Requirements: Most programs require you to have lived in the state full-time for the tax year.

- Homeownership or Rent Status: Property tax relief and housing credits are targeted at primary residences.

Let’s walk through real-world examples to show how these programs are playing out across the U.S.

These States Are Sending Tax Refunds: State-by-State Breakdown

Alaska — Permanent Fund Dividend (PFD)

Since 1982, Alaska has paid out a dividend each year to share its oil wealth with residents. In 2025, eligible Alaskans will receive about $1,300, depending on investment performance.

- Eligibility: Must be a full-year resident and apply by March.

- Payment method: Direct deposit or mailed check.

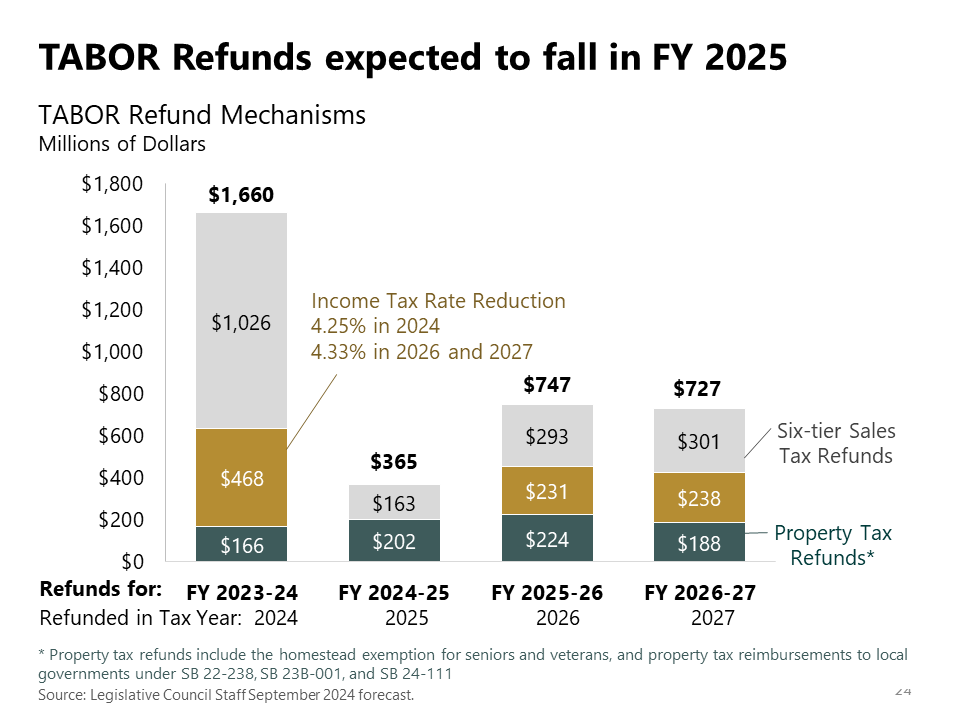

Colorado — TABOR Refund

Under the Taxpayer’s Bill of Rights (TABOR), Colorado must refund excess revenue. Refunds for 2025 are expected to range from $800 to $1,500.

- Eligibility: Must file a 2024 state return.

- Timing: Late December for most, early January for mailed checks.

California — Middle Class Tax Refund

California’s one-time relief program returns up to $1,050 to qualifying residents who filed in 2023 or 2024. Amounts vary by income and dependents.

- Income thresholds: Under $500,000 joint / $250,000 single.

- Distribution: Started in phases and will finish by December 31.

New Jersey — ANCHOR Rebate

The Affordable New Jersey Communities for Homeowners and Renters (ANCHOR) program pays up to $1,750 to property owners and renters.

- Eligibility: Based on income, ownership status, and property tax paid.

- Payment: Usually by direct deposit; mailed checks for older residents.

Oregon — Kicker Refund

Oregon’s unique kicker law returns surplus revenue automatically. If revenues beat estimates by over 2%, residents get a refund.

- Average refund: ~$980 in 2025, with some seeing over $1,500.

- Format: Automatic tax credit or mailed check.

Virginia — Tax Rebate

Virginia is issuing $200 for individuals and $400 for joint filers who paid state income taxes and filed their 2024 return on time.

- Deadline to file: November 1, 2025

Florida — Property Tax Relief (Storm-Related)

Counties in Florida impacted by hurricanes or flooding are offering up to $1,200 in refunds or credits to affected homeowners.

- Verification: May require documentation of damage or displacement.

- Contact: Local property appraiser or tax collector’s office.

Minnesota — One-Time Inflation Credit

Part of the 2025 budget, Minnesota will issue $260 per adult and dependent to households under a certain AGI.

- Households: Could receive up to $1,040 for family of four.

- Automatic: No application required if filed state taxes in 2024.

How to Check If Your States Are Sending Tax Refunds?

Step 1: Visit Your State’s Revenue Department Website

Use trusted sources — avoid unofficial “track your refund” sites.

Step 2: Use Online Refund Tools

Most states have lookup tools where you enter:

- Social Security Number (SSN)

- Filing status

- Refund amount (estimate)

Step 3: Watch Your Mail or Bank

Some payments go to last-known addresses. If you moved, update your records.

Step 4: Contact State Tax Officials

If you suspect you’re eligible but haven’t seen a refund, call or email the department directly. Some payments are delayed due to processing backlogs or holidays.

Common Mistakes to Avoid

- Assuming federal payments are included: These are state-only. The IRS is not issuing general refund checks in December 2025.

- Filing late: If your 2024 return isn’t filed on time, many states will exclude you.

- Providing wrong bank info: If your account is closed, your payment may bounce and delay re-issuance.

- Not checking eligibility requirements: Income limits, residency rules, or property qualifications vary widely.

Scams to Watch Out For

With billions of dollars moving around, scammers are active. Be alert for:

- Phone calls claiming to be from the “state refund department” asking for banking info.

- Texts or emails with suspicious links to “track your refund.”

- Offers to “speed up your payment” for a fee — this is never legit.

Remember: Your state will never ask for payment or sensitive information via phone or text. Always go directly to the official website.

Professional Tax Planning Advice

For professionals, accountants, and tax preparers, these programs represent both opportunities and challenges:

- Advisory opportunity: Clients unaware of refunds may benefit from help filing or checking eligibility.

- Estimated payments: Some refunds may affect clients’ estimated tax needs for Q1 2026.

- Non-taxable income: In many cases, these refunds are not taxable at the federal level, per IRS guidance (but check for exceptions).

Tax professionals should stay on top of deadlines, particularly for clients who move between states or are on fixed incomes.

States Continuing Tax Rebates and Refunds Before 2025 Ends — Full Overview

$2000 Child Tax Credit in December 2025, How to get it? Check Payment Date

Why Tax Refunds Could Be About $1,000 Higher Next Year Under New Law – Check Details