Texas Social Security Schedule: When the calendar flips to a new year, many Texans start checking their bank accounts and calendars for one important reason: Social Security payments. If you’re relying on those monthly checks—whether for retirement, disability, or supplemental income—it’s critical to know exactly when your money will arrive and whether you qualify. This guide focuses on the Texas Social Security Schedule for January 2026, but don’t worry—it applies across the U.S. since Social Security is a federal program. However, we’ve added local context and practical advice specific to Texans to help you get the most out of your benefits. Whether you’re 67 and retired, 35 and disabled, or 25 and caring for an aging parent, this article will help you stay informed, stay prepared, and make smart money moves in 2026.

Table of Contents

Texas Social Security Schedule

The Texas Social Security Schedule for January 2026 is more than just a list of dates—it’s a roadmap for your financial security. With payments set for January 2, 14, 21, and 28—and SSI benefits arriving early—you can start the year strong with better budgeting and less stress. Stay ahead by knowing your eligibility, applying online, using the SSA portal, and making smart choices like delaying retirement or coordinating benefits. Whether you’re a senior, a caregiver, a vet, or a professional helping others, this guide gives you the tools to get what’s yours.

| Topic | Details |

|---|---|

| January 2026 Payment Dates | Jan 2, 14, 21, 28 (based on birthdate) |

| SSI Payment Date | Dec 31, 2025 (for January), Jan 30 (for February) |

| 2026 COLA | 2.8% benefit increase |

| Work Credit Value | $1,890 per credit (4 max/year) |

| SSI Max Monthly Benefit | $994 (individual), $1,491 (couple) |

| Texas Beneficiaries | Over 4 million residents receive SSA/SSI |

January 2026 Texas Social Security Schedule

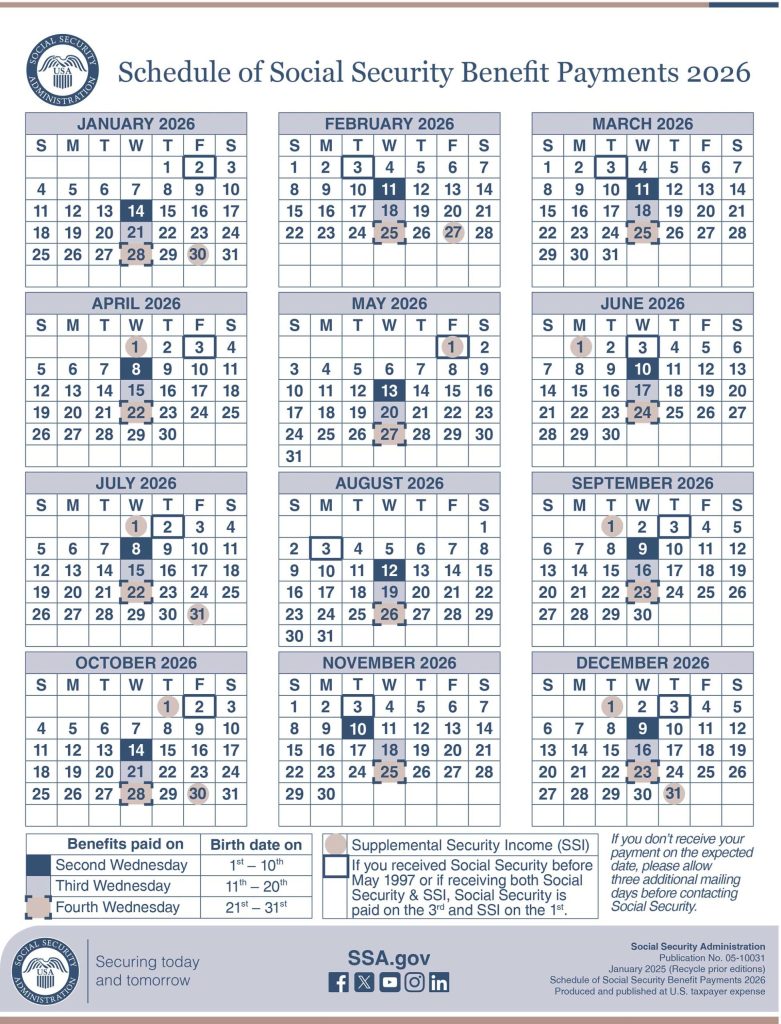

In January 2026, Social Security checks will be distributed based on the date of birth and enrollment timeline. The Social Security Administration uses a three-tier system to spread out payments.

For Retirees, SSDI, and Survivor Benefits:

| Birthdate Range | Payment Date (Jan 2026) |

|---|---|

| 1st–10th | Wednesday, January 14 |

| 11th–20th | Wednesday, January 21 |

| 21st–31st | Wednesday, January 28 |

Early Payment:

- If you started receiving benefits before May 1997, your check is issued on Friday, January 2, 2026, since January 3 falls on a weekend.

For SSI Recipients:

- January Payment: Delivered Wednesday, December 31, 2025

- February Payment (Paid Early): Friday, January 30, 2026

This schedule prevents weekend and holiday delays, ensuring you get your payment on time or early.

Who’s Eligible for Texas Social Security?

Social Security covers several programs, including:

- Retirement Benefits

- Disability Benefits (SSDI)

- Supplemental Security Income (SSI)

- Survivor Benefits

- Spousal and Dependent Benefits

Let’s break them down.

1. Retirement Benefits

You may claim retirement benefits starting at age 62, but you’ll receive a reduced amount. To get the full benefit, wait until your Full Retirement Age (FRA):

- Born in 1959: FRA is 66 years and 10 months

- Born in 1960 or later: FRA is 67

To qualify, you need:

- 40 work credits (about 10 years of work)

- In 2026, you earn 1 credit for every $1,890 in wages

The longer you wait (up to age 70), the bigger your monthly check.

2. Disability Benefits (SSDI)

If you become disabled and can’t work for 12 months or more, you may qualify for SSDI, provided you’ve worked and paid into the system.

Eligibility factors:

- Sufficient work credits (amount depends on age)

- Verified medical disability

- Inability to engage in “substantial gainful activity”

3. Supplemental Security Income (SSI)

SSI is not based on work history. It’s for:

- Low-income seniors (65+)

- Blind or disabled individuals (any age)

- Limited assets: <$2,000 (individual) or <$3,000 (couple)

Texas residents can also get state supplementation in some cases.

4. Survivor Benefits

When a loved one passes, survivors (spouses, minor children, disabled children, or elderly parents) may receive monthly benefits.

Requirements depend on:

- Age of the survivor

- Work history of the deceased

- Relationship to the deceased

Widows and widowers can claim benefits as early as age 60 (or 50 if disabled).

What’s New in 2026?

The Social Security program sees annual updates to keep up with the economy. In 2026, several changes kicked in.

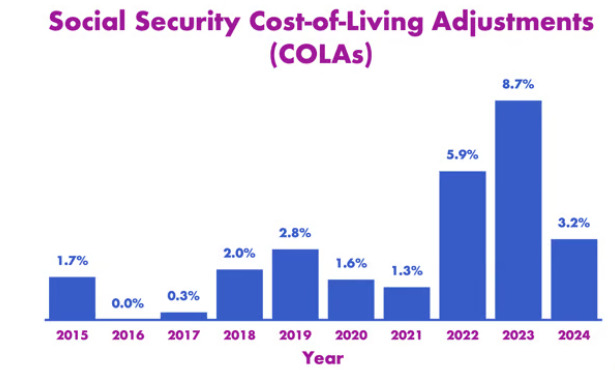

Cost-of-Living Adjustment (COLA)

- +2.8% increase to all benefits

- Average retirement benefit rises by ~$56/month

- Helps offset inflation pressures

Higher Earning Limits

If you’re under Full Retirement Age and still working while receiving benefits:

- You can earn up to $22,320 before benefits are reduced

- Over that limit, $1 is withheld for every $2 earned

Taxable Income Thresholds

Benefits may be taxed if your combined income is:

- Over $25,000 (individual)

- Over $32,000 (married couple)

How to Apply or Check Your Texas Social Security Schedule?

Applying for benefits is easier than ever thanks to online access.

How to Apply Online:

- Visit ssa.gov/apply

- Choose the correct benefit type (Retirement, Disability, SSI)

- Upload required documents: ID, birth certificate, W-2s, etc.

- Submit and monitor application via your SSA account

Create a “my Social Security” Account:

With a free mySSA account, you can:

- Check payment dates

- Download tax forms (SSA-1099)

- Update direct deposit details

- Estimate future benefits

How Social Security Is Funded?

Social Security isn’t a welfare program—it’s earned. Workers pay 6.2% of their income into the system (plus another 6.2% from employers), up to a wage cap of $184,500 in 2026.

These taxes fund:

- Retirees

- Disability recipients

- Survivors

- SSI (from general funds, not payroll taxes)

Social Security’s trust funds are projected to remain solvent until at least 2034, though reforms may be needed.

Mistakes to Avoid

These common errors could cost you time and money:

- Not checking your earnings record annually: Mistakes happen. One wrong W-2 can reduce your lifetime benefit.

- Failing to report income changes if on SSI: You must notify SSA if your income or assets change.

- Claiming too early without doing the math: Starting benefits early could permanently reduce your monthly check.

- Missing out on spousal benefits: Spouses may qualify even if they didn’t work.

Appeals and Reconsiderations

If you get denied Social Security or disagree with a decision:

- Request a Reconsideration (within 60 days)

- If denied again, request a Hearing with an administrative law judge

- Next steps: Appeals Council and possibly Federal Court

Texas residents can request appeals via their local SSA office or online.

Tips to Maximize Your Benefits

- Delay Retirement: Waiting until age 70 can boost your monthly check by up to 32%.

- Use Spousal Benefits: You can receive up to 50% of your spouse’s benefit, even if divorced.

- Check for Medicare: At 65, you can enroll in Medicare even if you delay Social Security.

- Coordinate With Other Retirement Plans: Social Security is just one piece of your financial puzzle.

Real-Life Scenarios

Example 1:

Barbara, born on January 12, gets her Social Security retirement check on January 14, 2026.

Example 2:

Carlos, who receives SSI only, gets his January check on December 31, 2025, and February’s check on January 30, 2026.

Example 3:

Rosalinda, a widow aged 61, receives survivor benefits from her late husband’s work record.

Social Security Benefits January 2026: How Much Will Your Payments Increase?

Social Security Payment Schedule 2026 – Why Millions Will See New Dates and Larger Checks