Tax Refunds Could Be About $1,000 Higher Next Year: Why tax refunds could be about $1,000 higher next year is making waves in financial circles, news headlines, and household conversations alike. If you’re wondering whether this could apply to you — and how to make the most of it — you’re in the right place. In this in-depth guide, we break down what’s happening, who benefits the most, what steps you should take now, and how to ensure you claim every eligible dollar come tax time.Let’s dive in with both feet — smart, friendly, and straight-shooting.

Table of Contents

Tax Refunds Could Be About $1,000 Higher Next Year

Tax refunds could be about $1,000 higher next year — and that’s not wishful thinking. It’s the result of a perfect storm: a generous tax law (the One Big Beautiful Bill Act), IRS withholding delays, and a slew of new deductions and credits targeted at working Americans and families. Whether you’re a parent, senior, hourly worker, or auto buyer, the 2025 tax law changes could put real cash back in your hands — but only if you’re informed and prepared. Now’s the time to gather your records, recheck your W‑4, and talk to a tax pro if you need help. Because next year’s refund? It could be the biggest you’ve ever seen.

| Item | Details / Links |

|---|---|

| Refund Increase | Most taxpayers could see $1,000–$2,000 higher refunds in early 2026. |

| Primary Reason | Withholding tables weren’t updated to reflect 2025 tax law changes. |

| New Law | One Big Beautiful Bill Act, signed July 2025. |

| Bigger Standard Deduction | Increased to $31,500 for married couples filing jointly. |

| Refund Affects | W-2 workers, families with kids, overtime workers, auto buyers, seniors. |

| Other Tax Breaks | Overtime deduction, car loan interest deduction, SALT cap increase, adoption credit changes. |

| Official IRS Guidance | https://www.irs.gov/newsroom/one-big-beautiful-bill-provisions |

What’s Causing the Tax Refunds Could Be About $1,000 Higher Next Year?

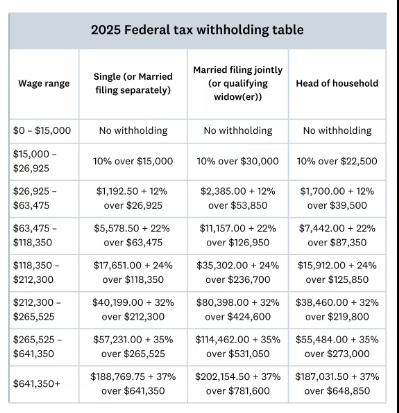

To put it plainly: in 2025, Congress passed a sweeping tax law called the One Big Beautiful Bill Act (OBBBA). It included multiple tax relief provisions, expanded credits, and new deductions. But here’s the twist: even though the law passed in July 2025, IRS withholding tables weren’t updated for the rest of the year. That means employers kept withholding taxes based on old rules — even though the new rules reduced what you actually owed. So if you worked in 2025, you likely overpaid taxes all year long — and when you file in 2026, the IRS sends that money back. That refund? For many taxpayers, it’s estimated to be $1,000 or more higher than usual.

Inside the One Big Beautiful Bill Act (OBBBA)

This law expanded parts of the 2017 Tax Cuts and Jobs Act (TCJA) and introduced new relief measures to support working- and middle-class Americans. It also gave some temporary help to seniors, families, and workers in tough industries like retail and food service.

Let’s break down the big changes that contribute directly to bigger refunds.

1. Bigger Standard Deduction

Standard deduction levels for the 2025 tax year are:

- $31,500 – Married filing jointly

- $23,625 – Head of household

- $15,750 – Single filers

This matters because the standard deduction lowers your taxable income. The more income you can exclude, the less tax you owe — which directly boosts your refund.

And don’t forget: if you’re 65 or older, you get an extra $6,000 deduction on top of the regular standard deduction.

2. Deduction for Overtime Pay

If you worked extra hours in 2025, the OBBBA allows you to deduct qualified overtime earnings up to $12,500 (or $25,000 jointly). This is brand new, and a huge win for hourly and gig workers.

Instead of getting taxed on every dollar of overtime, this deduction cuts your taxable income — and increases your refund.

3. Car Loan Interest Deduction

Another standout feature: you can deduct interest on certain auto loans if you purchased a U.S.-made vehicle in 2025. The deduction is capped at $10,000 but can significantly lower your tax bill.

This targets working-class Americans who rely on car loans and could never deduct that interest in the past.

4. Expanded Child Tax Credit

Families with kids under 17 get a boost thanks to a larger, inflation-indexed child tax credit. More of the credit is refundable, meaning you could get a check from the IRS even if you don’t owe taxes.

And with tax refund amounts tied to how many kids you’re claiming, families stand to benefit greatly in 2026.

5. SALT Deduction Cap Lifted

State and Local Tax (SALT) deductions were capped at $10,000 under prior law. In 2025, the cap was raised significantly, allowing residents of high-tax states like New York, New Jersey, and California to deduct more of their local taxes — again reducing taxable income.

Additional Refund-Boosting Provisions

Adoption Credit Expansion

Families adopting children can now claim a larger adoption credit, which is refundable in 2025. That means if your tax owed is low, the IRS may still send you money back — a first for many families.

Senior & Retirement Breaks

Retirees saw two changes:

- Extra deduction for age 65+: $6,000

- Relaxed retirement withdrawal penalties for emergency use

Together, these changes ensure many seniors get tax relief even on fixed incomes.

Real-Life Examples: Who Gets What?

Example 1: Middle-Class Family

Married couple, 2 kids, one spouse earns $70K, the other $45K

- Qualified for the full standard deduction ($31,500)

- Child Tax Credits worth $4,000

- Overpaid on withholding due to outdated IRS tables

- Total refund: likely $6,000–$7,500 (compared to $4,000 last year)

Example 2: Single Overtime Worker

Single warehouse worker earning $45K plus $10K in overtime

- Can deduct part of that overtime pay

- Paid excess tax due to old tables

- Likely refund increase: $1,000–$1,800 more than previous year

Example 3: Retired Senior

Single filer, 68 years old, living off $25K pension + $15K Social Security

- Benefits from the $6,000 senior deduction boost

- Has no children, but gets more from adjusted tax brackets

- Result: reduced liability and refund up to $600–$900 more than 2024

Why the Tax Refunds Could Be About $1,000 Higher Next Year Isn’t Universal?

While many Americans will see bigger refunds, not everyone benefits equally.

Groups That May See Lower Refunds:

- High-income earners (phaseouts still apply to some deductions)

- Business owners (rules differ for pass-through income)

- Freelancers without withholding (no overpayment to refund)

- Those who adjusted their W‑4 in 2025 to reflect lower tax rates

Still, the majority of wage-earning households will see larger-than-average refunds.

How to Prepare for a Big Refund in 2026?

1. Review Your Paystubs

Check if you were taxed under the old rates all year. If so, you’re due that money back.

2. Organize New Deduction Records

- Track overtime hours

- Save car purchase documents if you financed a new vehicle

- Log all childcare or adoption-related expenses

3. Revisit Your W‑4

If you’re still getting taxed at 2025 levels in 2026, you may want to adjust withholding so you don’t overpay again.

4. Use the IRS Tax Withholding Estimator

Available at irs.gov, this tool helps tailor your withholding and refund expectations.

States Continuing Tax Rebates and Refunds Before 2025 Ends — Full Overview

Illinois expands property tax relief for seniors: Check eligibility and application

Goodbye IRS Direct File—The Free Tax Filing Program Is Ending, and Millions Must Now Adjust