Tariff Dividend Payments: Tariff Dividend Payments January 2026 have become a hot topic in the media, especially on social platforms and in political speeches. You’ve likely heard someone say, “A $2,000 check is coming your way—thanks to tariff revenue!” But is it true? Can the government just hand out money from tariffs? What even is a tariff dividend? And most importantly, are you getting paid? Let’s make one thing clear from the start: no federal tariff dividend payment has been approved for January 2026. While the idea of sending Americans money collected through tariffs has been floated by politicians—especially former President Donald Trump—it remains a proposal, not a law. This article is your easy-to-understand but professionally detailed guide to what’s really going on. Whether you’re a curious citizen, a student, or a policy expert, we’re going to unpack the facts, add some financial wisdom, and explain where this idea stands today and what might happen next.

Table of Contents

Tariff Dividend Payments

The idea of Tariff Dividend Payments in January 2026 might sound like music to the ears—especially in tough economic times—but it’s not a reality. While the political conversation is heating up, there is no legislation, no IRS directive, and no real payment process in place. Think of it as a campaign slogan with an asterisk. That doesn’t mean it won’t happen. But for now, it’s just an idea. Stay informed. Stay sharp. And remember—when it comes to government money, always follow the law, not the headlines.

| Topic | Summary |

|---|---|

| Tariff Dividend Payments | Not approved or scheduled for January 2026 |

| Proposed Payment Amount | ~$2,000 per person (based on public proposal) |

| Annual Tariff Revenue | Estimated $158B–$300B (varies by source) |

| Estimated Cost of Program | ~$450B–$500B for $2,000 per adult |

| Official Legislation | None passed as of January 2026 |

| Who Pays Tariffs? | U.S. importers, but cost often passed to consumers |

| Status | Concept only — not law or budgeted |

What Is a Tariff Dividend Payments?

A tariff dividend is an idea where the U.S. government would collect money from tariffs (taxes on imported goods) and redistribute that money directly to American citizens, usually in the form of a one-time or recurring payment.

It’s kind of like this: If the government makes money from taxing goods that come into the country (like electronics, steel, or cars), why not take some of that revenue and give it back to the people?

The proposal most people are talking about suggests giving $2,000 per eligible adult, supposedly funded by the tariffs already being collected at the border. Think of it like a “tax rebate,” except the tax was paid on goods from overseas. But, like many things in politics, it’s not that simple.

Why January 2026?

The buzz around January 2026 comes from several converging factors:

- Ongoing inflation concerns: Americans are still feeling the effects of price increases from 2023–2025, especially in housing, food, and gas.

- Election-year politics: With the 2026 midterms looming, political leaders are floating ideas that sound good to working- and middle-class voters.

- Residual memory of COVID-era stimulus checks: Many citizens remember getting $1,200 or more in 2020 and 2021, and they’re hoping for a repeat.

- Political rebranding of tariffs: Supporters of trade tariffs want to frame them not as taxes but as a source of public benefit.

Yet despite all this, no money is scheduled to be paid in January 2026. This is important: If you hear someone say checks are coming next week, they’re either misinformed or spreading clickbait.

Understanding Tariffs: How Do They Actually Work?

Let’s say a U.S. company wants to import $1 million worth of clothing from China. If there’s a 25% tariff, they have to pay $250,000 to the U.S. government.

Now, do you think that importer just eats that cost? No. They pass it on to retailers, who pass it on to you, the consumer. That means your jeans, your phone, even your toaster could cost more.

So, while tariffs raise government revenue, they also act like a hidden tax on consumers. According to the Tax Policy Center, households—especially lower- and middle-income ones—end up paying more in higher prices than they would get back from a dividend.

Can Tariff Dividend Payments Fund $2,000 Payments?

Here’s where things get mathematical.

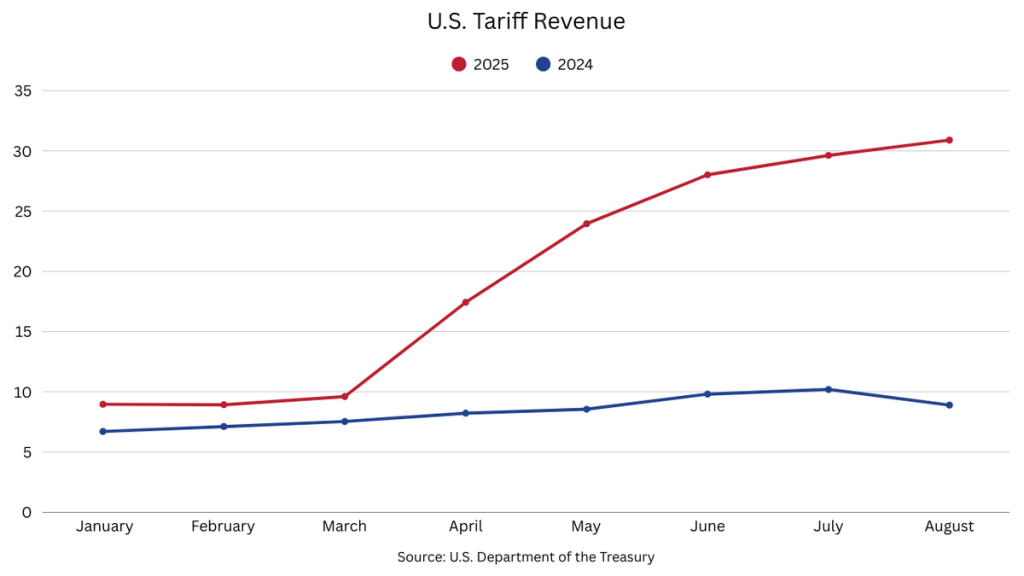

- Total U.S. tariff revenue in 2025: Estimated at $158 billion to $300 billion, depending on how many goods are taxed and at what rate.

- Cost to give $2,000 to every adult American: About $450–500 billion, assuming 225 million recipients.

The math doesn’t work out without either:

- Cutting other government spending,

- Raising taxes elsewhere, or

- Borrowing more money to make up the difference.

And if borrowing is involved, well—doesn’t that defeat the whole point of using tariff income?

Even conservative-leaning think tanks like the Heritage Foundation warn that tariffs alone cannot sustainably fund large-scale transfers without consequences like inflation, trade retaliation, or national debt growth.

Who Wins and Who Loses?

If tariff dividends did happen, here’s what the landscape might look like:

Potential Winners:

- Lower-income households: Would likely receive the full $2,000 and spend it quickly, boosting local economies.

- Political advocates of tariffs: Could claim that “tariffs pay off for Americans.”

- Retailers who source locally: Might gain a competitive edge over import-heavy competitors.

Potential Losers:

- Consumers in general: Could face higher prices on many goods.

- Exporters: Countries may retaliate, hurting U.S. exports.

- Long-term economic health: Artificially inflating demand while raising import costs could slow real economic growth.

Historical Context: Has This Happened Before?

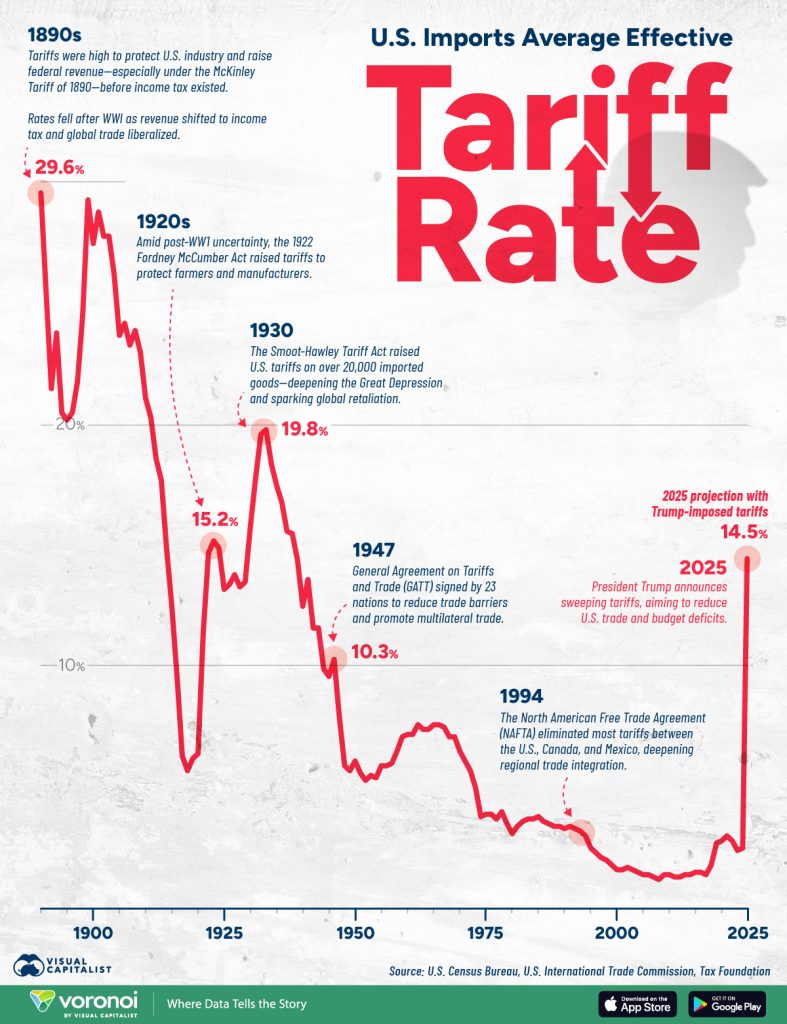

In the 1800s, tariffs were the U.S. government’s primary revenue source. There were no income taxes until the early 1900s. The Smoot-Hawley Tariff Act of 1930 famously raised tariffs so high that global trade collapsed, worsening the Great Depression.

More recently:

- The Trump administration (2017–2021) raised tariffs on China and other countries, increasing federal tariff revenue by billions annually.

- However, studies by the Federal Reserve and Peterson Institute for International Economics found that the costs were mostly passed to consumers and U.S. businesses, not absorbed by foreign producers.

No modern U.S. administration has ever sent direct payments funded solely by tariff revenue.

Legislative Hurdles: How a Tariff Dividend Payments Would Become Real

If the idea were to move forward, here’s how it would need to happen:

- Introduction of a Bill: A member of Congress must propose legislation formally creating the tariff dividend program.

- Committee Hearings: Economic, legal, and fiscal consequences are reviewed.

- CBO Scoring: The Congressional Budget Office determines the estimated cost and revenue impact.

- Floor Debate and Vote: Both the House and Senate must pass the bill.

- Presidential Signature: The president signs it into law.

- Implementation: IRS and Treasury set up the distribution process.

As of January 2026, none of these steps have been completed. No bill. No vote. No law.

Misinformation Watch: Scams and Fake News

Unfortunately, bad actors take advantage of confusion. In recent weeks, several fake websites and spoofed emails have claimed to offer “early access” to your $2,000 tariff dividend. Others claim the IRS is already distributing payments.

This is false. The IRS has issued multiple warnings not to fall for these phishing scams.

Protect yourself:

- Never share personal info on unofficial sites.

- Check updates only from IRS.gov and Treasury.gov.

- Don’t believe a random text or email promising “fast money.”

New $600 Tariff Rebate Plan — Who Could Qualify if Approved? Check Details

What It Would Really Take to Send $2,000 Payments Nationwide Under Trump’s Plan – Check Details

How Trump’s Proposed $2,000 Dividend Could Affect Retirees Receiving Social Security – Check Details