States That Tax Social Security: When you think about retirement, you probably think about saving money, enjoying a slower pace of life, maybe traveling a bit, or spending more time with the grandkids. But here’s a question many folks overlook: “How much of my Social Security will I actually keep?” Believe it or not, where you live in retirement can dramatically affect how much of your Social Security benefits you keep. Why? Because some states tax those benefits — while others don’t. Let’s break it all down in plain English: what it means for you, which states still tax Social Security in 2026, and how you can make smart decisions to protect your money.

Table of Contents

States That Tax Social Security

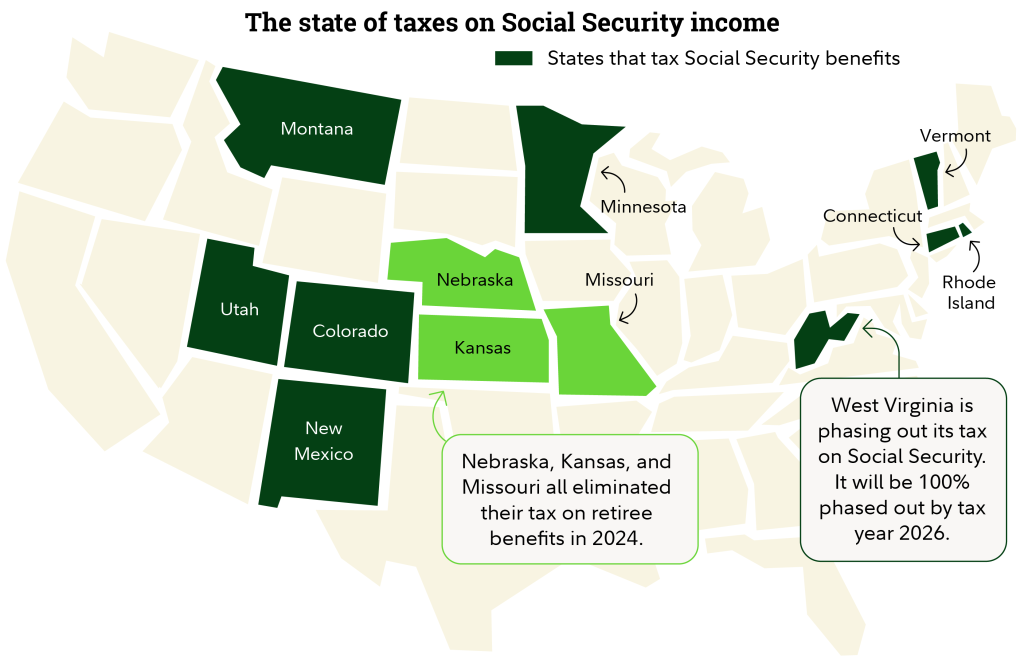

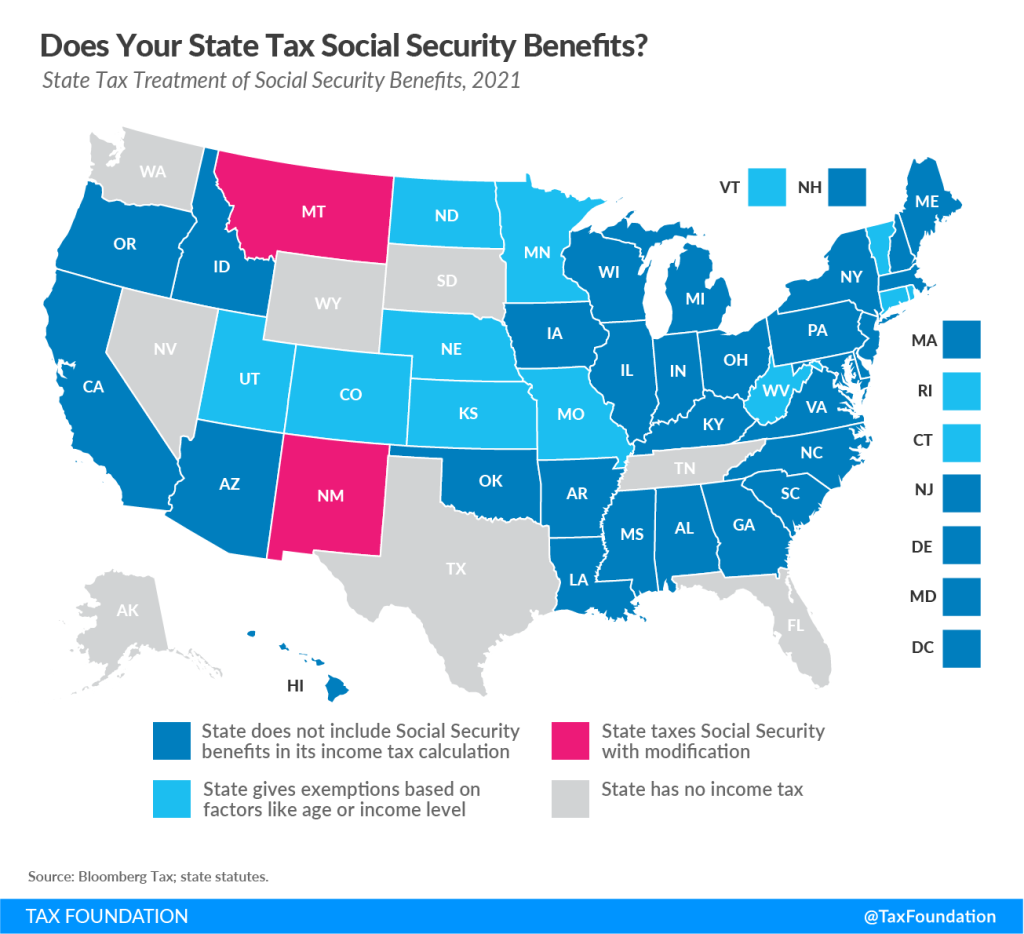

In 2026, the landscape of Social Security taxation is more favorable than ever — but only if you’re paying attention. Eight states still tax benefits, and depending on your income, that could mean losing thousands of dollars over the course of your retirement. But the good news? You have options. By understanding your state’s laws, planning smartly, and maybe even relocating, you can protect your retirement income and live out your golden years the way they were meant to be — comfortable, secure, and stress-free.

| Feature | Detail |

|---|---|

| States that tax Social Security | 8 (Colorado, Connecticut, Minnesota, Montana, New Mexico, Rhode Island, Utah, Vermont) |

| States that don’t tax Social Security | 42 states + Washington, D.C. |

| States that recently repealed taxes | Kansas, Missouri, Nebraska (starting 2024), West Virginia (starting 2026) |

| No income tax states | Florida, Texas, Nevada, Washington, Wyoming, South Dakota, Tennessee, Alaska |

| Partial exemptions based on income | Most taxing states use income thresholds |

| Map Reference | Kiplinger State Tax Map |

Why States Tax Social Security at All?

Let’s clear something up: the federal government already taxes your Social Security if your combined income is above certain levels. Depending on your situation, up to 85% of your benefits may be taxable.

Now, here’s the kicker: some states tack on their own tax. That’s a double whammy if you’re not careful. States do it to raise revenue, especially those with tighter budgets or heavier public services.

However, this practice is becoming less popular, as more states repeal Social Security taxes due to voter pressure and aging populations.

Which States Tax Social Security in 2026?

As of the 2026 tax year, only 8 states still apply a state income tax to some or all Social Security benefits. Here’s a breakdown of how it works in each:

1. Colorado

- Offers a large retirement income deduction ($24,000).

- Benefits may still be taxed if total income exceeds limits.

2. Connecticut

- Exempts benefits if you earn less than $75,000 (single) or $100,000 (joint).

- Above that? Your benefits get taxed.

3. Minnesota

- Uses a subtraction method that softens the blow.

- Still, high earners may pay several percent on their benefits.

4. Montana

- Taxed based on a state-specific formula, not identical to federal.

- Exemptions may apply to low-income retirees.

5. New Mexico

- Exemptions introduced recently.

- But if you’re a higher earner, you could still face taxation.

6. Rhode Island

- Benefits exempt if income is under $95,800 (single) or $119,750 (married).

- Full tax above those levels.

7. Utah

- Offers a nonrefundable credit to offset some tax burden.

- Still ends up taxing many middle-income retirees.

8. Vermont

- Offers partial exemptions, but if your income is over $65,000 (married), you’ll owe state tax on part of your benefits.

Important Tip: Each state uses its own formula. Some follow the federal model, while others use independent income brackets or thresholds.

States That DON’T Tax Social Security in 2026

Good news: the majority of states – 42 plus Washington, D.C. – don’t tax your Social Security. These fall into two categories:

Tier 1: No State Income Tax at All

If your state doesn’t charge any income tax, your Social Security benefits are safe by default. These states include:

- Florida

- Texas

- Nevada

- Tennessee

- South Dakota

- Washington

- Wyoming

- Alaska

Living here? You won’t pay a dime in income tax — on benefits or anything else.

Tier 2: Income Tax States That Exempt Social Security

These states have income tax but specifically exclude Social Security:

- California

- New York

- New Jersey

- Pennsylvania

- Ohio

- Illinois

- Michigan

- Delaware

- Georgia

- North Carolina

Some of these states go a step further and offer senior-specific deductions on other retirement income too.

Recent Changes You Should Know (2024–2026)

A few states are jumping off the tax bandwagon. Here are the most notable updates:

- Kansas: Exempting all Social Security benefits starting in 2024.

- Missouri: Previously had income caps; now fully exempts all Social Security benefits.

- Nebraska: Phased out the tax fully by 2025.

- West Virginia: Will complete its repeal in 2026, dropping from the taxable list.

This means more breathing room for retirees — and greater pressure on the remaining 8 states to follow suit.

How Much Can State Tax Hurt? A Real-World Example

Let’s say you earn $50,000/year, including $25,000 from Social Security.

If you live in Texas, your state tax bill = $0.

If you live in Minnesota, your Social Security might be up to 85% taxable at the federal level, and state tax could add another $600–$1,200 per year.

Over 20 years, that’s over $20,000 in lost retirement income — just for living in the wrong state.

Retirement Relocation Checklist

If you’re considering moving in retirement, keep this checklist handy:

- Does the state tax Social Security?

- What’s the overall income tax rate?

- How high are property taxes?

- What are sales taxes, especially on essentials?

- How’s access to healthcare and specialists?

- Does the state tax pensions or 401(k) withdrawals?

- What’s the cost of living and housing market like?

Don’t let a low income tax rate fool you — property taxes and healthcare can make a big dent.

How to Avoid or Reduce State Tax on Social Security?

Even if you’re in one of the 8 taxable states, here are some smart strategies:

- Delay Social Security benefits

Wait until age 70 to maximize your monthly check and reduce early withdrawals that bump up taxable income. - Use Roth IRA accounts

Withdrawals from Roths don’t count toward combined income — so they don’t increase your benefit taxation. - Shift taxable income to retirement credits

Use deductions for senior expenses, donations, and medical costs to drop into a lower bracket. - Relocate part-time

If you split your year between a tax-heavy state and a tax-free one, establish residency in the favorable state (get a driver’s license, vote, pay property tax there).

Social Security Tax Bills to Change in 2026 — Calculate What You’ll Owe Before It’s Too Late

Social Security Payments Abroad – SSA Confirms Benefits Can Be Received Outside the US

What Changes to Social Security Begin in 2026: Check Full Retirement Age Updates!