SSI Payment Timing Change: Supplemental Security Income (SSI) is a vital financial support program for millions of Americans—especially seniors, people with disabilities, and low-income individuals. But in early 2026, many beneficiaries noticed something unusual: January and February checks were deposited earlier than expected. If you’re wondering what’s going on, you’re not alone. In this in-depth article, we’ll break down why these early payments happen, how the Social Security Administration (SSA) schedules disbursements, and what this means for your monthly budgeting and financial planning. Whether you’re a beneficiary or helping someone who is, this guide will clear the confusion—in plain, no-nonsense American English.

Table of Contents

SSI Payment Timing Change

When it comes to SSI, early payments are not unusual. They’re a simple fix for weekends and holidays in the calendar. But the key is to plan ahead, know what to expect, and manage your funds wisely. Getting two checks in January might feel good in the short term—but remember: that second payment is for next month’s expenses, not a reason to splurge. Stay informed. Stay prepared. And don’t be afraid to ask for help if you need it.

| Key Point | Details |

|---|---|

| January 2026 SSI Payment | Issued early on December 31, 2025, due to New Year’s Day falling on a federal holiday. |

| February 2026 SSI Payment | Issued on January 30, 2026, because February 1st is a Saturday. |

| No Extra Checks | These are not bonus payments; they’re just rescheduled due to holidays/weekends. |

| Budgeting Implication | Receiving two checks in January can create gaps in February spending if not planned. |

| Official Source | SSA Payment Calendar & SSI Info |

What Is SSI and Who Gets It?

Supplemental Security Income (SSI) is a federal assistance program managed by the Social Security Administration (SSA), designed to help aged (65+), blind, and disabled individuals who have limited income and resources.

As of 2024, the federal maximum SSI monthly benefit is:

- $943 for individuals

- $1,415 for couples

These amounts may vary by state, as some states add a supplemental payment on top of federal SSI.

According to the SSA, over 7.5 million people received SSI in 2023, including 1.1 million children with disabilities.

The Standard SSI Payment Schedule

The SSA typically pays SSI benefits on the 1st of each month. But when that date falls on a weekend or federal holiday, the payment is issued on the last business day before the 1st.

Let’s break it down:

- If Feb 1 is a Wednesday, you’ll get paid on Feb 1.

- If Feb 1 is a Saturday, you’ll be paid on Jan 31 (or the previous Friday if Jan 31 is a weekend).

- If Jan 1 is New Year’s Day, you’ll be paid Dec 31 (or earlier if needed).

This rule applies every year and ensures recipients aren’t waiting around with no cash due to banks or SSA offices being closed.

Why January 2026 and February 2026 SSI Payment Timing Change?

Let’s look at the exact calendar quirks that triggered this:

January 2026

- Jan 1, 2026 falls on a Thursday, which is a federal holiday (New Year’s Day).

- So, the SSA issues January’s payment on Wednesday, December 31, 2025.

February 2026

- Feb 1, 2026 lands on a Saturday, when federal offices and most banks are closed.

- SSA sends February’s check on Friday, January 30, 2026, the last business day before the 1st.

So in January 2026, you’ll actually receive:

- Your January check on Dec 31, 2025

- Your February check on Jan 30, 2026

This means two checks in January—but none in February. That can feel weird if you’re not expecting it, but it’s all by design.

Are These Extra Payments?

Nope! Let’s clear that up real quick.

Some folks see two payments hit their accounts in January and think they’ve received a bonus, or worse, worry it’s a mistake they’ll have to pay back. That’s not the case.

You are not being paid extra.

You won’t have to return any money.

These are just your regular monthly checks, issued earlier than usual to work around the government holiday and weekend schedule.

How SSI Payment Timing Change Affects Your Budget (And What to Do About It)

Getting two checks in one month can throw off your normal flow. If you’re living paycheck to paycheck—as many SSI recipients are—this early payment might feel like a windfall. But without proper planning, it can lead to a cash shortage in February.

Smart Budgeting Tips for Early Payments

1. Label the Checks

Keep track of which payment is for which month. The December 31 check is your January money, and the January 30 check is for February expenses.

2. Divide and Conquer

Break each payment down into weekly budgets so you don’t overspend too early.

For example:

- If you receive $943 for January and February, that’s $1,886 total in January.

- Instead of spending freely, plan for 4–5 weeks of expenses until your next check on March 1, 2026.

3. Use a Budgeting App or Notebook

Apps like Mint, You Need a Budget (YNAB), or even a simple notebook can help you visualize and track your spending week by week.

4. Save a Little, If Possible

We know—it’s tough. But even setting aside $20–$50 from the early check can cushion you in case something comes up before your next deposit in March.

5. Talk to a Social Worker or Case Manager

If budgeting feels overwhelming, reach out to a local nonprofit, social worker, or benefits counselor. Many states offer free SSI budgeting help for seniors and people with disabilities.

A Brief Look at the SSA’s Payment System

You might be wondering: “Why can’t SSA just pay on the same day every month like clockwork?”

Well, here’s a peek behind the curtain:

- The U.S. Treasury works with the SSA to process millions of payments monthly. Weekends and federal holidays can cause processing delays, especially with paper checks or when banks are closed.

- Issuing payments early ensures that no one is left without funds, especially during the start of the month when bills are due.

- This system has been in place for decades and is highly automated to reduce errors and delays.

Historical Examples: This Has Happened Before

This isn’t new. Similar shifts happen almost every year.

Here are a few examples:

| Year | Early Payments |

|---|---|

| 2021 | January check sent Dec 31, 2020 |

| 2022 | October check sent Sept 30, 2022 (Oct 1 was a Saturday) |

| 2023 | April check sent March 31, 2023 (April 1 was a Saturday) |

| 2024 | June check sent May 31, 2024 (June 1 was a Saturday) |

This is a normal and predictable pattern, not something to worry about.

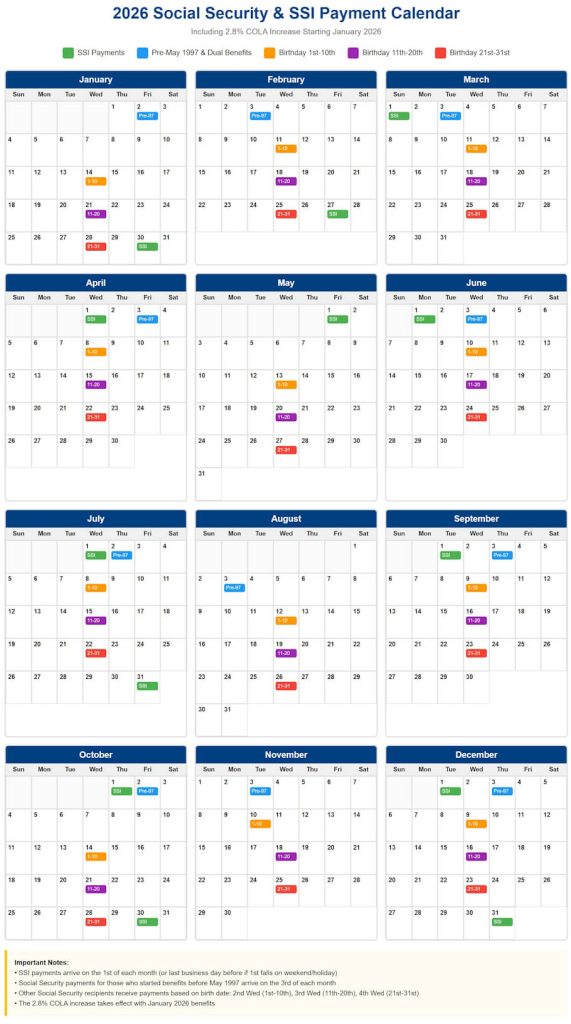

Pro Tip: Use the SSA Payment Calendar

The SSA releases an official payment schedule every year. This calendar is your go-to tool for knowing exactly when to expect your SSI, SSDI, or retirement check.

Keep it on your fridge, on your phone, or tucked into your planner. It’ll help you track payments and avoid surprises.

Social Security 2026: How Much You Must Earn to Get the Highest Benefit

January 2026 Social Security Checks – Timeline for the First Deposits of the New Year

2026 Social Security Update: Check Important Changes to COLA, Medicare Costs, and Benefit Rules