SSI February 2026 Payments: Supplemental Security Income (SSI) February 2026 payments are stirring curiosity — and some confusion — among millions of Americans. Why is the check coming early? Is it extra money? What should recipients expect next month? If you’re on SSI, care for someone who is, or help people navigate Social Security, you need the facts — plain, true, and on time. This guide breaks down the exact SSI payment dates for February 2026, what triggers early deposits, how much to expect, and how to manage back-to-back payments in your monthly budget. We’ll walk you through it — no jargon, no confusion — just straight-up info from trusted sources.

Table of Contents

SSI February 2026 Payments

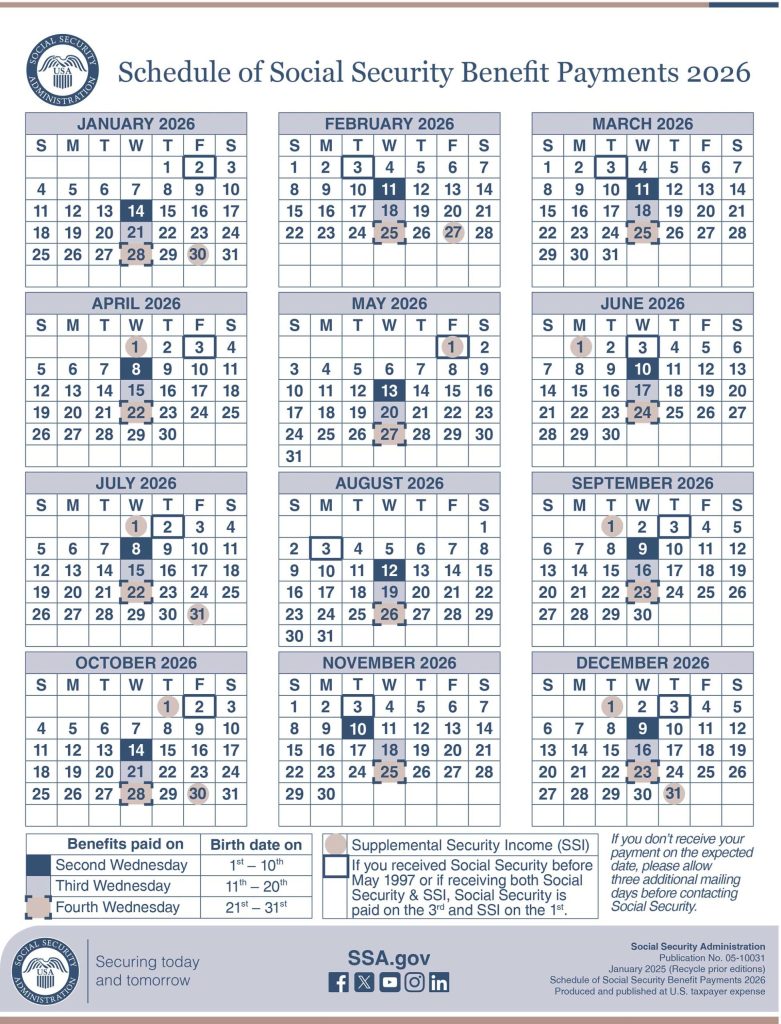

The February 2026 SSI payment lands early — on January 30, 2026 — because February 1 is a Sunday. Likewise, March’s SSI benefit comes February 27, due to another Sunday. While it may feel like you’re getting a bonus, it’s really just a shift in timing, not extra cash. Knowing these quirks ahead of time helps prevent budgeting mishaps and makes sure every dollar works for you.

| Topic | Detail / Data |

|---|---|

| February 2026 SSI Payment Date | Friday, January 30, 2026 |

| Reason for Early Payment | Feb 1 is a Sunday; SSA pays early on last business day |

| March 2026 SSI Payment Date | Friday, February 27, 2026 |

| Monthly SSI Max Payment in 2026 | $994 individual / $1,491 couple / $458 essential person |

| COLA for 2026 | 2.8% increase, effective January 2026 |

| SSA Official Calendar | ssa.gov/pubs/calendar.htm |

| Why Payment Shift Happens | SSA rule: If the 1st falls on a weekend or holiday, pay early |

| 2026 SSA Payment Gaps to Watch | Potential 4+ week wait after February 27 |

Understanding Supplemental Security Income (SSI)

Let’s get one thing straight: SSI is not regular Social Security. It’s a federal assistance program designed to help older adults, blind individuals, and people with disabilities who have limited income and resources. That includes folks who may have never worked — or didn’t work long enough to qualify for Social Security retirement.

SSI is funded by general tax revenues, not Social Security trust funds. That means you can get SSI even if you never paid into Social Security. According to the SSA, more than 7.5 million Americans rely on SSI monthly.

To qualify in 2026, you must:

- Be 65 or older, blind, or meet the SSA’s definition of a disability

- Have limited income and assets (less than $2,000 for an individual or $3,000 for a couple, excluding one home and one vehicle)

- Be a U.S. citizen or qualifying legal resident

Why do the SSI February 2026 Payments Comes Early?

Here’s where most folks get tripped up: the February 2026 SSI payment isn’t actually made in February — it arrives Friday, January 30, 2026.

Why?

Because the SSA follows a strict rule: if the 1st of the month lands on a weekend or federal holiday, the payment is issued on the prior business day.

- February 1, 2026 is a Sunday

- Therefore, the payment is bumped up to Friday, January 30, 2026

This isn’t a fluke or bonus check — it’s simply a schedule adjustment to ensure people receive benefits on time.

Important note: If you’re used to receiving SSI on the 1st of the month, this earlier deposit might feel like a windfall — but it’s still February’s check, so budget accordingly.

Early March 2026 Deposit: A Double-Payment Month

Here’s the kicker: March 2026 SSI benefits will also come early — on Friday, February 27, 2026 — because March 1 also falls on a Sunday.

That means recipients will receive two SSI payments in February:

- January 30, 2026 – for February

- February 27, 2026 – for March

Don’t be fooled into thinking you’re getting bonus money. It’s just the way the calendar plays out. You’re still getting one monthly payment — just earlier than usual.

This pattern happens almost every year. In 2025, for example, January’s payment was issued on December 29, 2024, because January 1, 2025 is a holiday. So it’s not unusual, but it’s important to plan ahead.

2026 SSI Benefit Amounts: How Much Will You Get?

The SSI maximum monthly federal benefit changes yearly based on inflation and cost-of-living changes. In 2026, due to a 2.8% Cost-of-Living Adjustment (COLA), the new monthly federal base rates are:

- $994 for an individual

- $1,491 for a couple

- $458 for an essential person (someone who lives with the recipient and provides care)

These amounts may be higher in some states, as many states add a state supplementary payment (SSP). For example, California, New York, and New Jersey often top up the federal SSI amounts. Check with your state’s social services department for exact totals.

What Is COLA and Why It Matters?

COLA stands for Cost-of-Living Adjustment. It’s a yearly increase in Social Security and SSI benefits to keep up with inflation — you know, when gas, milk, rent, and medicine all get more expensive.

The SSA uses data from the Consumer Price Index for Urban Wage Earners (CPI-W) to determine the percentage increase. In 2026, the COLA is 2.8%, which slightly boosts monthly checks to help you stay even with rising costs.

For instance:

- A 2025 SSI benefit of $967 becomes $994 in 2026.

- A couple’s check of $1,453 becomes $1,491.

It may not sound like a lot, but every dollar counts when you’re stretching a fixed income.

Full 2026 SSI Payment Calendar

Here’s a quick peek at the SSI payment schedule for 2026, per the SSA’s official calendar:

| Month | Payment Date |

|---|---|

| January | December 31, 2025 |

| February | January 30, 2026 |

| March | February 27, 2026 |

| April | April 1, 2026 |

| May | May 1, 2026 |

| June | May 29, 2026 |

| July | July 1, 2026 |

| August | August 1, 2026 |

| September | September 1, 2026 |

| October | October 1, 2026 |

| November | October 30, 2026 |

| December | December 1, 2026 |

Watch Out: Long Gap After February

With two payments in February 2026, recipients might mistakenly think the next check is due sooner — but here’s the trap:

- After February 27, your next SSI deposit doesn’t arrive until April 1, 2026

- That’s 33 days later — a long stretch for folks living paycheck to paycheck

Budget wisely. Treat the February 27 payment as March’s money. Break it up weekly if needed — consider separating it in two accounts or using a budgeting app to pace your spending.

How to Check Your SSI February 2026 Payments?

For the smoothest experience, set up your my Social Security account online. Here’s what you can do:

- Track past and future payment dates

- See benefit amount breakdowns

- Get 1099 tax forms

- Update bank info or address

If your payment doesn’t show up on time, call the SSA at 1-800-772-1213 or contact your local SSA field office.

Social Security Payments 2026 – Why Higher Checks May Not Increase Take-Home Income

Social Security 2026 Update – What’s Changing Next Year and How New Payment Dates Will Work

$5,181 Social Security Check – The Income Level You Must Reach in 2026 to Qualify