SSI February 2026 Payment Schedule: The SSI February 2026 Payment Schedule is something millions of Americans are tracking closely. If you or someone you care about depends on Supplemental Security Income (SSI), knowing exactly when your check lands isn’t just helpful — it’s essential. Every penny counts when you’re budgeting groceries, bills, and rent down to the dollar. In this article, we’re going to walk you through everything you need to know about the February 2026 SSI payment, when your money’s coming, how it all works, and what to do with this info. Whether you’re a retiree, disabled individual, a low-income senior, or a professional managing finances for a client or loved one — this is for you.

Table of Contents

SSI February 2026 Payment Schedule

The SSI February 2026 payment is being issued on Friday, January 30, 2026, because February 1 falls on a weekend. March’s payment comes early too — on February 27, 2026. That’s two checks in one month, but remember: they cover two different benefit periods. With a 2.8% COLA increase this year, maximum SSI payments rose to $994 for individuals and $1,491 for couples, though your actual amount may vary. By budgeting smart, checking your dates, and understanding how these shifts work, you can keep your financial ship sailing smoothly through 2026.

| Topic | Details |

|---|---|

| SSI Payment for February 2026 | Friday, January 30, 2026 (Paid early due to Feb. 1 being a Sunday) |

| SSI Payment for March 2026 | Friday, February 27, 2026 (Paid early since March 1 is also a Sunday) |

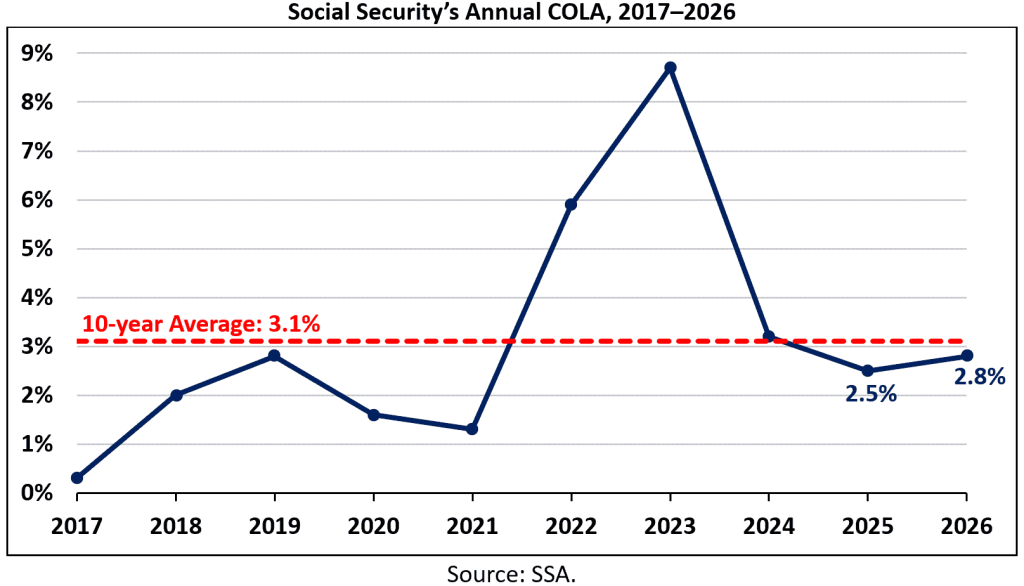

| 2026 COLA Adjustment | 2.8% increase applied to SSI and Social Security benefits |

| Max Monthly SSI in 2026 | $994 (individuals), $1,491 (couples) |

| SSA Online Account | Track benefits, deposits, and manage banking info |

What Is SSI? A Quick Primer

Supplemental Security Income (SSI) is a U.S. federal program that provides monthly financial assistance to qualifying individuals who are age 65 or older, blind, or have a disability and limited income and resources.

Unlike Social Security Retirement or Disability Insurance (SSDI), SSI is funded by general tax revenues — not Social Security trust funds. That means your eligibility and benefits are based on financial need, not your work history.

People who qualify for SSI often:

- Don’t have a long work history (or any)

- Live on low or fixed income

- Need help affording basic living expenses like food, rent, and utilities

Why Is the SSI February 2026 Payment Schedule Early?

Here’s where it gets interesting. While SSI payments are typically made on the 1st of every month, there’s an exception:

If the 1st falls on a weekend or a federal holiday, the SSI payment is issued on the last business day before that.

In February 2026, the 1st is a Sunday, so the payment will be deposited on Friday, January 30, 2026.

This means your February benefits will be in your account before February even begins.

Similar Case for March 2026

In the same way, March 1, 2026 is also a Sunday. As a result, the March SSI payment will arrive on Friday, February 27, 2026.

That’s two SSI payments in one calendar month (February) — but they’re for two different months:

- January 30 deposit is for February

- February 27 deposit is for March

So don’t let the calendar trick you — this isn’t bonus money. It just means March won’t have its own separate SSI deposit because it arrived early.

How Much Will You Receive in 2026? COLA & Benefit Amounts

Thanks to the Cost-of-Living Adjustment (COLA), monthly SSI benefits went up by 2.8% in 2026 to help match inflation and rising living costs. (ssa.gov)

Here’s what that looks like in real numbers:

- Individual maximum benefit: $994/month

- Couples maximum benefit: $1,491/month

- Essential person support: $498/month

These are the federal baseline amounts. However, your actual SSI payment may differ depending on:

- Your state (some states offer state supplements)

- Your income and living situation

- Whether you live alone, with others, or in a care facility

For example, some states like California, New York, and Pennsylvania add a state supplement that could increase your monthly check.

What If You Receive Both SSI and Social Security?

Some people receive both SSI and Social Security benefits. This is known as receiving “concurrent benefits.” If that’s your situation, you’ll have two payment dates to track:

- SSI Payment: Follows the 1st-of-the-month rule, adjusted for weekends (like Jan. 30 in this case)

- Social Security Payment: Follows the birth date-based schedule or legacy rules

Here’s how the Social Security payment dates work in February 2026:

- If your birthday falls on the 1st–10th → Paid on Wednesday, February 11

- If your birthday falls on the 11th–20th → Paid on Wednesday, February 18

- If your birthday falls on the 21st–31st → Paid on Wednesday, February 25

If you started receiving Social Security before May 1997, or you receive both SSI and Social Security, you might get your payment on the 3rd of the month instead.

How to Prepare Financially for SSI February 2026 Payment Schedule?

When two payments hit your account in one calendar month, it can look like a bonus, but it’s really just a shift in scheduling. That means:

- No SSI deposit in March

- You need to budget your money to cover all of March with February’s second payment

Budgeting Tip:

Break down your total monthly costs (rent, utilities, food, medicine, transportation) and divide your February 27 payment into weekly portions to ensure it lasts through March.

Plan ahead and avoid overspending in February, especially if the two payments make you feel “flush.”

How to Check Your Payment Status Online?

The Social Security Administration offers a free online portal to check your:

- Benefit payment dates

- Payment amounts

- Direct deposit status

- Tax documents (1099s)

- Update your mailing address or bank info

It’s the best way to track your benefits without needing to call SSA or wait for letters in the mail.

Social Security Boost by State 2026 – Five States Where Benefits Could Rise by Up to $2,000

Average Social Security Benefits 2026 – New Monthly Payment Amounts by Retirement Age

2027 Social Security COLA – Early Forecast Signals a Smaller Raise Than Expected

What If Your Payment Is Delayed?

If your SSI check hasn’t arrived by the expected date:

- Wait at least 3 business days after the payment date

- Contact your bank or credit union to see if it’s pending

- If still missing, call the SSA at 1-800-772-1213 (TTY: 1-800-325-0778)

Make sure your banking information and mailing address are updated in your SSA profile to prevent delays.

Important Documents You’ll Need for Tax Season

Even though SSI benefits aren’t taxed, many recipients also receive Social Security or SSDI, which may be taxable depending on income.

Around January each year, SSA sends out Form SSA-1099 to help you file taxes. You can also:

- View and print tax forms via My Social Security

- Share benefit letters with accountants or financial advisors

- Use this info to apply for housing or assistance programs