SSDI Payments 2026 Increase: If you rely on Social Security Disability Insurance (SSDI) or know someone who does, you’ll be glad to hear that SSDI payments are getting a boost in 2026. Thanks to a 2.8% cost-of-living adjustment (COLA) from the Social Security Administration (SSA), beneficiaries can expect higher monthly payments to help offset rising living expenses. This isn’t just a small tweak — it’s part of a broader set of changes that affect more than 75 million Americans receiving SSDI, Supplemental Security Income (SSI), retirement, survivor, and spousal benefits. In this comprehensive guide, we break down everything you need to know in plain English, with solid data, official links, and real-world advice — all from the lens of an experienced professional.

Table of Contents

SSDI Payments 2026 Increase

he 2026 SSDI payments increase of 2.8% is good news — but it’s only one piece of the puzzle. Between higher Medicare premiums, earning limits, SGA thresholds, and state benefit offsets, you’ll want to understand the full scope to make smart financial decisions. If you’re receiving SSDI or SSI, now’s the time to:

- Review your benefits letter

- Log into your SSA account

- Understand how work, Medicare, or taxes could affect your net pay

- Talk to a benefits advisor or disability attorney if you plan to earn more or appeal a decision

Stay informed. Stay proactive. And check back every October when new COLA updates are announced — they shape your year ahead.

| Feature | 2025 Amount | 2026 Amount (2.8% COLA) | Notes / Sources |

|---|---|---|---|

| COLA Increase | — | 2.8% | Announced by SSA (ssa.gov) |

| Average SSDI Payment | ~$1,586 | ~$1,630 | Based on national averages |

| SSI (Individual) | $967 | $994 | Federal max monthly benefit |

| SSI (Couple) | $1,450 | $1,491 | Combined benefit for eligible couples |

| Payment Start – SSI | — | Dec 31, 2025 | For January 2026 payment |

| Payment Start – SSDI | — | January 2026 | Based on recipient’s birthdate |

| Max Taxable Earnings | $176,100 | $184,500 | Social Security payroll tax ceiling |

| Substantial Gainful Activity (SGA) | $1,550/mo | ~$1,593/mo (est.) | Income limit for disability eligibility |

| Medicare Part B Premium | $185.00 | $202.90 (est.) | Deducted from SSDI benefits |

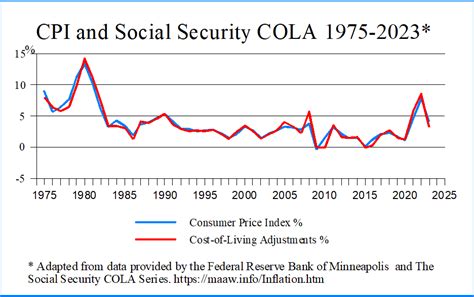

What Is COLA and Why Does It Matter?

COLA stands for Cost-of-Living Adjustment. It’s how Social Security keeps benefits in line with inflation — the general rise in prices over time. COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), calculated by the U.S. Bureau of Labor Statistics.

In short: when prices go up, so do your benefits.

The 2.8% increase for 2026 is a sign that inflation is still impacting essentials like:

- Rent and housing

- Food and groceries

- Transportation and fuel

- Prescription medications

- Utility bills

Even if 2.8% doesn’t sound like much, it’s meaningful over time — especially for those living on fixed incomes.

SSDI vs. SSI: Know the Difference

Before we go further, let’s make sure we’re on the same page:

SSDI – Social Security Disability Insurance

- For people who worked and paid Social Security taxes.

- Based on your earnings record and work history.

- Monthly benefit varies for each person.

- Eligible after meeting SSA’s definition of “disability.”

SSI – Supplemental Security Income

- For low-income individuals with limited income and assets.

- Does not require work history.

- Flat federal payment amounts (plus possible state supplements).

- Strict asset limits: typically $2,000 for individuals, $3,000 for couples.

How the 2.8% SSDI Payments 2026 Increase Affects SSDI Payments

If you receive SSDI, your exact increase depends on your current benefit amount. Here’s how to estimate your new check:

Let’s say you receive $1,600 per month in 2025. A 2.8% COLA increase would give you:

$1,600 × 0.028 = $44.80

$1,600 + $44.80 = $1,644.80/month starting in January 2026

That may sound small, but over 12 months, that’s an extra $537.60 for the year — enough to help with a few prescription refills, grocery runs, or utility bills.

How the COLA Affects SSI Payments?

Unlike SSDI, SSI has fixed federal limits that go up uniformly with COLA:

- 2025 Max for Individuals: $967

- 2026 Max for Individuals: $994

- 2025 Max for Couples: $1,450

- 2026 Max for Couples: $1,491

Some states provide an extra amount — called a state supplement — which could further raise your SSI check.

When Do the New Payments Start?

- SSI recipients will receive their increased payment on December 31, 2025 (the January 2026 check comes early due to the holiday).

- SSDI beneficiaries will see the new amount on their January 2026 payment date — this depends on your birth date and other factors.

If you haven’t already, consider setting up a “my Social Security” account at ssa.gov to view your COLA notice, payment schedule, and benefit breakdowns.

Can You Still Work on SSDI or SSI in 2026?

Yes — but there are rules. Let’s simplify:

SSDI Work Rules – SGA Threshold

You can work and still receive SSDI, as long as your earnings stay under the Substantial Gainful Activity (SGA) limit:

- 2025 SGA (non-blind): $1,550/month

- 2026 SGA (estimated): ~$1,593/month

- 2026 SGA (blind): ~$2,730/month

Earning above SGA may cause your benefits to pause or stop — but the Ticket to Work program and Trial Work Period (TWP) allow you to test employment without losing benefits right away.

Other Financial Impacts in 2026

1. Taxable Maximum Earnings Increase

In 2026, the amount of income subject to Social Security tax goes up to $184,500. This affects:

- Higher earners who pay payroll tax

- The calculation of future retirement/SSDI benefits

- Employer matching responsibilities

This change doesn’t directly affect most SSDI recipients, but it does impact future benefit projections and trust fund stability.

2. Medicare Part B Premiums

If you receive SSDI for 24 months, you become eligible for Medicare. Most people on Medicare pay Part B premiums (deducted from your SSDI check):

- 2025: ~$185/month

- 2026 (projected): ~$202.90/month

That means your actual take-home may not increase by the full 2.8%, since the COLA raise and Medicare costs often cancel each other out.

What About Taxes on SSDI and SSI?

SSDI: May Be Taxed

Your SSDI benefits might be taxable if you have other income (like a spouse’s income, pension, or side gig). Here’s the basic breakdown:

- If you file single and your total income exceeds $25,000, part of your SSDI may be taxable.

- For married couples filing jointly, the threshold is $32,000.

SSI: Not Taxable

SSI payments are never taxed, as they are considered welfare-based aid.

Common Myths About SSDI Payments 2026 Increase– Let’s Clear Them Up

Myth 1: You must reapply to receive the COLA.

Fact: Nope. It’s automatic. No forms, no phone calls. You’ll see the increase in your next payment.

Myth 2: You lose SSDI if you earn any income.

Fact: Not true. The SSA encourages work through TWP and SGA rules, giving you a chance to test work without penalty.

Myth 3: COLA raises always keep up with inflation.

Fact: They try to, but many recipients say their real expenses rise faster than the COLA adjustments.

$4018 SSDI Payment in December 2025: How to get it? Check Eligibility, Schedule

US $4873 December 2025 Direct Deposit: Check Eligibility Criteria & Payment Schedule

$2000 Stimulus Check in December 2025: Check Payment Date & Eligibility Criteria