SSA Confirms 2026 Payment Schedule: When it comes to Social Security benefits, there’s one question every American wants answered: “When will I get my check?” Whether you’re a retired teacher in Oklahoma, a disabled veteran in Arizona, or a widowed spouse raising kids in Montana, that monthly deposit from the Social Security Administration (SSA) matters. It’s more than just money—it’s security, dignity, and peace of mind. Now that the SSA has officially confirmed the 2026 payment schedule, it’s time to break it down in plain English—no jargon, no fluff. Just solid, trustworthy information. You’ll learn when your payment is coming, why it comes when it does, and how to stay on top of it so you’re never caught off guard.

Table of Contents

SSA Confirms 2026 Payment Schedule

Understanding the 2026 Social Security payment schedule isn’t just helpful—it’s empowering. Whether you’re 65 and retired, 38 and disabled, or just trying to help your parents manage their benefits, knowing the when, how, and why behind your payment dates means fewer surprises and more control. Plan your bills. Use your MySSA account. And stay informed about your benefits—because you’ve earned them.

| Detail | Explanation |

|---|---|

| SSA Retirement & SSDI Paydays | 2nd, 3rd, and 4th Wednesdays (based on birth date) |

| Birthday Groupings | 1st–10th: 2nd Wed, 11th–20th: 3rd Wed, 21st–31st: 4th Wed |

| SSI Paydays | 1st of the month (or the weekday before if it lands on a weekend/holiday) |

| Legacy Rule | Started benefits before May 1997? You get paid on the 3rd of each month |

| COLA for 2026 | Estimated 2.8% increase for inflation |

| Official SSA Source | SSA 2026 Payment Calendar PDF |

Why the SSA Confirms 2026 Payment Schedule Is So Important?

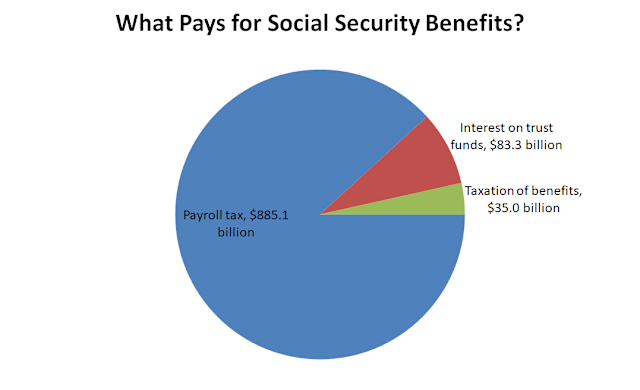

If you’re one of the over 70 million Americans receiving Social Security benefits, you know timing is everything. For most recipients, Social Security is either the only or the primary source of income. According to SSA data, nearly half of elderly beneficiaries rely on it for 90% or more of their monthly income.

That’s why knowing when the check hits your account is more than just convenience—it’s essential. Missing a bill because you thought your check was coming early? That’s not just stressful. It could lead to late fees, overdrafts, or worse.

So let’s make sure you never miss a beat in 2026.

SSA Confirms 2026 Payment Schedule: When Will You Get Paid?

If You Started Benefits After May 1997

Your payment date is determined by your birth date. Here’s how it works:

| Birthday Range | Monthly Payday |

|---|---|

| 1st – 10th | 2nd Wednesday |

| 11th – 20th | 3rd Wednesday |

| 21st – 31st | 4th Wednesday |

Let’s say your birthday is September 4. In 2026, your checks will come on the second Wednesday of each month. If your birthday is October 29, expect your payment on the fourth Wednesday.

If You Started Benefits Before May 1997

You’re part of what SSA calls a “legacy group.” You’ll receive your payment on the 3rd of each month, regardless of your birth date.

- If the 3rd falls on a Saturday, Sunday, or federal holiday, you’ll be paid on the weekday before.

This rule mostly applies to long-time retirees or survivors who’ve been on Social Security for decades.

If You Receive SSI (Supplemental Security Income)

SSI follows a different track. These payments go out on the 1st of each month. But here’s the twist:

- If the 1st is a weekend or holiday, payment is moved up to the prior business day.

For example:

- January 1, 2026 is a holiday → your January SSI will be paid on December 31, 2025

This means some months (like March, August, and November) will have two SSI payments, while others may have none.

Full 2026 Social Security Pay Date Chart

Let’s get visual. Here’s when checks go out for folks in each birthday group:

| Month | 2nd Wednesday | 3rd Wednesday | 4th Wednesday |

|---|---|---|---|

| January | 14 | 21 | 28 |

| February | 11 | 18 | 25 |

| March | 11 | 18 | 25 |

| April | 8 | 15 | 22 |

| May | 13 | 20 | 27 |

| June | 10 | 17 | 24 |

| July | 8 | 15 | 22 |

| August | 12 | 19 | 26 |

| September | 9 | 16 | 23 |

| October | 14 | 21 | 28 |

| November | 11 | 18 | 25 |

| December | 9 | 16 | 23 |

Note: If you’re on SSI or the legacy 3rd-of-month system, your dates will differ.

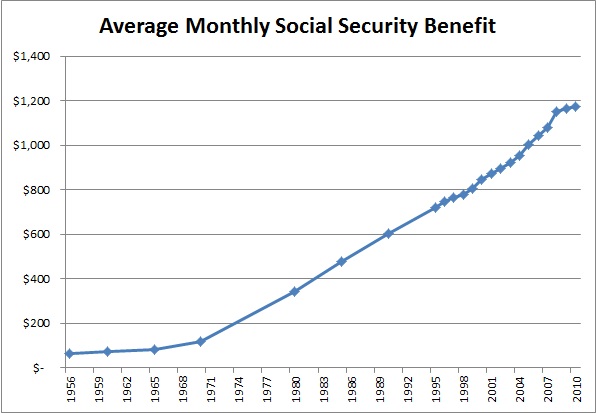

2026 COLA (Cost-of-Living Adjustment): What to Expect

Every year, SSA evaluates inflation and adjusts benefits through the Cost-of-Living Adjustment (COLA). For 2026, it’s estimated to be around 2.8%—a modest but meaningful bump in your monthly check.

The exact COLA is announced each October, based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W)

How to Manage Your Social Security Account Online?

Managing your benefits is easier than ever, thanks to the My Social Security portal. Here’s what you can do:

- Set up Direct Deposit

- Check your payment history

- Get SSA benefit verification letters

- Update address or bank info

- Download tax forms (SSA-1099)

How to Change Bank Accounts or Payment Method?

Switched banks? No sweat. Here’s what to do:

- Step 1: Log into your My Social Security account

- Step 2: Go to “Direct Deposit”

- Step 3: Enter new bank routing number and account number

- Step 4: Save changes

Expect the update to take 1 to 2 payment cycles. During that time, monitor your old and new accounts closely.

Social Security Payment Safety: Avoiding Scams

Sadly, scammers are targeting Social Security recipients with increasing frequency. Here’s how to protect yourself:

- SSA will never call to threaten you or demand money

- Do not share your SSN, bank info, or personal data via phone or email

If you receive a suspicious call, hang up. Then report it.

Young and Working? Why You Should Still Care About This

Even if retirement is decades away, Social Security impacts you:

- You’re earning credits now that determine future eligibility

- If you become disabled, your SSDI benefit depends on your work history

- Your survivors may qualify for death benefits

Track your earnings yearly and correct any mistakes early. Errors can reduce your benefits later.

Disability (SSDI) Recipients: Additional Help Available

If you’re receiving SSDI, you may also qualify for:

- Medicare after 24 months

- Supplemental Nutrition Assistance Program (SNAP)

- Housing support programs

You can also join SSA’s Ticket to Work program to re-enter the workforce without losing benefits immediately.

Missing Social Security Checks This Week?: Here’s the Real Reason Behind the Delay

Which States Tax Social Security Benefits? Check the Full Map and What You Might Pay in 2026!

Social Security and Medicare 2026 – What Retirees and Savers Should Prepare for Now