Social Security Tax Rules by State: When it comes to retirement income, every dollar counts. And while many people count on Social Security benefits as a dependable monthly check, what they might not realize is that those benefits can be taxed — not just by the federal government but also by some states. That’s right. Depending on where you live, your state government could be taking a cut of your Social Security check. Understanding which states tax your benefits — and how those taxes work — can make a major difference in your retirement planning. In this article, we break down the Social Security tax rules by state, who’s affected, and how to plan ahead to protect your hard-earned benefits.

Table of Contents

Social Security Tax Rules by State

Social Security was designed to support you — not to get eaten away by unnecessary taxes. And while you can’t avoid federal rules, you can control your state-level tax exposure. Being aware of how your location affects your Social Security income is one of the smartest moves you can make. With a little planning and the right guidance, you can keep more of your money and live with more peace of mind in retirement.

| Topic | Summary |

|---|---|

| States that tax Social Security | 9 states still tax benefits in 2025 |

| States that don’t tax it | 41 states + D.C. fully exempt Social Security benefits |

| Federal taxation threshold | Benefits may be taxed if income exceeds $25,000 (single) / $32,000 (joint) |

| Retirement planning tip | Relocating to a tax-free state can preserve income |

| Income-based exemptions | Many states offer income-based deductions or credits to reduce tax |

What Is Social Security Income?

Social Security is a federally funded program designed to provide income to Americans who are retired, disabled, or survivors of deceased workers. It’s funded by payroll taxes under the Federal Insurance Contributions Act (FICA).

If you’ve worked at least 10 years (40 credits), you’re entitled to monthly benefits starting at age 62 — though full retirement age varies from 66 to 67 depending on your birth year. The longer you delay up to age 70, the more you get.

But here’s the kicker: while it’s considered a federal entitlement, the benefits are not always tax-free.

Social Security Tax Rules by State

The federal government may tax a portion of your benefits if your income exceeds certain levels. The formula used by the IRS includes:

- Adjusted Gross Income (AGI)

- Tax-exempt interest (like municipal bonds)

- 50% of your annual Social Security benefits

Add those up and you get your “combined income.”

If your combined income exceeds the following thresholds:

- $25,000 for single filers

- $32,000 for married couples filing jointly

Then up to 85% of your Social Security benefits may be subject to federal income tax.

This federal rule applies to everyone, regardless of which state they live in.

Why Social Security Tax Rules by State Matter?

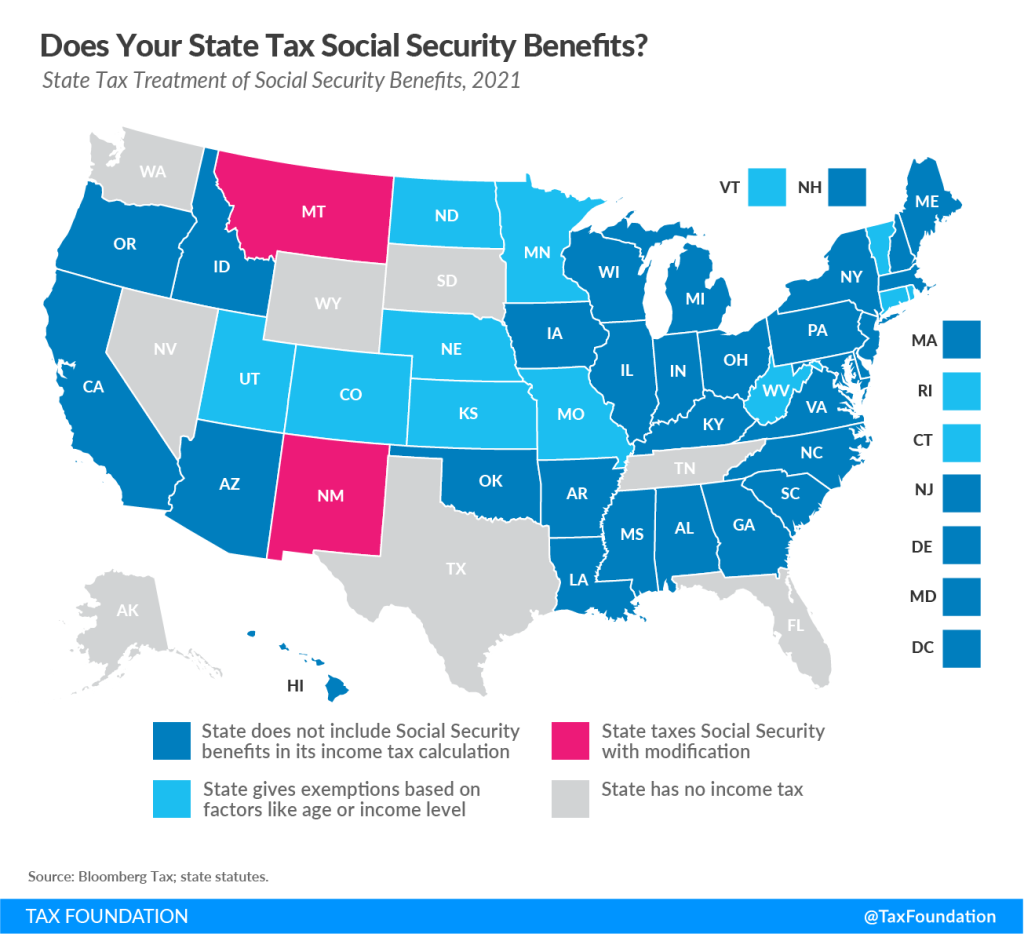

While the federal tax rules are the same nationwide, state rules vary wildly.

Some states don’t tax retirement income at all. Others tax it like any other income. A handful fall somewhere in between — taxing benefits based on your income, age, or other deductions.

This means where you live in retirement can significantly affect how much Social Security money you actually keep.

States That Do NOT Tax Social Security (2025)

Here’s the good news: 41 states and Washington D.C. do not tax Social Security income at all.

These include:

- Alaska

- Arizona

- California

- Florida

- Georgia

- Illinois

- Indiana

- Kentucky

- Michigan

- New York

- North Carolina

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Virginia

- Washington

- Wisconsin

- Wyoming

- … and many others.

Some of these states don’t have any income tax at all (like Florida and Texas), while others have income tax but specifically exclude Social Security from taxable income.

This makes them ideal locations for retirees living on fixed incomes.

States That DO Tax Social Security (2025)

As of 2025, the following 9 states tax Social Security benefits to some extent:

- Colorado

- Connecticut

- Minnesota

- Montana

- New Mexico

- Rhode Island

- Utah

- Vermont

- West Virginia (phasing out by 2026)

Let’s break down a few of these so you can see how the rules play out.

Colorado

- Taxes Social Security income.

- Residents age 65 and older may fully deduct their benefits from income.

- Younger retirees may deduct up to $24,000, depending on income.

Minnesota

- One of the more aggressive states when it comes to taxation.

- Follows the federal formula but offers a subtraction for low-to-moderate income earners.

- If your AGI is below $84,490 (single) or $108,320 (joint), you may qualify for full exemption.

New Mexico

- Social Security benefits are taxed like regular income, but exemptions kick in if:

- Your AGI is under $100,000 (single) or $150,000 (joint).

- Over those thresholds? Expect a state tax bill.

Utah

- Offers a non-refundable tax credit based on income and filing status.

- Designed to offset the tax on Social Security for moderate-income retirees.

West Virginia

- Previously taxed benefits similarly to the IRS.

- Currently phasing out its tax — all benefits will be exempt by 2026.

Real-World Impact of Social Security Tax Rules by State: Why It Matters

Imagine this: You and your neighbor both get $24,000 per year in Social Security. You live in Florida. Your neighbor lives in Minnesota. You both worked hard, paid into the system — same benefits.

But your neighbor loses $1,000+ per year to state taxes, while you keep the whole thing.

That difference adds up over 10–20 years of retirement.

It can affect:

- How long your savings last

- Whether you can afford assisted living

- How much you travel, donate, or gift to family

- Your ability to cover medical costs or rising expenses

This is why choosing a retirement-friendly state is not just a lifestyle decision — it’s a financial strategy.

Retirement Planning Advice from Financial Experts

If you’re working with a CPA, financial advisor, or retirement planner, here’s what they’ll likely tell you:

- Location is leverage: State income taxes, property taxes, and cost of living all matter.

- Don’t just focus on Social Security: Pensions, 401(k) withdrawals, IRA income — all could be taxed differently at the state level.

- Run projections: Use calculators to model your expected income and taxes in different states.

- Review annually: States change tax laws often — stay updated to make adjustments.

- Think about estate planning: Some states have inheritance or estate taxes that could impact your legacy.

Social Security $1,850 Monthly Check – How the 2026 Update Changes This Benefit Amount

Social Security 2026: How Much You Must Earn to Get the Highest Benefit

Social Security Increases by State 2026 – The Five States Seeing the Largest Benefit Gains