Social Security Spousal Benefits: If you’re nearing retirement or planning for your future, there’s one little-known Social Security perk that could mean hundreds or even thousands of dollars in extra retirement income each year — even if you didn’t work much or at all. It’s called the Social Security spousal benefit, and in 2026, it’s more relevant than ever. Social Security spousal benefits in 2026 are designed to support married or formerly married individuals who may not have earned enough to qualify for a sizable benefit on their own. In some cases, these benefits can be up to 50% of your spouse’s Social Security check, depending on when you file and how long you’ve been married. Whether you’re a stay-at-home parent, divorced after a long marriage, or simply earned less than your spouse over the years, this guide is here to help you understand the rules, avoid mistakes, and get the most from what you’ve earned together.

Table of Contents

Social Security Spousal Benefits

Social Security spousal benefits in 2026 offer a crucial opportunity to boost retirement income — especially for spouses who earned less or stayed home. Whether you’re married or divorced, this benefit can mean the difference between a bare-bones retirement and one with breathing room. Remember, you’ve paid into this system — through your household, your partner, or your marriage. Don’t leave what you’ve earned on the table. Check your eligibility, estimate your benefit, and make sure you file smart. This is your money. Claim it with confidence.

| Feature | Details |

|---|---|

| Eligibility (Married) | Must be married for at least 1 continuous year |

| Eligibility (Divorced) | Marriage lasted at least 10 years, currently unmarried |

| Minimum Age to Claim | 62 (with reductions), 67 (Full Retirement Age for full benefit) |

| Max Benefit Amount | Up to 50% of spouse’s FRA benefit |

| Own vs Spousal Benefit | You get whichever is higher — not both |

| COLA for 2026 | 2.8% Cost-of-Living Adjustment across all Social Security benefits |

| Filing Requirement | Spouse must have filed for benefits (unless divorced 2+ years) |

| Where to Apply | SSA.gov or call 1-800-772-1213 |

What Are Social Security Spousal Benefits?

Spousal benefits are part of the broader Social Security retirement program, which provides monthly payments to eligible Americans based on work history. But not everyone earns enough credits through work to receive a large benefit — or any benefit at all.

That’s where spousal benefits come in.

If you’re married to someone who qualifies for Social Security, you may be able to collect benefits based on their earnings, even if your own work record is minimal or nonexistent. These benefits are not dependent on your own contributions but rather are calculated using your spouse’s work history and benefit amount.

Important: Spousal benefits are separate from survivor benefits, which may allow a widow or widower to collect up to 100% of a deceased spouse’s benefit. These follow different rules.

Who Qualifies for Social Security Spousal Benefits?

Understanding the rules around eligibility is key to maximizing your benefit — and avoiding unnecessary delays.

If You’re Married

To qualify:

- You must have been married for at least one continuous year

- Your spouse must have filed for their own Social Security benefits

- You must be at least age 62

- You must be a U.S. citizen or lawful resident

Note: If you’re caring for your spouse’s child who is under 16 or disabled, you may be eligible even before age 62.

If You’re Divorced

You may still qualify for spousal benefits from your ex if:

- Your marriage lasted at least 10 years

- You’ve been divorced for 2 years or more

- You’re currently unmarried

- Your ex-spouse is eligible for Social Security (they do not need to have filed yet)

Pro Tip: Your ex will not be notified if you file. It’s a completely private application.

How Much Can You Receive in 2026?

This is where things get interesting — and where the math kicks in.

Full Retirement Age (FRA)

For anyone born in 1960 or later, Full Retirement Age (FRA) is 67. At this age, you can receive the maximum spousal benefit, which is 50% of your spouse’s FRA benefit.

If your spouse is entitled to $2,400 per month at their FRA, you could receive $1,200/month if you claim at your own FRA.

Claiming Early

You can start claiming spousal benefits as early as age 62, but with permanent reductions:

- At 62, expect about 32.5% of your spouse’s FRA benefit

- This could reduce your $1,200 FRA benefit down to around $780/month

Delayed Claiming

Unlike your own Social Security benefit, spousal benefits do not increase if you delay past your FRA. There’s no bonus for waiting beyond age 67.

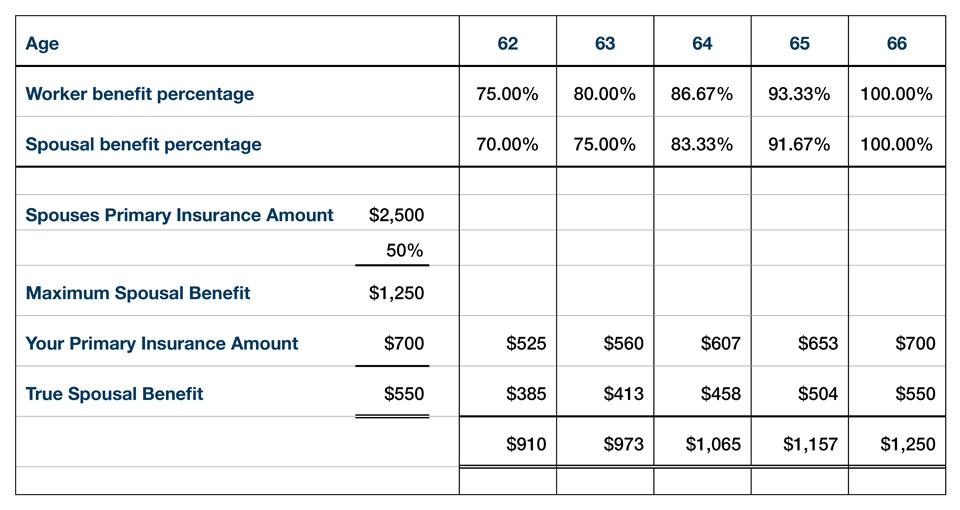

Your Own Benefit vs. Spousal Benefit

You don’t get both — Social Security pays you whichever is higher:

- If your personal benefit is greater than your spousal benefit → You get your benefit.

- If your spousal benefit is greater than your personal benefit → SSA pays the difference to boost you up to the spousal amount.

Let’s say:

- Your benefit = $900/month

- Your spousal benefit = $1,200/month

- SSA pays your $900, plus $300 to bring you up to $1,200

How to Apply for Social Security Spousal Benefits?

Step 1: Create Your “My Social Security” Account

- Sign up at ssa.gov/myaccount

- View your earnings history and benefit estimates

Step 2: Gather Documents

You’ll typically need:

- Your marriage certificate or divorce decree

- Birth certificates

- Social Security numbers

- Direct deposit info

Step 3: Apply

- Online: Apply here

- By phone: 1-800-772-1213

- In-person: Visit your local SSA office (appointments recommended)

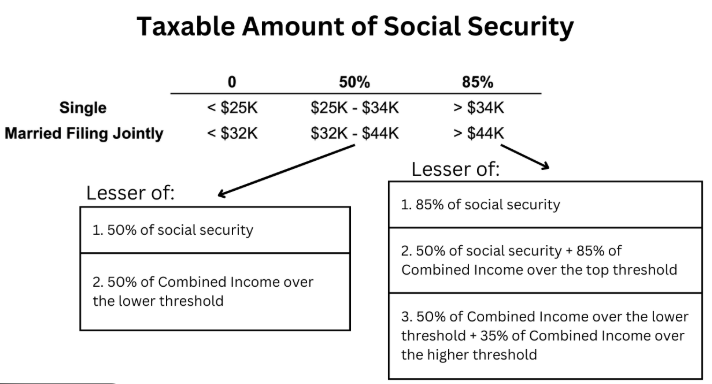

Tax Considerations in 2026

You may need to pay federal income tax on your benefits, depending on your combined income (your adjusted gross income + nontaxable interest + 50% of your Social Security):

| Filing Status | Combined Income | % of Benefit Taxed |

|---|---|---|

| Individual | $25,000–$34,000 | Up to 50% |

| Individual | Over $34,000 | Up to 85% |

| Joint | $32,000–$44,000 | Up to 50% |

| Joint | Over $44,000 | Up to 85% |

Most states do not tax Social Security, but a few still do (e.g., Colorado, Montana, New Mexico).

Common Mistakes to Avoid

- Claiming too early

Reduces your monthly benefit for life. - Not realizing you qualify as a divorced spouse

Millions of Americans are eligible without realizing it. - Thinking you can collect both full benefits

You only get the higher of the two, not both. - Assuming your ex needs to file first

They only need to be eligible, not filed — if you’ve been divorced 2+ years.

Real-Life Use Cases

Stay-at-Home Spouse

Maria never worked outside the home. Her husband qualifies for $2,400/month. She can receive $1,200/month at 67 — without impacting his benefit.

High-Earning Wife, Low-Earning Husband

Beth earns more than her husband. At retirement, they find his spousal benefit is higher than his personal one, so he takes spousal at FRA.

Divorced, No Contact

John was married for 12 years, now divorced for 5. He applies for benefits on his ex’s record without ever contacting her.

Strategic Claiming Tips

- Spouses can’t file for spousal benefits unless the other has filed.

- Divorced spouses can file independently after two years of being divorced.

- Consider filing a “restricted application” if born before January 2, 1954 (grandfathered in).

Talk to a Social Security planner or advisor before making a final decision — it’s hard to undo after the fact.

Working While Collecting Social Security 2026 – The Earnings Limit That Keeps Your Benefits Safe

Social Security Payment Schedule for February 2026 and COLA Increase Explained

Social Security Planning 2026 – 8 Practical Moves That Can Help You Secure Higher Lifetime Benefits