Social Security Rules 2026 Explained: that’s exactly what we’re going to cover in this detailed, easy-to-understand article. Whether you’re already collecting benefits, planning to retire soon, or helping clients navigate the system, understanding what’s new in 2026 is essential. This year, Social Security sees some significant changes — a 2.8% Cost-of-Living Adjustment (COLA), increases to maximum taxable wages, new earnings thresholds, and updates to SSI benefit limits. The government’s largest retirement and disability program affects more than 71 million Americans, and 2026’s changes impact nearly all of them in some way. We’ll walk through the updates, what they mean for your bottom line, and how to make the most of your benefits under the new rules

Table of Contents

Social Security Rules 2026

The Social Security Rules 2026 Explained show that while benefits are increasing, so are taxes and healthcare costs. With a 2.8% COLA, higher SSI limits, and wage caps, there’s more money on the table — but also more to manage. Whether you’re just getting started with retirement planning or you’re already collecting benefits, staying informed about these updates empowers you to make smarter financial decisions. Use the tools available, revisit your retirement goals, and if needed, speak with a financial advisor to make sure you’re getting the most out of what you’ve earned.

| Category | 2026 Update |

|---|---|

| COLA | 2.8% increase starting January 2026 |

| Average Retirement Benefit | ~$2,071/month |

| SSI Max (Individual) | $994/month |

| SSI Max (Couple) | $1,491/month |

| Taxable Wage Base | $184,500 |

| Max Benefit at FRA | $4,152/month |

| Max Benefit at Age 70 | $5,251/month |

| Work Credit Threshold | $1,890 per credit |

| Annual Earnings Limit (Under FRA) | $24,480 |

| Earnings Limit (Year You Reach FRA) | $65,160 |

What is COLA and What Does the 2026 Adjustment Mean?

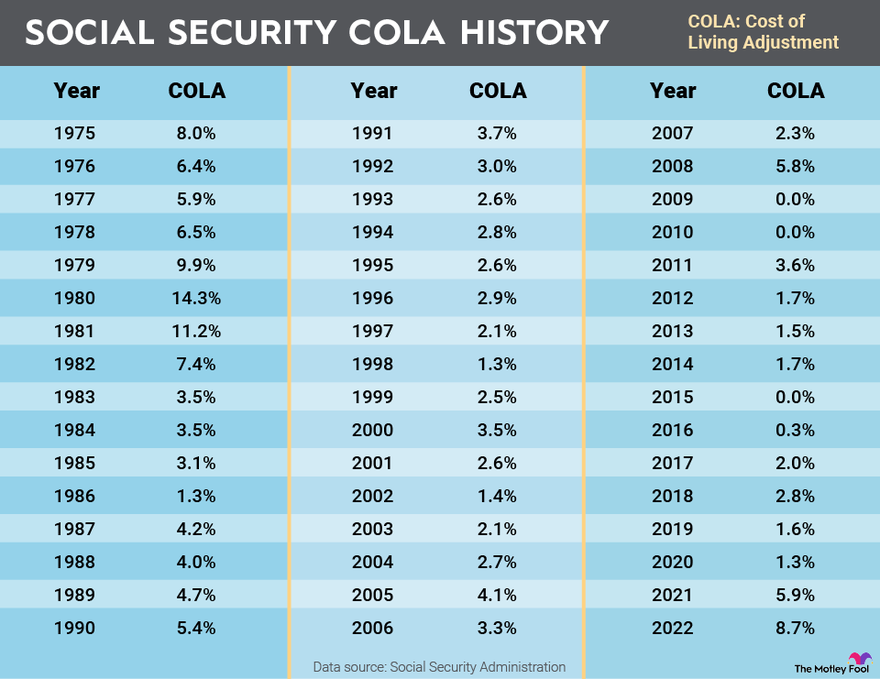

The Cost-of-Living Adjustment (COLA) is how the government ensures Social Security payments keep up with inflation. The COLA is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

For 2026, the COLA is 2.8%. This increase applies to:

- Social Security retirement benefits

- Social Security Disability Insurance (SSDI)

- Supplemental Security Income (SSI)

- Survivor and spousal benefits

For the average retiree, this translates to an estimated monthly benefit increase of around $56 — from $2,015 in 2025 to approximately $2,071 in 2026.

This boost can help offset rising costs in healthcare, housing, and food, especially as inflation continues to impact fixed-income seniors.

Tip: You don’t need to apply for this increase — it’s automatically applied starting with January 2026 payments.

Social Security Income (SSI) Payments for 2026

SSI, a need-based benefit for low-income individuals who are elderly, blind, or disabled, also receives the COLA increase.

The new 2026 federal payment standards are:

- $994/month for individuals (up from $943 in 2025)

- $1,491/month for eligible couples (up from $1,415 in 2025)

Some states provide a supplementary payment on top of the federal SSI benefit, which may further increase your check. Check with your state’s social services agency to learn more.

New Taxable Wage Base: What It Means for Workers

The Social Security payroll tax funds the benefits program. In 2026, the maximum amount of income subject to this tax — known as the taxable wage base — increases to $184,500, up from $176,100 in 2025.

- Employees pay 6.2% on earnings up to that amount

- Employers match with another 6.2%

- Self-employed workers pay the full 12.4% rate

If you earn more than $184,500, the excess isn’t taxed for Social Security purposes — but you’ll still pay 1.45% Medicare tax (plus the additional 0.9% surtax for high earners).

Why It Matters?

The higher wage cap means higher earners will contribute more to the system in 2026, but it also raises the bar for those aiming to qualify for maximum retirement benefits, which are based on your highest 35 years of earnings up to the wage base.

Maximum Social Security Benefits in 2026

Here’s a look at maximum possible monthly benefits in 2026 if you’ve worked at the wage base for at least 35 years:

- At Full Retirement Age (FRA): $4,152/month

- At Age 70 (maximum delayed credits): $5,251/month

Only a small percentage of Americans qualify for these amounts — but they’re useful targets for younger workers and professionals with high, consistent incomes over decades.

Social Security Rules 2026: Work Credits and Eligibility in 2026

To qualify for Social Security retirement benefits, you need 40 work credits, which typically means working for at least 10 years.

In 2026:

- 1 credit = $1,890 in earnings

- You can earn up to 4 credits per year, meaning $7,560 in annual income gets you all 4

This threshold is especially important for:

- Young workers just entering the workforce

- Self-employed individuals

- Gig workers who need to track earnings closely

Make sure your income is reported properly through payroll or self-employment taxes to ensure those credits count.

Working While Collecting Benefits: Earnings Test in 2026

If you claim benefits before your Full Retirement Age (FRA) and continue working, the earnings test applies.

2026 Earnings Limits:

- Under FRA all year: $24,480

- If you earn more than this, SSA withholds $1 in benefits for every $2 over the limit

- Reaching FRA in 2026: $65,160

- SSA withholds $1 for every $3 over the limit, but only for earnings before your birthday month

- Once you hit FRA: No limit — earn as much as you want without a benefit reduction

Note: These withheld benefits aren’t lost forever — they’re recalculated and added back once you reach FRA, boosting future checks.

Medicare Premiums: Impact on Net Social Security Checks

One hidden factor in your Social Security income is Medicare Part B premiums, which are automatically deducted from most beneficiaries’ checks.

- In 2026, the base Part B premium is expected to be around $202.90/month

- Higher earners may pay more due to Income-Related Monthly Adjustment Amounts (IRMAA)

If your COLA increase is $56/month and your Medicare premium rises by $18/month, your net increase is only $38/month. It’s important to plan accordingly and factor in healthcare costs.

Taxation of Benefits in 2026

Social Security benefits may be taxable depending on your combined income:

- Single filers: Income over $25,000

- Married couples: Income over $32,000

Up to 85% of your Social Security income may be taxable on your federal return.

Some states also tax Social Security benefits — though many have repealed or phased out these taxes. Check your state’s tax laws or consult a professional for personalized guidance.

Social Security Rules 2026: Strategic Claiming Tips

- Delay If You Can: Waiting past your FRA increases your benefit by 8% per year until age 70.

- Married? Use Spousal Strategies: One spouse may file early while the other delays, optimizing household income over time.

- Start Small Businesses: If you’re semi-retired, staying under the earnings limit can allow you to collect benefits while continuing to work.

- Monitor Your Earnings Record: Log in to your my Social Security account and make sure your earnings are correctly recorded. Errors can reduce your benefit.

Legislation Watch: What Could Change Next?

While these rules are set for 2026, there are several proposals in Congress aimed at reforming Social Security, including:

- Raising or eliminating the wage cap

- Changing the COLA formula to better reflect senior spending (CPI-E)

- Adjusting benefits for future retirees to improve long-term program solvency