Social Security Rule Changes: If you rely on Social Security benefits or plan to start soon, pay attention — because 2026 will bring several big rule changes that could impact your monthly budget and your long-term financial planning. Whether you’re already retired, still working, or somewhere in between, these updates from the Social Security Administration (SSA) are designed to keep benefits aligned with inflation and wage growth, but they’ll also influence how much you pay in taxes and how much ends up in your pocket. The SSA recently announced a 2.8% Cost-of-Living Adjustment (COLA) for 2026, along with increases to the taxable wage base and earnings limits for those who keep working while collecting benefits. While this means more money for retirees, higher taxes for top earners, and a few new income thresholds to understand, the real-world effect on your wallet depends on your situation — and your strategy. Let’s break down the details, the math, and the meaning behind the 2026 Social Security rule changes in plain, everyday English.

Table of Contents

Social Security Rule Changes

The Social Security rule changes coming in 2026 mark another step in adapting to economic shifts while keeping the system strong for future generations. A 2.8% COLA increase will give retirees a little extra breathing room, even as healthcare and living costs continue to rise. For working Americans, higher earnings limits and tax thresholds are part of the ongoing effort to balance fairness and sustainability. While the extra cash might not feel like a windfall, staying informed, budgeting wisely, and making small financial adjustments now can make a meaningful difference over time.

| Change / Topic | Details (2026) | Impact on You |

|---|---|---|

| Cost-of-Living Adjustment (COLA) | +2.8% increase | Average retiree gets ~$56 more per month |

| Taxable Wage Base | Rises to $184,500 | More income subject to payroll taxes |

| Earnings Limit (Under FRA) | Up to $24,480/year | Work more without losing benefits |

| Earnings Limit (Reaching FRA) | $65,160/year | More flexibility near retirement |

| Max Monthly Benefit (at FRA) | $4,152/month | Higher potential payout |

| Medicare Part B Premiums | Expected increase | May offset part of COLA gains |

A Brief Look Back: The Role of Social Security in American Life

Social Security isn’t just another government program — it’s one of America’s most trusted financial lifelines. Created in 1935 under President Franklin D. Roosevelt, it was designed to provide income security for retirees and families who lost a wage earner. Over the years, it has expanded to include disability and survivor benefits, covering more than 96% of U.S. workers today.

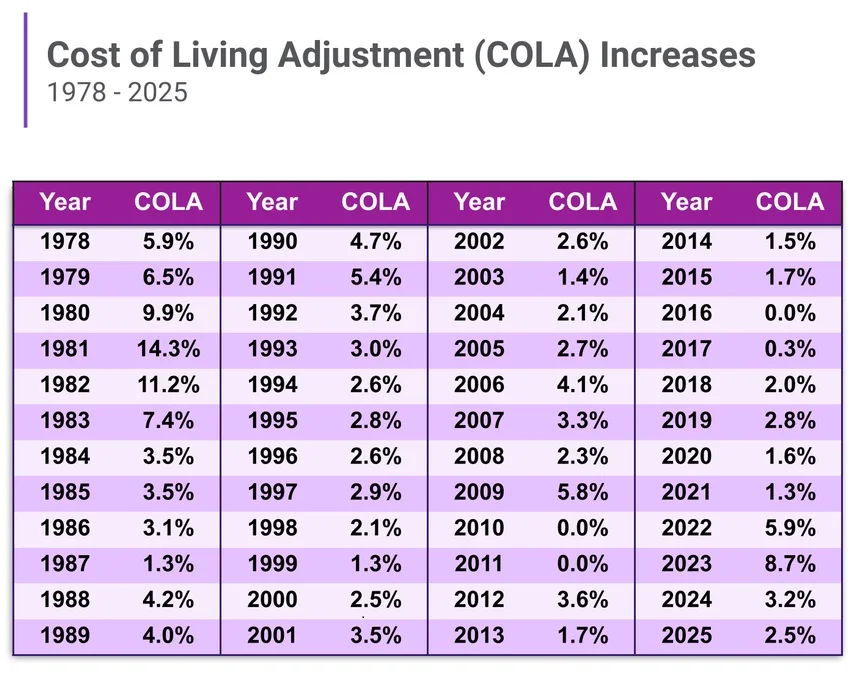

Every year, the SSA adjusts benefits to account for inflation — known as the Cost-of-Living Adjustment, or COLA. This helps maintain the purchasing power of beneficiaries, although many experts argue it often doesn’t fully keep pace with the real cost of living, especially for older Americans facing higher healthcare expenses.

Breaking Down the 2026 Social Security Rule Changes

1. The 2.8% COLA: A Modest Bump Amid Stabilizing Inflation

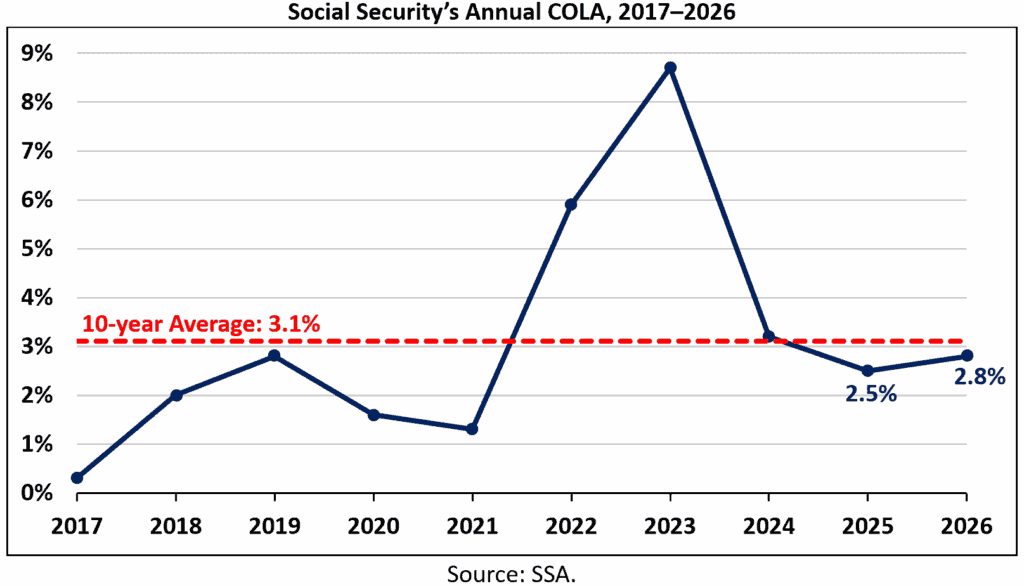

In 2026, Social Security beneficiaries will receive a 2.8% increase in monthly payments. This is smaller than the record-breaking 8.7% adjustment in 2023, but higher than the 1.3% average seen before the pandemic years.

The adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures inflation from the third quarter of one year to the next.

For most retirees, this means an extra $56 per month, or about $672 more per year.

For example:

- A retiree currently receiving $1,800/month will see their check rise to roughly $1,850/month.

- A retiree earning $2,500/month will receive about $2,570/month.

While that may not sound like a lot, it helps offset the continued rise in costs for essentials like groceries, gas, and utilities. And for those on tight budgets, every bit counts.

2. Higher Payroll Taxes for High Earners

The maximum taxable earnings limit, or “wage base,” will increase from $168,600 in 2025 to $184,500 in 2026. This means more of your income will be subject to the 6.2% Social Security payroll tax.

Here’s what that looks like in numbers:

- A worker earning $184,500 or more will pay $11,439 in Social Security taxes in 2026.

- Employers will match that amount, bringing the total contribution to $22,878.

- Self-employed individuals, who pay both portions, will contribute the full 12.4%, or about $22,878.

This change primarily affects upper-income earners but helps support the long-term solvency of the Social Security Trust Fund, which faces funding challenges as baby boomers retire in record numbers.

3. Working While Receiving Benefits: More Freedom to Earn

If you’re collecting Social Security before reaching Full Retirement Age (FRA) and still working, there’s a limit to how much you can earn before your benefits are temporarily reduced. The SSA is raising those thresholds in 2026:

- Under FRA: You can earn up to $24,480/year before any reduction kicks in (up from $22,320 in 2025).

- Year you reach FRA: You can earn up to $65,160/year (up from $59,520 in 2025).

For every $2 you earn above the first limit, $1 in benefits is withheld. For those in their FRA year, the reduction is $1 for every $3 earned over the higher threshold. Once you reach full retirement age, the SSA recalculates your benefit and credits back the withheld amount.

This change benefits older workers who still enjoy working part-time or running a small business while drawing benefits — giving them more breathing room before triggering benefit reductions.

4. Maximum Benefits Are Going Up

If you’ve consistently earned near or above the wage cap during your working years, you could qualify for the maximum Social Security benefit — which rises to $4,152/month in 2026, up from $3,927 in 2025.

That’s an annual income of nearly $49,800, providing a meaningful foundation for retirees with solid work histories.

5. Rising Medicare Costs Could Offset Gains

Medicare Part B premiums are expected to increase again in 2026, according to projections from the Centers for Medicare & Medicaid Services (CMS). While official numbers haven’t been released yet, experts anticipate a rise of about $5 to $10 per month due to higher healthcare costs and medical inflation.

That means while your Social Security check grows, your net gain after Medicare deductions may be smaller — possibly closer to $40–$45 more per month instead of the full $56 increase.

For retirees living primarily on Social Security, it’s crucial to plan for these rising healthcare costs when updating their budgets.

How Social Security Rule Changes Affect Different Groups?

- Retirees on Fixed Incomes: You’ll see a modest bump in monthly benefits, helping offset basic inflation.

- Working Seniors: You’ll have more flexibility to earn income without penalty — a win for those supplementing their benefits.

- High Earners: Expect to pay slightly more in Social Security taxes, but you’ll also increase your potential future benefits.

- Younger Workers: Higher taxable wages help stabilize Social Security funding, strengthening the system for future retirees.

The Bigger Picture: Why the Changes Matter

Every year, Social Security adjustments reflect both economic trends and demographic realities. As inflation cools and wage growth stabilizes, smaller COLA adjustments like 2.8% indicate that the economy is normalizing after the post-pandemic turbulence.

But challenges remain. The Social Security Board of Trustees has warned that by 2035, the program’s trust fund reserves could be depleted if no reforms are enacted. Without action, future benefits might need to be reduced by roughly 20–25%.

That’s why gradual increases in taxable income caps and payroll contributions are so important — they keep the system solvent while easing the burden on today’s retirees.

Budget Example: What 2026 Might Look Like

Let’s say you’re a 67-year-old retiree in 2025 receiving $2,000 per month.

| Category | 2025 Amount | 2026 (After COLA) | Change |

|---|---|---|---|

| Social Security Income | $2,000 | $2,056 | +$56 |

| Medicare Part B Premium | -$174 | -$180 (est.) | -$6 |

| Groceries & Utilities | $600 | $620 | -$20 |

| Miscellaneous (gas, insurance, etc.) | $300 | $315 | -$15 |

| Net Change | — | +$15/month | Slight net gain |

Even with the COLA, the rise in basic expenses can cancel out much of the benefit — reinforcing why retirees need to plan proactively and explore other income sources.

Practical Steps to Prepare for 2026 Social Security Rule Changes

- Review Your Social Security Statement — Visit SSA.gov/myaccount to verify your benefit estimate and earnings record. Errors can affect future payments.

- Reassess Your Budget — Include the COLA increase but also account for rising Medicare and living expenses.

- Plan Around Earnings Limits — If you’re under full retirement age, track your income to avoid unnecessary benefit withholding.

- Consult a Financial Advisor — Tax strategies can help you balance income sources and reduce taxable Social Security benefits.

- Explore Supplemental Income — Part-time work, consulting, or investment income can help offset inflationary pressures.

- Stay Informed About Medicare — Each fall, review plan options to ensure you’re getting the best coverage for your needs.

Expert Commentary

Certified Financial Planner Robert Doyle notes, “COLA increases help, but they’re not meant to cover everything. Retirees need to think in terms of total income strategy — Social Security, pensions, savings, and part-time income all play a role.”

He adds, “The key is to stay flexible. Inflation, healthcare costs, and taxes will keep changing. Your retirement plan should too.”

New York Social Security Schedule: Exact December 2025 Payment Dates

Why December’s Social Security Payments Will Follow a Modified Schedule This Year

New Bill Could Force Social Security to Issue New Numbers—Are You Affected?