Social Security Payments January 14: If you’re wondering whether you’ll get a Social Security check on January 14, 2026, you’re not alone. With inflation, rising rent, and grocery prices taking a bite out of our wallets, Social Security payments have become a lifeline for millions of Americans. Whether you’re retired, disabled, or receiving survivor benefits, knowing when and how you’ll get paid isn’t just useful — it’s essential. In this in-depth guide, we’ll break down who gets paid on January 14, how eligibility is determined, what affects the check amount, and how to take action if your payment doesn’t arrive. This isn’t just for retirees — it’s for caregivers, adult children of aging parents, professionals, and anyone helping others navigate the system.

Table of Contents

Social Security Payments January 14

Social Security payments on January 14, 2026, are scheduled for recipients with birthdays from the 1st to the 10th. Whether you’re retired, disabled, or receiving survivor benefits, this payment will include a 2.8% COLA increase to help you keep up with the rising cost of living. Stay informed and plan ahead to make the most of your benefits. With the right knowledge and tools, navigating Social Security can be simple, stress-free, and empowering.

| Topic | Details |

|---|---|

| Payment Date | January 14, 2026 |

| Who Gets Paid | Birthdays between 1st and 10th |

| Eligibility | Retirees, SSDI, Survivors, Dependents |

| COLA Increase | 2.8% in 2026 |

| SSI Payment Date | January 2, 2026 |

| Average Benefit (Retirees) | $1,907/month |

| Taxability | Up to 85% based on income |

| Payment Methods | Direct Deposit, Direct Express, Check |

| Official Source | www.ssa.gov |

What Are Social Security Payments?

Social Security is a federal insurance program designed to provide a safety net when you retire, become disabled, or lose a family member who supported you. It’s paid for through payroll taxes, which nearly all workers in the U.S. contribute to under FICA (Federal Insurance Contributions Act).

According to the Social Security Administration (SSA), more than 71 million Americans will receive monthly benefits in 2026 — that includes retirees, disabled workers, survivors of deceased workers, and people on SSI (Supplemental Security Income).

Social Security isn’t a handout — it’s a benefit you earn through a lifetime of work. And for many older Americans, it represents over 90% of their monthly income.

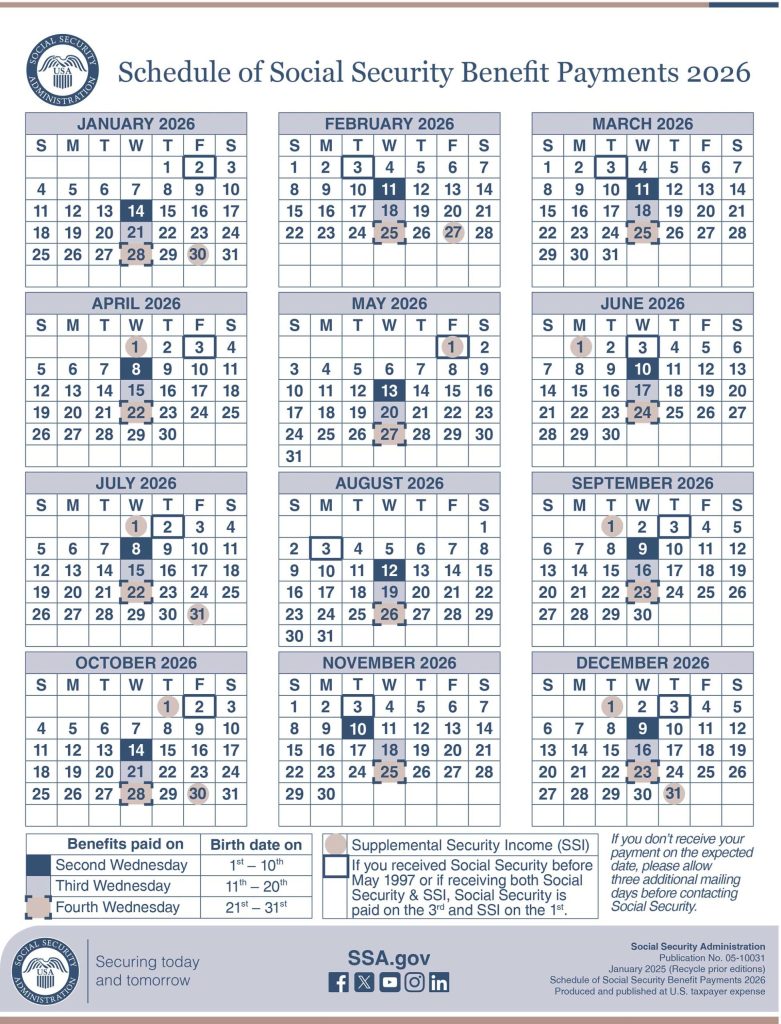

Social Security Payments Schedule: When Do You Get Paid?

Social Security doesn’t pay everyone on the same day. Your payment date depends on your birthday and when you started receiving benefits.

January 2026 Social Security Payment Schedule

| Birthday Range | Payment Date |

|---|---|

| 1st – 10th | January 14, 2026 |

| 11th – 20th | January 21, 2026 |

| 21st – 31st | January 28, 2026 |

| SSI Recipients or Early Beneficiaries | January 2, 2026 |

So, if your birthday falls between the 1st and 10th of any month and you began receiving benefits after May 1997, your check is scheduled for January 14.

If you started receiving benefits before May 1997, you likely got paid on January 2, 2026, regardless of your birth date.

Who Qualifies for Social Security Payments January 14?

To receive a Social Security check on this date, you must meet two main criteria:

- You receive Social Security benefits — retirement, SSDI (disability), or survivors benefits.

- Your birthday is between the 1st and 10th of the month, and you started receiving benefits after May 1997.

Let’s break this down by benefit type.

Retirement Benefits

You qualify if:

- You’re 62 years or older

- You’ve earned at least 40 work credits (around 10 years of work)

- You applied for and are receiving monthly benefits

Social Security Disability Insurance (SSDI)

You qualify if:

- You’ve worked and paid Social Security taxes long enough

- You have a medically documented disability

- You meet SSA’s five-step disability criteria

Survivor Benefits

You may qualify if you are:

- A spouse, child, or dependent parent of a deceased worker

- The deceased had earned enough work credits

- You meet age or disability criteria

Spousal or Dependent Benefits

If you’re a spouse or dependent of a retiree or disabled worker, you may also receive a check — typically up to 50% of their benefit.

What About SSI Payments?

Supplemental Security Income (SSI) is a separate program that supports:

- People with limited income/resources

- Seniors aged 65+

- Individuals who are blind or disabled, regardless of work history

SSI is paid on the 1st of each month, unless that day falls on a weekend or federal holiday. In 2026, January 1 is a holiday, so SSI was paid on January 2.

2026 COLA: What’s Changing?

Every year, Social Security checks get a bump based on the Cost-of-Living Adjustment (COLA). This adjustment helps benefits keep pace with inflation.

2026 COLA Facts:

- Increase: 2.8%

- Based on inflation data from the Consumer Price Index (CPI-W)

- Applies to retirement, SSDI, and SSI

So if you received $1,900/month in 2025, your new monthly check would be around $1,953.

SSA automatically applies the COLA to your benefit — you don’t need to do anything.

How Will You Get Paid?

SSA uses electronic payments by default, thanks to the Treasury Department’s “Go Direct” initiative.

3 Ways to Receive Your Check:

- Direct Deposit – Safest and fastest; goes right into your bank account.

- Direct Express Debit Card – A prepaid debit card for those without bank accounts.

- Paper Check – Still available, but it’s slower and prone to mail delays.

If you want to switch methods, visit your SSA account or call 1-800-772-1213.

What Affects the Amount You Receive?

Medicare Premiums

If you’re enrolled in Medicare Part B, the premium may be deducted from your Social Security check. In 2026, the standard Part B premium is around $178.60/month, but it may vary.

Taxes

Your benefits may be partially taxable:

- Up to 50% if you earn more than $25,000 (single) or $32,000 (married).

- Up to 85% if you earn more than $34,000 (single) or $44,000 (married).

You’ll get a SSA-1099 form each January to file your taxes properly.

Real-World Example

Meet Sarah, a retired librarian in Pennsylvania:

- Birthday: January 6

- Started collecting benefits: June 2019

- 2025 Benefit: $1,870/month

- 2026 Benefit (with COLA): $1,922/month

- Payment Date: January 14, 2026

- Receives payment via: Direct Express card

Sarah uses her online SSA account to view her annual cost-of-living notice and update her mailing address.

How to Check Your Social Security Payments Status?

To avoid surprises, create a my Social Security account. It’s fast, free, and secure.

With this account, you can:

- View your benefit statements

- Check payment dates

- Report changes (address, banking info)

- Get your SSA-1099 tax form

What to Do If You Don’t Get Your Payment?

If your payment is late or missing:

- Wait 3 mailing days after your scheduled payment date.

- Check your bank account or Direct Express card.

- Log in to SSA account for updates or alerts.

- Call SSA at 1-800-772-1213 or visit a local office.

You may also request a payment trace if needed.

Tips to Maximize Your Benefits

- Delay retirement to age 70 for higher monthly payments.

- Coordinate spousal benefits to maximize household income.

- Track your earnings to ensure all income is properly credited.

- Avoid earning penalties: If under full retirement age and earning over $22,320 (2026), your benefits may be reduced.

Average Social Security Check 2026 – New Estimates Show What Retirees May Receive

Texas Social Security Schedule – Check January 2026 Payment Dates and Eligibility Criteria