Social Security Payment Up to $4,018: The Social Security payment up to $4,018 is set to roll out on December 10, 2025, and millions of Americans are watching closely. If you’re one of the 67 million people who rely on Social Security benefits each month, this update matters. Whether you’re retired, disabled, or receiving survivor benefits, knowing when your check arrives and how much to expect can help you stay ahead of the curve. But before you assume that a $4,018 payment is heading your way, let’s break down what that figure actually means, who qualifies for it, and why it’s different for everyone.

Table of Contents

Social Security Payment Up to $4,018

The Social Security payment up to $4,018 scheduled for December 10, 2025 is another reminder of how vital this program remains for American families. For many, that check represents stability, security, and independence. Remember: $4,018 is the maximum, not the average. But whether your payment is $1,500 or $4,000, knowing when it arrives, budgeting around it, and staying informed can help you make the most of your benefits. Keep an eye on COLA updates, log into your SSA account regularly, and protect yourself from scams. Financial literacy is power — especially in retirement.

| Topic | Details / Data / Source |

|---|---|

| Maximum monthly benefit (FRA, 2025) | $4,018 |

| Average Social Security benefit (2025) | $1,976 |

| Total recipients | 67 million Americans |

| 2025 COLA (Cost-of-Living Adjustment) | 3.2% increase from 2024 |

| SSI double payments | December 1 and December 31 |

| Average SSDI benefit (2025) | $1,537 |

| Official schedule source | ssa.gov/pubs/EN-05-10031-2025.pdf |

Why Social Security Still Matters in 2025?

For nearly nine decades, Social Security has been the bedrock of retirement income in the United States. It’s not just a safety net—it’s the main source of income for many Americans over 65. In fact, according to the Social Security Administration (SSA), about 90% of older adults receive benefits, and for one-third of them, it represents at least 90% of their total income.

With the cost of living on the rise, especially in housing, healthcare, and groceries, those monthly checks are more crucial than ever. That’s why understanding your payment schedule, eligibility, and benefit amount is key—not just for comfort, but for survival in an inflation-heavy economy.

Why Social Security Payment Up to $4,018 Are Important?

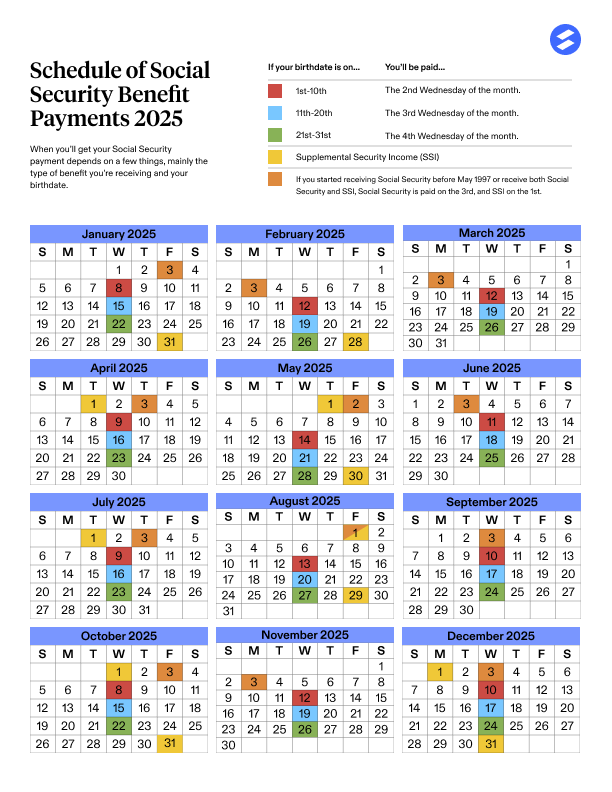

Social Security doesn’t pay everyone at once. Instead, the SSA follows a staggered schedule based on your birth date and the type of benefit you receive. This system keeps things organized and reduces the risk of processing delays.

Here’s the December 2025 payment schedule:

| Birth Date (Day of Month) | Payment Date (December 2025) |

|---|---|

| 1st–10th | Wednesday, December 10 |

| 11th–20th | Wednesday, December 17 |

| 21st–31st | Wednesday, December 24 |

| Pre-1997 or Dual SSI + SSA | Wednesday, December 3 |

If your birthday falls between the 1st and 10th, your payment lands on December 10, the second Wednesday of the month. That’s what this cycle is all about.

What “Social Security Payment Up to $4,018” Really Means?

That $4,018 number isn’t random—it’s the maximum monthly benefit allowed for a person who retired at full retirement age (FRA) in 2025. But that’s not what most people receive.

The SSA calculates each person’s benefit based on their work history, average lifetime earnings, and the age they begin collecting benefits. To qualify for that top-tier $4,018 payment, you’d need to:

- Have worked and paid Social Security taxes for at least 35 years.

- Earned the maximum taxable amount every year (in 2025, the maximum taxable earnings are $174,000).

- Begun collecting benefits at full retirement age (67 for most people).

If you retire early—say at 62—your benefit could be cut by up to 30%. On the other hand, if you delay until 70, you could earn up to 8% more per year in delayed retirement credits.

For example:

- Someone retiring at 67 with top earnings might get $4,018/month.

- Someone retiring at 62 might get around $2,800/month.

- Someone retiring at 70 could exceed $4,500/month thanks to delayed credits.

How Social Security Calculates Your Benefits?

It’s not magic; it’s math. The SSA uses three main factors:

- Work Credits: You earn up to 4 credits each year by working and paying into Social Security. You need 40 credits (10 years) to qualify for retirement benefits.

- AIME (Average Indexed Monthly Earnings): This averages your 35 highest-earning years, adjusting older wages for inflation.

- PIA (Primary Insurance Amount): The formula that converts your AIME into your monthly benefit.

The system is designed to be progressive—lower-income earners get a higher replacement rate than high-income earners. That means the program aims to ensure a basic standard of living for everyone, no matter their past income level.

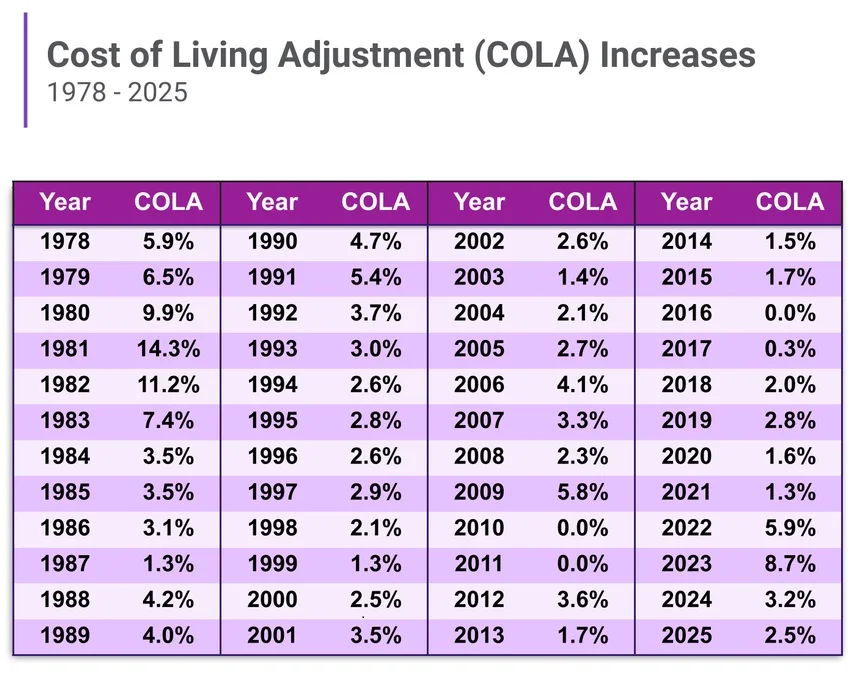

2025 COLA and Inflation

In 2025, Social Security recipients received a 3.2% Cost-of-Living Adjustment (COLA), designed to keep up with inflation. That’s smaller than the historic 8.7% jump in 2023, but still helpful.

Here’s what it looks like in real numbers:

- A retiree getting $2,000 in 2024 now gets $2,064 in 2025.

- A maximum earner’s check went from $3,822 to $4,018.

COLA is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), and it’s recalculated each year. If inflation rises in 2025, we can expect another bump for 2026, possibly between 2.8% and 3.0%.

Who Qualifies for the Social Security Payment Up to $4,018?

To qualify for the December 10, 2025 payment, you must:

- Receive retirement, survivor, or disability (SSDI) benefits.

- Have a birth date between 1st and 10th of any month.

- Started receiving benefits after May 1997 (those before that are paid on the 3rd of each month).

If that’s you, your payment hits your account on December 10 — no need to do anything. If you’re getting Supplemental Security Income (SSI), that’s a different story (more below).

Why Some People Get Two Payments in December?

Here’s something that confuses a lot of people: some folks get two payments in December. It’s not a bonus — it’s just a scheduling quirk.

If you get SSI (Supplemental Security Income), your normal payment date is the 1st of each month. But when the 1st falls on a weekend or holiday, SSA pays early.

In December 2025, you’ll receive:

- December 1 for December’s benefit, and

- December 31 for January 2026’s benefit (since January 1 is a federal holiday).

So while it looks like two checks, it’s really just December’s and January’s arriving close together.

How to Prepare and Manage Your Payments?

Here’s some practical advice from a financial planner’s perspective:

- Set Up Direct Deposit: Electronic payments are faster and safer than paper checks.

- Monitor Your SSA Account: Use your “My Social Security” portal to view payment history, future estimates, and notices.

- Budget Around Your Pay Date: If you’re paid on the 10th, structure bills and expenses accordingly to avoid overdrafts.

- Understand Taxes: Depending on your total income, up to 85% of your Social Security benefits may be taxable.

- Plan for Inflation: Even with COLA, inflation may eat into your purchasing power. Diversify savings if you can.

- Avoid Scams: SSA never calls or texts you for money. Report suspicious activity at oig.ssa.gov.

Common Examples

- Example 1: Mary, born January 4, retired at full retirement age after 35 years of work. She receives $3,980 monthly. Her December payment hits on December 10.

- Example 2: Joe, a disabled veteran born March 12, gets SSDI and will receive his December payment on December 17.

- Example 3: Linda, an SSI recipient, will get two payments in December — December 1 and December 31.

These examples show how the SSA schedule affects different groups, even if their benefit amounts vary widely.

Taxes and Withholding

Many retirees forget that Social Security benefits can be taxable. If your combined income (your adjusted gross income + non-taxable interest + half of your benefits) exceeds $25,000 for singles or $32,000 for couples, you may owe taxes on up to 85% of your benefits.

To avoid surprises at tax time, you can request that the IRS withhold taxes from your monthly check using Form W-4V.

The Future of Social Security

There’s been a lot of talk about the long-term stability of the program. According to the 2025 Trustees Report, the Social Security Trust Fund could face a funding gap around 2035, when reserves may run dry if no policy changes are made.

However, that doesn’t mean benefits will vanish. Even without new legislation, incoming payroll taxes would still cover about 80% of promised benefits. Policymakers are exploring fixes like raising the payroll tax cap or gradually increasing the full retirement age.

Historic Social Security Boost Coming to These 5 States in 2026; Are You on the List?

New York Social Security Schedule: Exact December 2025 Payment Dates

New Bill Could Force Social Security to Issue New Numbers—Are You Affected?