Social Security Payment: Social Security Payment January 14, 2026 is a date that millions of Americans are watching closely. For those who rely on Social Security benefits—whether through retirement, disability, or survivor programs—this marks the first payment of the new year that includes the updated Cost-of-Living Adjustment (COLA) for 2026. But who exactly gets paid on that date? And what impact does the 2.8% COLA increase have on your benefit? In this detailed guide, we’re going to walk you through everything you need to know—from the new payment schedule, to how much more you’ll receive, how Medicare deductions may affect your net payout, and the bigger financial picture for beneficiaries in 2026 and beyond.

Table of Contents

Social Security Payment

The Social Security Payment on January 14, 2026, is more than just a deposit—it’s a reflection of how inflation, policy, and personal planning collide. With the 2.8% COLA, beneficiaries see a helpful increase in their monthly benefits. But rising Medicare premiums, taxes, and cost-of-living pressures continue to affect how much truly reaches your wallet. Understanding what’s changing, why it matters, and how to act on it is key. Whether you’re currently receiving Social Security, about to retire, or helping a family member navigate benefits, this knowledge can help you protect your income and make smarter decisions moving forward.

| Topic | Details |

|---|---|

| Payment Date | January 14, 2026 (for those born 1st–10th of the month) |

| COLA for 2026 | 2.8% increase to all Social Security and SSI benefits |

| Average Retiree Benefit | ~Increased from $2,015 to $2,071/month |

| SSI Monthly Limit | $994 for individuals, $1,491 for couples |

| Medicare Part B Premium (2026) | $202.90 per month |

| Online Portal | Sign up for benefit info at ssa.gov/myaccount |

Understanding Social Security: A Quick Primer

Social Security is the foundation of retirement and disability income for over 70 million Americans. Established in 1935, the program is funded by payroll taxes and provides monthly payments to:

- Retired workers and their spouses

- Individuals with disabilities

- Survivors of deceased workers

- Low-income individuals through Supplemental Security Income (SSI)

To qualify, workers generally need to have earned at least 40 credits (about 10 years of work). The size of your benefit depends on your lifetime earnings, the age you begin collecting, and any COLA adjustments that apply.

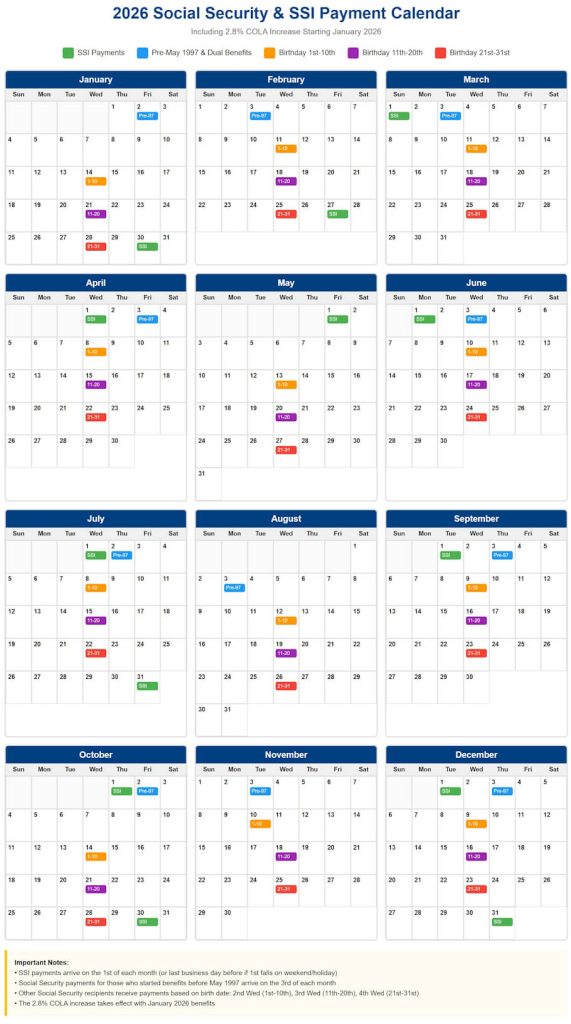

Who Gets Social Security Payment on January 14, 2026?

The Social Security Administration (SSA) doesn’t pay everyone on the same day. Payments are distributed based on your birthdate, as follows:

- Born 1st–10th of any month: Paid on January 14, 2026

- Born 11th–20th: Paid on January 21, 2026

- Born 21st–31st: Paid on January 28, 2026

If you began receiving benefits before May 1997, or if you’re getting both SSI and Social Security, your payment might arrive earlier—often on the 3rd of the month.

These staggered payments help reduce system strain and ensure timely delivery for everyone.

What Is COLA and Why Is It Important?

COLA, or Cost-of-Living Adjustment, is a yearly increase in benefits that helps Social Security keep pace with inflation. The adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) as measured by the U.S. Bureau of Labor Statistics.

For 2026, the COLA is 2.8%, a response to rising consumer prices across key categories like housing, food, healthcare, and transportation.

Why this matters: Without COLA, fixed Social Security payments would gradually lose purchasing power as prices go up. COLA helps preserve the real-world value of your benefits.

How Much More Will You Receive in 2026?

Let’s break it down using real examples.

Retired Worker

- 2025 monthly benefit: $2,015

- 2026 with 2.8% COLA: $2,071

- Annual increase: $672

SSI Recipient (Individual)

- 2025 maximum: $967/month

- 2026 maximum: $994/month

SSI Couple

- 2025 maximum: $1,450/month

- 2026 maximum: $1,491/month

Survivor Benefits

Survivors (such as widows, widowers, or minor children) also receive the full 2.8% COLA increase. If a surviving spouse receives $1,400/month, their payment will rise to approximately $1,439/month in 2026.

These increases apply automatically—you don’t need to take any action.

Medicare Premiums: The Hidden Deduction

If you’re enrolled in Medicare Part B, your monthly premium is automatically deducted from your Social Security payment. In 2026, the standard Part B premium rises to $202.90/month, up from $185 in 2025.

This means your COLA increase might feel smaller once the Medicare premium is subtracted.

Example:

- COLA adds $56 to your check

- Medicare Part B takes an extra $17.90

- Net increase: Only $38.10

If your income is above a certain level, you may pay higher premiums through the Income-Related Monthly Adjustment Amount (IRMAA).

Understanding the Tax Angle

Social Security benefits may be partially taxable depending on your income. Here’s how it breaks down:

- Single filers with income $25,000–$34,000: Up to 50% of benefits taxable

- Single filers over $34,000: Up to 85% taxable

- Joint filers with income $32,000–$44,000: Up to 50% taxable

- Joint filers over $44,000: Up to 85% taxable

The IRS uses combined income (AGI + nontaxable interest + ½ of Social Security benefits) to determine your tax level.

How to Budget Smarter in 2026?

With inflation still high, it’s smart to plan your budget around your actual net increase, not just the COLA headline.

Tips:

- Track Medicare deductions – Know how much you’re actually keeping each month.

- Use SSA’s myAccount tool – Monitor benefit statements at ssa.gov/myaccount

- Set aside part of your increase – For future expenses or emergencies.

- Review eligibility for extra help – Low-income seniors may qualify for Medicare Savings Programs or Supplemental Nutrition Assistance Program (SNAP).

The Bigger Picture: Long-Term Planning Tips

Here’s what professionals recommend for making the most of your Social Security in 2026 and beyond:

Don’t Claim Too Early

Each year you delay taking benefits past full retirement age (up to 70), your benefit increases. If you’re still working or have other income sources, it may pay to wait.

Maximize Spousal or Survivor Benefits

Spouses and widows/widowers can often switch to a higher benefit based on their partner’s earnings history. Know your options before claiming.

Coordinate with Other Income

Pensions, IRAs, or part-time work can impact both taxation and Medicare premiums. Coordinating withdrawals and earnings can save you money.

Use a Financial Advisor or Planner

A professional can help you create a tax-efficient retirement income strategy that takes into account inflation, COLA, taxes, Medicare, and other moving parts.

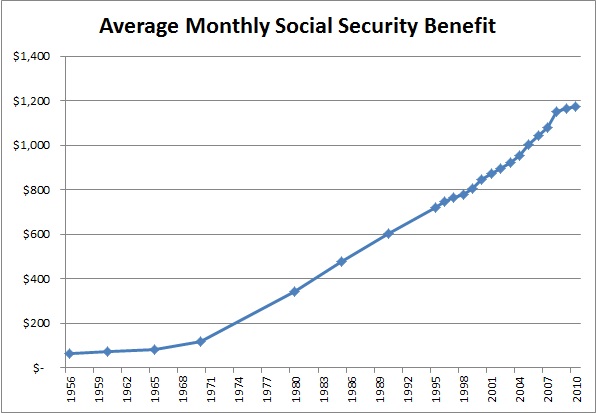

Historical Context: How Does 2.8% Compare?

Here’s a quick look at how the 2026 COLA stacks up:

- 2023: 8.7% (highest since 1981)

- 2024: 3.2%

- 2025: 2.5%

- 2026: 2.8%

While not a record-setting jump, the 2026 increase continues a pattern of modest but meaningful COLAs. Over the past 50 years, the average annual increase has been about 2.6%, so this year is slightly above the norm

Social Security Rules 2026 Explained – COLA Changes, Payment Updates, and New Maximums

Social Security Benefits January 2026: How Much Will Your Payments Increase?

Social Security Check at $1,850 – How Much Your Monthly Payment Could Increase in 2026