Social Security Payment Coming: now that’s a date millions of Americans have circled in red on their calendars. For folks receiving retirement, disability (SSDI), or survivor benefits, it’s not just a payday — it’s peace of mind. But if you’re wondering, “Why December 17? Who gets paid when? And how much?” — you’re not alone. In this complete guide, we’ll break down everything you need to know, in a clear, friendly voice, while also giving professional-grade insights, verified data, practical advice, and trustworthy links. Let’s roll up our sleeves and walk through what this Social Security payday really means for your wallet — and your future.

Table of Contents

Social Security Payment Coming

The Social Security payment coming December 17, 2025 is just one piece of a system that affects nearly every American at some point. Whether you’re relying on these payments to pay your heating bill, save for next year, or simply stay afloat, understanding the details — when you’re paid, how much, and why — puts you in control. This article gives you the facts, the figures, and the financial tips to use your benefit wisely. Make sure you’re checking your own records, staying updated, and planning for the future — even if it’s just one payment at a time.

| Topic | Details |

|---|---|

| Date | Wednesday, December 17, 2025 |

| Who Gets Paid | Beneficiaries with birthdays from the 11th to the 20th of any month — retirees, SSDI, survivors |

| Payment Type | Social Security Retirement, Disability (SSDI), and Survivors benefits |

| Average Monthly Check (2025) | $2,009.50 for retired workers |

| SSI Schedule (Separate) | Dec 1 (regular), Dec 31 (early January 2026 payment) |

| COLA Increase for 2026 | 2.8% Cost-of-Living Adjustment begins January |

| Maximum Retirement Benefit (2025) | Up to $4,873 if claimed at age 70 |

| Official Calendar | SSA Payment Schedule |

What’s So Special About December 17?

Let’s make it simple: the Social Security Administration (SSA) doesn’t send all benefits on the same day. It spreads them out across the month based on birthdays. That’s to prevent system overload and ensure smooth banking operations.

Here’s the SSA payment breakdown:

- Birthdays 1–10 → Paid on the second Wednesday (December 10, 2025)

- Birthdays 11–20 → Paid on the third Wednesday → December 17, 2025

- Birthdays 21–31 → Paid on the fourth Wednesday (December 24, 2025)

- SSI Beneficiaries → Paid on the 1st of the month and, for January 2026, early on December 31

And for folks who started receiving benefits before May 1997, their check lands on December 3 — the exception group that gets a fixed early payment.

So, if your birthday falls between the 11th and the 20th, you’re up on December 17. No need to guess — that’s your payday.

Who Exactly Gets Social Security Payment on December 17?

This isn’t just about retirement. Several beneficiary types receive their checks on this date:

1. Retired Workers

If you’ve worked, paid into Social Security, and claimed benefits based on age (as early as 62, full benefits around 66–67, or max at 70), your birthday determines your pay date.

2. Social Security Disability Insurance (SSDI)

SSDI benefits go to folks who became disabled and can no longer work, but have enough work history. They also follow the birthdate-based payment calendar.

3. Survivor Benefits

Widows, widowers, and other survivors drawing benefits after the death of a worker follow the same schedule.

Note: This does not include Supplemental Security Income (SSI) — that’s a needs-based federal program with a totally different payment structure.

How Much Will You Get?

Let’s talk numbers:

- Average retirement benefit (2025): $2,009.50/month

- SSDI average: $1,537/month

- SSI individual maximum: $943/month

- SSI couples max (2025): $1,415/month

- Maximum retirement benefit at age 70: $4,873/month

These numbers depend on:

- Work history

- Earnings

- Claiming age

- Marital or dependent status

What About the 2026 COLA Increase?

Good question.

The Cost-of-Living Adjustment (COLA) is how SSA keeps your benefits rising with inflation. Starting January 2026, benefits increase by 2.8%, thanks to the latest Consumer Price Index (CPI-W) numbers.

What does that mean in plain English?

- A person receiving $2,000/month in 2025 will get about $2,056/month in 2026

- An average $56/month increase — or $672 per year

This is especially important for seniors on fixed incomes, as inflation pushes up food, rent, and medication costs.

Tax Implications — Will Your Check Be Taxed?

Let’s get real here: Social Security isn’t always tax-free.

Your benefits may be taxable at the federal level based on combined income:

- Single filers:

- Income $25,000–34,000 → up to 50% of benefits taxed

- Over $34,000 → up to 85% taxed

- Married filing jointly:

- $32,000–44,000 → up to 50% taxed

- Over $44,000 → up to 85% taxed

This doesn’t mean you lose 85% of your benefit — it just means that much is added to your taxable income.

Also, 12 states still tax Social Security income — though many have eliminated or reduced these taxes in recent years. Always check with a tax pro in your state.

Budgeting Tips Around the December 17 Social Security Payment

Here’s where the rubber meets the road:

1. Don’t treat Dec 17 as a bonus. It’s your regular income — even if it feels like a holiday gift.

2. Plan ahead for bills. Pay essentials first: rent, power, meds, food. Then plan any holiday spending.

3. Track expenses. With two SSI payments (Dec 1 and Dec 31), some might overspend in December — then feel short in January.

4. Build a small emergency fund. Even $10/month set aside can help avoid payday loans or late fees.

5. Automate what you can. Use your bank to schedule bill payments and transfers the day after your deposit hits.

Social Security and the Bigger Picture

Here’s some important context:

- 74 million Americans receive benefits from SSA (retirement, disability, SSI, and survivors)

- $1.4 trillion+ is paid annually

- Social Security replaces about 40% of pre-retirement income on average

- By 2033, trust funds are projected to be depleted if no reforms are passed

- Benefits would still continue but at about 77% of scheduled payments unless Congress acts

Many in Washington are debating solutions, like:

- Raising the payroll tax cap (currently $168,600 income limit)

- Increasing retirement age

- Changing benefit formulas

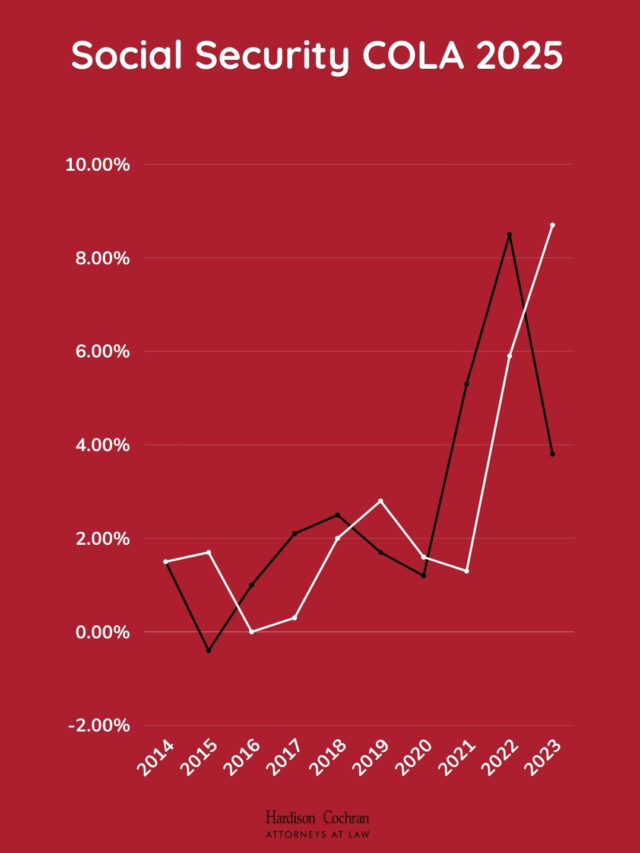

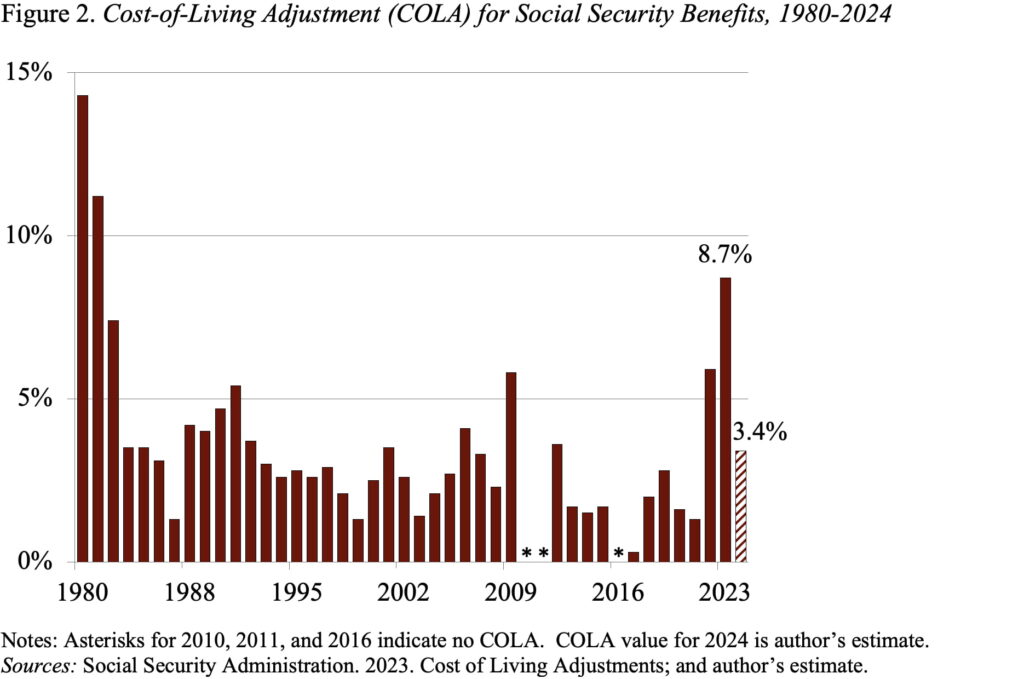

COLA History — How It’s Changed Over Time

Let’s put the 2.8% increase in perspective:

| Year | COLA % |

|---|---|

| 2025 | 3.2% |

| 2024 | 8.7% (highest in 40 years) |

| 2023 | 5.9% |

| 2022 | 1.3% |

| 2010–2020 Average | 1.5% |

So while 2026’s 2.8% might not feel huge, it’s more generous than pre-COVID years and helps with current price hikes.

What If Your Social Security Payment Is Missing?

If you expected your Social Security payment on December 17 and it hasn’t shown up by the next day, follow these steps:

- Check your bank — it may still be processing the direct deposit

- Log in to your My Social Security account and verify your deposit date

- Wait 3 mailing days if it was a paper check

- Call SSA at 1‑800‑772‑1213 (TTY 1‑800‑325‑0778) after 3 business days

Missing payments are rare but can happen due to address changes, bank changes, or system errors.

Goodbye to Retirement at 65: Social Security Raises the Bar—Starting in 2026

Why December’s Social Security Payments Will Follow a Modified Schedule This Year

Social Security Max Payout for December 2025 Is In; Are You Getting the Full Amount?