Social Security Not Enough: In 2026, Social Security just isn’t enough for most Americans to live comfortably. That monthly check, as dependable as it may be, doesn’t stretch like it used to. Food prices are up. Rents are high. Medical bills seem to multiply overnight. If you’re retired or close to it, and wondering how you’ll make ends meet, you’re far from alone. Millions of elders, including many in Native communities, are finding that what used to work no longer cuts it. But this isn’t the end of the road—it’s just a fork in the path. With the right strategies and planning, you can boost your retirement income, reduce stress, and create a lifestyle that honors your hard work and heritage. This article offers a step-by-step guide to practical, proven methods to stretch and strengthen your income in 2026 and beyond.

Table of Contents

Social Security Not Enough

You’ve worked hard. You’ve earned your retirement. But today’s economy doesn’t make it easy. That’s why it’s more important than ever to get creative, be strategic, and take control of your financial future. From working part-time and renting out space, to Roth conversions, annuities, and using government assistance—you have options. And each one brings you closer to a retirement with more dignity, freedom, and peace of mind. Start with one step. Then another. The canoe moves forward one paddle at a time.

| Topic | Details |

|---|---|

| COLA 2026 | 2.8% increase – below real inflation |

| Average Social Security (2026) | $1,907/month |

| Full Retirement Age (FRA) | Age 67 for those born in 1960 or later |

| Top Income Boosters | Work part-time, rent out rooms, delay benefits, Roth conversions |

| Healthcare Cost in Retirement | $315,000 average for a 65-year-old couple |

| Official Tools | SSA Estimator, BenefitsCheckUp |

Why Social Security Not Enough?

Social Security was never meant to be your full retirement income—it’s a supplement, not a solution. Yet millions of Americans rely on it as their primary or only source of income.

Let’s break it down:

- The average benefit is around $1,907 per month in 2026, according to AARP.

- That’s only about 40% of pre-retirement income for most retirees.

- Experts recommend replacing at least 70% to 80% of your pre-retirement income to maintain your standard of living.

Add inflation, medical expenses, and the rising cost of living, and it’s easy to see why more seniors are searching for new ways to bridge the retirement income gap.

Strategy 1: Earn Extra with Flexible Work

Whether it’s part-time, seasonal, or freelance, a little work can go a long way—both financially and emotionally.

Popular part-time jobs for retirees:

- Substitute teaching

- Virtual assistant or remote office support

- Tour guide for cultural or historical tours

- Pet sitting or dog walking

- Delivering for Instacart or DoorDash

- Selling handmade goods or crafts at local markets or online

Even earning an extra $500 to $1,000 per month can dramatically improve your cash flow.

Know the limits:

- If you’re under full retirement age (FRA) and earn more than $22,320, your benefits may be temporarily reduced.

- After reaching FRA, you can earn as much as you want without penalties.

Strategy 2: Make Your Home Work for You

Your home isn’t just a place to live—it can be a source of income.

Here’s how:

- Rent out a spare room to students, travelers, or seasonal workers.

- List your property on Airbnb or Vrbo during events or tourist seasons.

- Downsize and move to a smaller, more affordable home.

- Join or create an intergenerational housing setup with family—common in many Native communities.

Even small towns now see demand for short-term stays. Some retirees are pulling in $800 to $2,000/month this way.

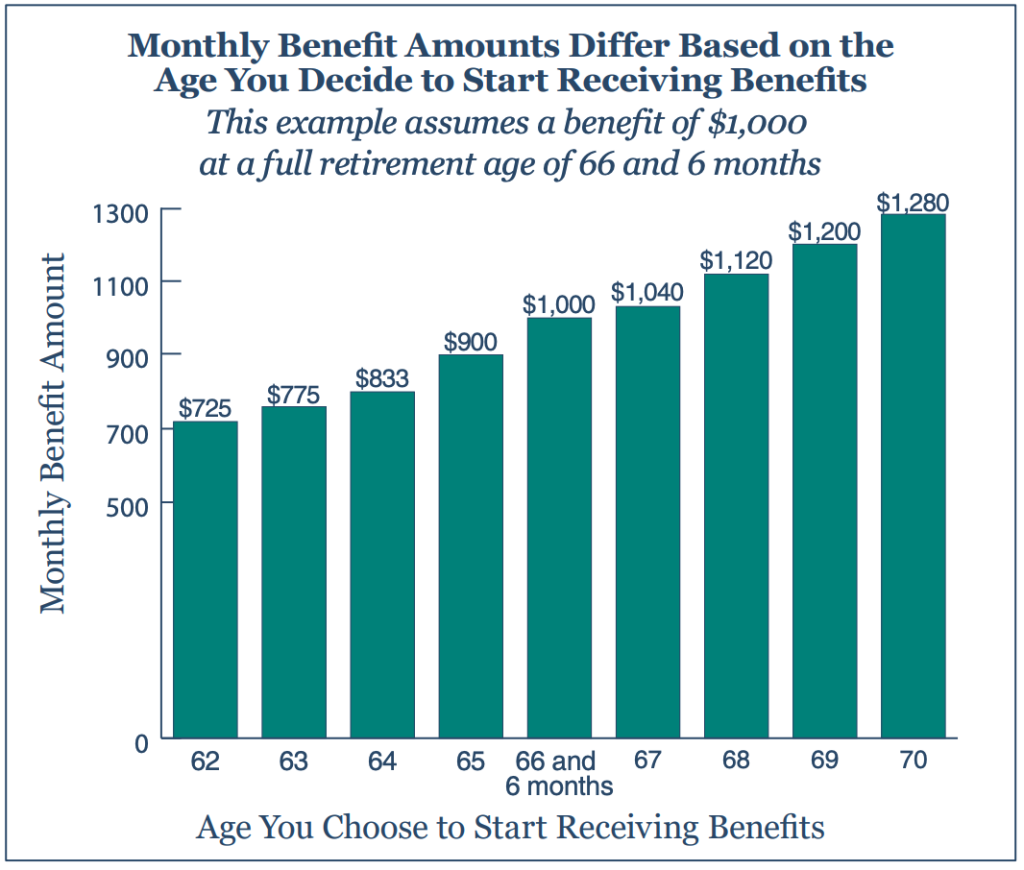

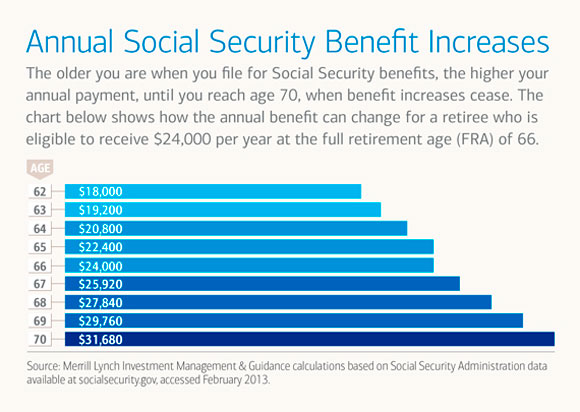

Strategy 3: Delay Claiming Social Security

One of the most powerful ways to increase your Social Security income is to wait.

Claiming at different ages:

- 62 (earliest age) – Reduced benefits, permanently.

- 67 (FRA) – Full benefits.

- 70 (latest delay) – Benefits increase by 8% per year delayed past FRA.

Real Example:

If your full benefit at 67 is $1,800/month:

- Claim at 62 = $1,260/month

- Claim at 70 = ~$2,230/month

That’s nearly $1,000/month more for life if you wait.

Strategy 4: Use IRAs and Roth Accounts Smartly

Tax planning makes a huge difference in how long your money lasts.

Key retirement account moves:

- Roth IRA: Withdrawals are tax-free. No required minimum distributions (RMDs).

- Traditional IRA: Tax-deferred, but RMDs start at 73.

- Roth conversions: Move funds from Traditional IRA to Roth in lower-income years.

- Qualified Charitable Distributions (QCDs): After age 70½, donate up to $100,000/year directly from IRA to charity—reduces taxable income.

Strategy 5: Consider Annuities for Peace of Mind

Annuities give you guaranteed monthly income, like a pension.

Types to consider:

- Immediate fixed annuity – Start payments now.

- Deferred income annuity – Start payments later, but get more.

- Indexed annuity – Grows with market index, limited risk.

They’re not for everyone—fees and contracts can vary. But for some, annuities reduce worry about outliving savings.

Strategy 6: Control Healthcare Costs Proactively

According to Fidelity, the average 65-year-old couple will need $315,000 in today’s dollars for healthcare costs in retirement. That includes premiums, deductibles, and out-of-pocket expenses—not long-term care.

Take these steps:

- Sign up for Medicare at age 65—even if you’re still working.

- Compare Medigap and Medicare Advantage plans carefully.

- Use HSAs (Health Savings Accounts) if you’re still eligible.

- Look into tribal clinics or IHS (Indian Health Service) where available.

Strategy 7: Tap into Government Benefits You’ve Earned

Many seniors are missing out on benefits they qualify for.

Key assistance programs:

- SNAP (food assistance)

- LIHEAP (energy bill help)

- Medicaid or Extra Help with Medicare

- State property tax credits

- Tribal Elder Benefit Programs

Don’t leave money on the table. Many of these programs are easy to apply for online or through local agencies.

Strategy 8: Trim the Fat Without Sacrificing Joy

Cutting costs doesn’t mean cutting happiness.

Simple ways to save:

- Switch to streaming instead of cable

- Cook at home more often

- Buy in bulk and split with neighbors or family

- Use senior and tribal discounts

- Relocate to tax-friendly states or communities

Some retirees save $500/month or more just by being intentional about spending.

Strategy 9: Use Technology to Stay in Control

Technology can make your retirement smarter and easier.

Tools worth trying:

- SSA MyAccount: Estimate benefits

- You Need a Budget (YNAB): Budgeting app

- Fidelity, Schwab apps: Investment tracking

- PensionHelp America: For finding lost pensions

- SmartAsset Calculators: Estimate taxes and withdrawals

Most of these tools are free, secure, and user-friendly—even if you’re not a tech whiz.

Real Case: How David Increased His Monthly Income by $1,850

David, 69, lives in rural Montana on tribal lands. His Social Security was only $1,700/month, and rising food costs were squeezing him hard.

Here’s what he did:

- Delayed Social Security until age 69 – now gets $2,050/month.

- Rents out his guest cabin seasonally – earns $900/month.

- Delivers groceries locally part-time – brings in $400/month.

- Switched to a Medicare Advantage plan – saved $200/month.

- Qualified for LIHEAP and food assistance – further relief.

Now David lives with more breathing room, takes part in tribal events, and feels in control again.

Social Security Planning 2026 – 8 Practical Moves That Can Help You Secure Higher Lifetime Benefits

Which States Tax Social Security Benefits? Check the Full Map and What You Might Pay in 2026!

Social Security February 3 Payments – Who Will Receive Benefits on This Date and Why