Social Security Max Payout: The Social Security Max Payout for December 2025 has finally been confirmed, and it’s the highest in history. Millions of Americans rely on Social Security as the foundation of their retirement income — and this year’s record-breaking payout has everyone talking. If you’ve spent decades working hard and paying into the system, you’re probably wondering: “Am I getting the full amount?” Let’s break it down in a way that’s clear, friendly, and practical — no jargon, no fluff, just straight talk about how this affects you and what you can do about it.

Table of Contents

Social Security Max Payout

The Social Security Max Payout for December 2025 — a record $5,108 per month for those claiming at 70 — marks a new milestone in American retirement history. But few reach that level. Most retirees will see smaller checks based on their work history and claim age. The good news? With the right strategy — working longer, delaying benefits, and monitoring your SSA record — you can still maximize your payout. Social Security isn’t just a check; it’s your reward for decades of contribution, discipline, and perseverance. Plan wisely, and you’ll make every dollar count.

| Category | Details (2025) |

|---|---|

| Maximum benefit at age 70 | $5,108 per month |

| Full retirement age (FRA) | 66–67 years |

| Max benefit at FRA | $4,018 per month |

| Early retirement (age 62) | $2,831 per month |

| Supplemental Security Income (SSI) | $967 (individual), $1,450 (couple) |

| COLA increase (2026 projection) | 2.8% |

What’s the Buzz About the 2025 Social Security Max Payout?

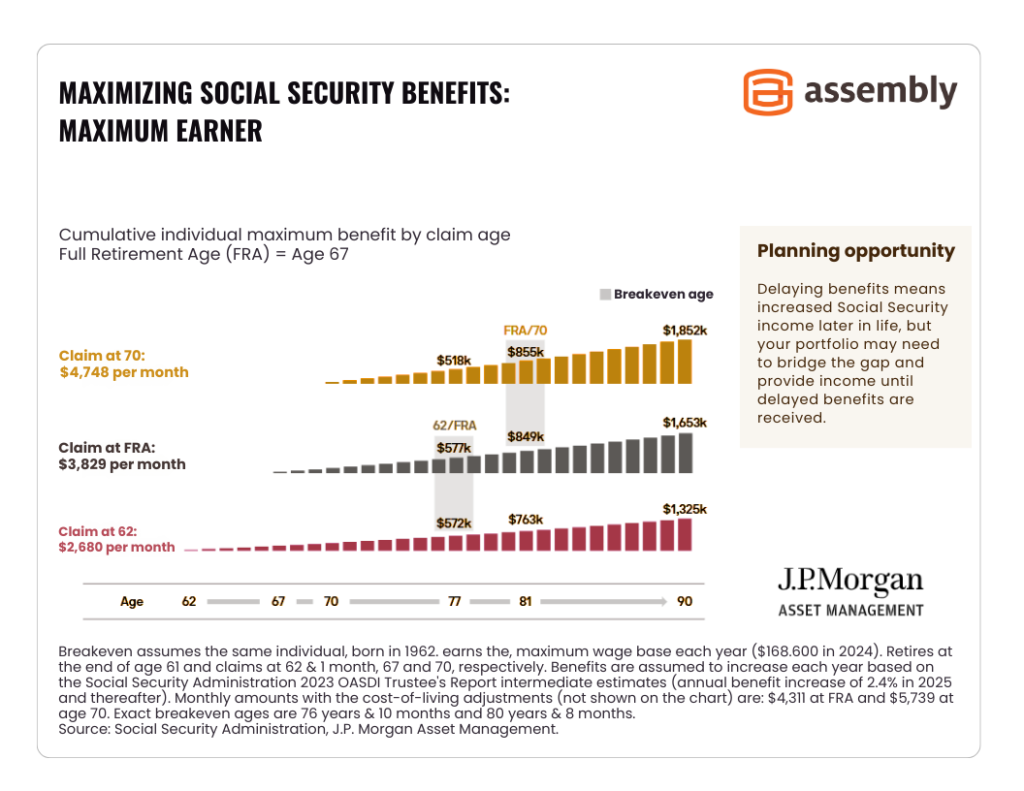

According to official data from the Social Security Administration (SSA), retirees who delay claiming benefits until age 70 can receive a maximum monthly payment of $5,108 in 2025. For those who retire at full retirement age (FRA) — between 66 and 67 years old, depending on their birth year — the maximum benefit is $4,018. If you start early at age 62, the cap drops to about $2,831 per month (SSA.gov).

These amounts aren’t random. They reflect the cumulative effect of decades of inflation, wage growth, and cost-of-living adjustments (COLA) that ensure retirees maintain purchasing power. But getting the full amount isn’t automatic — it takes decades of steady, high earnings and smart timing when you claim.

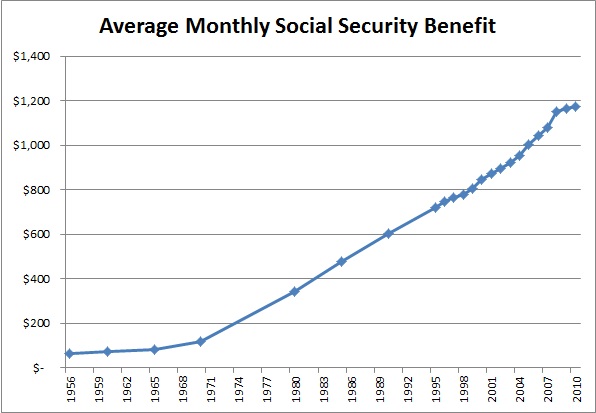

How Social Security Benefits Have Grown Over Time?

To appreciate today’s record-setting payouts, it helps to see where we’ve come from. In 2010, the maximum monthly benefit for someone retiring at age 70 was roughly $3,000. By 2015, it had climbed to $3,501, and in 2020, it reached about $3,790. By 2024, the maximum check topped $4,873 — and now in 2025, it’s just over $5,100.

This steady climb reflects not just inflation, but also America’s growing wage base. Each year, the Social Security taxable wage base — the maximum amount of income subject to Social Security taxes — rises. In 2025, it’s $168,600, up from $168,200 in 2024. That increase allows higher earners to pay more into the system — and eventually receive more back.

Understanding How the SSA Calculates Your Benefit

Social Security benefits are calculated using a formula that looks at your lifetime earnings, adjusts them for inflation, and applies specific percentages. Here’s how it works:

Step 1: Average Indexed Monthly Earnings (AIME)

The SSA averages your highest 35 years of earnings, adjusted for inflation. If you worked fewer than 35 years, zeroes get added, which drags down your average.

Step 2: Primary Insurance Amount (PIA)

Your PIA is the amount you receive if you retire at your full retirement age. It’s based on “bend points” — income brackets where different percentages apply (90%, 32%, and 15% of your AIME).

Step 3: Claiming Age Adjustments

- Age 62: Early claimers take up to a 30% reduction for life.

- Full Retirement Age: You get 100% of your PIA.

- Age 70: Each year you wait beyond FRA adds roughly 8% to your monthly benefit.

Example:

Mary from Texas worked 35 years, consistently earning near the maximum wage base. If she claims at 70, she receives the full $5,108 per month. If she had claimed at 62, her benefit would be about $2,831, meaning she’d leave nearly $2,300 per month on the table.

How to Qualify for the Full $5,108 Social Security Max Payout?

Only a small percentage of retirees actually hit the maximum Social Security payout. To get there, you need to:

- Work at least 35 years with steady earnings.

- Earn at or above the Social Security taxable maximum each year (currently $168,600).

- Wait until age 70 to claim benefits to earn delayed retirement credits.

This combination rewards long careers and patience. For many Americans, even achieving 70–80% of the maximum benefit is a big financial win.

How Cost-of-Living Adjustments (COLA) Impact Your Check?

Every October, the SSA announces a Cost-of-Living Adjustment (COLA) for the following year, based on inflation data from the Bureau of Labor Statistics’ Consumer Price Index (CPI-W). In 2025, the COLA increase was 3.2%, helping retirees keep up with rising prices for essentials like food, gas, and healthcare.

For 2026, analysts at Bankrate and The Senior Citizens League project a 2.8% COLA, meaning benefits will continue inching upward. That means your $4,000 check in December 2025 could become around $4,112 in January 2026 — not a game-changer, but every dollar helps in retirement.

Common Myths About Social Security

| Myth | Reality |

|---|---|

| “Social Security is going bankrupt.” | Not true. The trust fund could face shortfalls by 2035, but payroll taxes will still cover roughly 77% of scheduled benefits (SSA Trustees Report). |

| “Everyone gets the same amount.” | False — benefits depend on your lifetime earnings and claiming age. |

| “I should claim as soon as I’m eligible.” | Waiting can significantly boost lifetime benefits, especially if you live into your 80s or 90s. |

| “Spouses can’t get benefits unless they worked.” | Wrong — non-working spouses can receive up to 50% of their partner’s benefit. |

Practical Ways to Boost Your Benefit

Even if you’re far from the maximum payout, you can still increase your benefit through smart planning:

- Keep working if you can. Each additional year of earnings can replace a lower-income year in your 35-year record.

- Delay retirement. Every month past your FRA adds more money.

- Coordinate with your spouse. Use a claiming strategy that maximizes your combined lifetime income.

- Avoid claiming while working. If you claim before FRA and keep working, part of your benefit may be withheld due to the earnings test.

- Check your SSA statement. Visit My Social Security to verify your earnings and projected benefits — errors can cost you.

SSI vs. Social Security Retirement Benefits

Many people confuse SSI (Supplemental Security Income) with Social Security Retirement Benefits, but they serve very different purposes.

| Feature | Social Security Retirement | Supplemental Security Income (SSI) |

|---|---|---|

| Based on Work History | Yes | No |

| Funded By | Payroll taxes | General federal funds |

| 2025 Max Benefit | $5,108 | $967 individual / $1,450 couple |

| Who Qualifies | Workers with 10+ years of contributions | Low-income individuals or disabled persons |

In short, Social Security is an earned benefit, while SSI is a needs-based safety net.

The December 2025 Payment Schedule

Social Security payments are distributed based on your birthday. Here’s the breakdown:

- December 3, 2025: Beneficiaries who began receiving benefits before May 1997, plus SSI recipients.

- December 10: Birthdays between 1st and 10th.

- December 17: Birthdays between 11th and 20th.

- December 24: Birthdays between 21st and 31st.

Additionally, SSI recipients will receive two checks in December 2025 — one on December 1 and another on December 31 — because the January 2026 payment date falls on a holiday weekend.

Inflation, Taxes, and Your Net Social Security Benefit

Many retirees forget that Social Security benefits can be taxable. If your combined income (adjusted gross income + nontaxable interest + half of your Social Security benefits) exceeds $25,000 for singles or $32,000 for couples, you may owe federal income tax on up to 85% of your benefits.

In high-cost-of-living states, taxes and Medicare premiums can also eat into your check. That’s why experts recommend pairing Social Security with other retirement income sources like 401(k)s, IRAs, or annuities for financial security.

The Big Picture: Will Social Security Survive the Future?

There’s a lot of chatter about the future of Social Security, but here’s the truth: it’s not disappearing. According to the 2025 Trustees Report, the trust fund may face shortfalls around 2035 if Congress doesn’t act, but payroll taxes will still fund most benefits. Policymakers could raise taxes, adjust the wage cap, or slightly tweak benefits to close the gap — none of which would eliminate payments.

Simply put, the system needs maintenance, not a total rebuild. And if history tells us anything, Congress tends to act when voters’ retirement security is at stake.

New York Social Security Schedule: Exact December 2025 Payment Dates

December 10 Social Security Payments: What Retirees Will Receive and Who Qualifies

December Social Security & SSI Guide: Payment Dates, Double Checks, and Next Year’s COLA