Social Security January Payments: Exact Dates to Expect Your Check and What Changes in 2026 is the question echoing across kitchen tables, financial advisor offices, and retirement communities right now. And for good reason. With more than 71 million Americans receiving Social Security or Supplemental Security Income (SSI), knowing when the money arrives and what’s changing in 2026 matters—a lot. If you’re living on a fixed income, planning your budget, or advising others on their retirement strategy, this is the guide for you. We’ll break down the exact payment schedule, explain the new Cost-of-Living Adjustment (COLA), share how Medicare premiums, taxes, and earnings limits can affect your check—and walk you through smart moves to stretch every dollar in 2026.

Table of Contents

Social Security January Payments

Social Security in January 2026 isn’t just about dates and dollar signs—it’s about planning, peace of mind, and financial stability for millions of Americans. With clear payment schedules, a 2.8% COLA increase, and some shifting numbers like Medicare premiums and tax thresholds, it pays to be prepared. Whether you’re collecting benefits, helping a loved one, or advising clients, this guide gives you the tools to navigate the new year confidently. Remember, the more you understand, the more power you have to make your money work for you.

| Topic | Details |

|---|---|

| January 2026 SS Payment Dates | Payments on Jan 2, 14, 21, 28 depending on benefit type & birthday |

| 2026 COLA Increase | 2.8% increase starting January |

| SSI Federal Payments | $994 individual, $1,491 couple |

| Medicare Part B Premium 2026 | Standard premium: $202.90 |

| Earnings Limits for 2026 | Increased limits for working beneficiaries |

| Taxation in 2026 | Some benefits may be taxed federally |

Social Security January Payments Dates

Let’s kick it off with the most pressing question: When will I get paid?

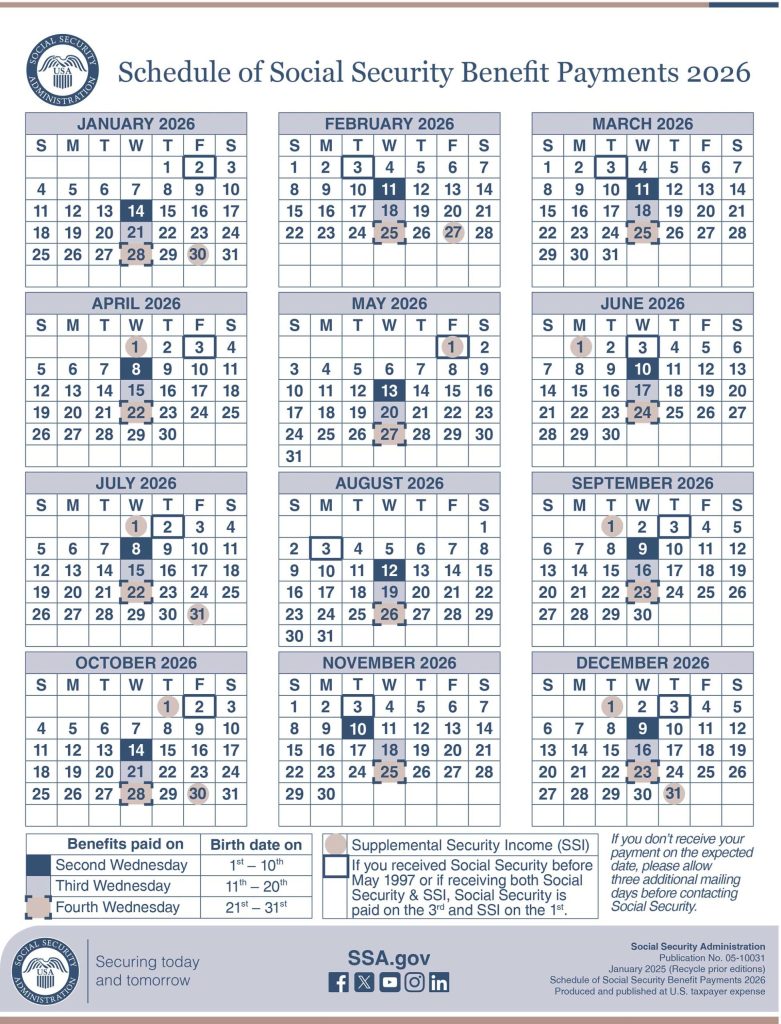

Regular Social Security (Retirement, Disability, Survivors)

If you’re receiving Social Security benefits and filed after May 1997, your payment is scheduled based on your birthdate:

- January 14, 2026 — If your birthday falls on the 1st to the 10th

- January 21, 2026 — If your birthday falls on the 11th to the 20th

- January 28, 2026 — If your birthday falls on the 21st to the 31st

Early Beneficiaries & Dual SSI/SS Recipients

If you started receiving Social Security before May 1997 or receive both SSI and SS, your check will arrive January 2, 2026. Normally these payments go out on the 3rd, but since Jan 3 lands on a Saturday, the date shifts forward.

Supplemental Security Income (SSI)

SSI is typically paid on the 1st of the month, but when that day falls on a holiday or weekend, payments come early. This year:

- December 31, 2025 — SSI payment for January 2026

No, that’s not a mistake. January’s SSI check lands in December.

Understanding these dates helps families pay rent, buy groceries, and schedule essential purchases without unnecessary anxiety. That’s especially important if your income is tight and every dollar counts.

The 2026 COLA: What a 2.8% Increase Means for You

The Cost-of-Living Adjustment (COLA) for 2026 is 2.8%—a number set by the Social Security Administration (SSA) based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

That means your Social Security and SSI checks are getting a raise in 2026.

Example Breakdown:

- $1,800/month → New amount: $1,850.40

- $2,500/month → New amount: $2,570.00

- SSI individual: $943 → $994

- SSI couple: $1,415 → $1,491

While this increase is helpful, it may not fully keep up with actual inflation in areas like housing, healthcare, and food. For many seniors, COLA is quickly absorbed by other rising costs.

That’s why understanding the full picture—including Medicare premiums and tax implications—is key.

How Medicare Premiums Could Shrink Your Raise

Here’s the kicker: Just because your Social Security check is going up, doesn’t mean your take-home pay is.

Medicare Part B premiums are automatically deducted from most Social Security payments. In 2026, that deduction will likely be $202.90 per month, up nearly $18 from the previous year.

This means:

- If your benefit goes up by $70/month because of COLA…

- But Medicare increases by $18/month…

- You’re only seeing $52 more in your pocket.

Why Medicare Costs Matter?

For seniors on fixed incomes, even modest increases in healthcare premiums can wipe out the benefits of COLA. This is especially true if you’re enrolled in both Part B and Part D, or if you’re in a Medicare Advantage plan with extra costs.

Healthcare and Social Security are joined at the hip. Knowing what’s deducted from your check helps you avoid surprises and plan ahead.

Working While Collecting Social Security January Payments? Know the 2026 Earnings Limits

More older adults are working part-time or freelancing to boost retirement income. If you’re collecting Social Security before full retirement age and still earning a paycheck, you need to know about the earnings limit.

For 2026:

- If you’re under full retirement age all year, you can earn up to around $22,320 without penalty.

- Earn more than that, and $1 is withheld for every $2 you earn above the limit.

- The year you reach full retirement age, the limit jumps to around $59,520—and the penalty drops to $1 for every $3 over.

Once you reach full retirement age (typically 66–67 depending on your birth year), these earnings limits go away entirely.

It’s a delicate balance. Earning more money might sound great—but if you don’t know the rules, you could lose some of your Social Security temporarily. Make sure the math adds up.

Will You Owe Taxes on Your Social Security? Maybe.

Many people are shocked to learn that their Social Security income could be subject to federal income taxes. Here’s how it works:

If your combined income (AGI + tax-exempt interest + 50% of SS benefits) exceeds:

- $25,000 (single filers) or

- $32,000 (joint filers),

You may owe tax on up to 85% of your Social Security benefits.

Real-World Example:

Let’s say you’re a single filer with:

- $15,000 in part-time work income

- $18,000 in Social Security benefits

Your combined income would be:

- $15,000 + (50% of $18,000) = $24,000

You’re under the threshold—no taxes on Social Security.

But if you earned just a few thousand more? Boom. You might owe.

This is why tax planning matters even in retirement. Talk to a CPA or advisor who understands how to navigate these waters.

Practical Strategies to Stretch Your Social Security January Payments

You’ve worked hard to earn your benefits—so let’s talk about how to make them go further.

A. Delay Taking Benefits (If You Can)

For every year you delay taking Social Security past your full retirement age, your benefits increase by about 8%—up to age 70. If you’re healthy and have other income sources, delaying could mean thousands more over your lifetime.

B. Optimize Medicare Enrollment

Avoid costly mistakes by signing up for Medicare at the right time. Late penalties can be permanent. And choosing between Medicare Advantage and Original Medicare with a supplement is a strategic decision.

C. Consider Withholding Federal Taxes

You can ask SSA to withhold taxes from your benefits so you don’t get hit with a surprise tax bill in April. This especially helps if you have other income streams.

What About the Future of Social Security? Should I Be Worried?

We’d be remiss not to mention the bigger picture: Social Security’s long-term solvency.

According to recent trustee reports, if Congress doesn’t make changes, the Social Security trust fund could run short by 2034, meaning only about 81% of scheduled benefits would be payable.

That doesn’t mean Social Security will disappear. But it does suggest we may see future changes—like higher taxes, raised retirement ages, or benefit adjustments.

For now, 2026 payments are safe and locked in. But for younger workers and long-term retirees, staying informed is essential.

Social Security Benefits January 2026: How Much Will Your Payments Increase?

Social Security Payment Schedule 2026 – Why Millions Will See New Dates and Larger Checks