Social Security January 14 Payments: If you’re trying to make sense of Social Security January 14 payments and the 2026 COLA (Cost-of-Living Adjustment), you’re in the right place. This article breaks everything down — no confusing jargon, just the facts, friendly advice, and professional insight. We’ll answer all your questions:

- Who gets paid on January 14?

- How does the COLA increase affect you?

- How is COLA calculated?

- What tools can help you manage your benefits?

By the end, you’ll know what’s coming, how to prepare, and how to maximize your Social Security benefits in 2026 and beyond.

Table of Contents

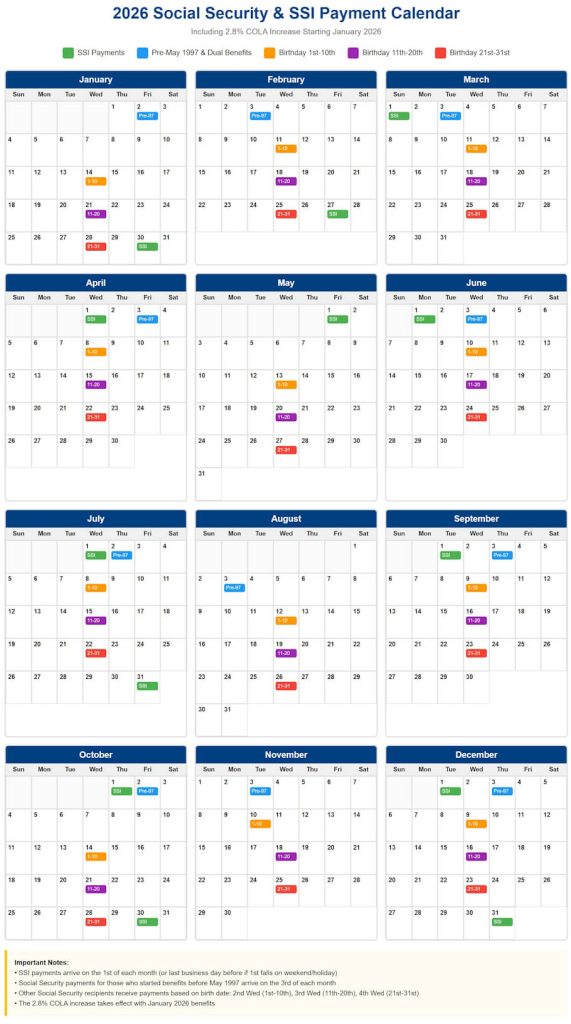

Social Security January 14 Payments

Social Security January 14 Payments are a key date for millions of Americans. If your birthday falls between the 1st and 10th, expect your first COLA-adjusted benefit of 2026 to arrive that day. With a 2.8% increase, the 2026 COLA helps your benefits keep pace with inflation and rising living costs. Understanding how this works — from payment schedules to how COLA is calculated — gives you the knowledge you need to plan smart, avoid scams, and make the most of your benefits. Whether you’re retired, disabled, or managing finances for a loved one, staying informed means staying in control.

| Topic | Details |

|---|---|

| Payment Date | January 14, 2026 (second Wednesday of the month) |

| Who Qualifies | Social Security recipients born between the 1st and 10th of any month who started benefits after May 1997 |

| 2026 COLA Rate | 2.8% increase, effective January 2026 |

| Applies To | Retirement, Disability (SSDI), Survivors, and SSI benefits |

| Average Monthly Increase | Around $56/month for retired workers |

| SSI Note | January 2026 SSI paid early on December 31, 2025 due to New Year’s Day federal holiday |

| Official SSA Website | ssa.gov/cola |

What Are Social Security January 14 Payments?

The Social Security Administration (SSA) delivers monthly benefits to retirees, disabled workers, survivors, and certain family members. The exact day you receive your benefit depends on:

- Your birthday

- When you began receiving benefits

Those who began collecting benefits after May 1997 receive payments based on a birthdate-based schedule:

| Birth Date Range | Payment Date (January 2026) |

|---|---|

| 1st–10th | Wednesday, January 14 |

| 11th–20th | Wednesday, January 21 |

| 21st–31st | Wednesday, January 28 |

| Pre-May 1997 | Friday, January 2 |

| SSI Recipients | Wednesday, December 31 (early) |

So if your birthday falls between the 1st and 10th, you’ll be getting your Social Security check on January 14, 2026.

Who Qualifies for Social Security January 14 Payments?

To be paid on January 14, 2026, you must:

- Be receiving Social Security Retirement, Disability (SSDI), Survivor, or Spousal/Dependent benefits.

- Have a birthday between the 1st and 10th of the month.

- Have started receiving benefits after May 1997.

If you started your benefits before May 1997, you get paid on the third of each month, not according to your birthday.

Special note about SSI (Supplemental Security Income): SSI follows a different schedule. The January 2026 SSI payment is sent on December 31, 2025, because January 1 is a federal holiday.

Understanding the 2026 COLA – A 2.8% Benefit Boost

The Cost-of-Living Adjustment (COLA) ensures your benefits keep pace with inflation. Each year, the SSA adjusts benefits based on inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

In 2026, SSA announced a 2.8% increase in Social Security and SSI benefits — helping millions of Americans maintain purchasing power amid rising prices.

Why COLA Matters?

With the price of everyday items like groceries, rent, and prescriptions going up, COLA helps protect your spending power. It doesn’t make you rich overnight, but it does help you keep up.

This year’s 2.8% COLA is higher than 2025’s 1.9% and closer to the long-term average increase. It reflects inflation trends measured in the third quarter of 2025.

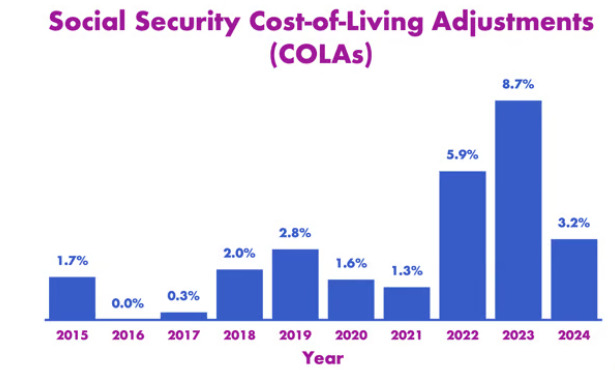

Historical Context: How COLA Has Changed

Here’s a quick look at recent COLA increases:

| Year | COLA % |

|---|---|

| 2020 | 1.6% |

| 2021 | 1.3% |

| 2022 | 5.9% |

| 2023 | 8.7% |

| 2024 | 3.2% |

| 2025 | 1.9% |

| 2026 | 2.8% |

For a complete list, visit the SSA’s COLA history.

How Is COLA Calculated?

COLA is based on the CPI-W inflation data from July through September (Q3) each year.

Simple COLA Formula:

If average Q3 CPI-W rises compared to the previous year:

- SSA calculates the percentage difference.

- That percentage becomes the COLA.

Example:

- Q3 2025 CPI-W: 305.9

- Q3 2024 CPI-W: 297.4

- Percent difference: 2.8% → That’s your COLA.

How Much Will You Get Social Security January 14 Payments With 2.8% COLA?

Here’s what a 2.8% boost looks like for different benefit types:

| Benefit Type | 2025 Monthly Payment | 2026 Monthly Payment (est.) |

|---|---|---|

| Retired Worker (avg.) | $2,000 | $2,056 |

| SSDI Recipient | $1,300 | $1,336 |

| SSI Individual | $943 | $994 |

| SSI Couple | $1,415 | $1,491 |

| Widowed Parent (2 kids) | $3,540 | $3,639 |

Your specific amount depends on work history, earnings, and filing age.

How to Prepare for Your Social Security January 14 Payments?

1. Verify Your Payment Schedule

Check your birthday and payment group to confirm January 14 is your date.

2. Set Up Direct Deposit

Direct deposit is the fastest and safest way to receive your money. You can set it up through your mySSA.gov account.

3. Review Your Benefit Notice

SSA sends annual COLA letters each December. You can also download yours online.

4. Update Your Budget

Account for your COLA increase. Use the extra money to cover rising costs or pad your savings.

Tips from a Social Security Professional

As someone who’s helped hundreds of retirees and SSDI recipients plan their finances, here are a few pointers:

- Don’t rely on COLA alone – It’s helpful but not a substitute for long-term financial planning.

- Use the increase wisely – Consider putting part of the raise into an emergency fund.

- Check your tax liability – If COLA pushes your income above thresholds, you may owe taxes on a portion of your benefits.

If you’re not sure how to manage the increase, talk to a fee-only financial advisor with experience in retirement income planning.

Common Social Security Scams to Avoid

Scammers ramp up activity around COLA and benefit updates. Protect yourself by staying alert.

Red Flags:

- Calls saying your benefits are suspended.

- Demands for payment via gift card or wire transfer.

- Emails or texts asking for your SSN or bank info.

January 2026 Social Security Checks – Timeline for the First Deposits of the New Year

Social Security Benefits January 2026: How Much Will Your Payments Increase?

January Social Security Payment Timeline – When the First 2026 Checks Will Be Deposited