Social Security income $2,071 in 2026: that’s the projected average monthly amount many Social Security beneficiaries will receive in 2026 after the annual Cost‑of‑Living Adjustment (COLA). That number gets tossed around a lot in headlines, social media posts, and retirement forums. At first glance, it sounds like a solid boost for retirees. But here’s the real deal: a large portion of that money could be taxed, and even more could be eaten up by Medicare premiums, income‑related surcharges, and other costs before you ever spend a dime. In this article, we break down — in plain, conversational American English — why your Social Security benefit may not go as far as you thought, how taxes work on it, what else can reduce your payment, and practical ways to plan around these charges. Whether you’re a retiree, a financial advisor, or simply planning ahead, this guide will help you see the full picture.

Table of Contents

Social Security Income $2,071

Social Security income $2,071 in 2026 might sound like a straightforward bump in your retirement paycheck, but as we’ve explored, the net amount you take home depends on much more than that figure. Federal income tax rules, Medicare premiums (especially IRMAA surcharges), working while claiming benefits, and state tax laws all play significant roles in determining how much of that benefit you actually keep. With thoughtful planning — including timing withdrawals, considering Roth conversions, using qualified charitable distributions — you can keep more of your money in retirement and make more informed income decisions. Understanding these dynamics now can help you avoid surprises down the line.

| Topic | Key Data / Takeaways |

|---|---|

| Average Monthly Social Security in 2026 | $2,071/month |

| Federal Tax Thresholds on Benefits | Up to 85% of benefits taxable depending on combined income |

| Medicare Part B Premium (2026) | $202.90/ month standard premium |

| IRMAA Thresholds | Income‑Related Medicare Surcharge begins above specific AGI |

| Senior Bonus Deduction | Up to $6,000 additional deduction for age 65+ |

| State Taxes on Social Security | Varies by state; many states don’t tax benefits |

What Does “Social Security Income $2,071 in 2026” Actually Represent?

Every year, the Social Security Administration (SSA) adjusts benefit amounts based on inflation through a mechanism called the Cost‑of‑Living Adjustment (COLA). This adjustment is meant to help retirees keep pace with rising costs for necessities like food, gas, utilities, and housing. For 2026, the average monthly benefit is estimated at $2,071, which amounts to about $24,850 annually for a typical beneficiary. These figures are based on official SSA projections and past COLA announcements. (Source: Social Security Administration)

However, that gross benefit number is only part of the story because your take‑home amount may be significantly less once taxes and Medicare come into play.

Why Your Social Security Income Could Be Taxed?

Contrary to a common belief, Social Security benefits are not automatically tax‑free. Whether a portion of your benefits is subject to federal income tax depends on your total income — not just your Social Security amount.

Understanding “Combined Income”

The IRS uses a formula called combined income (sometimes called provisional income) to determine how much of your Social Security benefits are taxable. That formula includes:

- Your adjusted gross income (AGI)

- Tax‑exempt interest (like interest from certain municipal bonds)

- 50% of your Social Security benefits

This combined figure is then compared to specific thresholds to decide what portion of your benefits is subject to income tax. The rules were first introduced in the 1980s and — crucially — have not been adjusted for inflation, meaning more retirees today fall into the taxable range than in past decades. (Source: Internal Revenue Service)

Federal Tax Thresholds for Social Security Benefits

For the 2026 tax year, the thresholds the IRS uses are roughly:

- No tax on Social Security benefits if your combined income is below:

- $25,000 (single filer)

- $32,000 (married filing jointly)

- Up to 50% of benefits taxable if combined income is:

- $25,000–$34,000 (single)

- $32,000–$44,000 (married joint)

- Up to 85% of benefits taxable if combined income exceeds:

- $34,000 (single)

- $44,000 (married joint) (Source: IRS Social Security FAQ)

That means if you have income from other sources — such as an IRA or 401(k) withdrawal, a pension, rental income, dividends or interest — that income could bump you into a bracket where most of your Social Security becomes taxable.

Example: How This Works in Real Life

Suppose you receive:

- Social Security: $2,071 per month → $24,852/year

- IRA distributions: $15,000/year

- No other income

Under the IRS rules:

- 50% of your Social Security = $12,426

- Combined income = $15,000 + $12,426 = $27,426

This puts you in the range where up to 50% of your Social Security benefits may be taxable. If you had even more income — say from investment earnings — you could easily cross the threshold where up to 85% of your Social Security benefits become taxable.

New Tax Break: The Senior Bonus Deduction (2025–2028)

Recent tax law changes have introduced a temporary tax break for older taxpayers that can help reduce taxable income. Known informally in tax planning circles as the Senior Bonus Deduction, this provision allows:

- Up to $6,000 additional deduction for individual filers age 65+

- Up to $12,000 for married couples filing jointly if both spouses qualify

This deduction isn’t applied directly to Social Security benefits, but it lowers your taxable income overall, making it easier to stay below the thresholds where Social Security becomes taxable. This break is set to be in place for tax years 2025 through 2028 and is designed to help retirees with rising living costs. (Tax media and expert commentary)

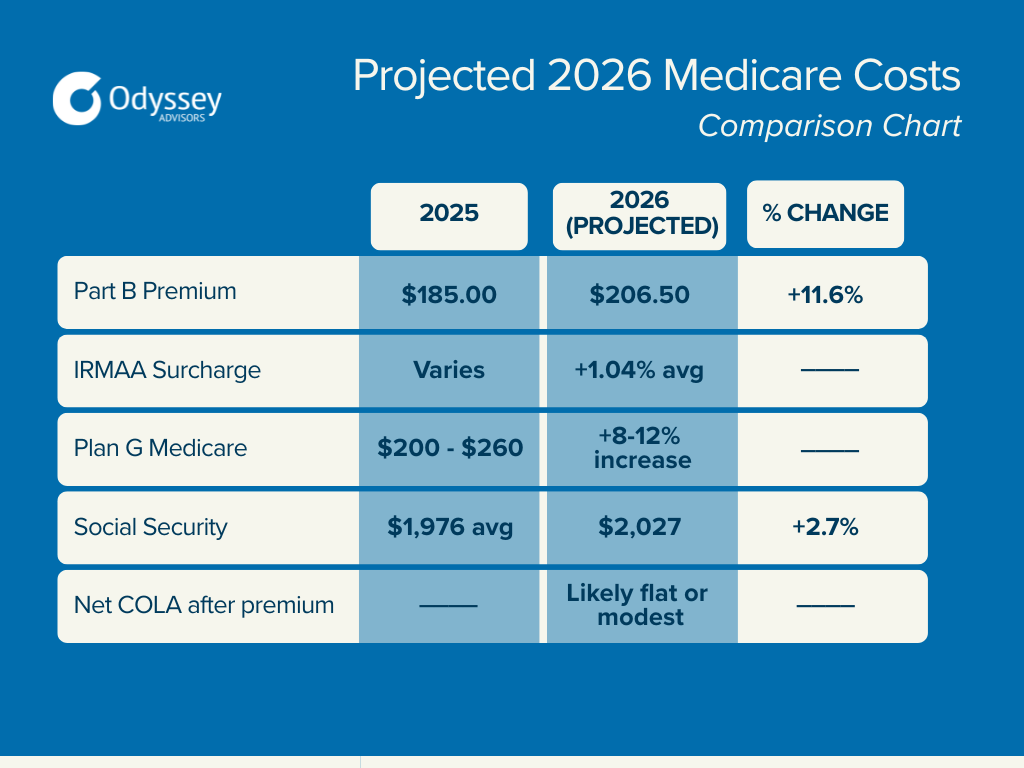

Medicare Premiums and IRMAA: Another Bite Out of Your Check

Social Security isn’t taxed only at tax time — you may also see reductions to your monthly benefit due to Medicare premiums. Most beneficiaries have their Medicare Part B (medical insurance) and Part D (prescription drug coverage) premiums automatically deducted from their Social Security checks.

In 2026:

- Standard Medicare Part B premium is about $202.90 per month, up from previous years’ amounts. (Centers for Medicare & Medicaid Services)

- If your modified adjusted gross income (MAGI) exceeds certain thresholds, you may face an Income‑Related Monthly Adjustment Amount (IRMAA), which is a surcharge on your Medicare Part B and Part D premiums.

IRMAA typically applies if your MAGI (usually from two years prior) is above:

- $109,000 for single filers

- $218,000 for married couples filing jointly (MedicareResources.org)

That surcharge can add $50–$500+ per month depending on your income level. Unlike regular Medicare premiums, IRMAA surcharges are not subsidized and are fully passed through to you. So even before satisfying your federal tax bill, a portion of your Social Security check may go directly to Medicare.

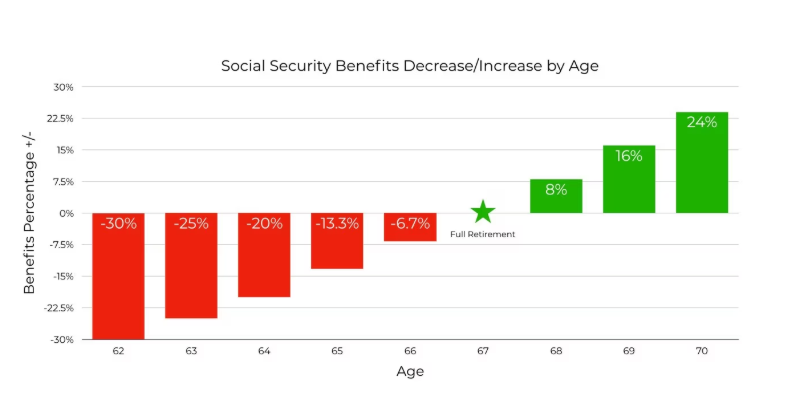

Working While Collecting Social Security Income $2,071

Many retirees work part‑time in retirement or during a transition period. If you claim Social Security before your full retirement age and continue working, the Social Security Administration may temporarily withhold benefits based on your earned income.

In 2026, if you are below full retirement age:

- SSA withholds $1 in benefits for every $2 you earn above about $24,480 per year.

- In the year you reach full retirement age, SSA withholds $1 for every $3 earned above a higher threshold.

That withholding is not a tax; it’s a temporary reduction. However, it does reduce the amount of money you receive monthly until full retirement age, at which point your benefit is recalculated to reflect months of withholding.

State Taxes on Social Security

Federal tax is only one piece of the picture. State tax treatment varies widely:

- Many states, including tax‑friendly ones like Florida, Texas, and Nevada, do not tax Social Security benefits at all.

- Other states either partially tax benefits or provide exemptions based on age or income.

- A few states fully tax Social Security benefits like ordinary income.

Knowing the tax rules of the state where you live — or are considering moving to — is an important part of retirement planning because it can affect how far your benefits go. (Investopedia overview on state taxation)

Smarter Planning to Keep More of Your Social Security Income

You can’t avoid all taxes — but you can reduce how much you pay with proactive planning. Here are practical strategies that financial planners and experienced retirees often consider:

Time Your Retirement Account Withdrawals

Large withdrawals from traditional IRAs or 401(k)s can quickly push your combined income higher, increasing the amount of your Social Security that becomes taxable and potentially raising your Medicare IRMAA bracket.

Convert to Roth Accounts Early

Roth IRAs are funded with after‑tax dollars, and qualified withdrawals from Roth IRAs are generally not counted toward your combined income. By doing Roth conversions before you start Social Security or Medicare, you may lower future taxable income.

Use Qualified Charitable Distributions (QCDs)

If you are 70½ or older, you can make a qualified charitable distribution from your IRA directly to a qualified charity. A QCD counts toward your required minimum distribution (RMD) but does not count as taxable income, helping reduce combined income.

Coordinate Filing and Retirement Timing

Delaying Social Security claims — even by a few months — can result in a higher monthly benefit, which can improve long‑term income. When combined with careful planning of other income sources, this strategy may help manage how taxable your benefits are.

Work With a Tax Professional

Everyone’s retirement income situation is unique. A CPA, enrolled agent, or fiduciary financial planner can run projections and suggest optimal strategies based on your income sources, filing status, and retirement timeline.

Is a 4th Stimulus Check Coming in January 2026? Latest Updates

Social Security Eligibility Income 2026 – The Exact Earnings Needed to Qualify

Social Security Benefits at 62, 65 & 70 – Average Monthly Checks Explained Side by Side