Social Security Full Retirement Age: If you were born in 1960 or later, your Social Security Full Retirement Age (FRA) will officially be 67 starting in 2026. This is the final step in a decades-long rollout by the government to raise the full retirement age in response to Americans living longer and putting more pressure on the system. This change might sound minor, but it has major consequences. For millions of workers approaching retirement, a shift in the FRA could mean thousands of dollars more or less over a lifetime, depending on how you plan. In this article, we’ll break down what’s changing, why it matters, and how to prepare, in plain language that’s easy to follow. Whether you’re 10 years away from retirement or just getting serious about planning, this guide is for you.

Table of Contents

Social Security Full Retirement Age

The move to Full Retirement Age 67 in 2026 closes the book on a 40-year shift in how America’s retirement system works. It affects everyone born in 1960 or later, and it reshapes the choices you’ll make around when and how to retire. Claiming early means less money for life. Delaying can pay off big — but it depends on your situation. The smart move is to know your options, review your benefits, and plan intentionally. Social Security isn’t just a government check — it’s a cornerstone of retirement. Treat it like it matters, because it does.

| Topic | Details |

|---|---|

| New Full Retirement Age (FRA) | 67 for anyone born in 1960 or later |

| Effective Year | 2026 |

| Earliest Claiming Age | Still 62 (with reduced benefits) |

| Delayed Credit Max | Up to 124% of FRA benefit if you delay until 70 |

| 2026 COLA Estimate | ~2.8% increase (based on inflation projections) |

| Work Earnings Limit (before FRA) | ~$22,320/year (2026 estimate) |

| Spousal & Survivor Benefits | Still available, subject to rules |

| Official Resource | ssa.gov |

What Is Social Security Full Retirement Age (FRA)?

Full Retirement Age is the age at which you’re eligible to receive 100% of your Social Security retirement benefits. You can still choose to start receiving benefits as early as age 62, but if you do, you’ll receive a permanently reduced amount.

If you delay receiving benefits past your FRA, you can increase your monthly check by up to 8% per year, up to age 70.

This is why understanding your FRA is so important — it affects your entire financial future.

What’s Changing in 2026?

The change is simple but significant:

- For people born in 1960 or later, the Full Retirement Age becomes 67.

- This is the final step in a gradual increase that began in the 1980s.

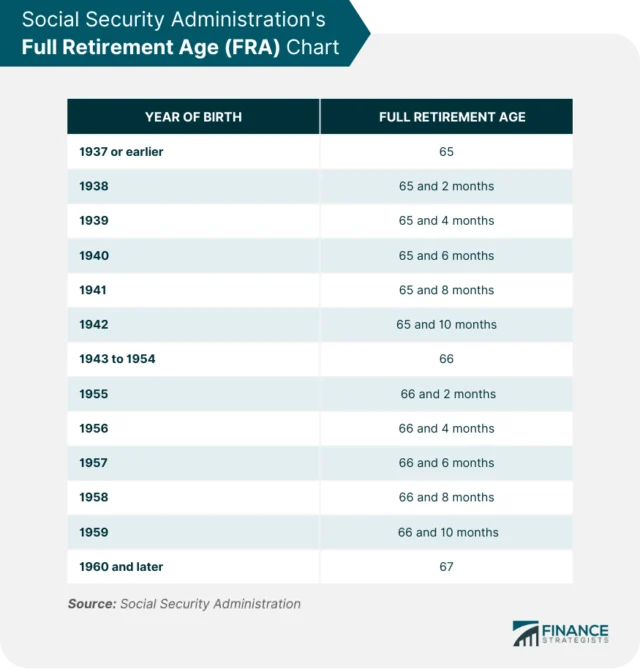

Here’s the timeline:

| Year of Birth | Full Retirement Age |

|---|---|

| 1954 or earlier | 66 |

| 1955 | 66 + 2 months |

| 1956 | 66 + 4 months |

| 1957 | 66 + 6 months |

| 1958 | 66 + 8 months |

| 1959 | 66 + 10 months |

| 1960 or later | 67 |

This means that if you turn 62 in 2022, you’ll be eligible for full benefits in 2026 — but only at age 67, not 66 and 10 months like those born a year earlier.

Why the Social Security Full Retirement Age Was Raised?

Back in 1983, Congress passed the Social Security Amendments of 1983, which included a plan to gradually raise the FRA from 65 to 67. This was done to keep the system financially solvent.

Why? Americans are living longer, having fewer children, and drawing on Social Security for more years than in the past. When Social Security was launched in 1935, average life expectancy was just over 61 years. Today, it’s nearly 77 years, and rising.

The full implementation of FRA 67 in 2026 represents the final step in a bipartisan plan set in motion over 40 years ago.

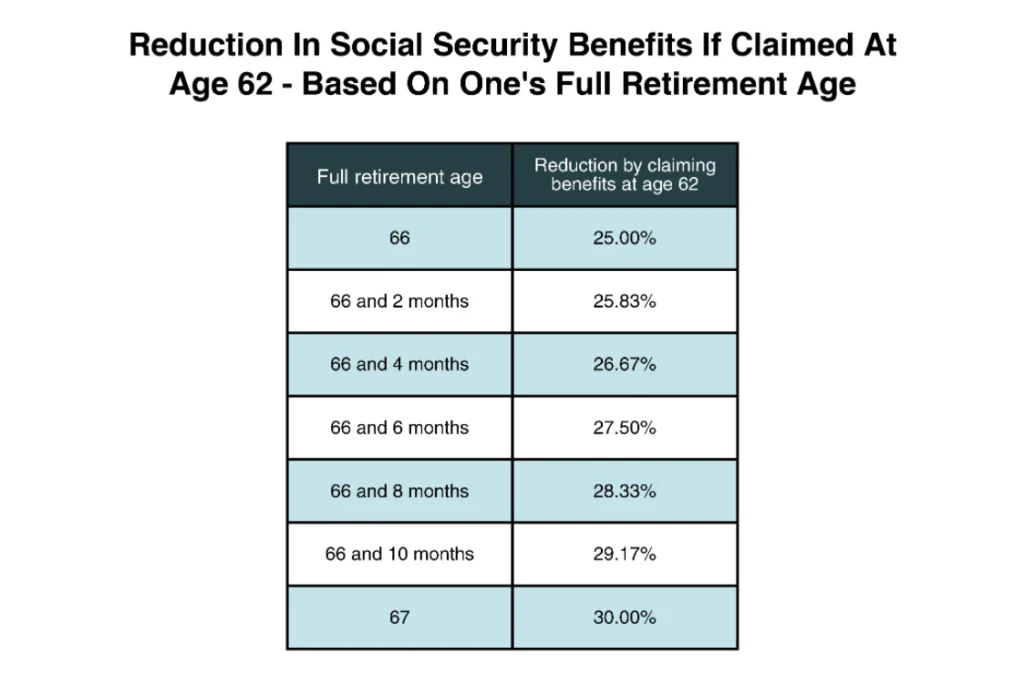

How Much Will Early or Late Claiming Affect You?

Let’s say your full benefit at FRA is $2,000/month.

Here’s what you’d get based on when you claim:

| Claim Age | Monthly Benefit | % of Full |

|---|---|---|

| 62 | $1,400 | 70% |

| 64 | $1,600 | 80% |

| 67 | $2,000 | 100% |

| 70 | $2,480 | 124% |

That’s an $1,080 monthly difference between claiming at 62 and 70.

Even delaying one or two years after age 62 can make a major difference — and if you’re in good health and expect to live into your 80s or beyond, it might be worth the wait.

How This Affects Different Income Groups?

Low-Income Workers

- Social Security is likely their primary or only retirement income.

- Claiming early can be tempting, but reduces their monthly benefit permanently.

- Advice: Use community resources, housing support, and financial counseling to help delay claiming if possible.

Middle-Income Earners

- May have a small pension or 401(k).

- Planning when to claim becomes critical to balance Social Security with other income streams.

High-Income Professionals

- Social Security may be just one component of retirement income.

- Likely to delay claiming to maximize return or coordinate with spouse.

- Advice: Work with a financial planner to consider tax impact and spousal strategy.

Real-World Case Study

Meet Linda, a 63-year-old nurse from Ohio, born in December 1960. She’s deciding whether to retire next year or wait.

- If she retires at 62, she’ll get $1,450/month.

- If she waits until her FRA in 2027 (age 67), she’ll get $2,070/month.

- If she works part-time from 62–67, she’ll still be able to claim full benefits later, while earning enough to stay afloat.

By delaying her benefit, Linda will collect $7,440 more per year — and over 20 years of retirement, that’s nearly $150,000 in added income.

Spousal and Survivor Benefits Still Apply

Social Security isn’t just about your own record. There are valuable benefits available to spouses, survivors, and even divorced spouses:

- Spousal Benefit: Up to 50% of the higher-earning spouse’s benefit.

- Survivor Benefit: Up to 100% of a deceased spouse’s benefit.

- Divorced Spouse: Eligible if married 10+ years and currently unmarried.

Just like regular benefits, these can be reduced if claimed before FRA — or increased if claimed later.

How to Prepare for Social Security Full Retirement Age?

Here’s a practical checklist:

- Check Your FRA

Use the SSA chart to find your exact full retirement age. - Review Your Social Security Statement

Create a “mySocialSecurity” account to access your earnings record and benefit estimate. - Compare Early vs. Late Claiming

Use calculators to run the numbers and visualize your options. - Plan for Spousal or Survivor Benefits

Married? Widowed? Divorced? The right claiming strategy can benefit both partners. - Avoid Working Penalties

If you claim before FRA and keep working, excess earnings may reduce your benefit temporarily. - Consult a Financial Planner

Especially if you have other retirement accounts or pensions.

Will the Retirement Age Go Even Higher?

While 67 is the current FRA, there is increasing talk among lawmakers about raising it again — to 68 or even 70 — to address future shortfalls in the Social Security trust fund.

However, no law has passed (yet). Any future changes would likely be phased in gradually and might not affect current near-retirees.

Social Security Rules 2026 Explained – COLA Changes, Payment Updates, and New Maximums

Social Security Benefits January 2026: How Much Will Your Payments Increase?

January Social Security Payment Timeline – When the First 2026 Checks Will Be Deposited