Social Security February 3 Payments: Social Security February 3 payments are one of the earliest benefits paid out each month, but who exactly gets that money — and why is February 3 such a significant date? This isn’t just a date on a calendar. For millions of older Americans, this is the day their rent gets paid, their groceries get bought, or their prescriptions get filled. In this guide, you’ll find a clear explanation of who receives benefits on February 3, 2026, why these payments are staggered throughout the month, and how to make the most of your benefits — whether you’re just starting retirement or helping a family member manage theirs.

Table of Contents

Social Security February 3 Payments

The Social Security February 3 payments are not random — they’re a scheduled part of a well-organized system designed to ensure timely payments to Americans who need them most. If you started benefits before May 1997 or receive both Social Security and SSI, February 3, 2026, is your day. Understanding why and when you get paid, how much to expect after COLA, and how your benefits connect with programs like Medicare gives you power — power to plan, to budget, and to live with peace of mind. So whether you’re reading this to track your next deposit, support a loved one, or prepare for retirement — you’re now better informed, equipped, and ready.

| Topic | Details |

|---|---|

| Who Gets Paid on Feb. 3, 2026 | Individuals who began receiving Social Security before May 1997 or receive both SSI and Social Security |

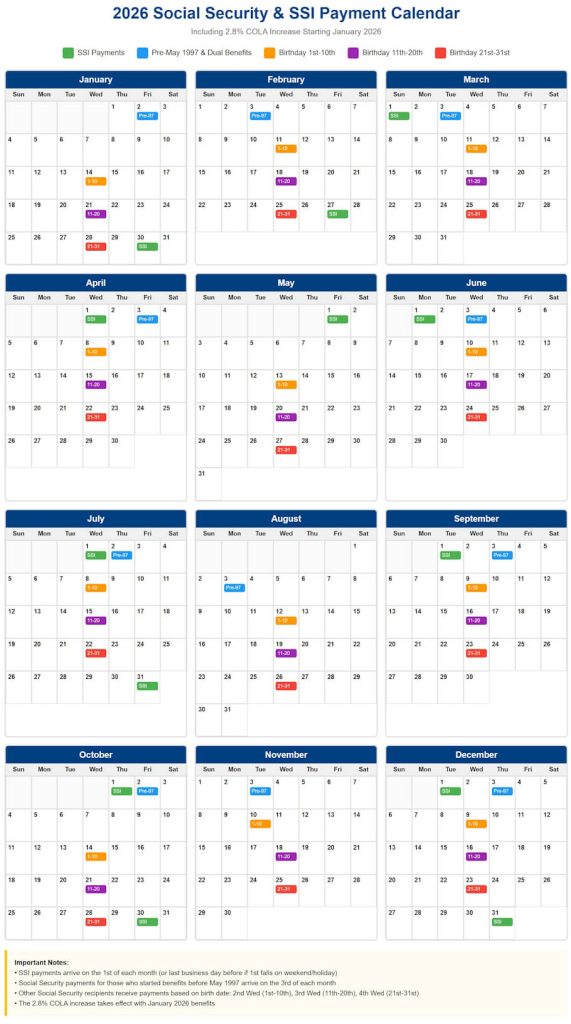

| Why the Date Matters | SSA separates payments by start date or birth date to manage over 70 million monthly benefits |

| Other February 2026 Pay Dates | Feb. 11 (born 1–10), Feb. 18 (born 11–20), Feb. 25 (born 21–31) |

| 2026 COLA Adjustment | Social Security benefits increased by 2.8% due to inflation |

| Maximum SSI in 2026 | $994 (individual) and $1,491 (couple) |

| Official Calendar | SSA Payment Schedule |

What Is Social Security and Why It’s So Important?

Social Security isn’t just a government check — it’s a lifeline for millions of Americans. Funded by your payroll taxes over the years, Social Security provides:

- Retirement benefits once you hit age 62 or later

- Disability benefits if you’re unable to work

- Survivor benefits for spouses and children of deceased workers

- SSI (Supplemental Security Income) for people with little to no income or assets

According to the Social Security Administration (SSA), over 74 million people receive monthly benefits in 2026. For many retirees, Social Security accounts for over 30% of their total income, and for others, it’s their only source of funds.

This isn’t just a government program. It’s the foundation of retirement security in America.

Why Are Social Security February 3 Payments Staggered?

The SSA doesn’t send all payments out on the same day — and that’s on purpose.

If the government sent out checks to over 70 million people all at once, banks would be overwhelmed, customer service lines would crash, and the system would be chaos. So instead, they spread payments out across four main dates each month:

- 3rd of the month – for early beneficiaries and dual SSI recipients

- 2nd Wednesday – if born 1st–10th

- 3rd Wednesday – if born 11th–20th

- 4th Wednesday – if born 21st–31st

February 3, 2026 falls on a Tuesday, and if you fall into one of the groups listed below, that’s when your Social Security money will hit your account.

Who Receives Social Security February 3 Payments?

Here’s the breakdown of who gets their money on this date:

1. Beneficiaries Who Started Before May 1997

If you began receiving Social Security benefits before May 1997, the SSA keeps you on the legacy payment system — which pays on the 3rd of each month. You’re not tied to birth date rules like newer recipients.

2. Dual SSI and Social Security Recipients

If you receive both Social Security and Supplemental Security Income (SSI), your Social Security check is scheduled for the 3rd — so it doesn’t fall too close to your SSI check (which comes around the 1st). This ensures a better spread for budgeting.

Important: If the 3rd falls on a weekend or federal holiday, SSA moves your payment to the preceding business day.

Social Security February 3 Payments: How About Everyone Else?

If you started receiving benefits after May 1997 and you’re not an SSI recipient, then your payment depends on your birth date:

- Born 1st–10th → paid on Feb. 11

- Born 11th–20th → paid on Feb. 18

- Born 21st–31st → paid on Feb. 25

This is true for retirees, disabled workers, spouses, and survivors.

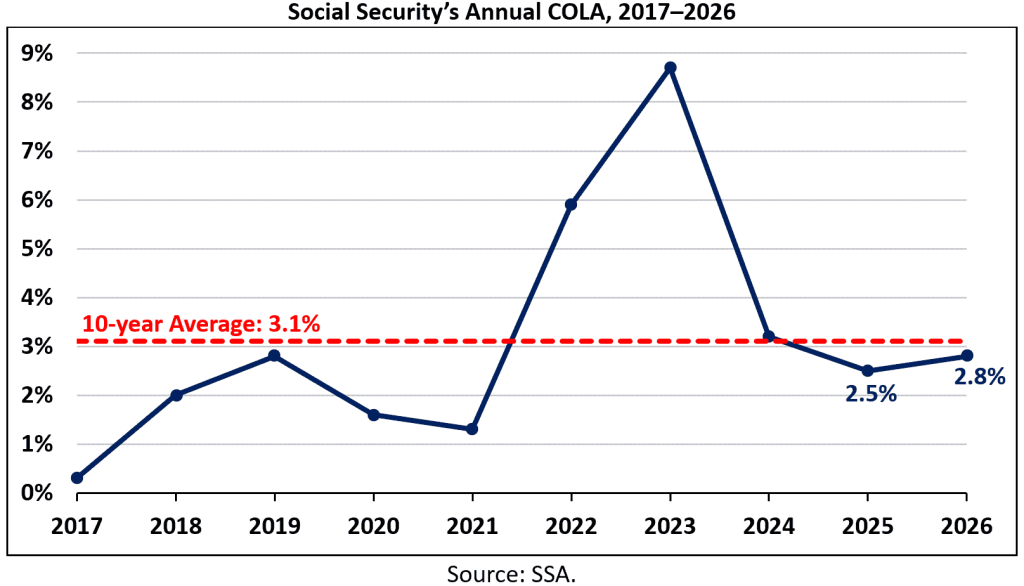

What Is the 2026 COLA Increase?

Each year, Social Security adjusts benefits through the Cost-of-Living Adjustment (COLA). In 2026, the COLA is 2.8%, reflecting recent inflation trends in the Consumer Price Index. This increase is automatically added to your check in January 2026 — so the February 3 payment will already include the new amount.

For example, if you were getting $1,500/month in 2025, your new check in 2026 would be about $1,542.

A Quick Word on SSI (Supplemental Security Income)

SSI is a needs-based program for people with little or no income, especially seniors and disabled individuals. It’s separate from Social Security retirement or disability but often paid to the same people.

In 2026, the maximum monthly SSI benefit is:

- $994 for an individual

- $1,491 for a couple

SSI is usually paid on the 1st of the month — unless the 1st is a weekend or holiday. Then it’s paid the business day before.

Tip: If you receive SSI and haven’t switched to direct deposit yet, it’s time. It’s faster, safer, and easier to track.

How Social Security Connects to Medicare?

Once you hit age 65, you’re eligible for Medicare — the federal health insurance program. Here’s how it links to Social Security:

- If you’re receiving Social Security when you turn 65, you’re automatically enrolled in Medicare Part A and B.

- The monthly premium for Medicare Part B (standard is $174.70/month in 2026) is usually deducted directly from your Social Security check.

That means if your benefit is $1,500/month, and you have Medicare Part B, your net deposit will be closer to $1,325/month.

Pro Tip: Always check your SSA statement to see deductions or changes due to Medicare coverage.

Mistakes to Avoid with Social Security February 3 Payments

Let’s talk about a few common errors folks make — and how you can avoid them:

1. Claiming Too Early

Yes, you can start collecting Social Security at 62 — but that comes with permanent reductions in monthly benefits. You’ll receive less for life than if you waited until Full Retirement Age (FRA) or even age 70.

2. Ignoring Spousal or Survivor Benefits

Many people don’t realize they may be eligible for benefits based on a spouse’s or ex-spouse’s work history. If your spouse earned more, you may qualify for up to 50% of their benefit or 100% if they passed away.

3. Not Reviewing Your Earnings Record

Your Social Security benefit is calculated based on your 35 highest-earning years. If there are mistakes in your earnings record, your benefit could be wrong.

Social Security Timeline – What to Expect Each Month

| Date | What Happens |

|---|---|

| 1st (or earlier if weekend) | SSI Payments |

| 3rd | Social Security for Pre-May 1997 + SSI/Social Security Dual Recipients |

| 2nd Wednesday | Birthdays 1–10 |

| 3rd Wednesday | Birthdays 11–20 |

| 4th Wednesday | Birthdays 21–31 |

Direct deposit often hits early morning. Paper checks may take several days.

Social Security Boost by State 2026 – Five States Where Benefits Could Rise by Up to $2,000

Average Social Security Benefits 2026 – New Monthly Payment Amounts by Retirement Age

Working While Collecting Social Security 2026 – The Earnings Limit That Keeps Your Benefits Safe