Social Security Digital Update: How $17 Billion in Retroactive Payments Will Be Issued — that’s the big headline making waves across America right now. Whether you’re a retiree sipping coffee on the porch, a financial planner reviewing client files, or just someone curious about what this means for your future, you’ve come to the right place. This isn’t just about numbers or policy changes — it’s about real people getting the money they were owed for years. For many, this is a life-changing correction decades in the making. Let’s break it down step-by-step in this easy-to-follow, professional, and clear guide — written in everyday language, with professional-level insights for those who want the details.

Table of Contents

Social Security Digital Update

The Social Security Digital Update and the historic $17 billion in retroactive payments is about more than policy — it’s about fairness, recognition, and modernization. For millions of retired public servants — teachers, cops, postal workers — this payout is a long-overdue acknowledgment of the contributions they made to society. With WEP and GPO finally repealed, Social Security is entering a new chapter of accessibility and equity. And with SSA’s improved digital infrastructure, the agency is better equipped to meet the needs of 70+ million Americans relying on it for retirement security.

| Metric / Topic | Details |

|---|---|

| Total Retroactive Payments | $17 billion in total, distributed by July 2025 |

| Beneficiaries Impacted | Over 3.1 million Americans received payments |

| Law Behind the Payments | Social Security Fairness Act (SSFA) |

| Key Rules Repealed | Windfall Elimination Provision (WEP), Government Pension Offset (GPO) |

| Back Pay Period Covered | From January 2024 to when benefits were adjusted |

| Average Payment | Estimated $6,710 per person (varies) |

| Payment Method | Mostly direct deposit; checks sent if no bank info on file |

| SSA Official Resource | ssa.gov/benefits/retirement/social-security-fairness-act.html |

What’s the Deal With This $17 Billion Social Security Digital Update?

The $17 billion in retroactive Social Security payments didn’t appear out of thin air — it’s part of a bigger story about fairness and modernizing the system.

In early 2025, Congress passed the Social Security Fairness Act (SSFA), repealing two controversial rules:

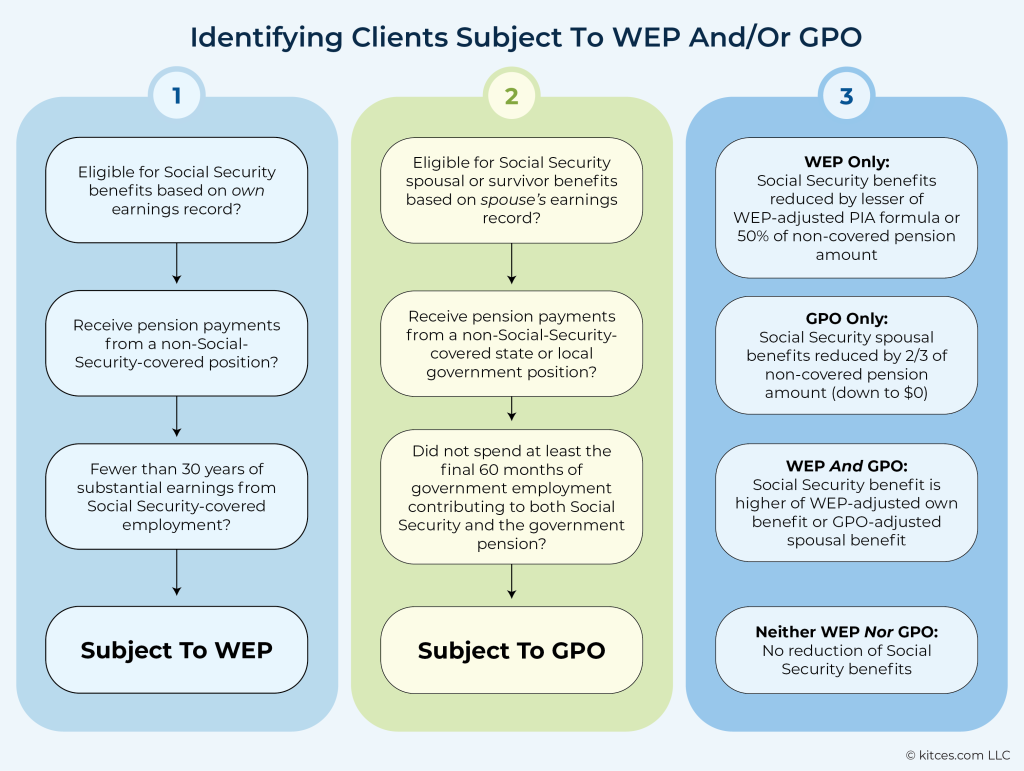

- Windfall Elimination Provision (WEP) – This rule reduced Social Security benefits for retirees who also earned a pension from jobs that didn’t withhold Social Security taxes (like many public school teachers or police officers).

- Government Pension Offset (GPO) – This one cut spousal or survivor Social Security benefits if the person also received a government pension.

These two rules had long been criticized for unfairly penalizing public sector workers who paid into Social Security through other jobs or were married to someone who did.

According to the Congressional Budget Office and SSA, repealing these rules restored full benefit eligibility to more than 3.1 million people.

Why Were the Payments Retroactive?

Here’s the heart of it: these people should have been getting higher benefits as early as January 2024, but the repeal didn’t become law until January 2025. To make up for that lost time, the government issued retroactive payments — money to cover those missing months.

These are one-time lump sum payments covering the gap between what folks should have gotten and what they actually received.

Social Security Digital Update: Who Received These Payments?

To be eligible for the retroactive payments:

- You had to be receiving (or entitled to) Social Security benefits that were previously reduced due to WEP or GPO.

- You needed to have worked in jobs where your pension came from employment not covered by Social Security, like some state/local/federal jobs.

- Your records needed to be current with the Social Security Administration (SSA), especially your direct deposit info or mailing address.

Some folks didn’t even realize they were affected — the SSA identified many cases automatically and issued payments without needing the recipient to file new paperwork.

How the Payments Were Calculated and Issued?

Once the SSFA passed, SSA began the complex process of calculating each eligible person’s new benefit amount and how much they were underpaid since January 2024.

Calculation Process:

- Benefit Recalculation: SSA used official work records to estimate what your benefit would have been without WEP/GPO.

- Back Pay Math: They subtracted what you did get and issued the difference as a lump sum.

- Automatic Disbursement: If your direct deposit was active with SSA, the payment went straight into your bank account.

- Paper Check Option: If no bank account was on file, a check was mailed.

On average, each eligible person received around $6,710, but some received less — or significantly more — depending on how long they’d been affected.

How SSA Pulled It Off — Digital Modernization

This wouldn’t have been possible without major digital upgrades to SSA’s backend systems. Until recently, SSA relied heavily on paper processing, mail correspondence, and in-office visits. That caused huge delays and errors — especially during the pandemic years.

In 2024, SSA launched a comprehensive modernization campaign:

- Introduced automated recalculation tools

- Upgraded “my Social Security” online portal

- Streamlined how records were matched across federal/state retirement systems

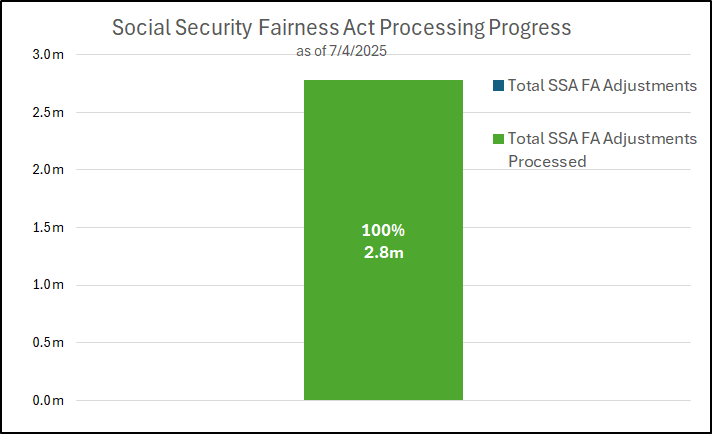

By leveraging AI and modern cloud systems, SSA was able to process millions of recalculations in record time — wrapping up payments by July 7, 2025, five months ahead of their original deadline.

That’s not just impressive — it’s historic.

Who Didn’t Get a Payment?

Just because you’re receiving Social Security doesn’t mean you were part of this payment group. You would not have received a retroactive check if:

- Your benefits were never reduced by WEP or GPO.

- You worked in a job fully covered by Social Security.

- You started benefits after January 2025.

- You were not yet receiving Social Security, even if you were eligible.

Important note: Some newly eligible folks (who didn’t apply before because WEP/GPO wiped out their benefits) may now qualify for Social Security — but they’ll need to file a new claim.

Tax Implications of Retroactive Social Security Payments

Retroactive payments from Social Security may be taxable depending on your total income and filing status.

SSA will issue a Form SSA-1099 showing how much you received in a calendar year. Here are some pointers:

- The IRS considers the full payment taxable in the year you receive it.

- You can request SSA withhold taxes from future benefits if needed.

- If the payment bumps your income into a higher bracket, it could affect your Medicare premiums or income taxes.

Financial planners and CPAs should proactively review client tax scenarios involving these lump sums — especially if the payment lands close to year-end.

Long-Term Impact on Social Security Trust Fund

One concern among policy experts is that restoring these benefits — and issuing such a large retroactive payout — may slightly accelerate the depletion of the Social Security Trust Fund.

According to the latest SSA Trustee Report, without further changes, the fund could run short by 2035. That doesn’t mean benefits would disappear — but they could be reduced unless Congress takes further action.

Still, most agree that correcting this long-standing injustice is worth the financial trade-off — and that future reforms (like lifting the payroll tax cap or adjusting retirement ages) are still on the table.

Practical Advice for Beneficiaries

Here’s a checklist if you’re a beneficiary or helping someone who is:

- Check “my Social Security” online for updated benefit amounts:

https://www.ssa.gov/myaccount - Keep all SSA notices — especially the payment letter explaining the retro amount.

- Talk to a tax preparer about how the retroactive payment might affect 2025 tax filings.

- Update your direct deposit and address info online to avoid any future delays.

- Stay alert for scams — SSA will never call to demand banking info or fees.

Social Security Unveils $17 Billion Digital Change – Retroactive Payments Coming Soon!

Social Security Planning 2026 – 8 Practical Moves That Can Help You Secure Higher Lifetime Benefits

When Will Your February 2026 Social Security Payment Arrive? Find Out Now