Social Security Changes 2026: If you’re receiving Social Security or plan to soon, there’s big news in 2026. Social Security recipients will see a 2.8% raise in benefits thanks to a new Cost-of-Living Adjustment (COLA), but that boost comes with a catch — rising Medicare premiums are also taking a bigger bite out of those payments. Whether you’re a retiree living on a fixed income, still working but nearing retirement, or just planning ahead, understanding what’s changing — and how to respond — can make a big difference in your financial future. In this complete guide, we’ll break down the Social Security changes for 2026 in simple, clear terms — with expert insights, real numbers, and practical strategies. This article is written for both everyday Americans and professionals looking for trustworthy, up-to-date information — backed by official data, reliable sources, and financial experience.

Table of Contents

Social Security Changes 2026

The Social Security changes in 2026 are a blend of welcome raises and hidden costs. The 2.8% COLA will help retirees and other beneficiaries keep up with inflation, but rising Medicare premiums and taxes will eat away a good portion of that gain. Still, by understanding these changes — and acting on them — you can protect your income, reduce surprises, and take control of your financial future. Remember: This program is one of America’s most valuable safety nets. Staying informed is the first step to making Social Security work for you.

| Topic | 2026 Update | Details |

|---|---|---|

| COLA Increase | 2.8% | Highest since 2022. Official source: SSA.gov |

| Average Retired Worker Benefit | $2,071/month | Increase of ~$56 over 2025. |

| Average Retired Couple | $3,208/month | Based on dual-income households. |

| Medicare Part B Premium | $202.90/month | Up $17.90 from previous year. |

| Part B Deductible | $283/year | Increased from $240. |

| SSI Max Benefit | $994/month | For individual Supplemental Security Income recipients. |

| Social Security Payroll Tax Cap | $184,500 | More income subject to payroll tax. |

| Early Retirement Earnings Limit | $22,320/year | Income above this reduces benefits. |

| Full Retirement Age | 67 | Applies to those born in 1960 or later. |

Understanding the 2026 COLA Increase

The Social Security Administration adjusts benefit amounts each year based on inflation using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This is known as the Cost-of-Living Adjustment, or COLA.

What’s New in 2026?

In 2026, the COLA is set at 2.8%, which is modest compared to the 8.7% increase in 2023 but still meaningful. It reflects easing inflation while ensuring retirees don’t lose purchasing power.

What Does That Mean in Dollars?

- Retired individuals: If you received $2,015/month in 2025, you’ll now receive about $2,071/month.

- Couples: With both partners receiving benefits, the average monthly check totals $3,208.

- Disabled workers: Average monthly benefits increase to about $1,630.

- SSI recipients: The federal maximum for individuals rises to $994.

While this sounds promising, it’s important to note that rising Medicare costs will reduce the effective impact of the COLA increase.

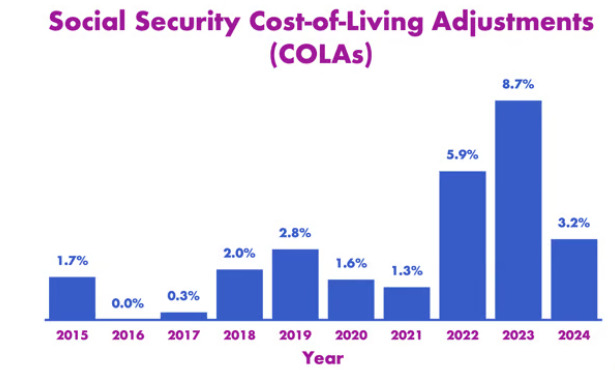

Historical Comparison of COLA Increases

To put 2026’s COLA into perspective, here’s how it compares to the past few years:

| Year | COLA % Increase |

|---|---|

| 2026 | 2.8% |

| 2025 | 2.5% |

| 2024 | 3.2% |

| 2023 | 8.7% |

| 2022 | 5.9% |

| 2021 | 1.3% |

| 2020 | 1.6% |

While the 2026 COLA may not feel as dramatic as in 2023, it’s still a substantial raise in a year of cooling inflation.

Medicare Costs in 2026: The Trade-Off

The flip side of the COLA coin is Medicare. As healthcare costs continue to rise, Medicare premiums and deductibles are increasing — cutting into that COLA bump.

Medicare Part B (Outpatient Coverage)

The standard Part B premium in 2026 is $202.90/month, an increase from $185.00 in 2025.

This amount is automatically deducted from most Social Security checks. So, if your COLA boost is $56/month but your Medicare premium rises by $17.90, your real increase is closer to $38.

Additional Medicare Costs:

| Medicare Part | 2026 Cost | Change |

|---|---|---|

| Part B Premium | $202.90 | Up $17.90 |

| Part B Deductible | $283/year | Up from $240 |

| Part A Hospital Deductible | $1,736 | Modest increase |

| IRMAA Surcharges | $250–$600+/month | For high earners only |

Who Pays More?

If your Modified Adjusted Gross Income (MAGI) is over $103,000 (individual) or $206,000 (joint filers), you may owe Income-Related Monthly Adjustment Amounts (IRMAA). These can increase your Medicare premium significantly.

Impact of Social Security Changes 2026 on Your Net Benefit

Here’s a simple look at how rising Medicare costs affect the real value of your COLA:

| Gross COLA Increase | Medicare Part B Premium | Net Monthly Increase |

|---|---|---|

| +$56.00 | -$17.90 | $38.10 |

For many, that’s less than half a tank of gas, so it’s wise to plan accordingly.

How Working Americans Are Affected by Social Security Changes 2026?

Social Security changes in 2026 don’t just affect current retirees — they also impact those still working and paying into the system.

Taxable Wage Cap Raised

If you’re employed in 2026, you’ll pay Social Security taxes (6.2%) on income up to $184,500. Employers match that contribution.

Previously, only the first $168,600 of income was taxed. So high earners will pay more into the system this year.

Early Retirement Earnings Limit

If you’re collecting benefits before full retirement age (67) and still working, you can only earn up to $22,320/year before the SSA starts withholding $1 for every $2 you earn above that.

Once you hit full retirement age, that earnings limit disappears — you can earn as much as you want without penalty.

Full Retirement Age Reminder

For people born in 1960 or later, full retirement age is 67. Taking benefits early (as early as 62) means permanently reduced benefits — sometimes by as much as 30%.

Delaying benefits past age 67 earns delayed retirement credits, boosting monthly payouts by up to 8% per year until age 70.

Planning Tips to Maximize Benefits

- Check Your Earnings Record

Visit mySocialSecurity.gov and review your history. Errors in reported income can lower your benefit. - Delay Claiming If You Can

Waiting until full retirement age — or even age 70 — can result in significantly higher monthly checks. - Use Spousal Benefit Strategies

Married couples can often coordinate claiming to maximize total household income. - Watch Your Income to Avoid IRMAA

Roth conversions, capital gains, or withdrawals from retirement accounts can bump you into higher Medicare brackets. Talk to a tax pro. - Diversify Retirement Income Sources

Don’t rely solely on Social Security. Consider IRAs, 401(k)s, or annuities to bridge income gaps.

Social Security Reform and the Road Ahead

Every year, the Social Security Trustees Report reminds us that the program is on shaky ground unless changes are made. By 2034 or 2035, the trust fund reserves could be depleted, meaning benefits would need to be reduced by about 20% if no policy action is taken.

Common Reform Proposals Include:

- Raising the payroll tax rate above 6.2%

- Increasing the taxable wage cap further

- Gradually increasing the retirement age

- Implementing means testing for benefits

None of these have become law yet, but with 70+ million Americans relying on Social Security, reform is inevitable.

January Social Security Payment Timeline – When the First 2026 Checks Will Be Deposited

Social Security Rules 2026 Explained – COLA Changes, Payment Updates, and New Maximums

Social Security Benefits January 2026: How Much Will Your Payments Increase?