Social Security Benefit Boost: The Social Security Benefit Boost 2026 is a big deal for millions of Americans, whether you’re a retiree, someone approaching retirement age, or simply planning ahead. With the cost of living rising and uncertainties about healthcare, inflation, and retirement savings, every dollar counts. This year, the Social Security Administration (SSA) has approved a 2.8% Cost-of-Living Adjustment (COLA), and while that gives a modest boost to monthly checks, there are additional ways you can take action to increase your Social Security benefit. And that’s exactly what this article is here to help you do—step by step, with clear examples and real-world advice. Whether you’re 35 or 65, understanding these rules and strategies can help you retire smarter.

Table of Contents

Social Security Benefit Boost

The Social Security Benefit Boost 2026 gives retirees and beneficiaries a helpful 2.8% increase. But if you want to truly optimize your benefits, it takes more than just waiting for COLAs. By working longer, delaying your claim, checking your earnings history, planning for taxes, and understanding spousal rules, you can increase your lifetime Social Security income by tens of thousands of dollars. Don’t let your benefits sit on autopilot. Take charge, make a plan, and give your future self a raise—because every dollar counts in retirement.

| Topic | Details |

|---|---|

| 2026 COLA | 2.8% increase applied to monthly Social Security benefits. |

| Average Monthly Benefit | $2,071/month for retired workers in 2026. |

| SSI Max Payment | $994 (individual); $1,491 (couple). |

| Earnings Limit | $24,480/year if collecting before FRA. |

| Medicare Part B | Premium rises to $202.90/month in 2026. |

| Taxable Wage Cap | $184,500 – earnings up to this amount are taxed for Social Security. |

| Full Retirement Age | Age 67 for those born in 1960 or later. |

| Official Source | Social Security Administration |

Understanding the 2026 Social Security COLA

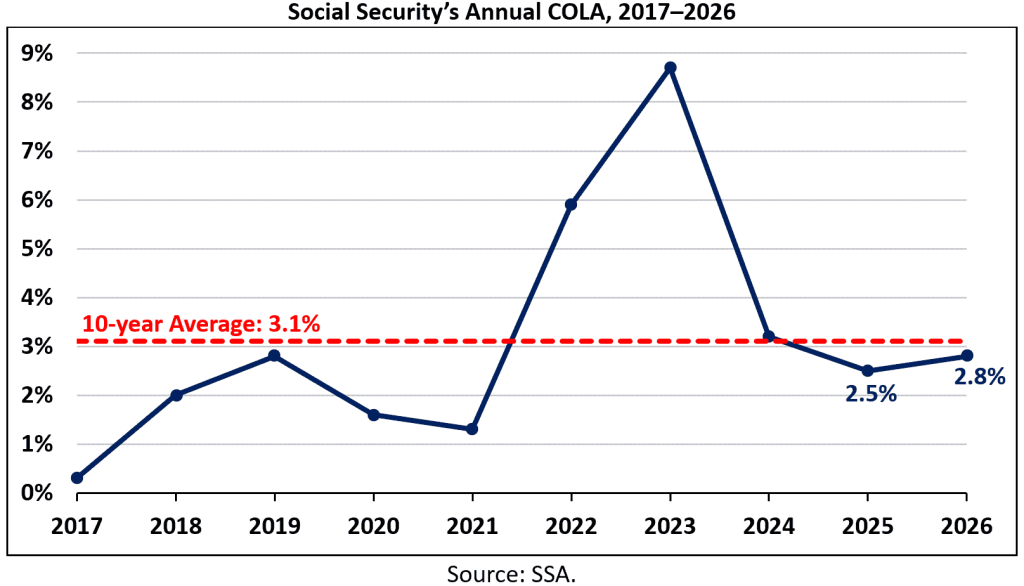

Each year, the SSA adjusts Social Security benefits based on inflation. This is known as the Cost-of-Living Adjustment (COLA). In 2026, the COLA is set at 2.8%, which reflects modest inflation growth over the past year.

What does this mean in practical terms?

If you’re receiving the average benefit of $2,015/month in 2025, your new check in 2026 will rise to about $2,071/month—an increase of $56/month or $672/year.

This change applies to:

- Retired workers

- Disabled workers

- Survivors

- SSI recipients

The adjustment takes effect in January 2026 for Social Security recipients and on December 31, 2025 for SSI beneficiaries.

Why the COLA Alone Isn’t Enough?

Even with a 2.8% increase, many retirees will still feel squeezed. That’s because:

- Inflation has outpaced COLAs in recent years.

- Medicare premiums are rising. In 2026, Part B premiums increase to $202.90/month, which can eat into your benefit.

- Grocery, gas, housing, and utility prices continue to rise at unpredictable rates.

Bottom line: You need to take additional steps to maximize your Social Security benefit.

6 Powerful Strategies for Social Security Benefit Boost

1. Work Longer to Replace Lower-Earning Years

Your Social Security benefit is calculated using your highest 35 years of earnings. If you have years with low income or no income, they count as zeros and drag your average down.

Working a few extra years can replace those zero or low-earning years with higher income years, raising your average and boosting your monthly benefit.

Example:

If you worked for 30 years and had 5 zero-income years, adding 5 more years of work at decent wages could significantly increase your check.

This is especially helpful for:

- People who took time off for caregiving

- Those who changed careers or had gaps in employment

- Anyone who started working later in life

2. Delay Claiming Benefits Until Age 70

The longer you wait to claim benefits, the more you get each month. Here’s how it works:

- Claim at 62 (early): You get less—up to 30% less than your full benefit.

- Claim at Full Retirement Age (FRA), which is 67 for most people now: You get 100%.

- Wait until age 70: You get about 8% more per year after FRA—potentially up to 124% of your full benefit.

Example:

If your FRA benefit is $2,000/month, and you wait until 70, it becomes $2,480/month. That’s a $480/month boost for life.

Delaying benefits is ideal if you:

- Are in good health

- Have other income sources (401(k), IRA, pension)

- Want to maximize survivor benefits for your spouse

3. Review and Correct Your Earnings History

Every dollar you earn and pay Social Security taxes on contributes to your benefit. But mistakes happen—and if a year of income is missing or misreported, it can shrink your future checks.

To fix this:

- Go to my Social Security

- Check your earnings record

- Report errors with W-2s, tax returns, or pay stubs

This small action could add hundreds of dollars per month in retirement.

4. Use Spousal and Survivor Benefits Strategically

Social Security provides benefits not just to workers, but to:

- Spouses

- Divorced spouses (if married 10+ years)

- Widows/widowers

You could receive up to 50% of your spouse’s benefit while they’re alive, or 100% if they pass away—depending on when you claim.

Example:

If your spouse’s benefit is $2,500 and you never worked or earned less, you could receive up to $1,250/month (spousal benefit) or $2,500/month (survivor benefit) depending on your filing age.

Timing matters. Claiming too early can reduce the amount. A professional planner can help you decide when to file.

5. Manage Income If You’re Working While Collecting

If you claim Social Security before your FRA and continue working, your benefits may be temporarily reduced if your earnings exceed the limit.

In 2026:

- You can earn up to $24,480 without penalty.

- After that, $1 is withheld for every $2 earned above the limit.

- Once you reach FRA, there are no earnings limits—you keep every dollar.

If you plan to work in retirement, coordinate your claiming strategy to avoid benefit reductions.

6. Minimize Taxation on Benefits

Yes, Social Security benefits can be taxed, depending on your income.

If your “combined income” (AGI + nontaxable interest + 50% of SS) exceeds these thresholds:

- $25,000 (single) or $32,000 (married), you may owe taxes on up to 85% of your benefits.

How to reduce taxes:

- Withdraw from Roth accounts (tax-free)

- Use qualified charitable distributions (QCDs)

- Coordinate withdrawals to stay below taxable thresholds

Tax planning can help you keep more of your Social Security income.

Additional Tips to Future-Proof Your Retirement

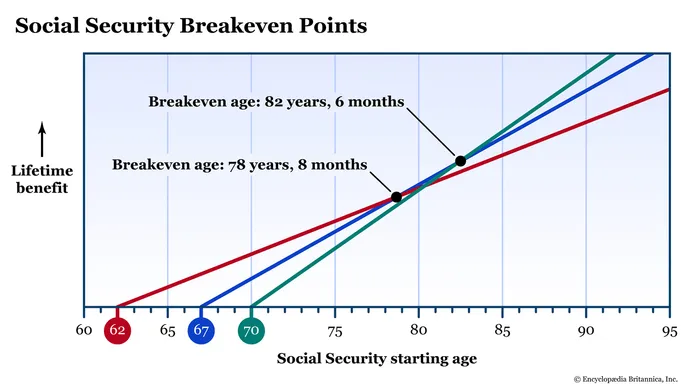

Know Your Break-Even Point

If you delay benefits, you miss out on early payments but gain higher checks later. The break-even point is the age at which delayed benefits “catch up” to early ones.

It’s typically around age 78–80. If you expect to live longer than that, delaying can pay off.

Watch for Medicare Coordination

As noted, Medicare Part B premiums are deducted from your benefit. In 2026, that’s $202.90/month.

Also consider:

- Medicare Part D drug plan costs

- Income-Related Monthly Adjustment Amounts (IRMAA) if your income is higher

Plan ahead to keep premiums from reducing your net benefit too much.

January Social Security Payment Timeline – When the First 2026 Checks Will Be Deposited

Texas Social Security Schedule – Check January 2026 Payment Dates and Eligibility Criteria

Social Security Payment January 14, 2026 – Who Gets Paid and How COLA Affects the Amount