Social Security $994 Payment: When folks hear about the Social Security $994 payment for February 2026, it can sound like just another number from the government. But if you’re living on a tight income, or helping a loved one who is, you know that number matters. It’s food on the table, the lights staying on, and maybe even a little breathing room for once. That $994 is more than just digits — it’s tied to the Supplemental Security Income (SSI) program, which exists to support older adults, folks with disabilities, and low-income individuals. In this guide, we’ll break everything down: who qualifies, when payments arrive, how much you can expect, and how to make the most of your benefits. We’ll also show you how this all fits into the bigger picture of Social Security in 2026, and how you can protect yourself and your loved ones.

Table of Contents

Social Security $994 Payment

The Social Security $994 payment in February 2026 is part of a safety net that millions of Americans depend on — especially seniors and individuals with disabilities who face limited income. Understanding how and when it’s paid, who qualifies, and how to navigate the system ensures that you or your loved ones don’t leave money on the table. By learning the ropes and planning smart, you can turn a benefit check into lasting support.

| Topic | Details |

|---|---|

| SSI Payment (Individual) | $994/month |

| SSI Payment (Couple) | $1,491/month |

| February 2026 SSI Payment Date | January 30, 2026 (Early due to weekend) |

| COLA Increase (2026) | 2.8% |

| Eligibility Criteria | Aged, blind, or disabled with limited income/resources |

| State Supplements | Yes, varies by state |

| Apply for SSI | Online or at your local SSA office |

What Is the Social Security $994 Payment?

The $994 payment is the maximum federal SSI benefit for an individual in February 2026, following a 2.8% Cost-of-Living Adjustment (COLA). This boost helps SSI recipients keep up with inflation, especially as the price of groceries, rent, and gas keeps creeping higher.

This payment is not the same as Social Security retirement or SSDI. SSI is designed for:

- People aged 65 and older

- Adults and children with disabilities or blindness

- Individuals with limited income and resources

The federal government sets the base amount — in 2026, that’s $994 per month for individuals and $1,491 for couples.

That number may go up in some states thanks to State Supplementary Payments (SSP) — and we’ll cover that shortly.

Why Is It $994 in 2026? (Understanding COLA)

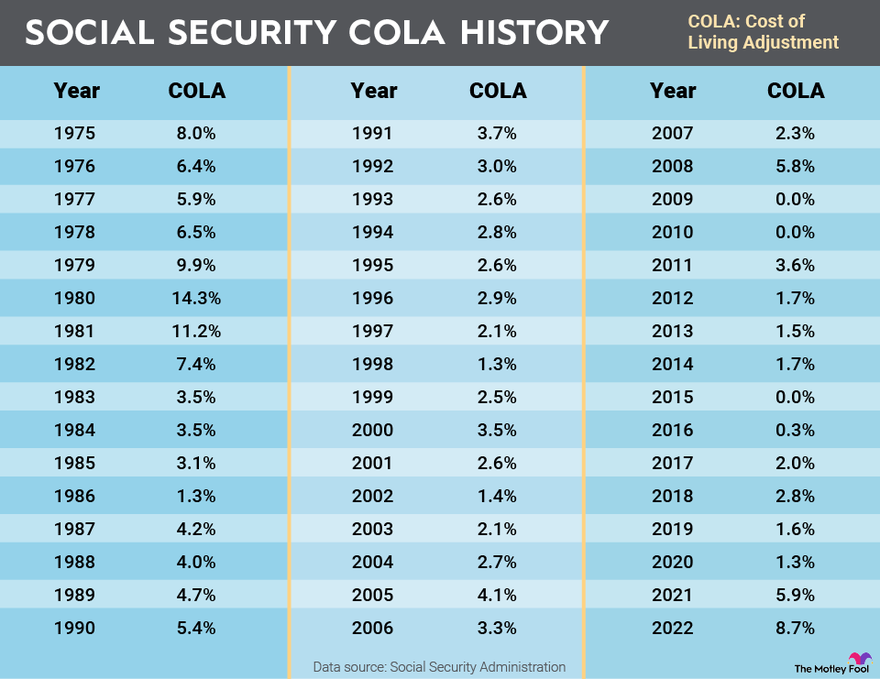

The Cost-of-Living Adjustment (COLA) is how the Social Security Administration keeps benefits in line with inflation. Every fall, the SSA looks at data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to decide if benefits need a boost.

For 2026, the COLA was set at 2.8%, reflecting steady inflation in consumer goods, housing, and energy. That’s why the individual SSI benefit jumped from $967 in 2025 to $994 in 2026.

February 2026 SSI Payment Date

SSI payments are typically sent on the 1st of each month, unless that day falls on a weekend or holiday. When that happens, the payment comes the business day before.

In February 2026, the 1st is a Sunday, so payments will go out on Friday, January 30, 2026.

This applies only to SSI. Other Social Security benefits (retirement, disability, survivor benefits) follow a different schedule.

Social Security Payment Schedule (Based on Birthday):

| Birth Date Range | Payment Date |

|---|---|

| 1st–10th | February 11, 2026 |

| 11th–20th | February 18, 2026 |

| 21st–31st | February 25, 2026 |

These dates apply if you started receiving benefits after May 1997. If you began receiving Social Security before May 1997, you’ll get paid on February 3, 2026.

Who Qualifies for SSI in 2026?

1. You must meet age or disability requirements:

- Age 65 or older, or

- Blind (as defined by SSA), or

- Disabled (physical or mental condition preventing substantial work)

2. You must have limited income and resources:

- Countable income must be low — includes wages, pensions, Social Security retirement, etc.

- Resources (assets) must be below:

- $2,000 for individuals

- $3,000 for couples

Your home, your car (if used for transportation), and certain personal effects usually don’t count against these limits.

3. Citizenship and Residency Requirements

- Must be a U.S. citizen or a qualifying noncitizen

- Must live in the U.S. or certain territories (excluding long-term travel abroad)

State Supplement Payments — You Might Get More

Some states add extra money on top of the federal SSI payment. This varies widely.

Examples:

- California: Adds up to $160/month depending on living situation

- New York: Adds about $87/month

- Massachusetts: Offers up to $114.39/month

- Texas & Arizona: Do not offer state supplements

This is called a State Supplementary Payment (SSP), and the amount depends on your living arrangements, marital status, and income.

SSI vs SSDI – What’s the Difference?

It’s easy to confuse SSI with Social Security Disability Insurance (SSDI) — but they are completely different programs.

| Feature | SSI | SSDI |

|---|---|---|

| Based on work history? | No | Yes |

| Financial Need Required? | Yes | No |

| Funded by | General taxes | Social Security trust fund |

| Health Insurance | Medicaid | Medicare (after 24 months) |

| Monthly Payment | Up to $994 | Varies (based on work earnings) |

Many people receive both SSI and SSDI — this is called concurrent benefits — especially if their SSDI payment is very low.

How to Apply for Social Security $994 Payment– Step-by-Step

Applying for SSI can feel overwhelming, but it’s doable. Here’s how to start:

Step 1: Get Your Documents Together

- Birth certificate or ID

- Social Security number

- Bank statements

- Income and asset records

- Medical records (if applying due to disability)

Step 2: Apply Online, by Phone, or In Person

- Online: https://www.ssa.gov/ssi/

- Phone: 1-800-772-1213

- Local office: Use the SSA locator to find one nearby

Step 3: SSA Reviews Your Application

They may contact you for more documents or interviews.

Step 4: You Receive a Decision (or Appeal If Denied)

If you’re denied, you can file a reconsideration appeal. Many people win benefits during the appeal process with the right medical evidence.

Avoiding SSI Scams — What to Watch Out For

Scammers often pose as Social Security agents to trick people into giving up personal info.

Never share:

- Your SSN

- Bank account numbers

- Login info

SSA will never call you asking for this information or threaten arrest.

Professional Tips for Managing SSI Payments

Financial planners often recommend:

- Stay below the asset limit: Don’t let your bank account cross $2,000.

- Use ABLE accounts: Great for saving money if you’re disabled and under 26.

- Track changes in income: Even part-time work can affect your payment.

- Plan for redeterminations: SSA will regularly check if you still qualify.

Historical Context: How SSI Payments Have Changed Over Time

SSI was created in 1972 under President Nixon. The first payments were made in January 1974, and back then, the maximum monthly benefit was:

- $140 for individuals

- $210 for couples

Over the years, COLA adjustments have steadily increased those amounts. In 2000, the max individual benefit was $512. Fast forward to 2026 — we’re now at $994, showing how important COLA is in protecting purchasing power.

January Social Security Payment Timeline – When the First 2026 Checks Will Be Deposited

Texas Social Security Schedule – Check January 2026 Payment Dates and Eligibility Criteria

Social Security Payment January 14, 2026 – Who Gets Paid and How COLA Affects the Amount