Social Security 2026 Update: Social Security 2026 Update is one of the hottest financial topics heading into the new year. Whether you’re already collecting benefits, applying soon, working while drawing Social Security, or just planning for retirement, 2026 brings meaningful updates that can impact how much you get, when you get it, and how you manage your finances. With over 75 million Americans relying on Social Security and Supplemental Security Income (SSI), understanding these updates is key. This article simplifies what’s changing, explains payment schedules, dives into new earning limits, and shares practical advice you can act on. And yes — we’ll keep things easy to follow, with examples, tips, and a tone that’s friendly but informed, like getting help from a savvy neighbor who also happens to be a retirement planner.

Table of Contents

Social Security 2026 Update

Social Security in 2026 is changing just enough to matter. With a 2.8% COLA, adjusted payment dates, new earnings limits, and rising Medicare costs, there’s a lot to keep track of. Whether you’re already receiving benefits or planning to apply soon, now’s the time to review your strategy, track your income, and prepare for what’s next.

| Topic | 2026 Update / Data |

|---|---|

| COLA (Cost-of-Living Adjustment) | +2.8% increase for most benefits |

| Average Monthly Increase | About +$56 more per month (retirees) |

| SSI Maximum Federal Amounts | $994 individual, $1,491 couple |

| Payment Timing Rule | Wed (2nd/3rd/4th) based on birthdate |

| Earnings Test Limits (Under FRA) | $24,480/year |

| Earnings Test Limits (Reaching FRA) | $65,160/year |

| Taxable Earnings Cap (Wage Base) | $184,500 |

| Full Retirement Age | 67 for those born 1960+ |

What Is Changing in Social Security 2026 Update?

Let’s start with the biggest news. In 2026, the Social Security Administration (SSA) is implementing a 2.8% cost-of-living adjustment (COLA). This increase helps beneficiaries keep up with inflation — meaning your checks will stretch a little further when you’re buying groceries, paying rent, or filling prescriptions.

For the average retiree, that 2.8% equals around $56 more per month, or about $672 per year. For couples who are both receiving benefits, the increase is even more noticeable. If you’re receiving Supplemental Security Income (SSI), your monthly payment goes up to $994 for individuals and $1,491 for couples.

Why is this a big deal? Because prices are still climbing. From rent to ramen noodles, inflation eats into fixed incomes — and COLA helps soften that blow. While it won’t solve every cost crunch, it keeps your benefits from losing value year after year.

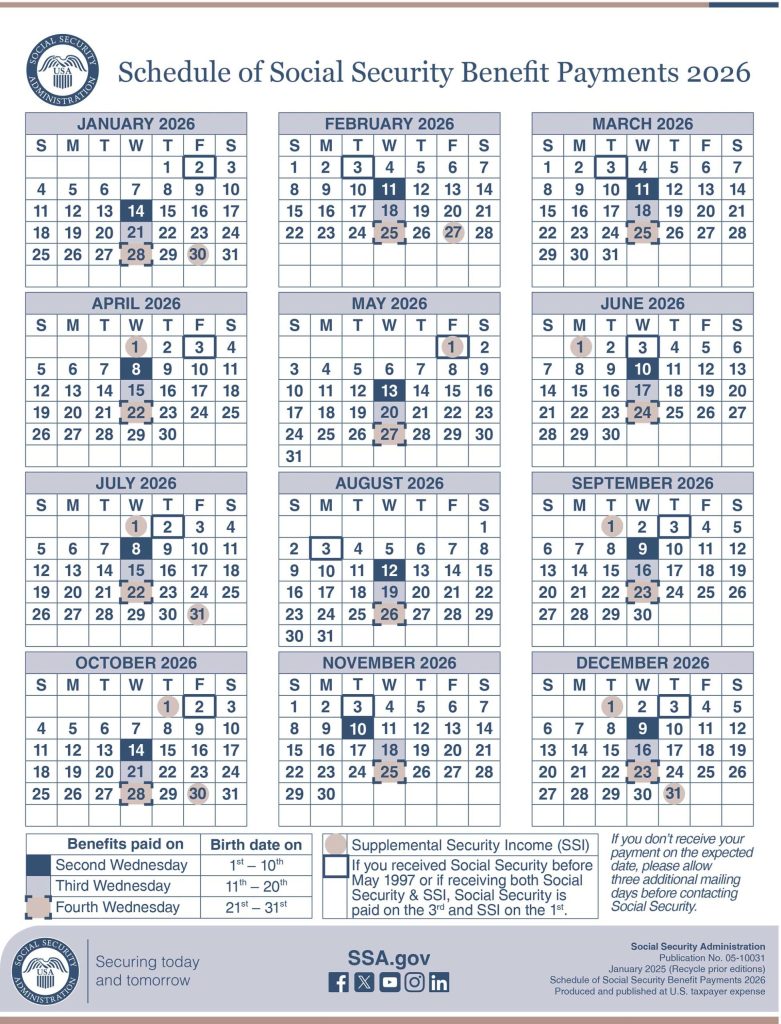

New Payment Dates and How They Work

One change that catches people off guard each year is the Social Security payment schedule. It’s not random — but it does follow rules that many folks don’t fully understand.

Here’s how the 2026 payment schedule breaks down for most recipients:

For Retirement, Disability, and Survivor Benefits:

If your Social Security benefits started after May 1997, you’re on the birthdate-based payment schedule:

- Born 1st–10th → Paid on the 2nd Wednesday of the month

- Born 11th–20th → Paid on the 3rd Wednesday

- Born 21st–31st → Paid on the 4th Wednesday

Let’s say you were born on May 6th. You’ll get paid on the 2nd Wednesday every month. If your birthday is July 19th, it’s the 3rd Wednesday. Simple once you know the formula — but important to plan around.

For Supplemental Security Income (SSI):

SSI recipients get paid on the 1st of every month, unless that date is a weekend or federal holiday. In that case, payment is moved one business day earlier.

Example: If the 1st falls on a Sunday, the check hits your account on the preceding Friday.

Understanding these dates is key to managing rent payments, auto-drafts, utility bills, and grocery runs. Mark them on your calendar or set mobile reminders to stay ahead.

How Much Will You Actually Get?

Now that we’ve covered the COLA increase and the schedule, let’s look at real numbers.

Here’s what the average benefits look like in 2026:

- Retired workers: $2,071/month (up from $2,015 in 2025)

- Spouses of retirees: ~$894/month

- Disabled workers: ~$1,537/month

- SSI individual (max federal): $994/month

- SSI couple (max federal): $1,491/month

These numbers vary based on your lifetime earnings and the age you claimed benefits. But the COLA applies across the board — everyone gets the same percentage bump.

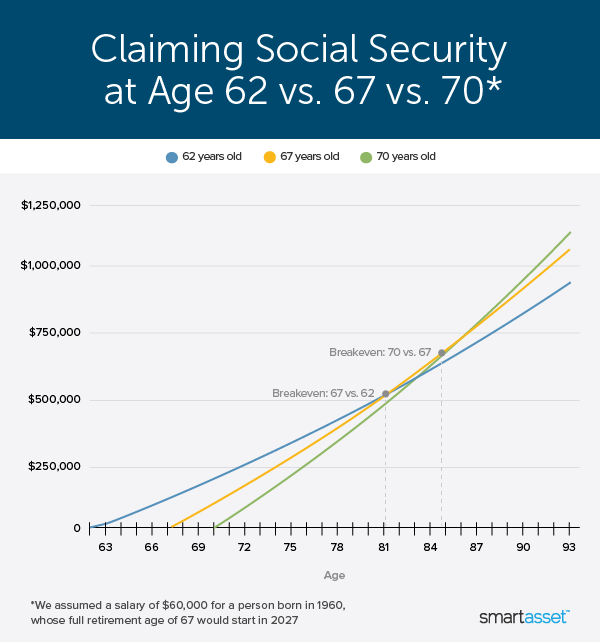

Full Retirement Age and Delayed Retirement

Full Retirement Age (FRA) in 2026 remains 67 for those born in 1960 or later. That’s the age when you can receive 100% of your calculated Social Security benefits.

But you don’t have to wait until 67. You can claim as early as age 62, though your monthly benefit will be permanently reduced. Claiming early can make sense if you need the money or have health concerns — but it costs you in the long run.

On the flip side, if you delay claiming past 67, your benefits grow 8% per year until age 70. This is called delayed retirement credits — and it’s one of the smartest moves for people who can afford to wait. In some cases, delaying to age 70 can boost your monthly check by 32% or more.

Work and Social Security: Earnings Limits Explained

Can you work while collecting Social Security? Absolutely. But if you’re under your full retirement age, there are earning limits that may temporarily reduce your benefits.

In 2026, here’s how it works:

- Under Full Retirement Age:

You can earn up to $24,480/year without penalty. If you go over, SSA will deduct $1 for every $2 earned above the limit. - Year You Reach FRA:

The limit increases to $65,160. For every $3 over the limit, SSA deducts $1 — but only until your birthday month. After that, there’s no limit. - After Full Retirement Age:

There’s no earnings limit. Work all you want — your benefit stays the same.

Don’t worry — benefits that are withheld due to working are not lost forever. SSA recalculates your benefits once you hit FRA, and your monthly amount may go up.

Medicare and Hidden Costs

Let’s talk about something that eats away at your benefit — Medicare premiums.

Most people are enrolled in Medicare Part B at age 65, and its premiums are usually deducted straight from your Social Security check. That means your actual deposit may be smaller than your gross benefit.

In 2026, Medicare Part B premiums are expected to increase again, following medical inflation. This could offset some or all of the COLA increase for certain retirees, especially those in higher-income brackets who pay IRMAA surcharges (Income-Related Monthly Adjustment Amount).

It’s not the most exciting part of the update, but it’s crucial for budgeting.

Taxes on Social Security 2026 Update

Here’s another thing that surprises folks: Social Security income can be taxed by the IRS.

If your combined income exceeds certain thresholds, up to 85% of your benefits can be taxable.

Combined income = Adjusted Gross Income (AGI) + Nontaxable interest + Half of Social Security

For example:

- Single filers: Taxable if combined income > $25,000

- Married filing jointly: Taxable if combined income > $32,000

These income thresholds haven’t been updated in decades — so more and more people fall into the taxable zone every year.

Practical Planning Tips on Social Security 2026 Update

Here’s how to make the most of these updates:

- Create a “my Social Security” account to view your benefit estimates, COLA notices, and payment history.

- Know your payment date — this helps prevent overdrafts and missed bills.

- Factor in Medicare when planning your net monthly income.

- Delay claiming if possible — your monthly check could be 24–32% higher if you wait until age 70.

- Plan around taxes — talk to a financial planner or CPA if your combined income is near IRS thresholds.

- Consider working past 62 — not only can you earn more, but it also increases your future Social Security benefit calculation.

Social Security Benefits at 62, 65 & 70 – Average Monthly Checks Explained Side by Side

Social Security Boost by State 2026 – Five States Where Benefits Could Rise by Up to $2,000

Social Security Payments 2026 – Why Higher Checks May Not Increase Take-Home Income