Save $450 in 2026 Thanks to Trump Tax Cuts: If you’re a retiree — or planning to call it quits from the workforce soon — you’re going to want to keep your eyes on 2026 tax changes. Thanks to a fresh set of rules passed under former President Donald Trump’s tax overhaul, millions of older Americans could save up to $450 when filing their federal income taxes in 2027. It’s not just a campaign promise — the “One Big Beautiful Bill Act” (OBBBA) is now the law of the land, and it delivers meaningful financial relief, especially for middle-income seniors. So let’s break it down: who qualifies, what changed, and how you can make sure you’re getting every last dollar back in your pocket.

Table of Contents

Save $450 in 2026 Thanks to Trump Tax Cuts

Thanks to the One Big Beautiful Bill Act, retirees could save up to $450 in federal taxes starting in 2026. If you or your spouse are 65 or older and your income falls within the qualifying range, you may benefit from a substantial increase in the standard deduction — meaning you keep more of your hard-earned (and hard-saved) money. Tax laws are complicated, but this one is worth understanding — and leveraging.

| Feature | Details |

|---|---|

| Law Name | One Big Beautiful Bill Act (OBBBA) |

| Applies To | Tax Year 2026 (filing in 2027) |

| Who Benefits | U.S. taxpayers aged 65+ |

| Deduction Amount | $6,000 (Single), $12,000 (Married, both 65+) |

| Maximum Estimated Tax Savings | Up to $450 |

| Income Threshold for Full Deduction | $75,000 (Single), $150,000 (Married) |

| Filing Requirement | Standard deduction via Form 1040 or 1040-SR |

| Official Source | IRS: Standard Deduction Rules |

What’s New: A Closer Look at the Trump Tax Cuts

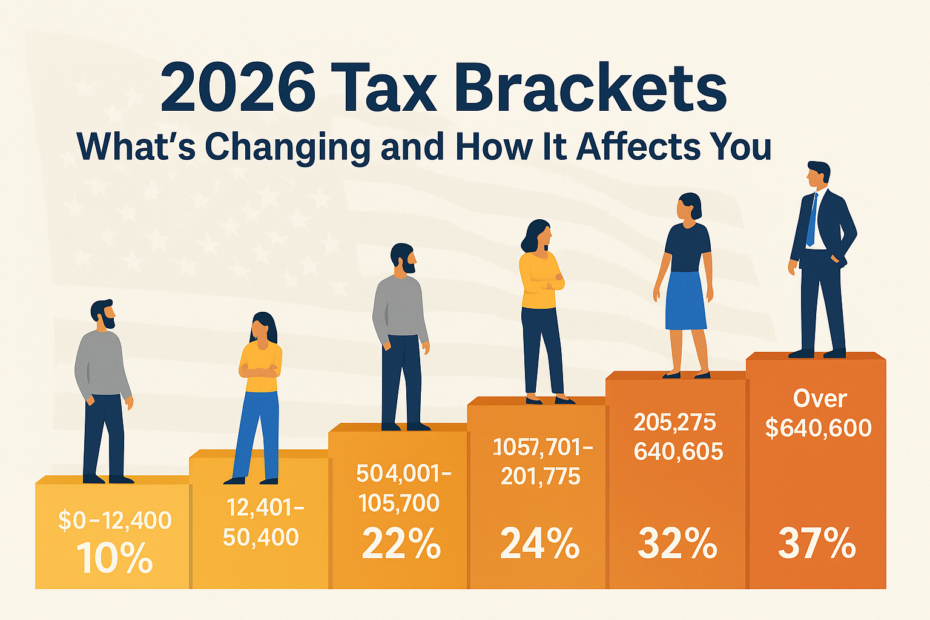

In 2025, the U.S. saw a sweeping tax reform package pass through Congress with significant changes aimed at middle-class households, small business owners, and especially retirees. Dubbed the One Big Beautiful Bill Act (OBBBA), it restructured standard deductions and tax brackets to provide broader relief to those living on fixed incomes.

One of the bill’s most impactful features for seniors is the enhanced standard deduction for individuals aged 65 and older, which increases their non-taxable income threshold and in turn lowers or eliminates taxes on Social Security and other retirement income.

Why This Trump Tax Cuts Matters — Especially in 2026

The timing couldn’t be more crucial. Retirees across America are already feeling the pinch. The Senior Citizens League reports that the purchasing power of Social Security has dropped by more than 30% since 2000, due to rising costs of essentials like housing, healthcare, and food.

Here are a few reasons this tax cut matters now more than ever:

- Inflation Impact: Healthcare costs have risen nearly 5% annually over the past decade.

- Savings Challenges: Only about 56% of retirees say they feel financially secure, per Transamerica Center for Retirement Studies.

- Social Security Taxation: Around 50% of Social Security recipients pay taxes on their benefits — a figure the new deduction aims to reduce significantly.

By increasing the standard deduction by $6,000 for individuals and $12,000 for eligible couples, the federal government is effectively raising the bar before income becomes taxable — which could mean more benefits stay in retirees’ pockets.

How Much Can Retirees Really Save?

Let’s walk through a realistic example. Meet Robert and Linda, both 67, retired, and living off a combination of Social Security and a small pension. Their total income is $48,000 annually.

- Under previous tax law, their federal tax liability was roughly $5,223.

- With the new deduction added in 2026, their liability drops to $4,773.

- That’s a $450 savings, equivalent to about 1% more take-home cash.

Depending on your personal situation — how much you earn, your filing status, and whether you’re drawing from retirement accounts — your savings may vary. But for most middle-income seniors, this could mean hundreds of dollars back in your wallet each year.

Eligibility Requirements: Who Qualifies?

To take advantage of the expanded standard deduction, you’ll need to meet a few clear requirements:

1. Age Threshold

You must be at least 65 years old by December 31, 2026. If you’re married, both spouses need to meet this threshold to claim the full $12,000 enhanced deduction.

2. Income Limits

To qualify for full savings, your Adjusted Gross Income (AGI) must be:

- Under $75,000 if filing single

- Under $150,000 if filing jointly

Beyond those thresholds, the deduction phases out, and taxpayers earning up to $175,000 (single) or $250,000 (married) may still qualify for partial savings.

3. Filing Status

You must file either:

- Form 1040

- Or Form 1040-SR (designed specifically for seniors with larger print and simplified layout)

Importantly, you do not need to itemize deductions. The extra senior deduction is part of the standard deduction and applied automatically if you meet the age and income criteria.

How to Save $450 in 2026 Thanks to Trump Tax Cuts: Step-by-Step Guide

Here’s how to make sure you’re not leaving money on the table:

Step 1: Review Your Income

Gather all 1099s, SSA-1099 (Social Security benefits), W-2s, or retirement statements to estimate your total Adjusted Gross Income.

Step 2: Use IRS Form 1040 or 1040-SR

The 1040-SR is recommended for seniors — it’s easier to read and highlights the age-based deduction.

Step 3: Select Standard Deduction

Avoid the hassle of itemizing unless you have complex deductions. As long as you meet age requirements, the IRS will automatically include the additional $6,000 or $12,000 into your standard deduction.

Step 4: File Early and Get Help

File early to avoid delays and access any refunds quickly. If you’re unsure how to proceed, get free or low-cost assistance from:

- AARP Tax-Aide

- IRS Free File

- Reputable software like TurboTax, H&R Block, or FreeTaxUSA

How It Compares to Prior Tax Laws?

Let’s take a look at how this new benefit stacks up against previous rules:

| Category | Before OBBBA (2023) | After OBBBA (2026) |

|---|---|---|

| Senior Deduction | $1,850 (Single), $3,000 (Married) | $6,000 / $12,000 |

| Tax-Free Threshold | ~$13,850 (Single) | ~$21,700 (Single) |

| Effect on Social Security Taxation | Many middle-class retirees taxed | Many retirees now exempt |

| Total Max Savings | ~$100–$150 | Up to $450 |

This change means that millions of seniors who were previously paying taxes on Social Security or small pensions will now pay little to nothing, freeing up cash for essentials like medical care, transportation, and housing.

Additional Tax Strategies for Retirees

While the new deduction is automatic, there are several proactive steps you can take to boost your tax outcome:

- Delay Social Security to increase future benefits and minimize early taxation.

- Utilize Roth IRAs — qualified withdrawals are tax-free.

- Consider Qualified Charitable Distributions (QCDs) if you’re 70½ or older, which can reduce your AGI.

- Contribute to Health Savings Accounts (HSAs) while eligible — funds can be used tax-free in retirement for medical expenses.

The more you understand how your income sources impact your tax bracket, the better you can manage your withdrawal strategy.

Potential Limitations or Criticisms

While the deduction is generous, it’s not without flaws:

- Low-income retirees (those already below the tax filing threshold) may not benefit much.

- Wealthy seniors earning beyond the phase-out limits will see reduced or no benefit.

- It may create confusion among seniors accustomed to previous deduction amounts.

Critics also point out that the law, like many tax cuts, may sunset after several years if not renewed by Congress — so the benefit may not be permanent.

Texas Social Security Schedule – Check January 2026 Payment Dates and Eligibility Criteria

SNAP Error Rates by State – Where Overpayments and Underpayments Happen Most Often