Real Reason Walmart Still Refuses Mobile Payments: Whether you’re a Gen Z college student trying to tap your phone at checkout or a parent juggling a toddler and groceries, you’ve likely faced the same surprise at Walmart: your Apple Pay or Google Pay just doesn’t work. Neither Apple Pay nor Google Pay is accepted at Walmart stores across the United States, and it’s not because the tech isn’t available. It’s an intentional, strategic decision made by the retail giant—and it’s been that way for years. This article dives deep into the real reasons Walmart still refuses to accept tap-to-pay mobile wallets, what it means for shoppers and businesses, and what alternatives you can use instead. We’ll walk through everything from how Walmart Pay works to what this means for the future of mobile payments.

Table of Contents

Real Reason Walmart Still Refuses Mobile Payments

Walmart’s refusal to accept Apple Pay or Google Pay isn’t about being behind the times—it’s about strategy. By controlling the payment experience through Walmart Pay, the company avoids hardware upgrades, protects its data interests, and keeps customers within its ecosystem. Still, this approach comes with trade-offs. In a world where mobile wallets are now the norm, Walmart’s stance leaves many customers feeling inconvenienced and unheard. Whether the company eventually caves to customer pressure or doubles down on its system, one thing is clear: how we pay is changing fast—and Walmart is gambling that their way is still the best way.

| Topic | Key Info & Data |

|---|---|

| Apple Pay acceptance | No — Walmart does not accept Apple Pay at U.S. registers, online, or self-checkout. |

| Google Pay acceptance | No — Google Pay and other NFC tap-to-pay wallets are not supported. |

| Walmart’s mobile payment option | Walmart Pay via QR code inside the Walmart app. |

| Mobile wallet adoption in the U.S. | Apple Pay is accepted at ~85–90% of U.S. retailers. |

| Why Walmart resists Apple/Google Pay | Walmart prioritizes data control, customer ecosystem, and cost savings |

| Mobile wallet usage trends | Mobile wallet payments reached nearly $2 trillion in U.S. by 2024. |

| Official Walmart Pay | https://www.walmart.com/pay |

Why Does Walmart Still Refuses Mobile Payments?

Walmart has been asked this question so many times it might as well be on a T-shirt. While most major retailers—like Target, Starbucks, CVS, and Kroger—allow customers to pay with just a tap of their phone, Walmart refuses to follow suit.

Let’s break it down with clarity.

1. Control Over the Payment Ecosystem

Walmart wants control over the entire transaction process—from your product search in their app to the way you pay at the register. That’s why they developed Walmart Pay, a mobile payment system embedded directly in the Walmart app.

Unlike Apple Pay or Google Pay, which work across hundreds of thousands of stores, Walmart Pay keeps the shopper inside the Walmart ecosystem. The app isn’t just for payments; it includes your purchase history, savings catcher, store maps, and even product scanning.

Keeping shoppers in their own app is a strategic advantage that increases the chance of upselling, collecting behavioral data, and building long-term loyalty.

2. Data Ownership Is the Real Goldmine

Apple and Google are big on privacy. When you use Apple Pay, your card number is never shared with the merchant. Instead, it uses a unique Device Account Number that keeps your transaction secure—and largely invisible to the retailer.

This presents a challenge for Walmart.

Without access to that card or transaction data, Walmart can’t connect purchases to specific customer accounts. With Walmart Pay, the company sees:

- What you bought

- When you bought it

- How much you spent

- What promotions worked on you

This allows Walmart to tailor advertising, stock inventory intelligently, and develop personalized promotions based on your history.

3. Avoiding NFC Hardware Costs

To accept Apple Pay or Google Pay, retailers need to install NFC (Near Field Communication) readers at all checkout points. These devices aren’t cheap. With over 5,300 Walmart stores and thousands of registers, the cost would be substantial.

Instead, Walmart Pay uses QR codes, which work with existing barcode scanners and any smartphone with a camera. This means minimal additional investment and a fast rollout across the entire store network.

From a business perspective, it’s the cost-effective route. But from a shopper’s point of view, it’s not nearly as convenient as a quick tap of a smartwatch or phone.

4. Historical Resistance to External Payment Systems

Let’s not forget the past. Walmart was part of a consortium called MCX (Merchant Customer Exchange), which created a mobile payment app called CurrentC. It was meant to rival Apple Pay and reduce dependence on credit card networks by encouraging ACH (direct bank) transfers.

While CurrentC flopped and MCX eventually disbanded, the attitude remained. Walmart prefers to operate independently of tech giants when it comes to consumer payments.

This is the same mindset behind their reluctance to join Apple Pay.

How Walmart Pay Works — A Practical Guide

If you’re determined to go mobile at Walmart, Walmart Pay is your only option. Fortunately, it’s not too hard to use.

Here’s a step-by-step walkthrough:

- Download the Walmart App

Available on both the Apple App Store and Google Play. - Set Up Walmart Pay

Inside the app, go to Services → Walmart Pay.

Link your credit/debit card or Walmart gift card. - At Checkout

Open Walmart Pay on your phone.

A QR code will pop up on the register screen.

Use your phone’s camera to scan the code. - Confirmation

You’ll get a digital receipt immediately in your app.

Is it smooth? Yes. Is it as seamless as Apple Pay? Arguably not—but it’s the best available option if you want to go wallet-free at Walmart.

What About Online Purchases?

Walmart.com and the Walmart app also do not accept Apple Pay or Google Pay for online purchases. You’ll need to use:

- Credit/debit cards

- Walmart gift cards

- EBT (in certain states)

- PayPal (in some cases)

This continues the trend of keeping shoppers inside Walmart’s payment infrastructure.

Mobile Wallet Adoption in the U.S.

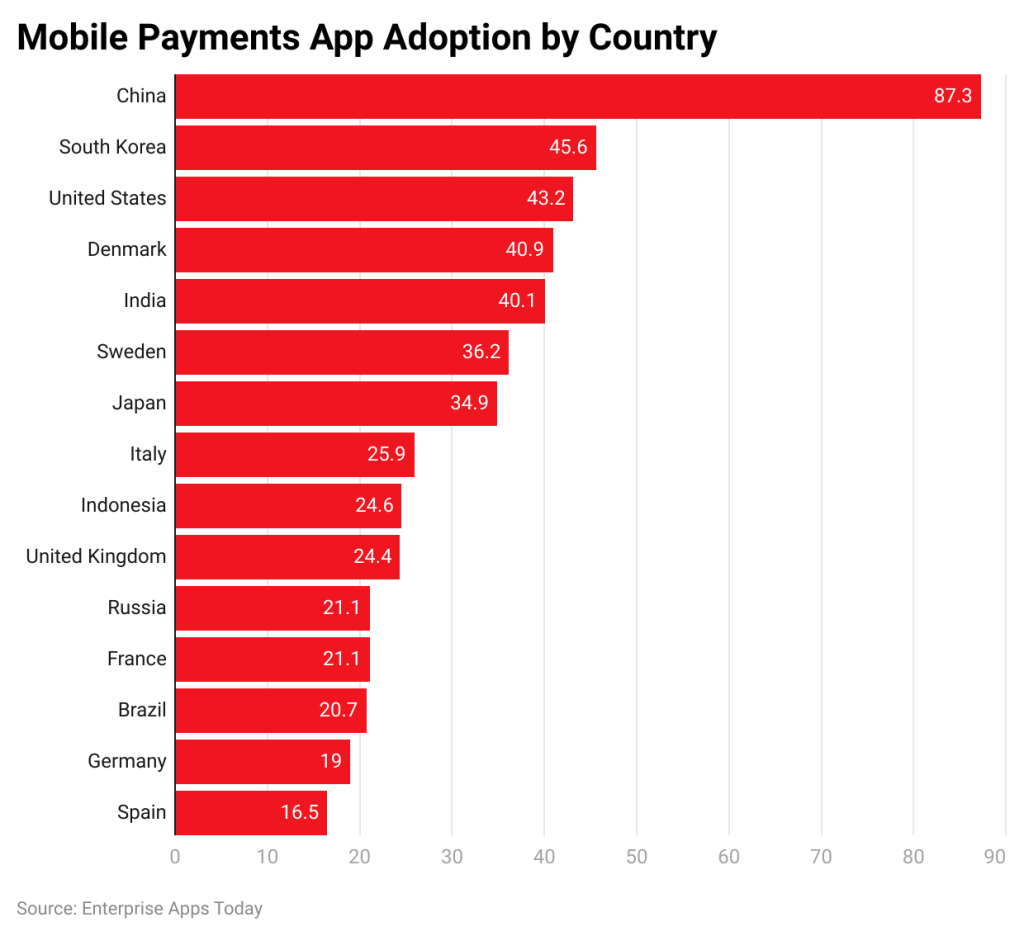

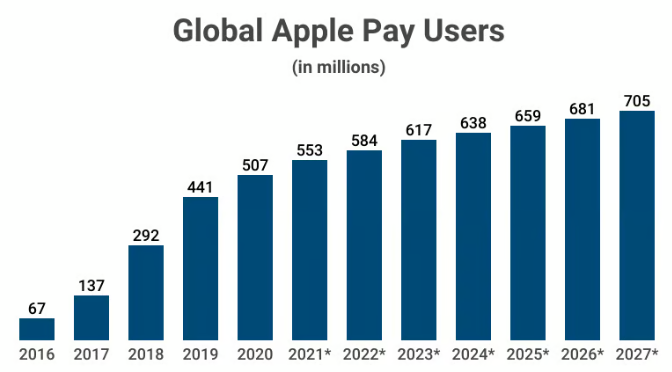

To understand why shoppers are so frustrated, just look at the numbers:

- Apple Pay is available at 85–90% of U.S. retailers.

- Google Pay is accepted by most Android-supported chains.

- Mobile wallet payments in the U.S. hit nearly $2 trillion in 2024, up from $1.3 trillion in 2022.

The expectation has changed. Shoppers want contactless payments—and Walmart isn’t providing them.

What’s more? Over 53% of consumers say they feel safer using mobile wallets than physical cards, especially post-pandemic.

In this landscape, Walmart’s refusal stands out like a sore thumb.

Frustration from Shoppers and Tech Users

Online forums and social media are filled with complaints like:

- “Why does Walmart feel like it’s in 2005?”

- “Every other store takes Apple Pay. I walked out when I couldn’t tap.”

- “Even my local coffee truck takes Google Pay. Why not Walmart?”

Walmart’s stance might make business sense internally—but it creates real friction at the customer level. With increasing tech adoption, this decision could even hurt brand loyalty among younger consumers.

Comparison: Walmart Pay vs Apple Pay vs Google Pay

| Feature | Walmart Pay | Apple Pay | Google Pay |

|---|---|---|---|

| Technology | QR Code | NFC | NFC |

| Accepted at Walmart | Yes | No | No |

| Accepted Elsewhere | No | Yes | Yes |

| Privacy Features | Low (data shared with Walmart) | High (tokenized) | High (tokenized) |

| Platform Loyalty | Walmart-only | iPhone, Apple Watch | Android, Wear OS |

| Setup Complexity | Moderate | Easy | Easy |

Will Walmart Still Refuse Mobile Payments?

As of late 2025, Walmart has given no official statement indicating it will accept Apple Pay or Google Pay in the future. While they haven’t completely closed the door, insiders suggest that Walmart is doubling down on expanding features in its own app—rather than adopting external wallet systems.

Still, customer demand may eventually lead to a shift. Retailers must follow the money—and if shoppers abandon Walmart for more convenient options, even a giant like Walmart may need to reconsider.

Walmart Mobile Payment Policy – Why Apple Pay and Google Pay Still Don’t Work at Walmart Stores

Walmart Slashes Jewelry Prices Nationwide: Swarovski Necklace Drops to $19 – Check Details

Walmart Christmas Eve 2025 Deals: What’s Still On Sale at the Last Minute