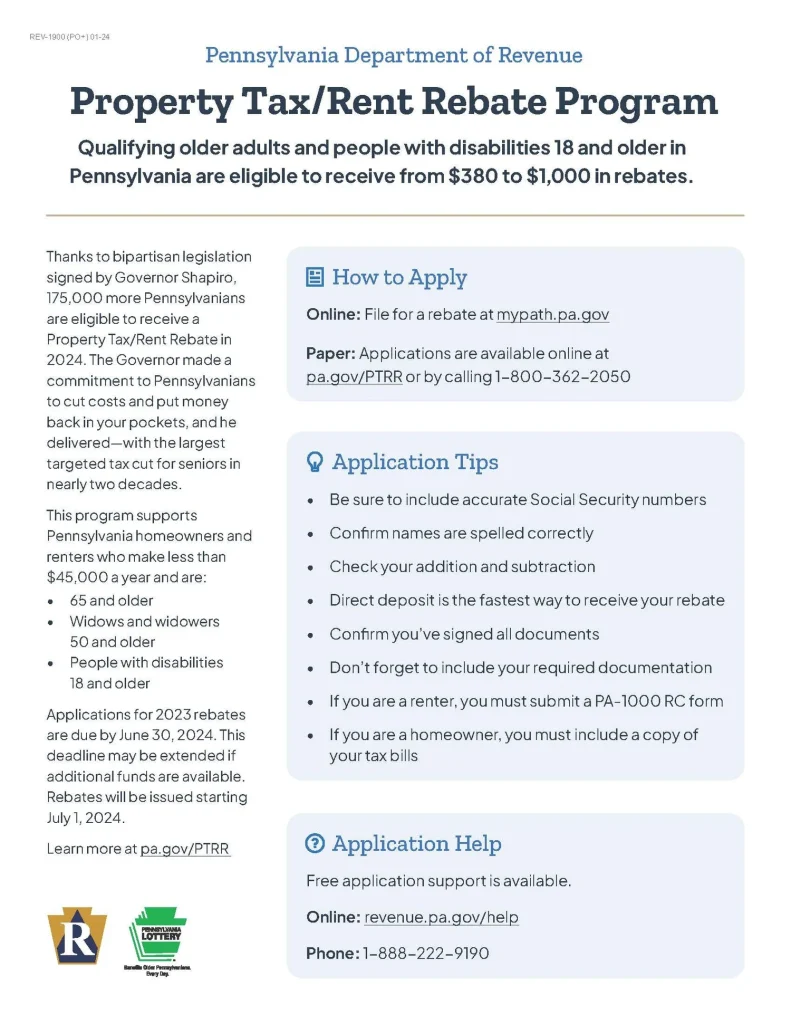

Pennsylvania’s $1,000 Stimulus Payment: As 2026 approaches, many Pennsylvanians are hopeful for the state’s $1,000 stimulus payment. But before you get too excited, it’s important to know exactly what this payment is, who qualifies, and how you can check if you’re eligible. In this guide, we’ll break down all the essential information about Pennsylvania’s Property Tax/Rent Rebate Program—which is often referred to as the “stimulus payment” for its financial relief benefits—and give you step-by-step instructions on how to apply and track your rebate. In this article, we’ll provide clear explanations, essential facts, and insights that both everyday citizens and professionals can use. If you want to know everything about this important program, keep reading!

Table of Contents

Pennsylvania’s $1,000 Stimulus Payment

The Pennsylvania $1,000 Stimulus Payment is not a traditional federal check, but the Property Tax/Rent Rebate Program offers much-needed financial relief to eligible residents. If you are 65 or older, a widow/widower, or have a permanent disability, and if your income is under $48,110, you could be eligible for up to $1,000 in rebates. Be sure to apply before the June 30, 2026 deadline, and keep track of your application to ensure you receive your rebate as soon as possible. By following this step-by-step guide, you can maximize your chances of receiving the financial support you need.

| Key Data/Stats | Details |

|---|---|

| Payment Amount | Up to $1,000 (possibly more with supplemental rebates) |

| Eligibility Age | 65+, Widow/Widower 50+, or 18+ with permanent disability |

| Income Limit | $48,110 or less (for household income) |

| Application Deadline | June 30, 2026 |

| Rebate Distribution | Payments start July 1, 2026 |

| Official Website | Pennsylvania Property Tax/Rent Rebate |

What Is the Pennsylvania’s $1,000 Stimulus Payment?

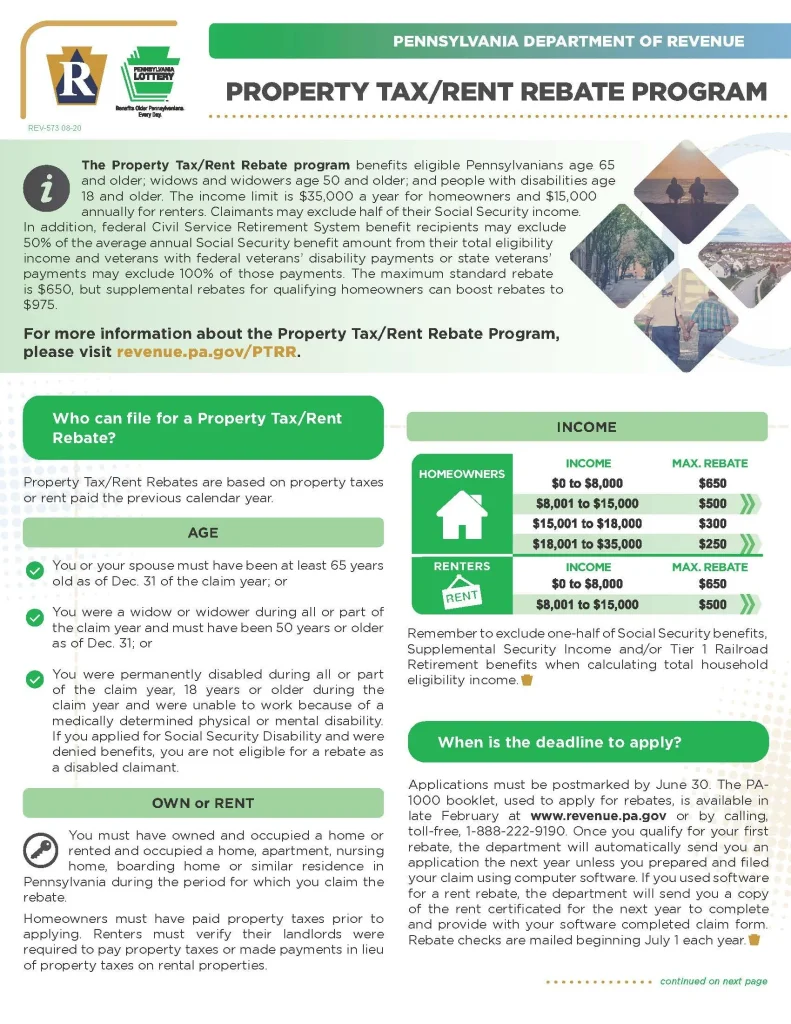

The $1,000 stimulus payment circulating in Pennsylvania is actually part of the state’s Property Tax/Rent Rebate Program (PTRR). This rebate isn’t a federal stimulus check, but rather a state-level tax relief initiative designed to help older adults and those with disabilities offset the cost of property taxes or rent.

The Basics of the Property Tax/Rent Rebate Program (PTRR)

Pennsylvania’s Property Tax/Rent Rebate Program has been around for decades, offering financial relief to qualified residents. The payments are based on the property taxes or rent that applicants paid in the previous year. In 2026, eligible individuals can receive a rebate of up to $1,000, which can be a real help for those living on fixed incomes, such as retirees or individuals with disabilities.

While this rebate program has been ongoing, it’s become especially significant in light of rising costs across the country. With the 2026 application period already open, this guide will help you determine if you qualify, how to apply, and when you can expect to receive your rebate.

Who Is Eligible for the Pennsylvania’s $1,000 Stimulus Payment?

The Property Tax/Rent Rebate Program has specific requirements, so not everyone will qualify for the full $1,000. Here’s a breakdown of who is eligible:

Age and Disability Requirements

- Seniors: To qualify, you must be 65 years of age or older by December 31, 2025. This means if you were born before January 1, 1961, you’re eligible.

- Widow/Widowers: If you are a widow or widower aged 50 or older, you also qualify.

- Individuals with Disabilities: If you are 18 years old or older and have a permanent disability, you can qualify as well.

Income Requirements

To be eligible for a rebate, your annual income (for the 2025 tax year) must be $48,110 or less. This income includes wages, pensions, Social Security benefits, and other types of income.

Residency Requirements

You must be a Pennsylvania resident to apply for the Property Tax/Rent Rebate Program. The payment is available to individuals who have lived in the state for at least half the year.

How to Apply for Pennsylvania’s $1,000 Stimulus Payment?

Step 1: Gather Necessary Documents

Before applying, it’s important to have the required documents. These might include:

- Proof of income (e.g., pay stubs, Social Security statements, or tax returns)

- Proof of rent or property taxes paid (e.g., lease agreements or property tax bills)

Step 2: Submit Your Application

To apply, visit the Pennsylvania Department of Revenue’s online portal—myPATH.pa.gov. There, you can fill out the necessary forms and upload any required documents. You can also apply by phone or mail if you prefer not to submit your application online.

Step 3: Wait for Confirmation

After you apply, the state will review your application. If everything checks out, you’ll receive a rebate. You can check your application’s status online with the Where’s My Rebate? tool. This tool helps you track the progress of your application, making it easier to stay updated on when to expect your payment.

When Will the Payment Be Issued?

The rebates for 2025 property taxes and rent will start to be distributed on July 1, 2026. This means if you apply early in 2026, you may have to wait until July for your rebate to be processed and sent. The Pennsylvania Department of Revenue will issue payments via direct deposit or a paper check.

If you miss the application deadline on June 30, 2026, you won’t be able to get your rebate until the next year. So be sure to apply on time!

Supplemental Rebates: The “Kicker”

In some cases, applicants can receive a supplemental rebate in addition to the regular payment. These “kicker” rebates are available to people whose property taxes are high compared to their income. If you qualify for the kicker, your rebate could be higher than $1,000.

$1702 Stimulus Payment 2026: Is It Really Confirmed?

Stimulus Check Update 2026: Is the $2,000 Payment Actually Coming?

Minnesota Stimulus Payment 2026 – Eligibility Rules for Checks Worth Up to $1,423