Pennsylvania Extends Rebate Deadline: If you live in Pennsylvania and paid rent or property taxes in 2024, you might be missing out on up to $1,000 in cash — money that the state wants to give you. Thanks to recent changes by state officials, the deadline for the Property Tax/Rent Rebate Program (PTRR) has been extended until December 31, 2025. That’s a full extra year to get your paperwork in — and potentially receive a check in the mail (or direct deposit) that could cover groceries, utilities, prescriptions, or anything else you need. This guide explains everything: who qualifies, how much you can get, how to apply, and why this program has expanded in 2025. Whether you’re applying for yourself, a parent, or a neighbor, this article gives you the information you need.

Table of Contents

Pennsylvania Extends Rebate Deadline

If you’ve ever said, “I wish there were more help out there,” this is it. The Property Tax/Rent Rebate Program is real, expanded, and easier to apply for than ever. Whether you’re a senior on Social Security, a disabled veteran, or helping your aging parent, now’s the time to claim what’s rightfully yours. The deadline to apply is December 31, 2025, but there’s no reason to wait. Apply now, spread the word, and make sure every eligible Pennsylvanian gets their share.

| Topic | Details |

|---|---|

| Program Name | Property Tax/Rent Rebate Program (PTRR) |

| Administered By | Pennsylvania Department of Revenue |

| Deadline to Apply | December 31, 2025 |

| Max Rebate Amount | $1,000 (plus possible supplemental rebates) |

| Eligibility Age | 65+, Widow(er) 50+, or Disabled 18+ |

| Income Limit | $45,000 annually (half of Social Security income excluded) |

| Application Methods | Online at myPATH, mail, or in-person |

| Support Hotline | 1-888-222-9190 |

| Official Source | PA Revenue Department PTRR Page |

Understanding the PTRR Program: What Is It and Why Does It Matter?

The Property Tax/Rent Rebate Program (PTRR) is a Pennsylvania state program, started back in 1971, that aims to give back part of the money residents spend on rent or property taxes each year. It’s specifically designed to support older adults and people with disabilities who are often on fixed incomes.

Now in 2025, thanks to Governor Josh Shapiro’s Property Tax/Rent Rebate Law, the program has been modernized, including:

- An increased income cap (up from $35,000 to $45,000)

- A boosted maximum rebate (up from $650 to $1,000)

- Indexing for inflation starting in 2026

- Extended application deadline through December 2025

This reform was passed as part of Act 7 of 2023, with bipartisan support, and is expected to benefit more than 175,000 new applicants on top of the hundreds of thousands already eligible.

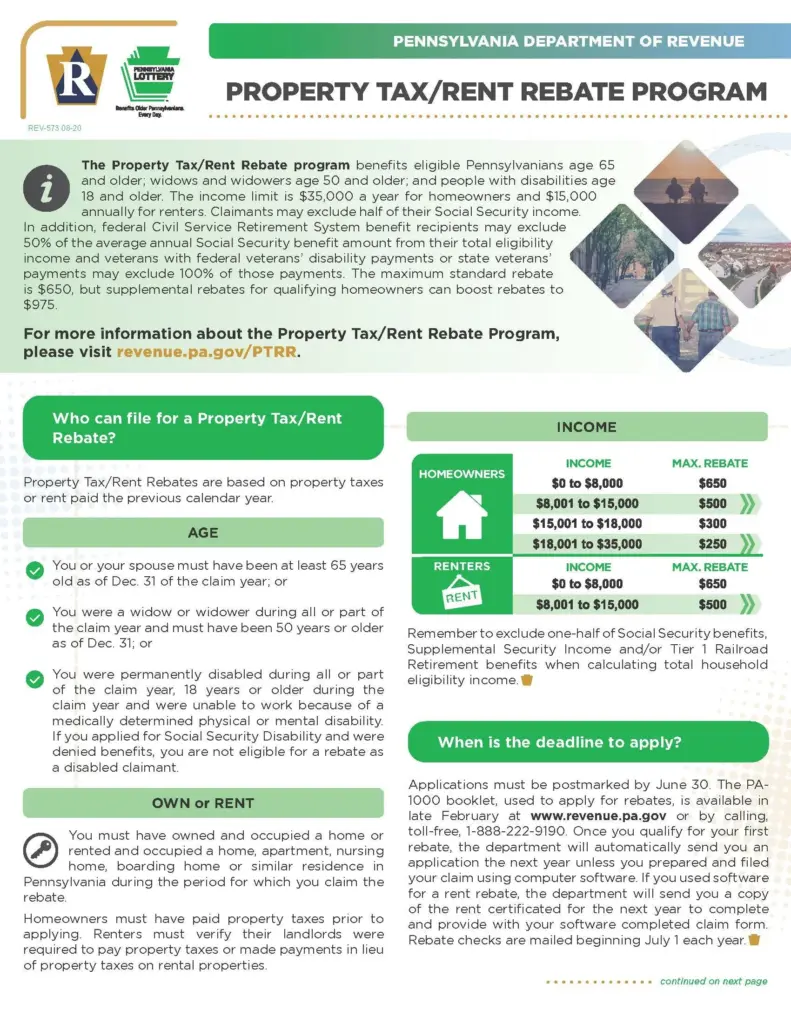

Who Can Apply for the PTRR Rebate As Pennsylvania Extends Rebate Deadline?

To be eligible for the rebate, you must meet the age/disability and income criteria:

Age or Disability Requirements:

- Be 65 years or older, OR

- Be a widow or widower aged 50 or older, OR

- Be a permanently disabled person aged 18 or older

Income Guidelines:

- Total income must be $45,000 or less

- Only 50% of Social Security income is counted toward this limit

- This applies whether you’re a homeowner or renter

Residency Rules:

You must have been a Pennsylvania resident for all of 2024, and you must have paid either:

- Rent on a primary residence, OR

- Property taxes on a primary home

And yes — mobile home owners, senior apartment residents, and even those living in subsidized housing can qualify, provided they meet the income and age requirements.

How Much Money Can You Receive?

The rebate amount you’re eligible for depends on your income and housing expenses. The standard rebates are calculated as follows:

| Income Level (Annual) | Rebate Amount |

|---|---|

| $0 – $8,000 | $1,000 |

| $8,001 – $15,000 | $770 |

| $15,001 – $18,000 | $460 |

| $18,001 – $45,000 | $380 |

Some applicants may also qualify for supplemental rebates, bringing the total above $1,000, particularly:

- Homeowners with high property taxes relative to income

- Renters in Philadelphia, Scranton, and other high-cost municipalities

Pennsylvania Extends Rebate Deadline: How to Apply for the Rebate

Step 1: Get Your Documents Together

You’ll need:

- A copy of your 2024 property tax receipt or rent certificate

- Your 2024 income information (Social Security 1099, W-2s, pensions, etc.)

- Proof of age or disability, if not already submitted in prior years

Step 2: Choose Your Method of Application

You can apply:

- Online: The fastest and easiest way is through myPATH

- By Mail: Complete Form PA-1000 and send it to the Department of Revenue

- In Person: You can visit:

- Local Area Agencies on Aging

- State representatives’ offices

- Community senior centers

Step 3: Submit by the Deadline

Make sure your application is received or postmarked by December 31, 2025.

Real-Life Example: How the Rebate Helps

Take “James,” a 70-year-old living in Erie. His annual income is:

- $12,000 from Social Security

- $2,500 from a small pension

His countable income = $12,000 ÷ 2 + $2,500 = $8,500

He pays $5,000/year in rent. Based on his income, James qualifies for a $770 rebate, potentially more if he’s in a high-cost area.

This money could pay for:

- 3–4 months of groceries

- Utility bills through winter

- Prescription costs not covered by insurance

For folks like James, this isn’t just a rebate. It’s relief.

Tax Questions: Is the Rebate Taxable?

No. According to the IRS, rebates from this program are not taxable. They:

- Don’t count as income

- Don’t affect Social Security, SNAP, Medicaid, or LIHEAP

- Won’t impact federal or state tax refunds

So you can claim your rebate without worrying about losing other benefits.

Common Mistakes to Avoid

Applicants sometimes miss out due to avoidable errors. Here’s how to stay ahead:

- Don’t include full Social Security: Remember, only half of your Social Security counts.

- Don’t delay: Apply early. Processing can take time, especially as the deadline nears.

- Keep copies: Save a copy of your application and documents.

- Don’t assume it’s automatic: You must apply every year — it doesn’t renew on its own.

- Avoid missing information: A single missing form can delay or cancel your rebate.

Extra Help Is Available: Where to Get Assistance

The state has beefed up its support systems so no one is left behind.

Here are options:

- Call the Rebate Hotline at 1-888-222-9190

- Get in-person help at local senior centers

- Use PA’s Revenue Customer Service Center

Organizations like AARP, Meals on Wheels, and Catholic Charities also help older adults apply during tax season.

Pennsylvania vs. Other States: A Leader in Rebate Support

Pennsylvania’s PTRR program is one of the most generous of its kind in the country. Here’s how it compares:

- New Jersey’s rebate maxes out around $500 for renters.

- Ohio has no statewide renter rebate program.

- California’s property tax relief is limited to homeowners only.

By offering both rent and property tax rebates, and expanding them in 2025, Pennsylvania sets the gold standard.

Alaska’s $1,000 Payments: Check Eligibility Criteria and Official Payment Date

VA Disability Payments December 2025: Exact Dates & New Monthly Amounts Revealed!

Goodbye IRS Direct File—The Free Tax Filing Program Is Ending, and Millions Must Now Adjust