Pacsun to Open 20–30 New Stores: Pacsun is going big. After nearly two decades of conservative store counts and a shift toward digital, the iconic Southern California lifestyle brand is making a bold retail pivot. The company has confirmed plans to open 20 to 30 new U.S. stores annually through 2029, with an emphasis on high-traffic malls, college towns, and urban corridors that cater directly to Gen Z shoppers. This expansion bucks industry trends and reinforces a powerful message: brick-and-mortar retail still matters — especially when it’s relevant, immersive, and driven by data and culture. Pacsun’s strategy is not just about opening more locations; it’s about reclaiming physical space as a vital part of brand storytelling and customer experience.

Table of Contents

Pacsun to Open 20–30 New Stores

Pacsun’s store expansion is more than a real estate move — it’s a cultural strategy. By meeting their customers where they are — both digitally and physically — Pacsun is redefining what modern retail looks like. Their focus on malls, college towns, and international hotspots shows a deep understanding of youth culture, shopping psychology, and brand-building in a connected age. As brands scramble to decode Gen Z, Pacsun isn’t guessing. They’re executing. And with 20–30 new stores launching every year, they’re doing it boldly — in full view of the entire retail industry.

| Topic | Details |

|---|---|

| Annual Store Openings | 20–30 new U.S. stores per year through 2029 |

| International Expansion | 20 stores across GCC (Gulf Cooperation Council) nations by 2030 |

| 2025 Store Openings | 9 total (8 in malls), including NYC Flatiron, Westchester |

| Target Markets | Gen Z hubs: malls, universities, urban retail strips |

| Physical Store Revenue | Outpaces digital/e-commerce sales consistently |

| Events & Marketing | UFC collabs, denim pop-ups, grassroots college campaigns |

| Metrics Used | Sales per square foot, monthly ROI, profitability analysis |

| Official Website | Pacsun.com |

Why Pacsun to Open 20–30 New Stores — And Why It Matters

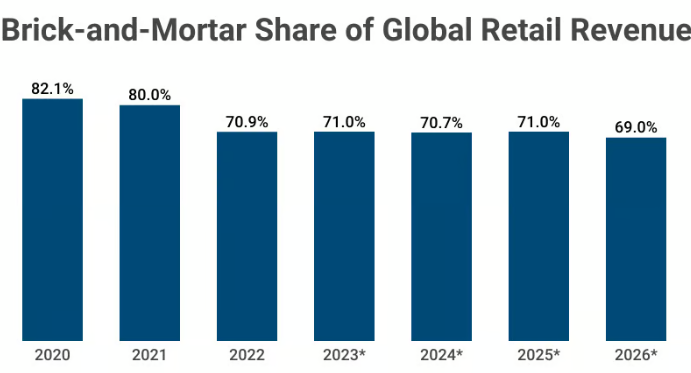

Retail in the U.S. has faced major transformation: pandemic closures, e-commerce growth, and changing shopper behaviors have led many brands to shrink their physical footprint or shift to online-only strategies. But Pacsun sees physical stores not as a liability, but as an asset — especially when curated around experience.

According to CEO Brieane Olson, Pacsun’s retail locations are outperforming expectations and remain critical to reaching their primary audience.

“We’ve created stores that serve not just as places to shop, but as culture centers. That’s where we’re seeing energy and sales momentum,” Olson said in an official press statement.

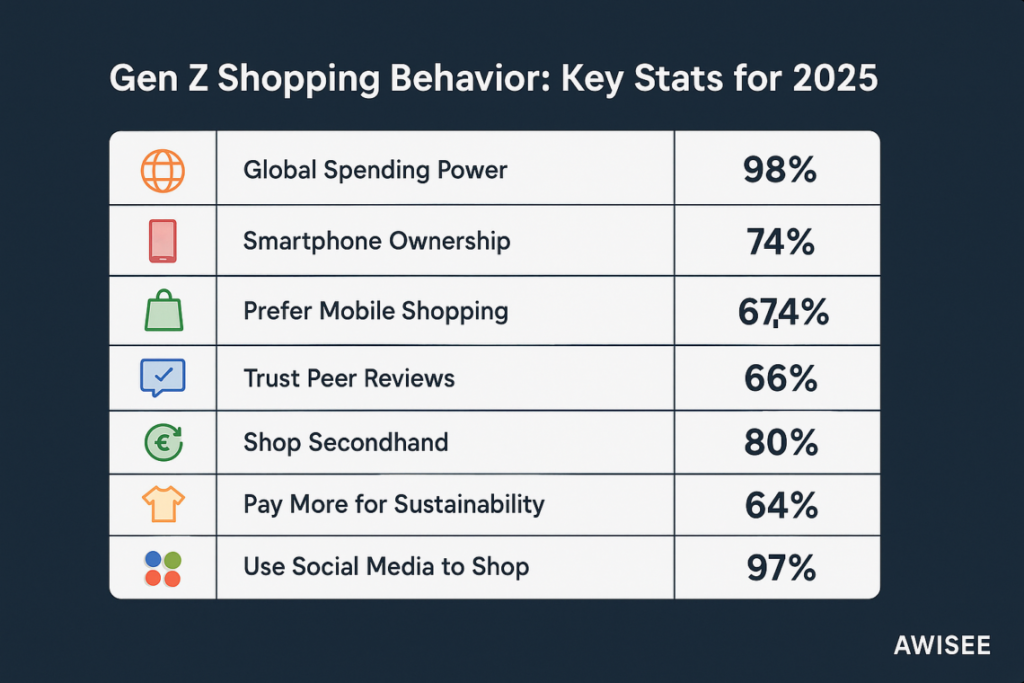

This echoes a larger trend: for Gen Z consumers — who grew up online — physical stores are not redundant. They’re a place for real-world discovery, for trying on trends, and for connecting with brand identity offline.

Where Will the New Stores Be?

Malls Are Making a Comeback — and Pacsun Knows It

While traditional malls took a hit in the early 2020s, many are undergoing transformation — turning into hybrid social spaces that blend retail, dining, entertainment, and lifestyle.

In 2025, Pacsun opened nine new U.S. stores, with eight of them located in malls. The company clearly sees value in these locations as more than just retail real estate — they’re cultural epicenters.

According to Joel Quill, VP of Retail, “Our customers — especially younger ones — still hang out at the mall. It’s where they go to kill time, see what’s new, and socialize.”

Malls chosen include locations with strong anchors, upgraded aesthetics, and a consistent draw of 16–24-year-olds — Pacsun’s sweet spot.

College Towns & Youth Culture Hubs

The other major focus? College towns and urban street retail zones where Gen Z lives, studies, and hangs out. In 2025, Pacsun launched in NYC’s Flatiron District — a spot strategically surrounded by fashion schools, student housing, and content creators.

More college-area stores are in the pipeline for 2026, including:

- Orlando’s Mall at Millenia (near UCF)

- Austin, TX (home to University of Texas)

- Tempe, AZ (Arizona State University)

These locations are not just chosen for foot traffic — they’re cultural laboratories, where Pacsun can test new trends, merchandise, and marketing strategies.

The Global Expansion: Pacsun Goes International

For the first time in its history, Pacsun is heading overseas. Beginning in 2026, the brand will open its first international flagship in Dubai’s Mall of the Emirates — one of the world’s premier luxury retail destinations.

This is part of a multi-year deal with Majid Al Futtaim, a dominant retail conglomerate in the Middle East, to launch 20 stores across the GCC nations by 2030.

This global push is more than a revenue play — it’s brand evolution. Pacsun is seeking to:

- Broaden its global fashion influence

- Tap into affluent Gen Z markets abroad

- Introduce California-cool to new youth cultures

Expect future stores in Saudi Arabia, Qatar, and Kuwait — markets where American youth brands like Nike and Converse already thrive.

Stores Are Beating Online – Here’s Why

Despite the common assumption that Gen Z prefers to shop online, Pacsun’s in-store data tells a different story. Stores are not just holding their own — they’re leading revenue.

Reasons behind the in-store boom:

- Instant Gratification – Gen Z wants things now, especially after seeing them online.

- Inspiration Over Transaction – Shoppers want to experience fashion, not just scroll through it.

- Social Sharing – IRL moments (trying on clothes, attending events) generate social content.

- Trust Factor – Shoppers like touching fabric, checking quality, and trying on sizes in real time.

Quill explains, “When someone sees a product on TikTok, they’ll often walk straight into the store and ask for it by name. That’s powerful.”

Pacsun’s Retail Playbook: Pacsun to Open 20–30 New Stores

Community-Driven Events

Pacsun isn’t just opening stores — it’s activating them.

In 2025, they hosted a UFC athlete meet-and-greet with Alex Pereira, causing lines to wrap around the block. Similarly, in Soho, their Levi’s x Pacsun pop-up offered free customization, photo booths, and giveaways.

These events do double duty:

- Drive traffic

- Build local buzz

- Generate influencer and user content

Grassroots Meets Digital

Pacsun doesn’t rely solely on paid ads. They put feet on the street — literally handing out flyers in college quads, setting up sidewalk tents, and connecting face-to-face with their community.

It’s old-school hustle meets new-school storytelling.

Combined with a robust digital presence across:

- TikTok

- Instagram Reels

- Creator partnerships

…the brand is fully integrated — from scroll to store.

Inside Pacsun to Open 20–30 New Stores Strategy

What makes Pacsun’s rollout different is their data-backed discipline. Before committing to any new location, they analyze:

- Sales per square foot

- Local demographic alignment

- Monthly profit trends

- Performance over 30, 60, and 90 days

And if a location underperforms? They pivot. Fast.

This agility — backed by real-time numbers and a deep understanding of youth culture — is what separates Pacsun from other mall brands that grew too fast without oversight.

What Retailers Can Learn From Pacsun?

Whether you’re running a startup fashion label or managing a regional chain, Pacsun’s strategy offers powerful lessons:

- Integrate Channels – Let your online and offline experiences feed each other. Social media drives store visits. Store experiences fuel online buzz.

- Invest in Culture – Pop-ups, collabs, events — these are no longer optional. They create emotional touchpoints.

- Be Hyperlocal – What works in NYC won’t always work in Austin. Tailor each location’s launch to its community.

- Measure What Matters – Don’t just track foot traffic. Measure conversion, time in store, social mentions, and repeat visits.

- Don’t Fear the Mall – Modern malls are evolving. Find the right ones and use them as cultural hubs.

Frozen Shrimp Recall – FDA Issues Warning Over Possible Cesium-137 Contamination

Walmart Mobile Payment Policy – Why Apple Pay and Google Pay Still Don’t Work at Walmart Stores

Buc-ee’s Expansion Alert: 17 New Mega Gas Stations Are Coming to These 5 States