Oregon Medicaid & SNAP Rules: Oregon Medicaid & SNAP rules are entering a new phase—one that could cost the state big bucks and shake up how thousands of Oregon families get help with food and healthcare. New federal policies, rolled out under major legislation in 2025, are shifting the burden of food and health aid back onto states. Oregon, already known for strong social support programs, is now facing an estimated $340 million annual hit just to maintain what it currently provides. That number’s not just a budget line. It represents real people—seniors trying to stretch their groceries, single moms choosing between rent and medicine, and working families whose wages don’t keep up with bills. These programs have been lifelines for decades, but now the cost and rules are changing fast.

Table of Contents

Oregon Medicaid & SNAP Rules

Oregon Medicaid & SNAP rules are changing fast under new federal policies. With added costs and stricter eligibility requirements, Oregon may need to find an extra $340 million per year just to keep providing essential support. These changes will affect real people—your neighbors, your friends, maybe even you. Understanding what’s happening, preparing for compliance, and supporting those most affected will be crucial as Oregon navigates this new reality.

| Topic | What’s Happening |

|---|---|

| Federal SNAP funding cuts & cost shift | States may pay more for SNAP benefits & administrative costs |

| New SNAP work requirements | States must enforce expanded work/training hours for adults |

| Medicaid funding & work rules | Federal contributions reduced; work requirements added |

| Estimated Oregon cost | ~$340 million estimated added expenditure |

| Affected populations | Over 740,000 Oregonians on SNAP; many on Medicaid |

| Official SNAP info & updates | USDA SNAP implementation details |

What Are SNAP & Medicaid?

SNAP – The Nation’s Food Assistance Program

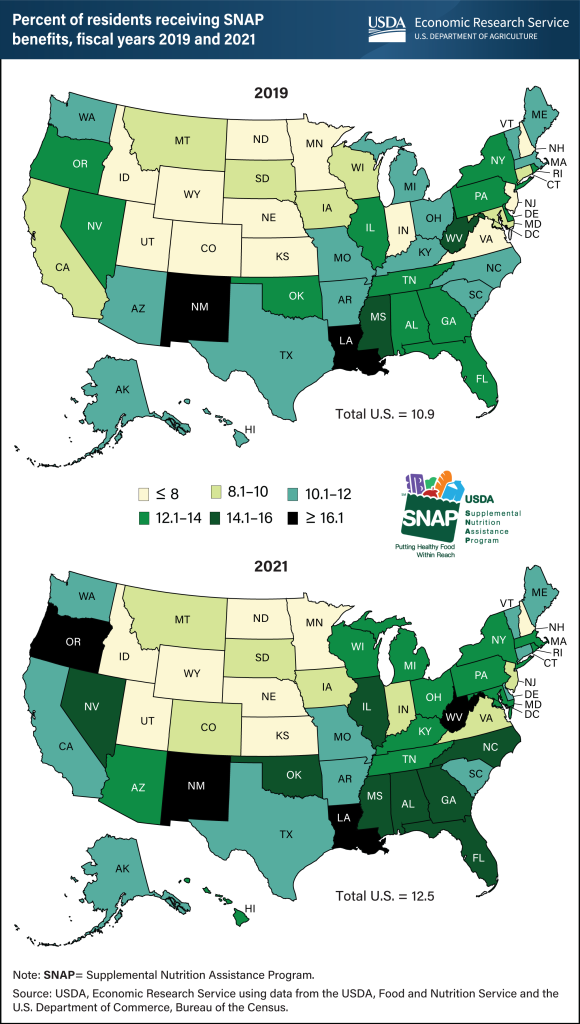

The Supplemental Nutrition Assistance Program, or SNAP, is what most folks used to call “food stamps.” It helps people afford groceries, especially low-income families, older adults, and people with disabilities. In Oregon alone, about 740,000 residents use SNAP to feed themselves and their families.

Historically, the federal government covered almost all the cost of SNAP benefits. States were responsible for administration—like processing applications, running call centers, and overseeing eligibility—but the actual money people received for food came from the feds.

That’s changing. Starting in 2025 and escalating in 2026, states are now expected to shoulder a bigger portion of both administrative and benefit costs. The federal government is essentially saying, “You still get the program, but you have to pay more to keep it running.”

Medicaid – Health Insurance for the Vulnerable

Medicaid is the public health insurance program that provides care for low-income individuals, children, pregnant people, seniors, and folks with disabilities. In Oregon, it’s known as the Oregon Health Plan (OHP).

OHP covers around 1.4 million people, which is about one-third of the state’s population. It includes doctor visits, prescriptions, hospital care, mental health support, dental care, and more.

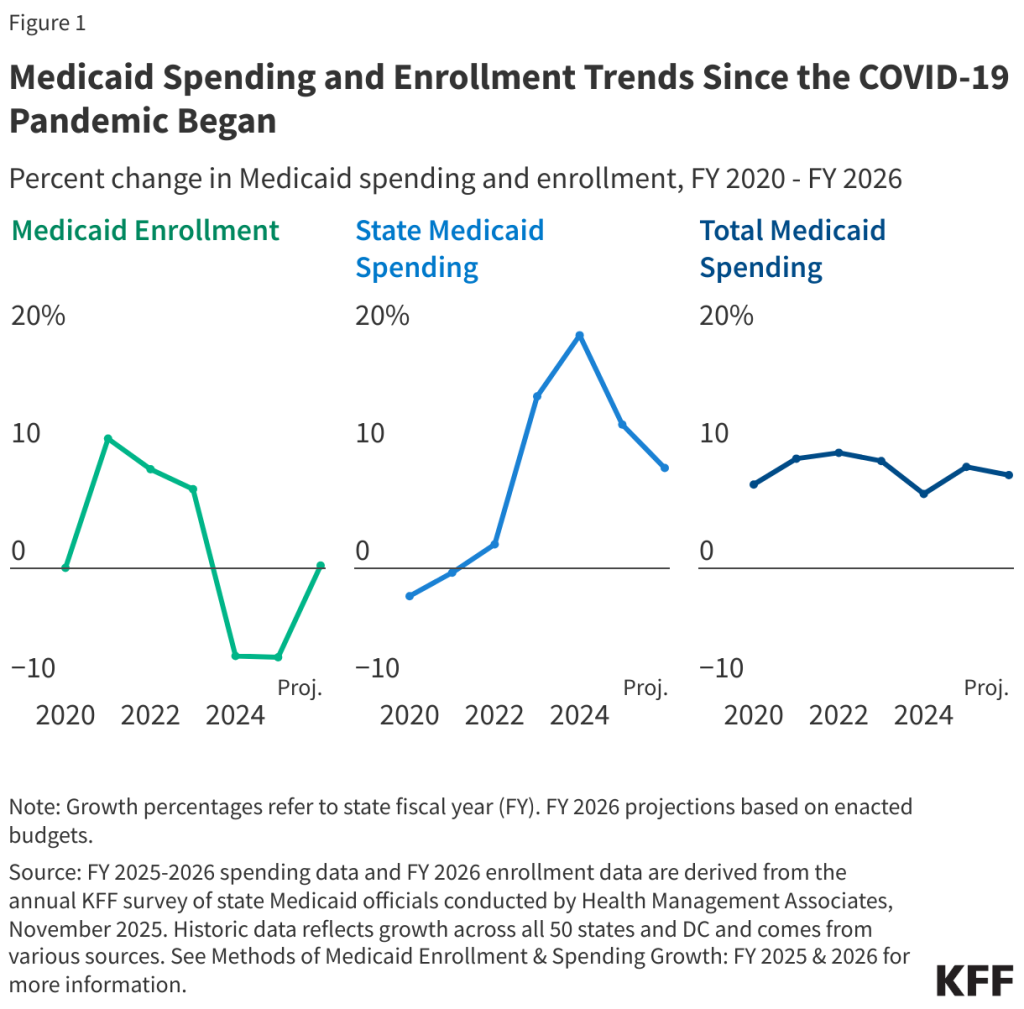

As with SNAP, Medicaid is a state-federal partnership. Traditionally, the federal government picks up between 60% to 90% of the tab, depending on the group and the services. But under the new laws, that support is shrinking—and Oregon could be left to pay much more on its own.

What’s Causing Oregon Medicaid & SNAP Rules Changes?

The federal government passed a sweeping package of changes in 2025 through a law often called the “One Big Beautiful Bill Act.” It was intended to streamline spending, reduce the national deficit, and “modernize” safety net programs.

That meant:

- Reducing federal contributions to state-run programs like SNAP and Medicaid.

- Expanding work requirements for able-bodied adults without dependents.

- Limiting exemptions for certain categories of people, like long-term unemployed adults.

- Adding new performance metrics for states, with financial penalties for error rates.

For states like Oregon, which have historically prioritized strong support systems, the price of maintaining current levels of aid just skyrocketed.

How Much Will This Cost Oregon?

According to projections from state budget analysts, Oregon could face up to $340 million per year in new costs, especially as it tries to keep SNAP and Medicaid services running at current levels.

Here’s how that number breaks down:

- Around $220 million to cover administrative and benefit gaps in SNAP.

- Approximately $120 million for implementing and managing Medicaid’s new compliance requirements and work rule enforcement.

- An additional $20 million in overhead costs for technology, training, reporting, and audits.

What’s more, if Oregon doesn’t comply with new federal rules—like failing to meet work requirement enforcement quotas or having error rates above national thresholds—the state could face financial penalties or lose federal matching funds altogether.

What Are the New SNAP Work Requirements?

Previously, work requirements for SNAP applied to able-bodied adults without dependents (ABAWDs)—typically adults between 18 and 49. Under the new rules:

- The age range is expanded to 18 to 55.

- Work requirements are now 80 hours per month (that’s about 20 hours per week).

- Qualifying activities include employment, job training, or community service.

- States must track and report compliance monthly.

These new rules rolled out in phases beginning in late 2025. By early 2026, most Oregon counties will be under full enforcement.

This change hits hard for people working part-time jobs with unpredictable hours—like warehouse workers, gig drivers, or restaurant employees. Even if they work, if their hours dip below the threshold, they risk losing benefits.

Medicaid Work Requirements – What’s Changing?

Medicaid’s new rules are a first at the national level. Adults between 19 and 64 must now prove they are:

- Working

- Volunteering

- Attending job training or school

- Meeting caregiving exemptions

Failure to comply means potential loss of coverage after 1–3 months of noncompliance.

Critics say these policies hurt the working poor—the very people these programs are meant to support. Many Medicaid recipients already work, but in jobs without consistent hours or easy documentation. Reporting mistakes or missed paperwork could cause someone to lose their doctor, their prescriptions, or even their life-saving treatments.

Oregon Medicaid & SNAP Rules: Historical & Economic Context

The Food Stamp Act of 1964 and Medicaid Act of 1965 were both part of President Lyndon B. Johnson’s “War on Poverty.” These programs dramatically reduced hunger and improved health outcomes in America over the last 60 years.

Cutting funding or adding bureaucratic barriers could undo decades of progress. SNAP, for instance, has been shown to:

- Improve children’s academic performance.

- Reduce hospital admissions for malnutrition.

- Boost local economies—every $1 in SNAP benefits generates up to $1.50 in economic activity.

Similarly, Medicaid helps prevent medical bankruptcies, improves birth outcomes, and connects people to mental health and addiction treatment—services that are critical as Oregon battles overlapping crises in housing, addiction, and poverty.

Who Will Feel These Changes Most?

The new rules are not just numbers in a spreadsheet. They affect:

- Rural residents who rely on food aid but have limited job options or no public transit.

- Older adults who are now required to work or volunteer just to keep their benefits.

- Part-time workers who already have jobs but can’t guarantee enough hours monthly.

- People with mental health issues, who may struggle to navigate new paperwork.

And then there are the children. Even if they’re exempt from work requirements, when parents lose food or health assistance, the impact is direct: missed meals, skipped checkups, and household stress.

What’s Oregon Doing About Oregon Medicaid & SNAP Rules?

State leaders have expressed concern. Oregon lawmakers and state agencies are:

- Exploring waivers and legal challenges to delay or minimize implementation.

- Investing in technology upgrades to track compliance more efficiently.

- Hiring more caseworkers and eligibility specialists to help process new requirements.

- Partnering with community organizations to educate families on what’s changing.

Governor and legislative leaders have warned that unless Congress reverses or amends some of the federal rules, the state may have to raise taxes, cut services elsewhere, or reduce benefits.

What Can You Do?

Here’s how Oregon residents and professionals can prepare and help:

- Stay Informed – Sign up for updates from Oregon DHS and OHP.

- Keep Documentation – Track your hours if you’re subject to work rules.

- Ask Questions – If you’re unsure, contact caseworkers early.

- Advocate – Talk to your state legislators or write your federal representatives.

- Support Local Nonprofits – Food banks, legal aid, and clinics are the last line of defense.

Texas SNAP Payment January 2026: Food Stamp Schedule & Eligibility

SSA Confirms 2026 Payment Schedule — Here’s When Your Social Security Check Will Arrive

Medicaid in 2026: New Rules, New Benefits, and What It Means for You and Your Family