One Popular Item at Costco Is Up 108%: It’s not every day you hear that a warehouse club famous for $5 rotisserie chickens is also the talk of the investment world. But lately, Costco has turned heads—not for snacks, electronics, or mega-packs of toilet paper—but for something far shinier: gold bullion bars. Over the past two years, Costco’s 1-ounce gold bars have skyrocketed in price by 108%, prompting the retail giant to introduce strict purchase limits. The bars, often priced well above spot rates, sell out within hours of being listed on the Costco website. The sudden surge in consumer demand has stunned even seasoned investors and economists. But what’s driving this gold rush among everyday Americans? Is buying gold from a retailer like Costco smart, safe, or just trendy? Let’s break down the facts, figures, and financial wisdom behind this shiny story.

Table of Contents

One Popular Item at Costco Is Up 108%

Costco’s 108% gold price increase over two years isn’t just about market trends—it’s a signal that Americans are waking up to the realities of financial instability, and seeking control of their wealth. What was once reserved for wealthy investors is now being bought by average households using a Costco membership. But gold isn’t a get-rich-quick scheme. It’s a legacy asset, a hedge, a peace-of-mind purchase. And Costco, surprisingly, may have just made it cool again.

| Topic | Details |

|---|---|

| Product | 1 oz 24K Gold Bullion Bars from PAMP Suisse or Rand Refinery |

| Price Increase | From ~$1,980 in 2021 to ~$4,100 in 2023 (108%) |

| Retailer | Costco Wholesale (members-only, online sales) |

| Purchase Limits | Up to 2 bars per transaction, max 4 bars per 24 hours |

| Demand Drivers | Inflation fears, stock market volatility, recession concerns |

| Target Buyer | Middle-class investors, professionals, retirees, collectors |

| Retail Premium | Spot price ~$2,100 vs Costco price ~$4,100 |

| Refund Policy | Final sale, no returns or exchanges |

| Official Site | www.costco.com |

Costco’s Foray into Gold: A New Era of Retail Investment

Costco entered the precious metals market somewhat quietly, offering 1-ounce .9999 fine gold bars online to its members only. But what began as a niche experiment quickly turned into a viral sensation. By late 2023, gold bars were disappearing from Costco’s website within hours—often just minutes—after listings went live.

Unlike novelty items or collectibles, these aren’t gimmicks. The bars are produced by:

- PAMP Suisse, a world-renowned Swiss refinery known for impeccable quality and anti-counterfeit packaging

- Rand Refinery, one of the largest and most trusted gold processing firms in Africa

Costco doesn’t store these in your local warehouse. Fulfillment happens via a secure, direct-to-consumer online model, giving everyday Americans easy access to physical gold.

One Popular Item at Costco Is Up 108%: Why the Sudden Spike in Gold Demand?

Historically, gold has always been viewed as a hedge against inflation, market uncertainty, and currency volatility. But in the last few years, several compounding factors have lit a fire under gold’s appeal:

Inflation & Cost-of-Living Crisis

As inflation hit 40-year highs in 2022–2023, with prices for groceries, housing, and energy surging, many Americans felt the need to protect their savings from further erosion. Gold, which traditionally holds value, looked more attractive.

Banking Instability & Market Volatility

Regional bank collapses like Silicon Valley Bank and First Republic Bank, along with wild stock market swings, left many questioning whether traditional financial systems could be trusted. Gold became a fallback for both new and seasoned investors.

Distrust of Fiat Currencies

The U.S. dollar, while still dominant globally, has seen criticism due to rising national debt and aggressive monetary policies. For some, holding physical gold feels safer than holding dollars or even crypto.

Accessibility & Branding

Costco’s trusted reputation and convenience made gold more accessible to average households—especially those hesitant to use online dealers they’d never heard of.

What Makes One Popular Item at Costco Is Up 108%?

While gold dealers have existed for decades (e.g., APMEX, JM Bullion, Kitco), Costco stands out in key ways:

- Brand Trust: Buyers trust Costco to source authentic products.

- Membership Exclusivity: Limits exposure to fraudulent or abusive purchases.

- Premium-Grade Gold: Costco only lists gold from top-tier refineries.

- No Middlemen: Purchases go directly through Costco’s verified supplier channels.

- Flat Pricing: Premiums are built-in—what you see is what you pay.

Despite selling above spot, customers accept the premium for the reliability, packaging, delivery, and reputation that comes with Costco’s name.

Step-by-Step: How to Buy Gold from Costco

- Become a Member

You need an active Costco membership. Choose between:- Gold Star ($60/year)

- Executive ($120/year with 2% rewards)

- Log in to Costco’s Website

Search for “gold bar” or “PAMP” to find available listings. - Act Fast

Inventory disappears quickly—often within minutes. - Observe Purchase Limits

You’re limited to:- 1–2 bars per transaction

- 4 bars per 24-hour period (may vary)

- Complete Checkout

Use a Visa card, Costco Shop Card, or debit. No returns or cancellations.

Is Buying Gold from Costco a Smart Move?

Yes and no—it depends on your goals. Costco’s gold offering is best for:

- People looking to diversify portfolios

- Investors seeking physical, tangible assets

- Families preparing for long-term security

- Gift-givers or collectors wanting pristine bars

However, Costco doesn’t offer buy-back services, so you’ll need to resell through a third party when the time comes. Also, since the price includes a hefty premium, it’s not ideal for quick flips.

Gold is best viewed as a long-term value preservation tool, not a speculative investment.

How Costco Prices Compare to Other Dealers?

| Dealer | Approx. Price (1 oz bar) | Includes Shipping? | Mint Quality |

|---|---|---|---|

| Costco | $4,100 | Yes | PAMP, Rand Refinery |

| APMEX | $2,600–$2,900 | Yes | Varied |

| JM Bullion | $2,500–$2,850 | Yes | Varied |

| Money Metals | $2,550–$2,750 | Yes | Varied |

Note: Prices above vary based on the spot market, premiums, and brand

What to Know About Storing Your Gold?

Once you’ve got your bar, the question becomes: Where do I keep it?

- Home Safe: Fireproof and waterproof safes are a must. Bolted to concrete? Even better.

- Bank Safety Deposit Box: Secure but access is limited to banking hours.

- Private Vaulting Services: For large investors or multiple bars.

Avoid storing it loose or disclosing it publicly. Gold theft is real.

Taxes, Reporting & IRS Considerations

Don’t forget Uncle Sam.

- Capital Gains Tax: Gold is taxed as a collectible at up to 28% on profits.

- Reporting Requirements: Large purchases may trigger IRS Form 8300 (for cash purchases over $10,000).

- Sales Receipts: Keep all receipts for tax records and future appraisals.

Consult a tax advisor if you’re planning to buy or sell large quantities.

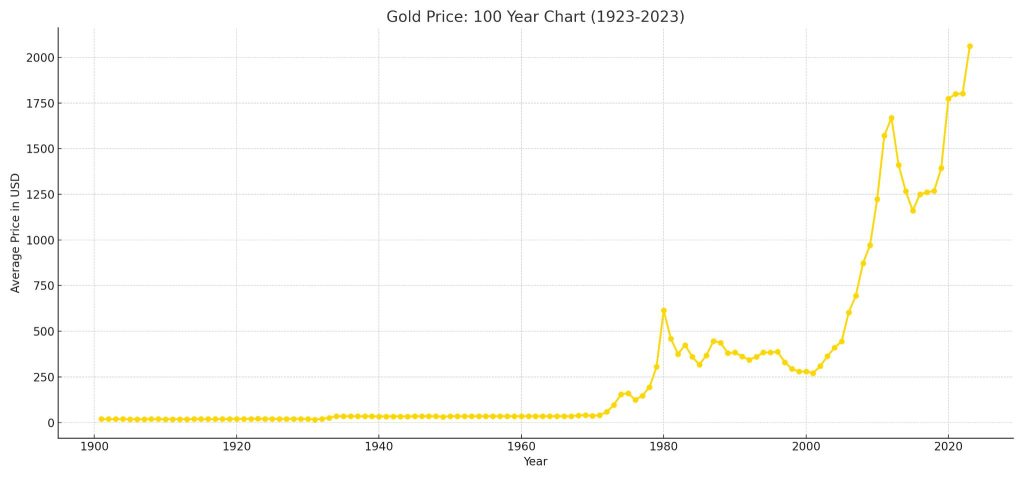

Historical Trends: Gold’s Performance Over Time

| Year | Average Gold Price (USD/oz) |

|---|---|

| 2000 | $279 |

| 2010 | $1,226 |

| 2020 | $1,770 |

| 2023 | $2,050–$2,200 |

Over the last two decades, gold has grown 7–9% annually on average, outperforming inflation and many conservative assets.

Shoppers Are Questioning These Aldi Policies — Here’s What’s Actually Going On

Walmart Mobile Payment Policy – Why Apple Pay and Google Pay Still Don’t Work at Walmart Stores

Costco Just Unveiled Its December 2025 Coupon Book; Here Are the 10 Deals Everyone’s Grabbing First