Official 2026 Military Pay Raise: The 2026 military pay raise is now official, bringing a 3.8% increase in basic pay for all U.S. service members, effective January 1, 2026. This pay bump follows President Donald Trump’s signature on the Fiscal Year 2026 National Defense Authorization Act (NDAA) in December 2025. The NDAA, passed annually by Congress, sets the policies, budget, and compensation for the Department of Defense.

The 3.8% raise applies across the board to all active-duty, Reserve, and National Guard personnel. It’s part of a larger effort to ensure military wages remain competitive with civilian compensation trends while addressing recruitment, retention, and quality-of-life improvements for service members and their families. This article gives a full breakdown of what this raise means, how much more you could be making, what other benefits are rising alongside it, and how to prepare for financial planning in 2026.

Table of Contents

Official 2026 Military Pay Raise

The 2026 military pay raise is more than just a budget line—it’s a critical step toward sustaining the force and supporting the men and women who defend our country. With a 3.8% raise in base pay, 4.2% average housing increases, and a one-time $1,776 bonus, military compensation in 2026 is aimed at easing inflation burdens and rewarding service. For service members, now’s the time to check your pay tables, revisit your financial plans, and take full advantage of the benefits you’ve earned. Whether you’re new to the military or nearing retirement, these changes make a real difference.

| Item | Detail |

|---|---|

| Basic Pay Raise | 3.8% increase for all uniformed personnel |

| Effective Date | January 1, 2026 |

| BAH (Housing Allowance) | Average increase of 4.2% |

| BAS (Food Allowance) | Projected increase based on cost-of-living |

| One-Time Warrior Dividend | $1,776 for eligible service members |

| Retirement & Disability COLA | 2.8% for retirees and veterans |

| Special Pays | Continued for qualifying roles (aviation, submarine, etc.) |

| Applicable To | Active Duty, Guard, Reserve personnel |

Why the Official 2026 Military Pay Raise Matters?

The annual military pay raise is more than just a percentage—it directly impacts morale, readiness, and financial security. The Department of Defense uses wage data from the private sector, particularly the Employment Cost Index (ECI), to determine the raise. This ensures military compensation remains competitive even as economic conditions shift.

In recent years, inflation and rising living costs have outpaced wage growth for many Americans. This year’s raise helps military families keep up with housing, groceries, childcare, and other essential needs—especially for junior enlisted members who often operate on tight budgets.

Moreover, in an era of recruiting shortfalls across all branches, increased compensation is a strategic incentive. A stronger benefits package helps attract top talent and encourages seasoned professionals to continue their service.

What Does a 3.8% Pay Raise Mean for You?

While a 3.8% pay raise may seem small on paper, it adds up significantly across the year. Here’s a practical look at how this increase affects common ranks:

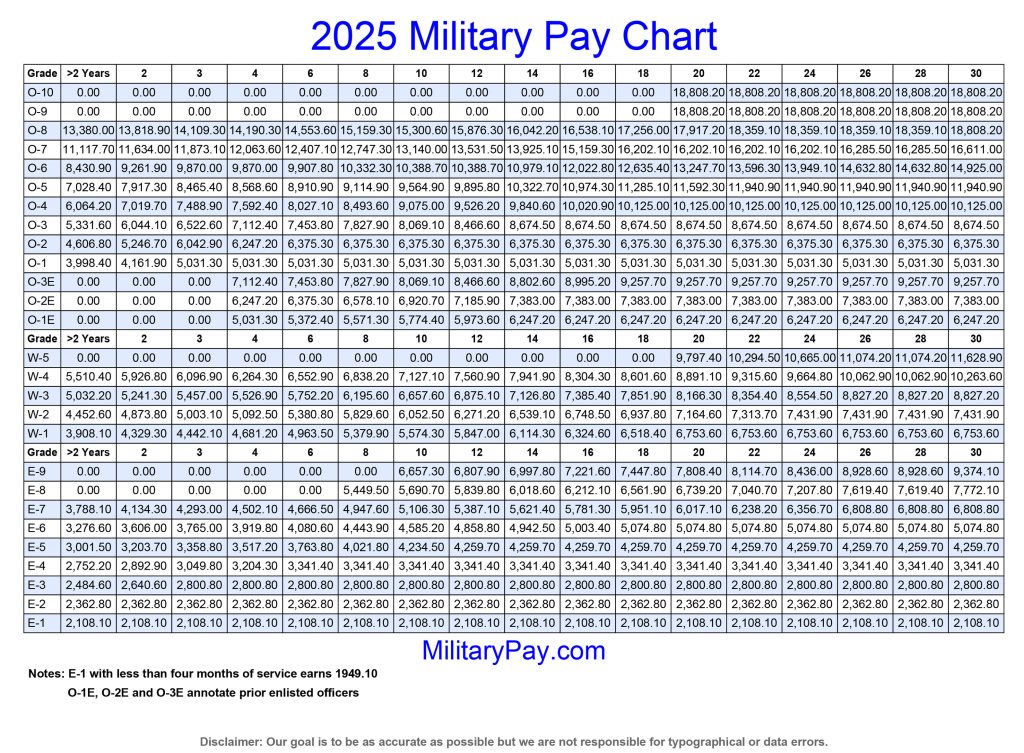

- E-1 (less than 2 years): Old base pay was around $2,300/month. New pay is approximately $2,387/month—an $87 increase.

- E-5 (6 years): Was about $3,058/month. Now: $3,174/month—about $116 more.

- O-1 (less than 2 years): Goes from $3,826 to $3,972/month—an increase of $146.

- O-3 (6 years): Climbs from $6,319 to $6,559/month—an increase of $240/month or $2,880/year.

These are just the base pay changes. When you include allowances, the raise can be much more substantial.

Basic Allowance for Housing (BAH) – What’s Changing?

BAH is designed to offset housing costs for those living off-post or in areas where government housing is not available. In 2026, the BAH is set to increase by an average of 4.2%, though actual changes vary by location, rank, and whether you have dependents.

Some high-cost areas such as San Diego, Washington D.C., and Honolulu may see larger increases. Service members in lower-cost-of-living regions may see smaller adjustments.

The military determines BAH annually based on local rental market surveys and utility data. If your BAH drops due to a change in local markets, the “individual rate protection” rule ensures that you won’t see a decrease as long as you stay in your current location without a break in service.

Basic Allowance for Subsistence (BAS)

BAS is a monthly food allowance provided to help offset meal expenses. While not part of basic pay, BAS is adjusted annually based on the cost of food.

In 2026, BAS is expected to increase by around 2.3% to 3.0%, based on projections from the Consumer Price Index for food. Currently, the BAS rate is:

- Enlisted Members: Around $460/month

- Officers: Around $320/month

These rates will rise modestly but consistently each year to account for inflation and rising grocery costs.

Special and Incentive Pays

While the 3.8% increase affects base pay, special and incentive pays are separate and continue based on qualifications and duties. These include:

- Aviation Career Incentive Pay

- Submarine Duty Pay

- Hazardous Duty Incentive Pay

- Sea Pay

- Language Proficiency Pay

These pays are essential in retaining service members with high-demand, specialized skills. There are no major policy changes in these pays for 2026, but service members should check with their unit finance office for updates on eligibility or rate adjustments.

Warrior Dividend – One-Time Payment

One of the more unique features of the 2026 compensation package is the “Warrior Dividend”—a one-time, $1,776 tax-free payment to eligible service members. Designed as a symbolic nod to the founding of America (1776), this bonus was supported in the NDAA as a morale booster and financial cushion amid inflation pressures.

Eligibility is expected to cover most active-duty enlisted and junior officers, although exact criteria will be outlined in an upcoming Defense Finance and Accounting Service (DFAS) directive.

This is not an annual benefit but a unique 2026 initiative.

Retirement and Disability Adjustments (COLA)

While active-duty pay increases 3.8%, military retirees and disabled veterans will see a Cost-of-Living Adjustment (COLA) of 2.8% for 2026. This ensures those who’ve already served receive support in retirement, especially important for those on fixed incomes.

COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). It’s applied automatically in January to eligible beneficiaries receiving:

- Military retirement

- VA disability compensation

- Survivor Benefit Plan (SBP) payments

Pay Raise vs. Inflation: Are Troops Keeping Up?

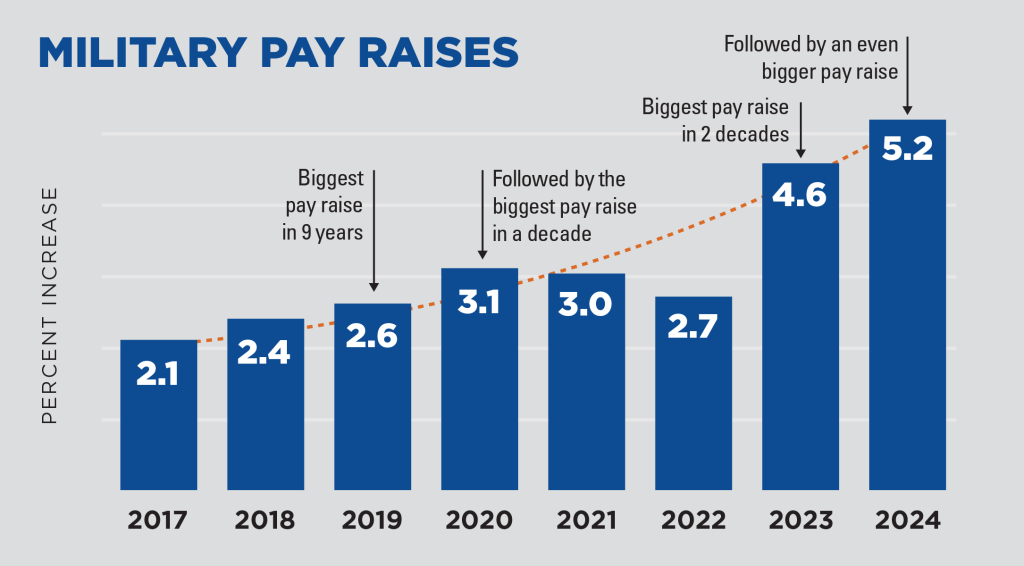

One key question is whether the 2026 military pay raise keeps up with the broader economy. While 3.8% is among the largest raises in the past 10 years, consumer prices in many sectors—housing, childcare, healthcare—have risen faster.

However, it’s important to note that the military compensation system includes other protections and supports, including:

- Free or subsidized healthcare via TRICARE

- Commissary and exchange privileges

- Tuition assistance and GI Bill benefits

- Retirement and savings programs (TSP)

So while the raise may not fully close the gap for all families, the total military compensation package remains robust, particularly when paired with base housing, childcare subsidies, and other benefits.

Recruitment and Retention: Strategic Reasons Behind the Official 2026 Military Pay Raise

The Department of Defense has faced serious recruiting challenges, with multiple services missing enlistment targets in recent years. Pay increases are not only about fairness—they’re a key part of recruitment and retention strategy.

Better pay helps:

- Attract college-eligible candidates who might otherwise choose civilian careers

- Retain skilled service members in high-demand technical fields

- Reduce turnover costs and training burdens

It’s also a signal from Congress and the White House that service and sacrifice are being respected and rewarded.

Steps You Should Take Right Now

- Review your LES: Use your Leave and Earnings Statement to understand your current pay and allowances.

- Calculate your new pay: Multiply your base pay by 1.038 to estimate your new monthly rate.

- Check BAH rates: Visit the DoD’s BAH calculator to find your updated housing allowance for your duty station.

- Rework your budget: With more cash coming in, now is a smart time to increase savings or pay down debt.

- Speak with a financial counselor: Every branch offers free financial planning services—use them to build a smart plan for the year.

How much will you receive from the Warrior Dividend Military Christmas Bonus? Check Eligibility

VA Disability Payments December 2025: Exact Dates & New Monthly Amounts Revealed!

Federal vs. Private Student Loans in 2026; Which One Should You Pick?